DXY is consolidating, but for lower or higher?

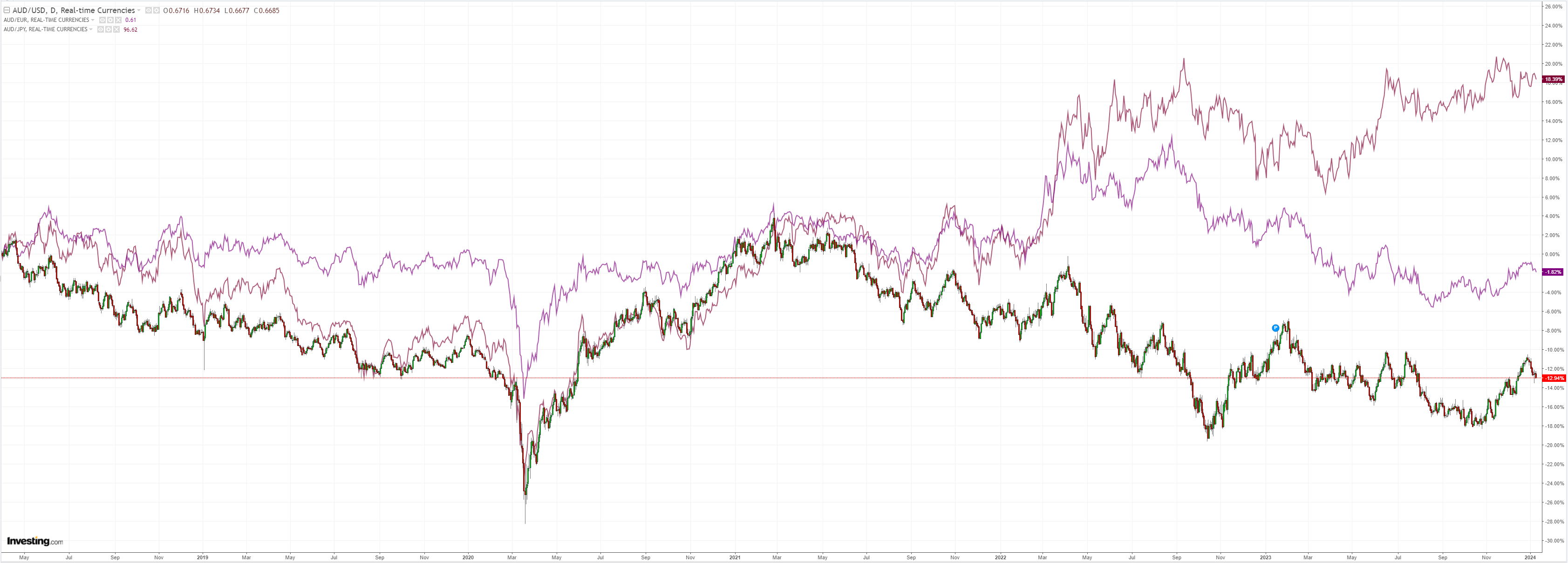

AUD is in free fall still:

