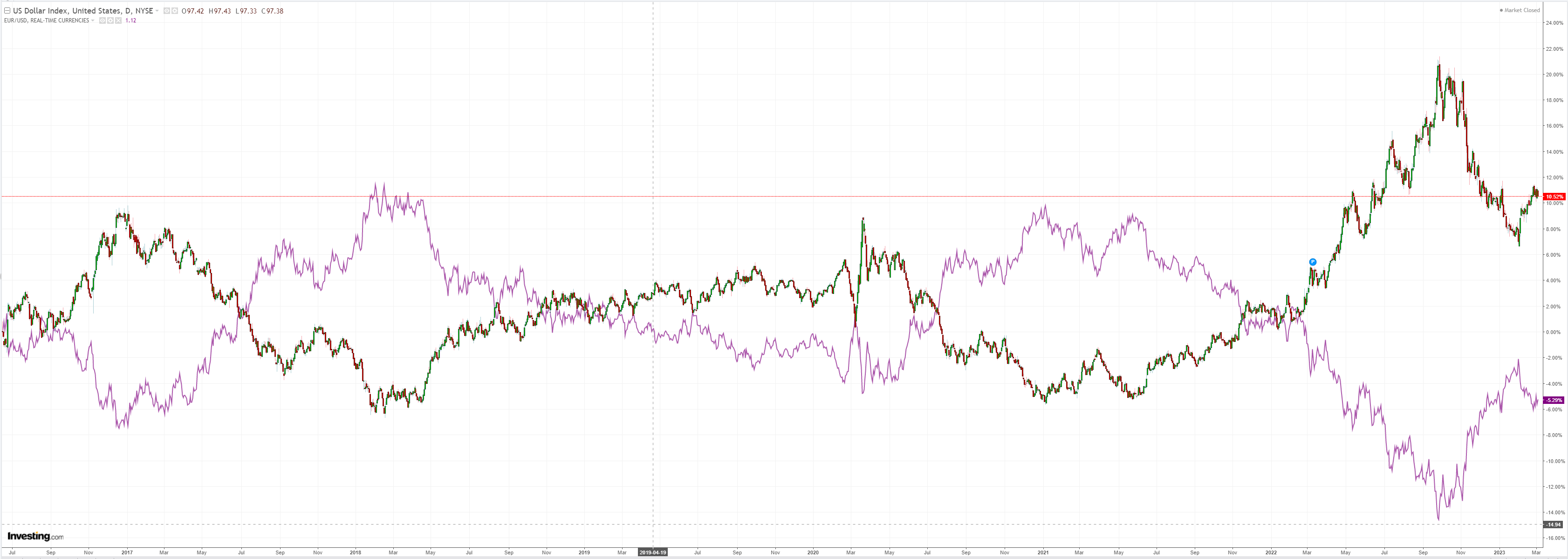

DXY slumped Friday night:

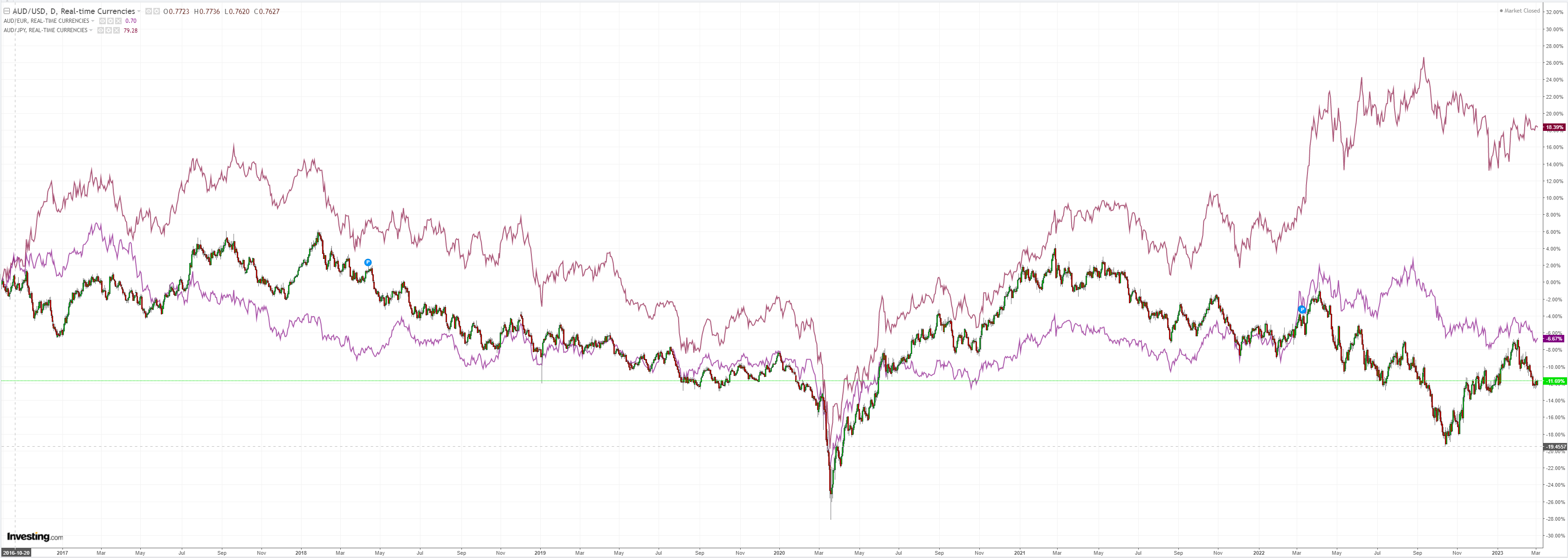

AUD lifted:

Oil and {{8830|gold} bounced:

Metals were firm:

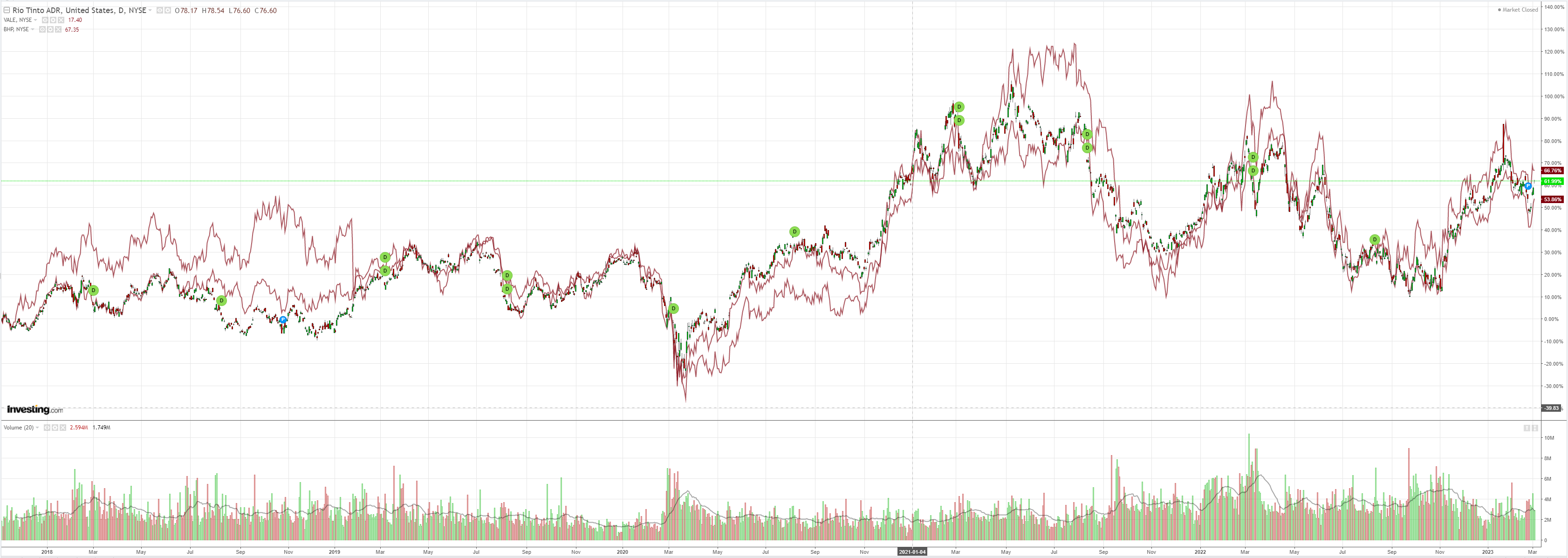

Miners (NYSE:RIO) jumped:

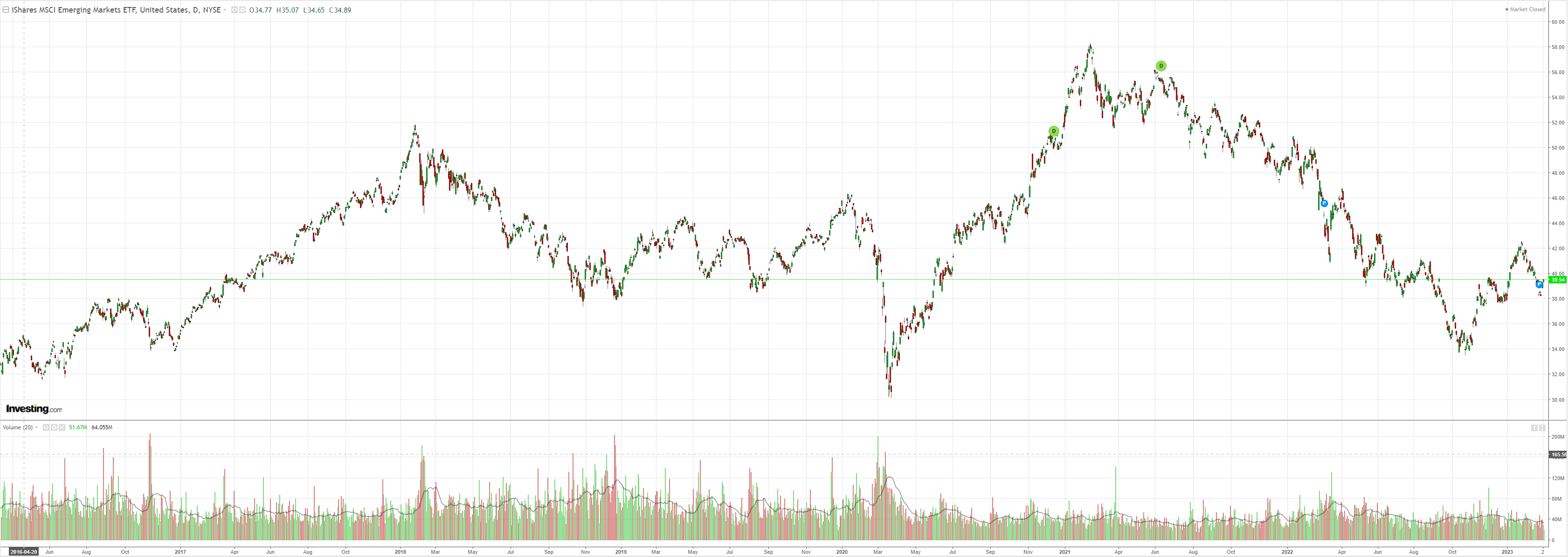

EM stocks (NYSE:EEM) too:

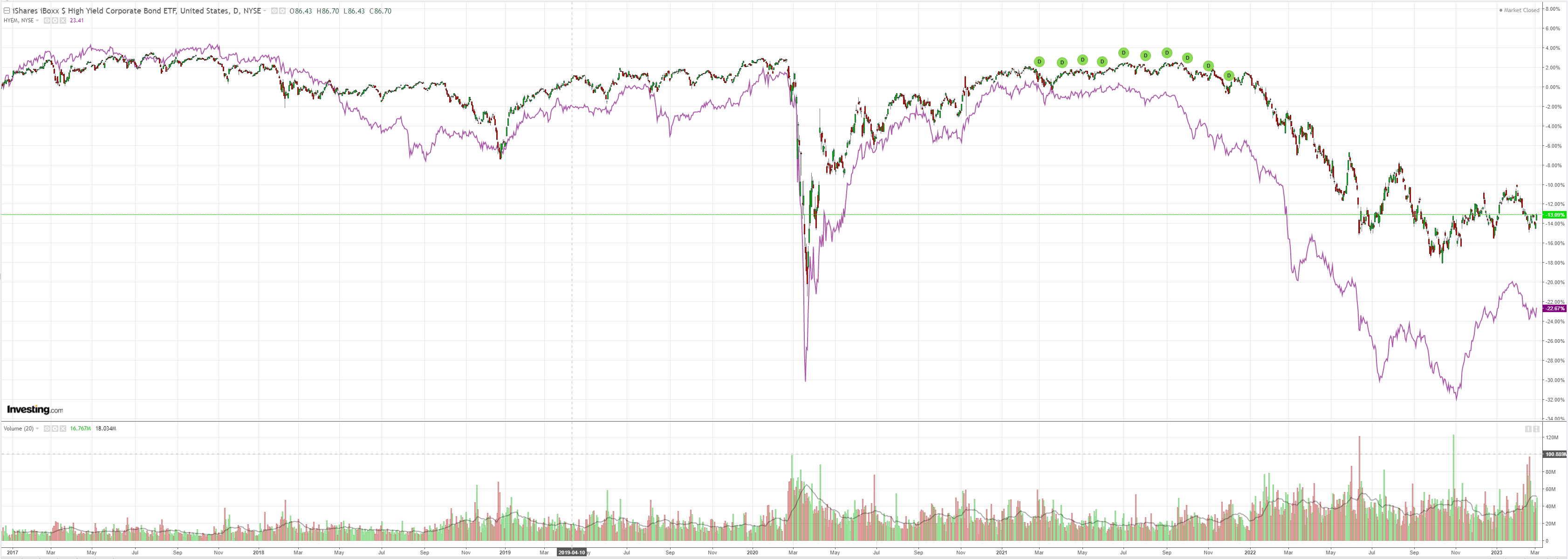

And junk (NYSE:HYG):

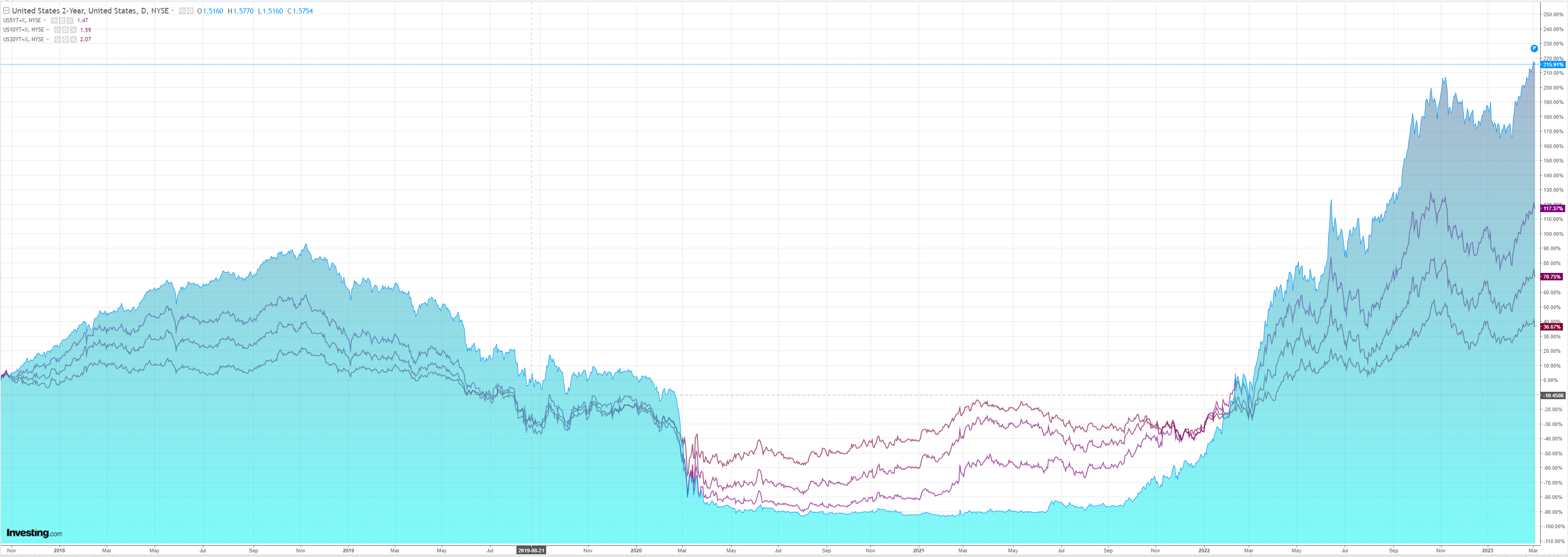

As duration was bought:

Unleashing stocks:

More frustrating up and down as weakening US data clashes with strengthening Chinese data.

The net result of this is proving to be volatility given the two do not offer much clarity on the progress of inflation in the US.

The Chinese reopening is starting to look as much like a traditional supply-side stimulus as it is a great consumer comeback.

If this bears out for any length of time, it is going to add to US inflation woes, particularly via oil, which is starting to shape into an upside pattern.

But, any rise in oil will be especially bullish for US shale production and, these days can push up DXY. Not least during a Fed tightening cycle.

These dynamics suggest more volatility in forex and the Australian dollar.

At least until the Fed goes too far and DXY rides a US hard landing higher (before crashing again!)