Street Calls of the Week

DXY was up and away on Friday night:

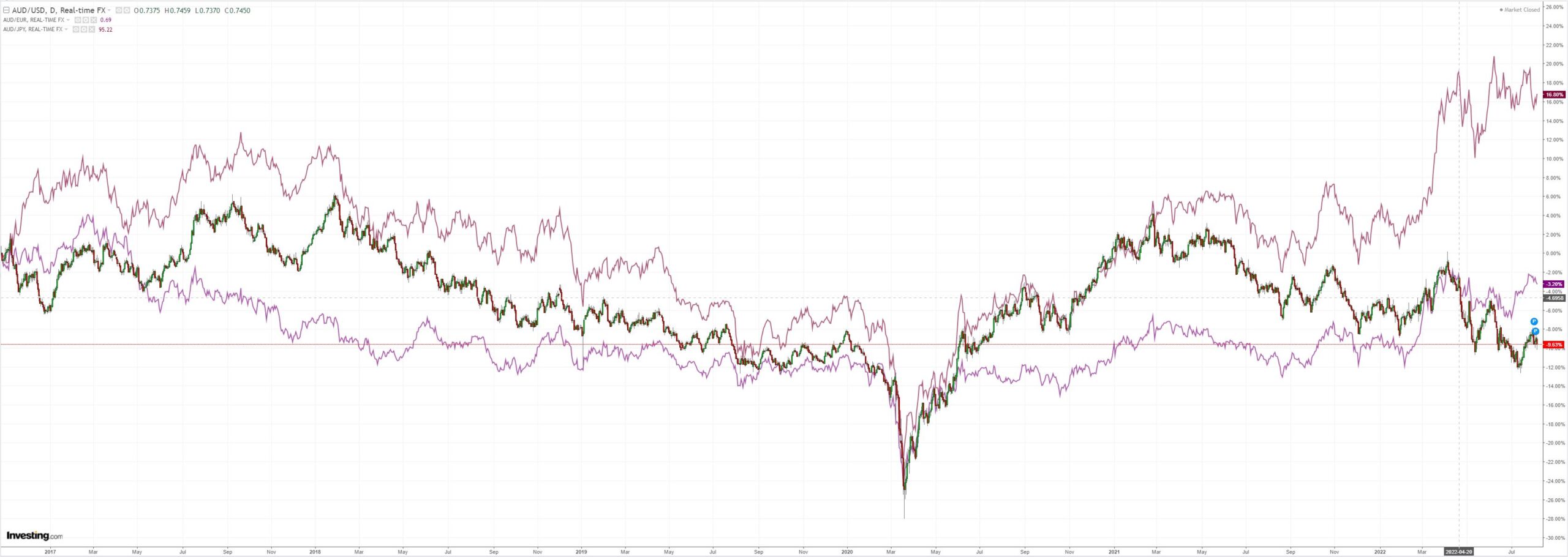

That squashed the AUD:

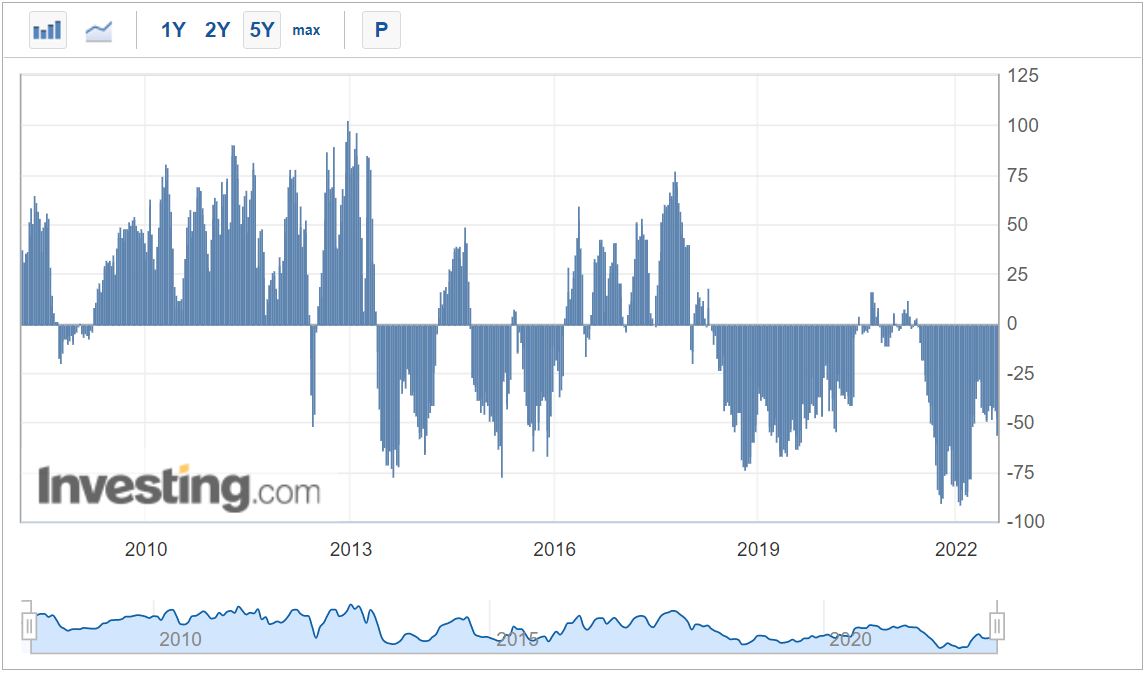

AUD shorts have been added during the bounce:

Oil held on but does not look well:

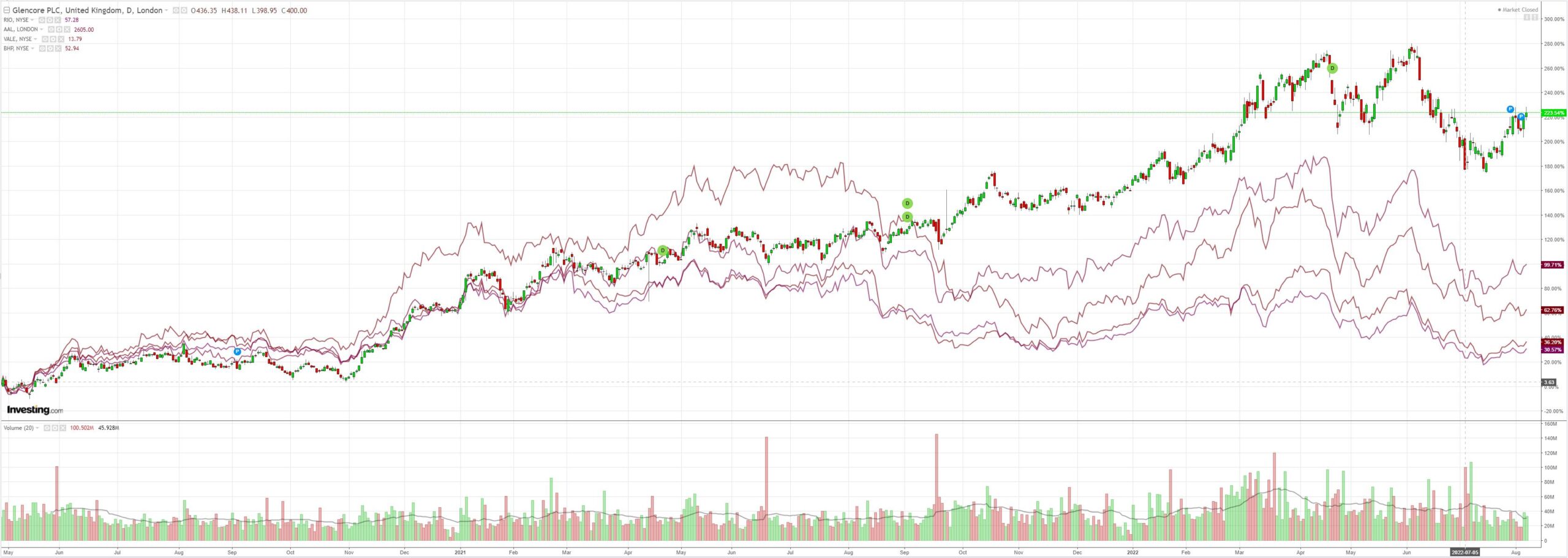

Metals did better and so did miners (LON:GLEN):

EM stocks (NYSE:EEM) are caught at resistance formerly support:

Junk (NYSE:HYG) was OK:

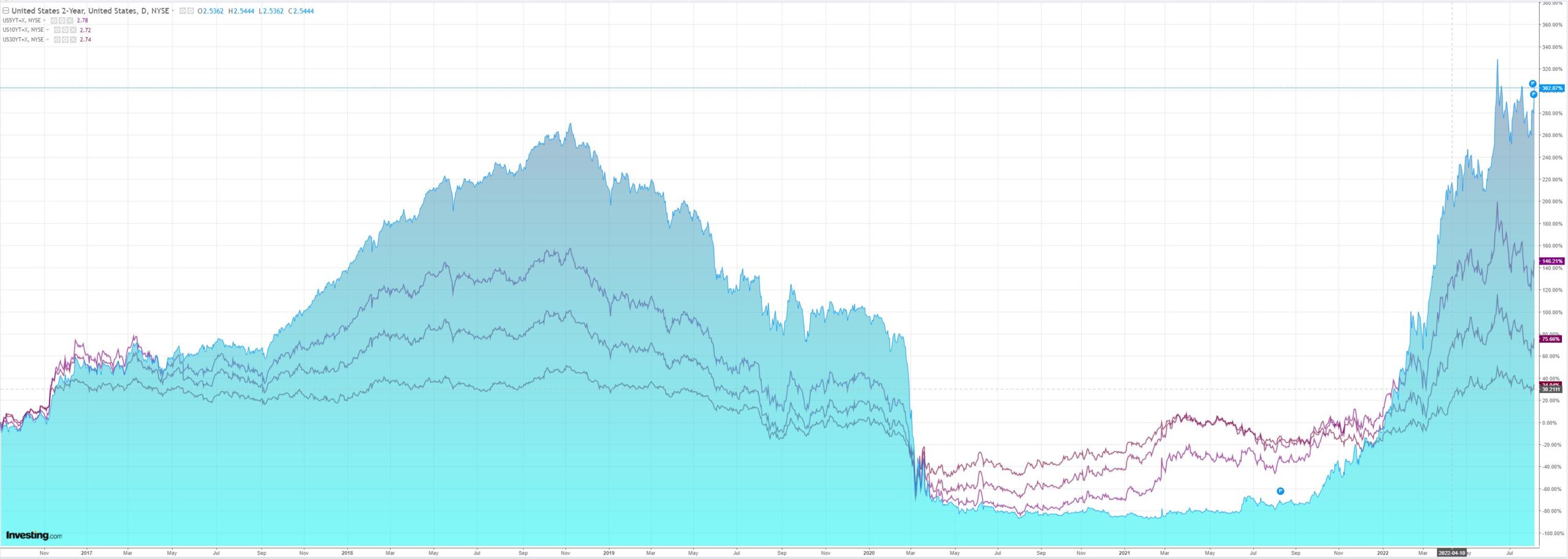

But the US curve inversion turned a deep, bloody red:

Stocks faded:

It was US jobs night of course. The BLS described a thumping labour market:

Total nonfarm payroll employment rose by 528,000 in July, and the unemployment rate edged down to 3.5 percent, the U.S. Bureau of Labor Statistics reported today. Job growth was widespread, led by gains in leisure and hospitality, professional and business services, and health care. Both total nonfarm employment and the unemployment rate have returned to their February 2020 pre-pandemic levels. The labor force participation rate, at 62.1 percent, and the employment-population ratio, at 60.0 percent, were little changed over the month. Both measures remain below their February 2020 values (63.4 percent and 61.2 percent, respectively).

In July, average hourly earnings for all employees on private nonfarm payrolls rose by 15 cents, or 0.5 percent, to $32.27. Over the past 12 months, average hourly earnings have increased by 5.2 percent. In July, average hourly earnings of private-sector production and nonsupervisory employees rose by 11 cents, or 0.4 percent, to $27.57. In July, the average workweek for all employees on private nonfarm payrolls was 34.6 hours for the fifth month in a row. In manufacturing, the average workweek for all employees held at 40.4 hours, and overtime increased by 0.1 hour to 3.3 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls remained unchanged at 34.0 hours.

BofA:

Establishment nonfarm payrolls topped all expectations with a 528k increase in July and positive revisions of 28k to the previous two months (BofA: 275k, Consensus: 250k). Private payrolls rose by 471k and government payrolls surprised with a 57k gain. After cooling modestly in the 1H of the year, the three-month average increase rose from 384k in June to 437k in July. The report throws cold water on a significant cooling in labor demand, but it’s a good sign for the broader U.S. economy and worker. The unemployment rate, meanwhile, fell to 3.5% and was very close to 3.4% with the unrounded measure at 3.458%, lowest since the late 1970s. The discrepancy between the household and establishment survey continued as employment rose by a more modest 179k in the household survey and has averaged a 62k increase over the last 3-months. Labor supply also remains soft according to the household survey as the participation rate dipped to 62.1% from 62.2%, though the prime age participation rate did tick up to 82.4% from 82.3%. Average hourly earnings were up a strong 0.5% mom on top of a one-tenth upward revision to the June data. The yoy rate is now at 5.2%, the same as the revised June figure. Wages have decelerated slightly in the goods sector to 4.5% yoy, from the March peak of 5.2%. Wages are running at 5.4% in the services sector. The payroll proxy (the index of aggregate hours worked multiplied by the index of average hourly earnings) rose by 1.2% mom in July, which should translate into positive real income growth given the decline in energy prices. On the heels of the July employment report, which shows little evidence of cooling labor demand, we now look for the Fed to lift the target range for the federal funds rate to 3.50-3.75% by year-end, 25bps more than we had expected previously. We still think the Fed will prefer to move in smaller-sized increments going forward when lifting its policy rate, and project 50bp hikes at the September and November meetings, followed by a 25bp hike in December. Risks to our outlook for monetary policy continue to be skewed into the direction of a firmer policy path.

That about sums it up. This leaves the bear market rally kicking its legs in mid-air as the ground falls away:

AUD too!