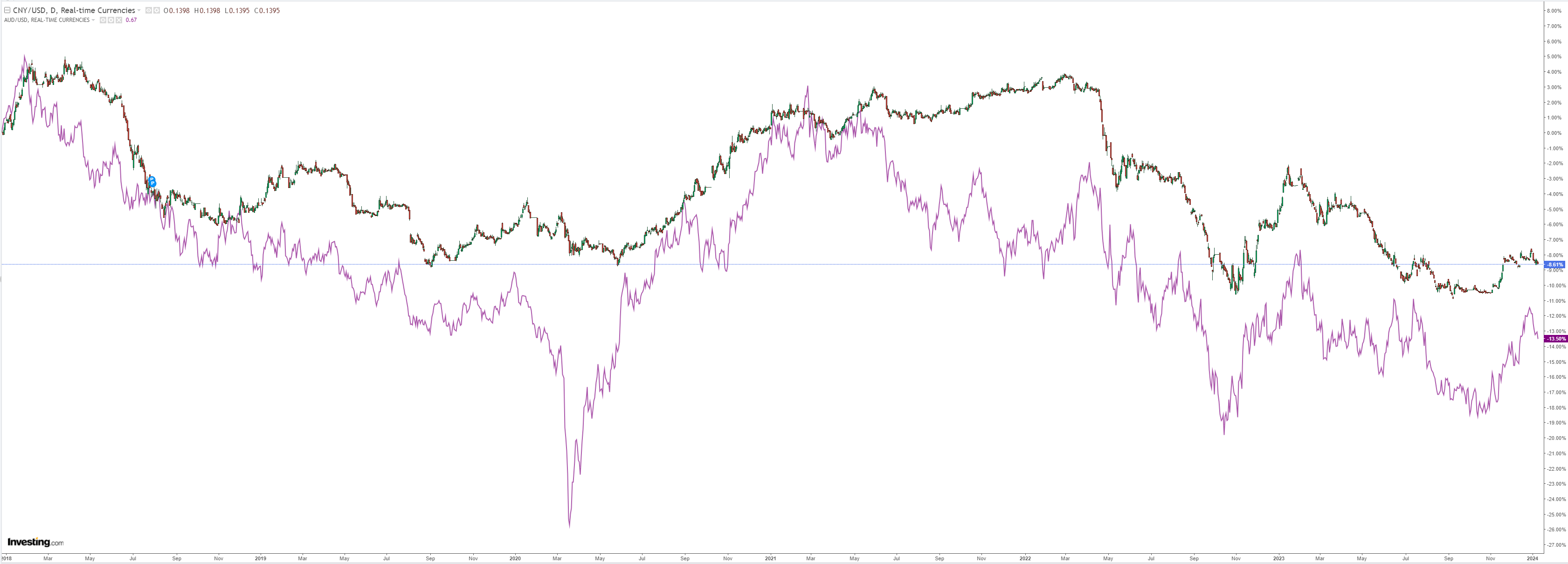

CNY is a ceiling:

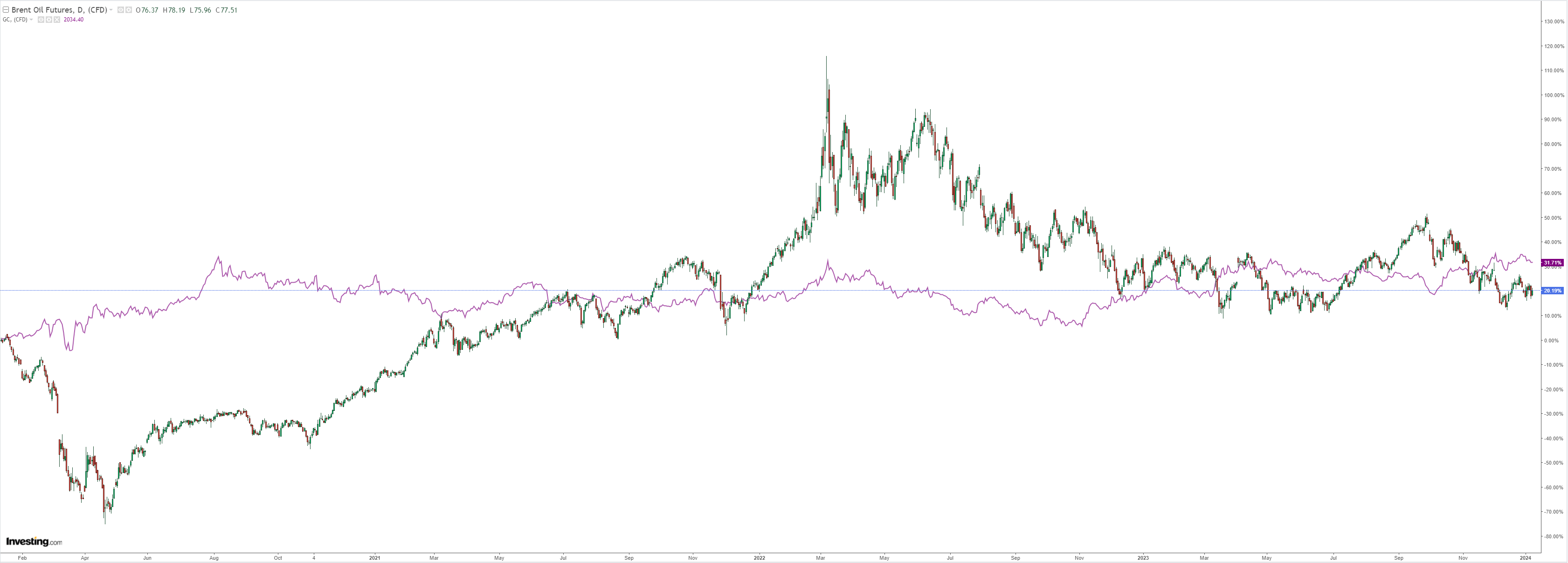

Oil is hanging on:

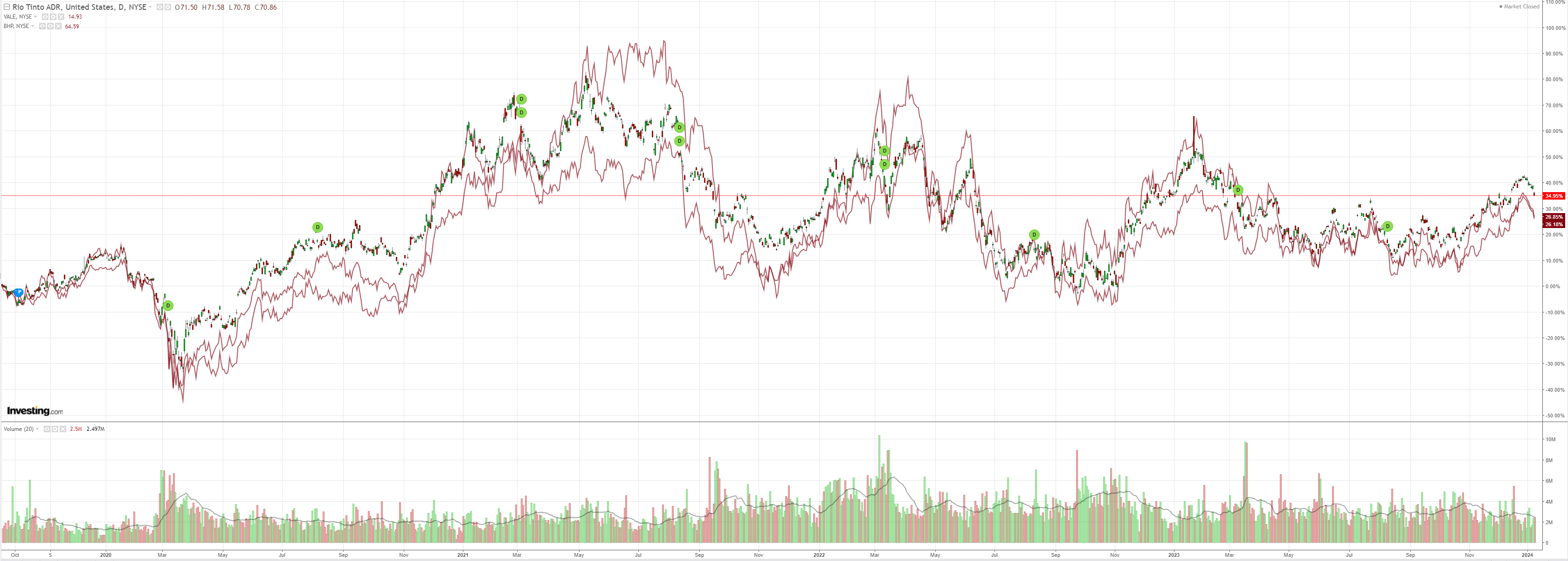

Dirt is not. China is not well:

Big miners are accelerating down:

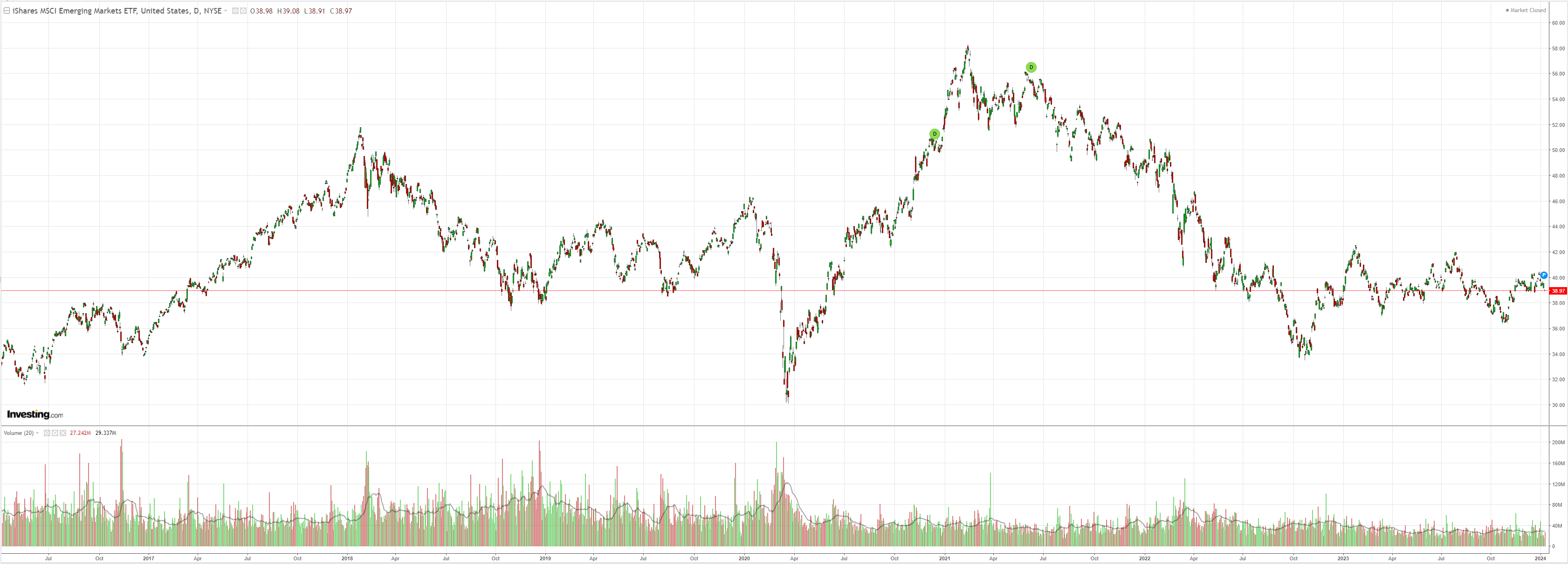

EM dead:

Junk is labouring:

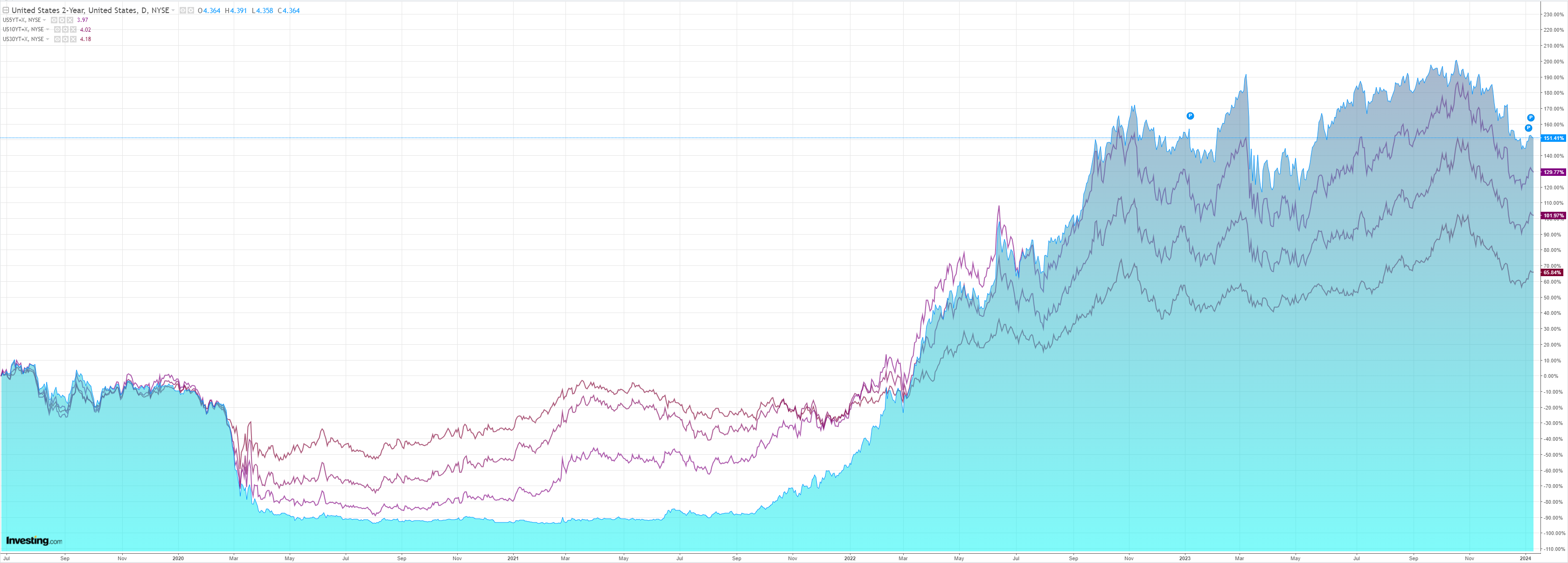

Yields fell:

Stocks were all over:

Iron ore is, apparently, the latest support for AUD:

An almost 30 per cent surge in the iron ore price to above $US140 a tonne has bolstered the prospects for the Australian dollar, which economists predict could hit US70¢ by the end of the year.

That’s the median forecast for the $A from The Australian Financial Review’s quarterly survey of 37 economists and compares with its current level of about US67¢.

These numbers are roughly the same as mine, but I would not put them down to iron ore.

I very much doubt it will hold at current levels, and the capital drought sweeping China owing to its various problems more than compensates to the downside for AUD.

The AUD is a proxy for the great China slowdown and attendant risks. Any strict relationship to iron ore would see it at 90 cents today.

China is more likely than not to hold AUD back this year.