DXY is looking pretty firm:

Leaving AUD in the dirt:

North Asia is going only one way. CNY is slowly deteriorating:

Gold and oil were pressured:

Most metals too:

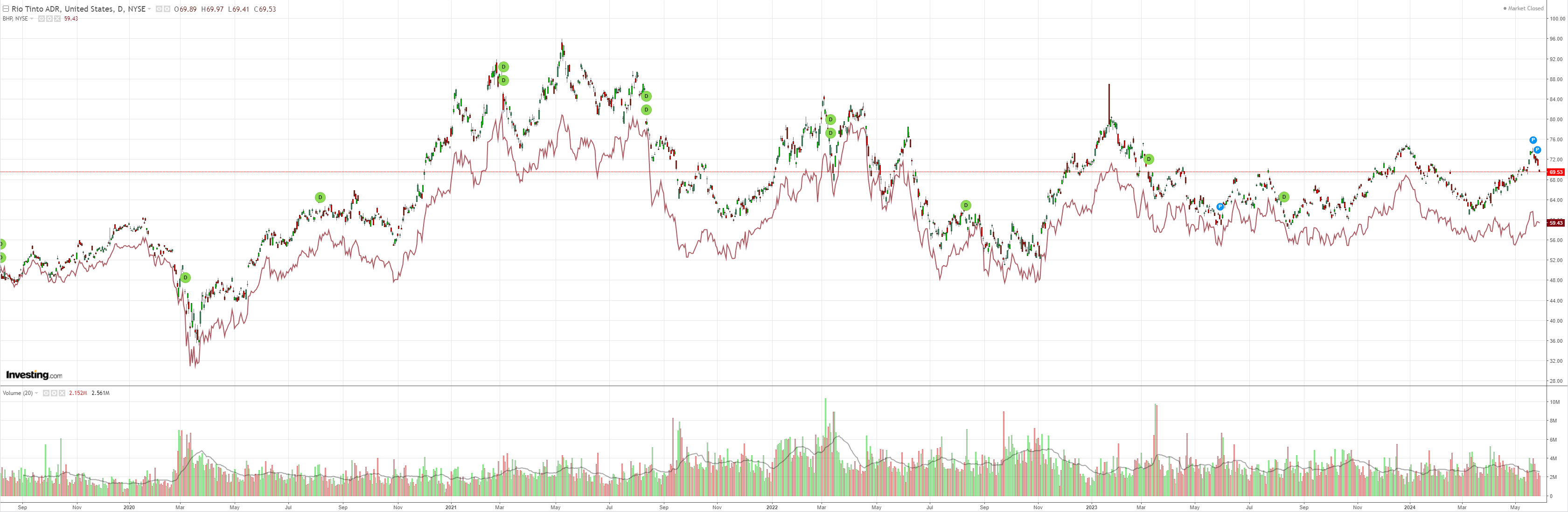

Miners meh:

EM is giving up as the Chinese rally rolls over:

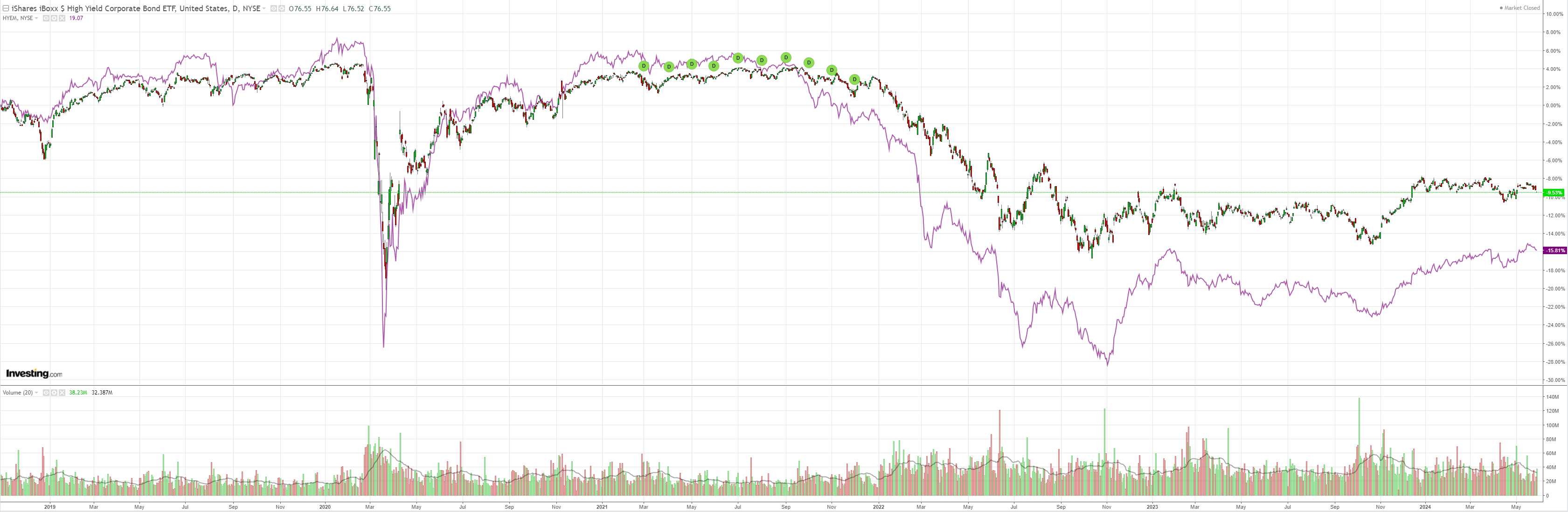

Junk is still warning:

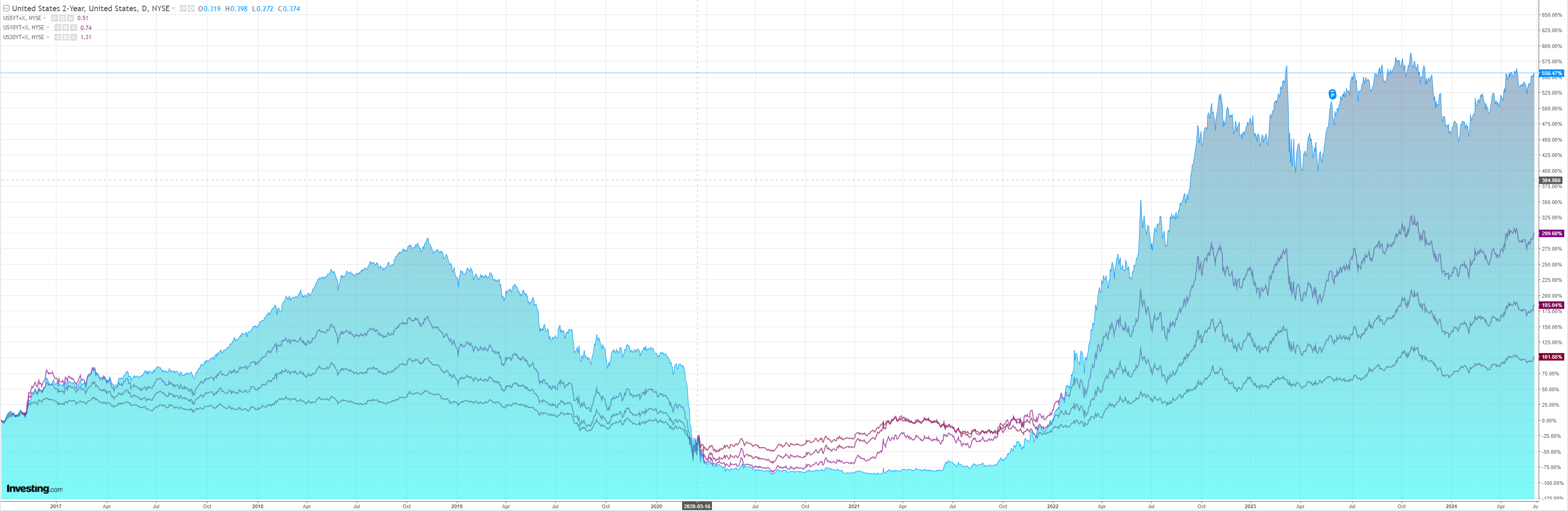

The curve was roughly stable:

As stocks gave some back:

As we roll towards H2, the headwinds for the AUD are once again intensifying:

- The US election race is about to begin, with the first debate scheduled only one month hence and tariffs a central theme.

- The Chinese property rescue is off to a poor start. This is by design, in my view.

- CNY and JPY are chronically weak.

- The likelihood continues to grow that the Federal Reserve will lag not lead any easing this year or next.

- Asset markets are still driven primarily by AI themes not very friendly to Australia.

- A global soft landing remains the base case. Fully priced bulk commodities are likely to underperform.

- Bearish positioning in the AUD has pulled back.

There are plenty of reasons here to expect a weak H2 for the Australian dollar.