DXY is holding gains as EUR fades:

AUD flamed out:

So did most commodIties:

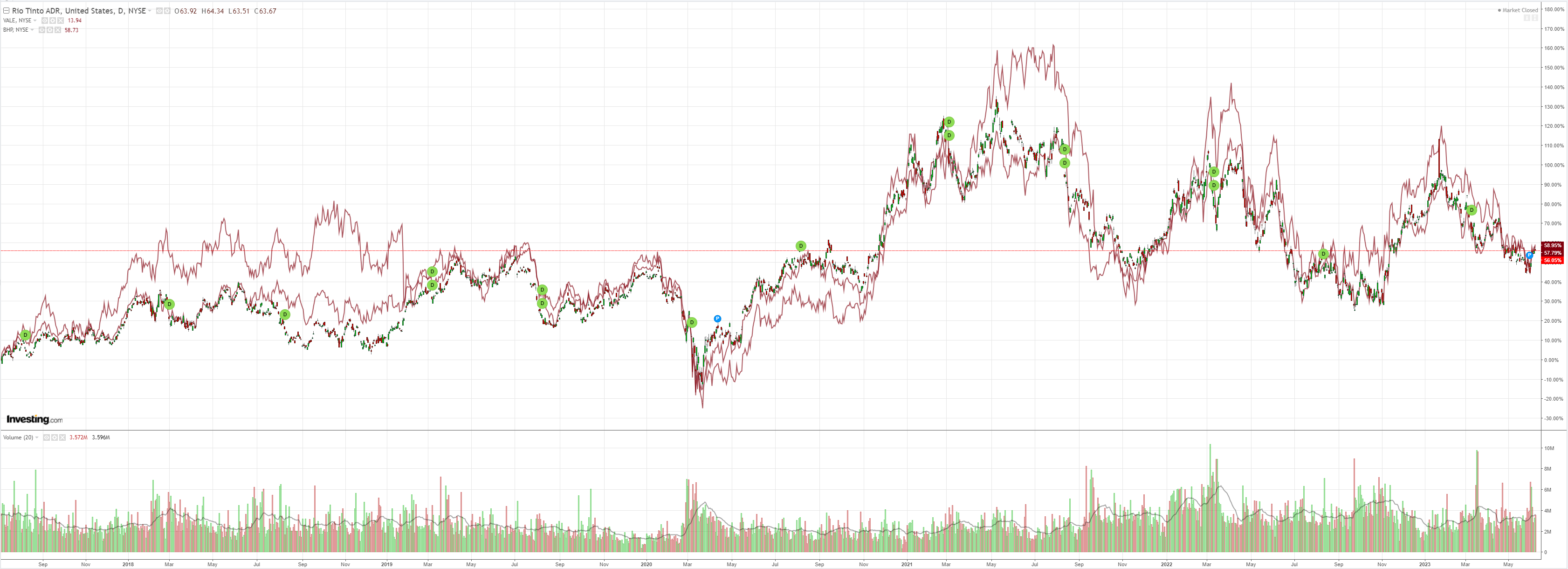

Miners (NYSE:RIO) did better on hope:

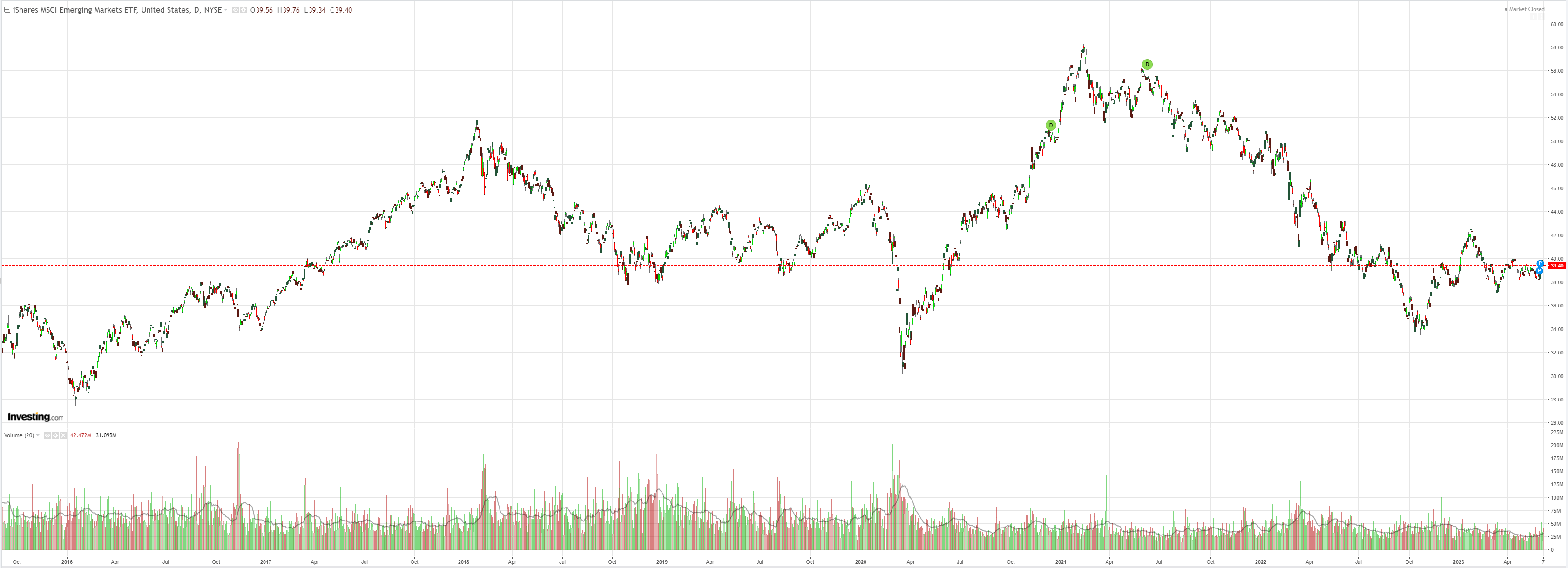

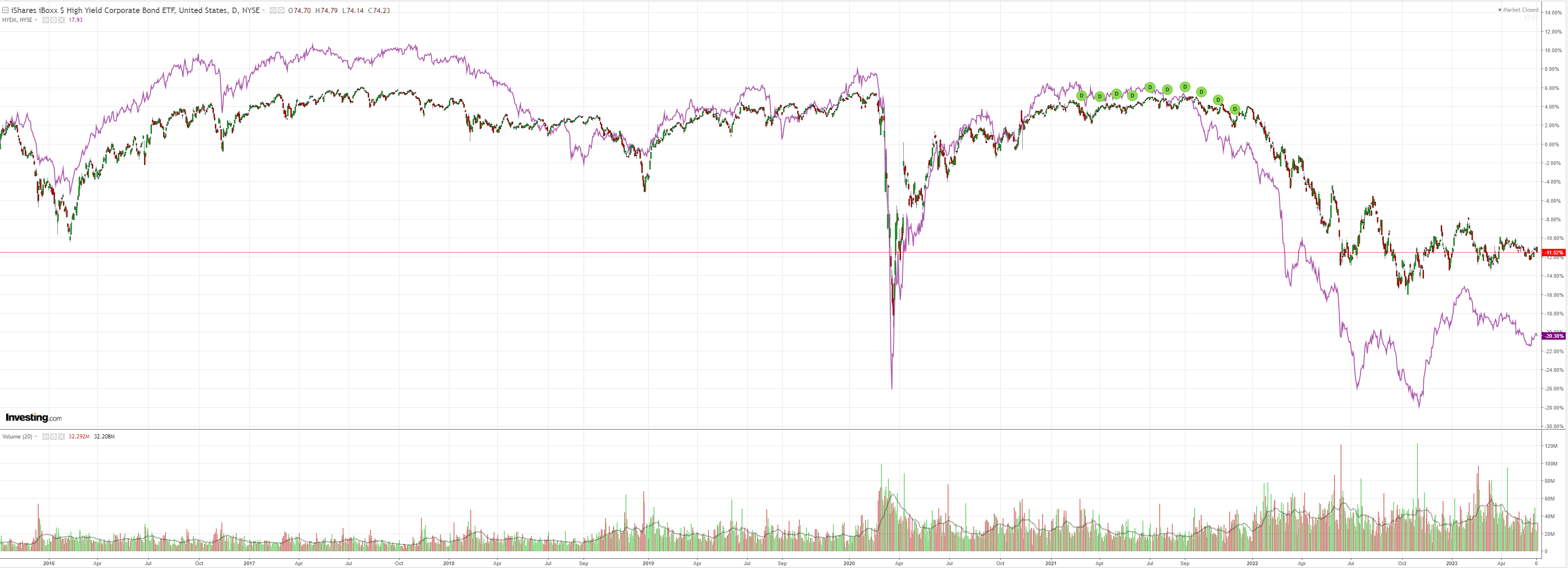

EM ETF (NYSE:EEM) and junk (NYSE:HYG) meh:

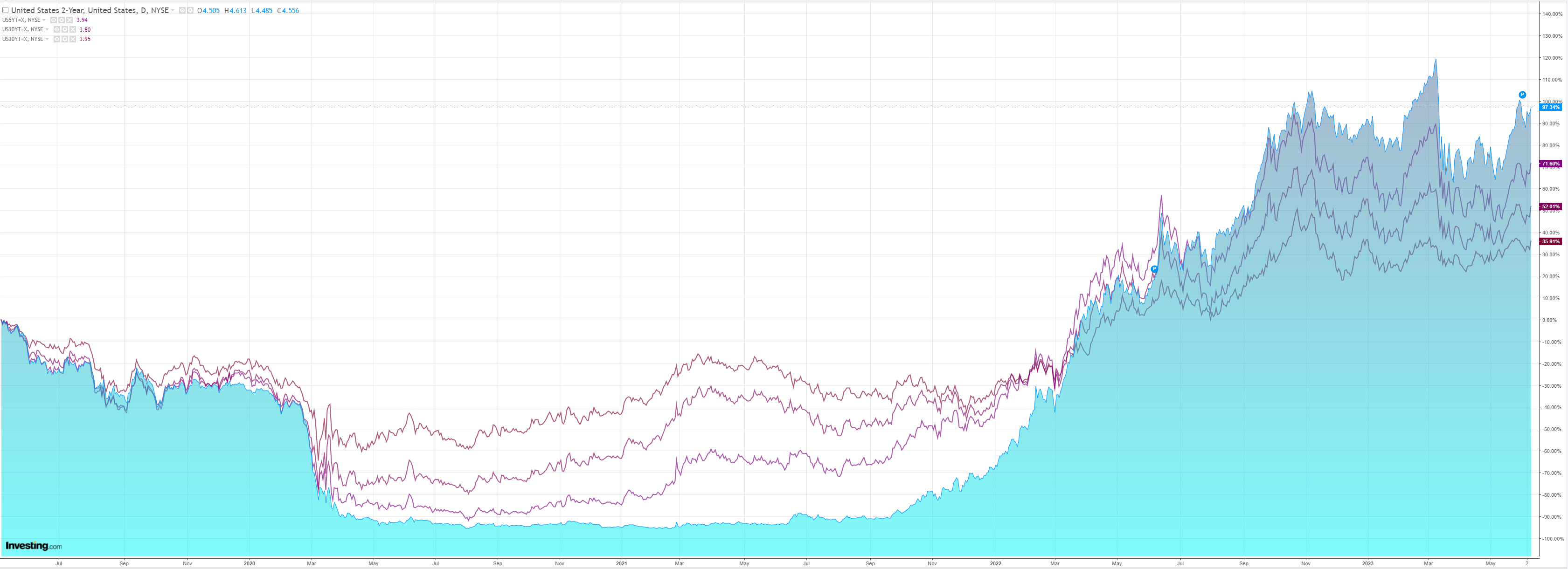

Treasuries are pricing more hikes:

Stocks didn’t like it:

Bank of Canada followed the RBA and hiked. Fed fund futures are now pricing a hike in July as well.

Rebounding bubbles everywhere are making it impossible to deflate inflation enough. More hikes are ahead everywhere.

Can this aid AUD? Credit Suisse (SIX:CSGN):

The USD retains a bias to move higher near-term against EUR, JPY and CNH. On the US side, the removal of the debt ceiling risk and the inverted yield curve support the USD via potential for higher US yields.

On the European front, softer inflation data are causing EUR to lose upward momentum: we are short EURUSD from 1.0732, targeting 1.0500 with a stop loss at 1.0835.

CNH is also losing support, as weaker activity data push policymakers to introduce fresh stimulus.

Meanwhile, disappointing Japanese wage data are reducing risks of a hawkish turn in BOJ policy at the upcoming 15-16 Jun, with negative implications for JPY. We suspect the BOJ will be content to see this unfold for now rather than try to signal a tighter policy stance. Only if USDJPY drives higher towards our near-term 145 target would we expect a reaction. But even then, it is first likely to be verbal or actual FX intervention rather than through signalling a monetary policy shift.

In this context, and with still-falling FX implied volatility giving a further boost to carry trades, we still see no reason to shift away from our recent tactical pro-USD bias against G10 low yielders as well as CNH, while retaining a structural view that some high-carry currencies such MXN and BRL in Latam can outperform the USD (given their own strong interest rate dynamics and positive underlying flow pictures).

In non-core G10 FX, we close our tactical AUD short from 0.6600 in the aftermath of the surprise RBA hike but remain nevertheless remain sceptical around the prospects of lasting RBA-driven AUD strength and hold on to our end-Q2AUDUSD 0.6600 target.

In Asia FX, we reiterate our USDCNH forecast range of 6.90-7.30, as we see potential for policy easing to undermine CNH via lower interest rates.

And that is a wrap. I agree. Most pointedly, the AUD has a terrible marriage with CNY so unless China pulls out the stimulus bazooka, not pop-gun, AUD is likely to ignore the RBA over the stretch: