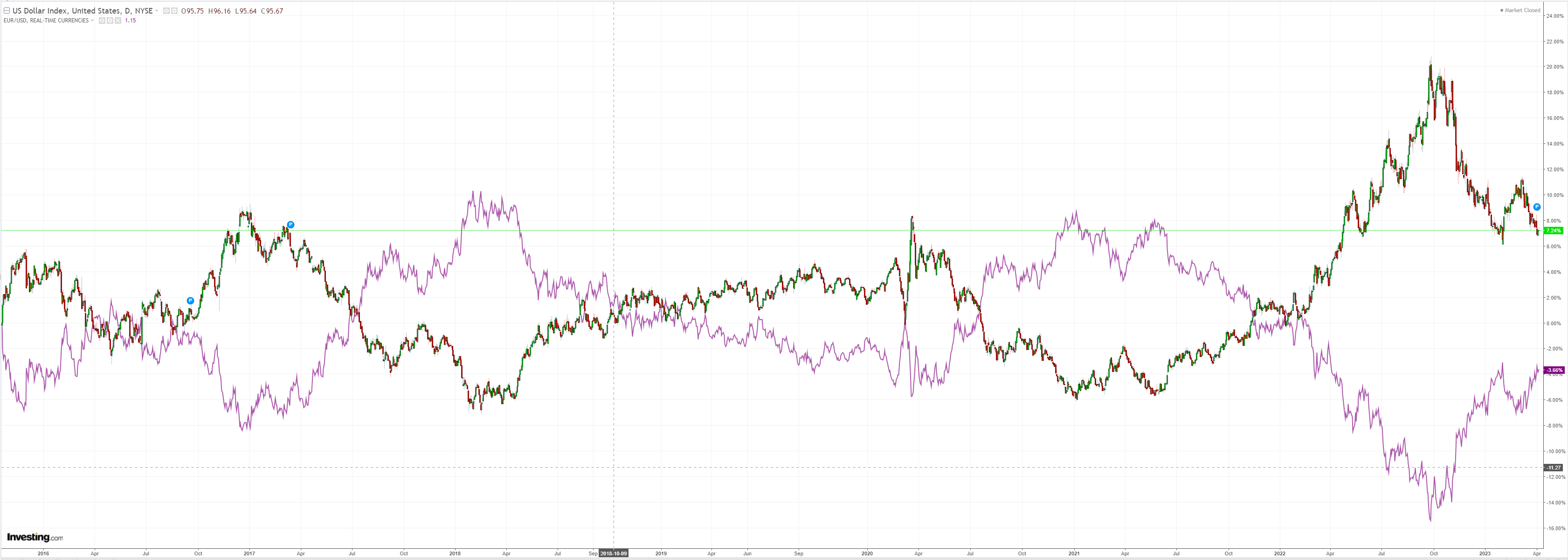

DXY rose before Easter:

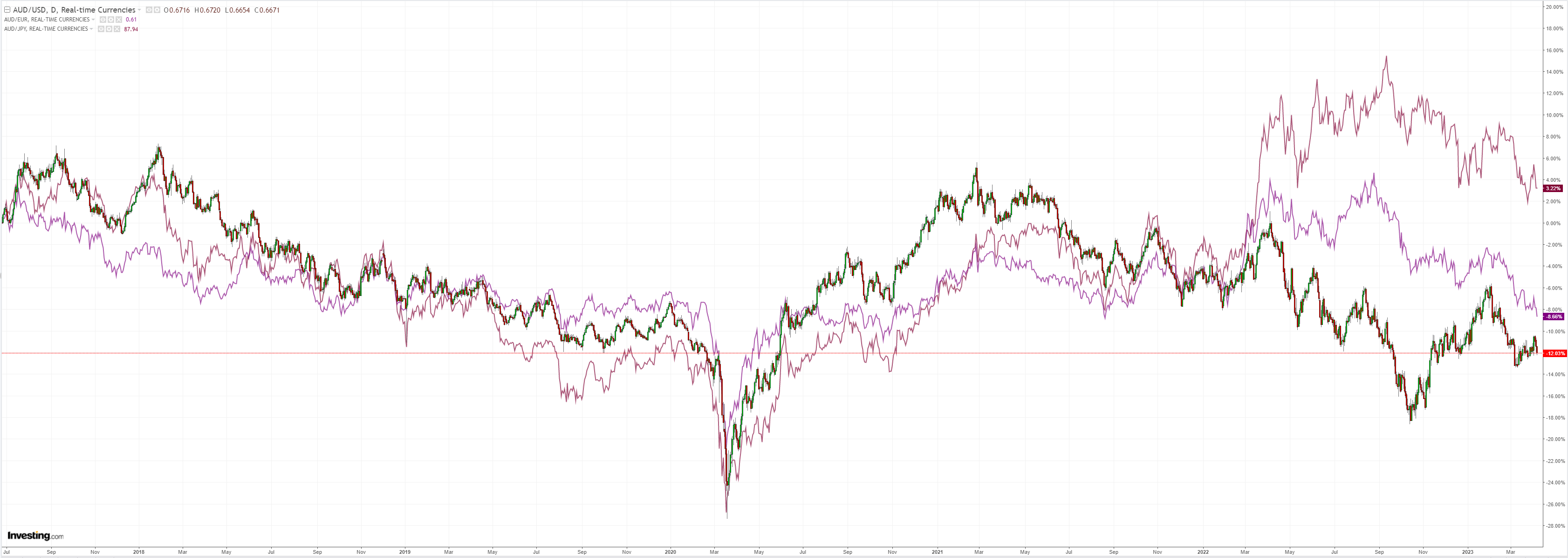

AUD is down, down:

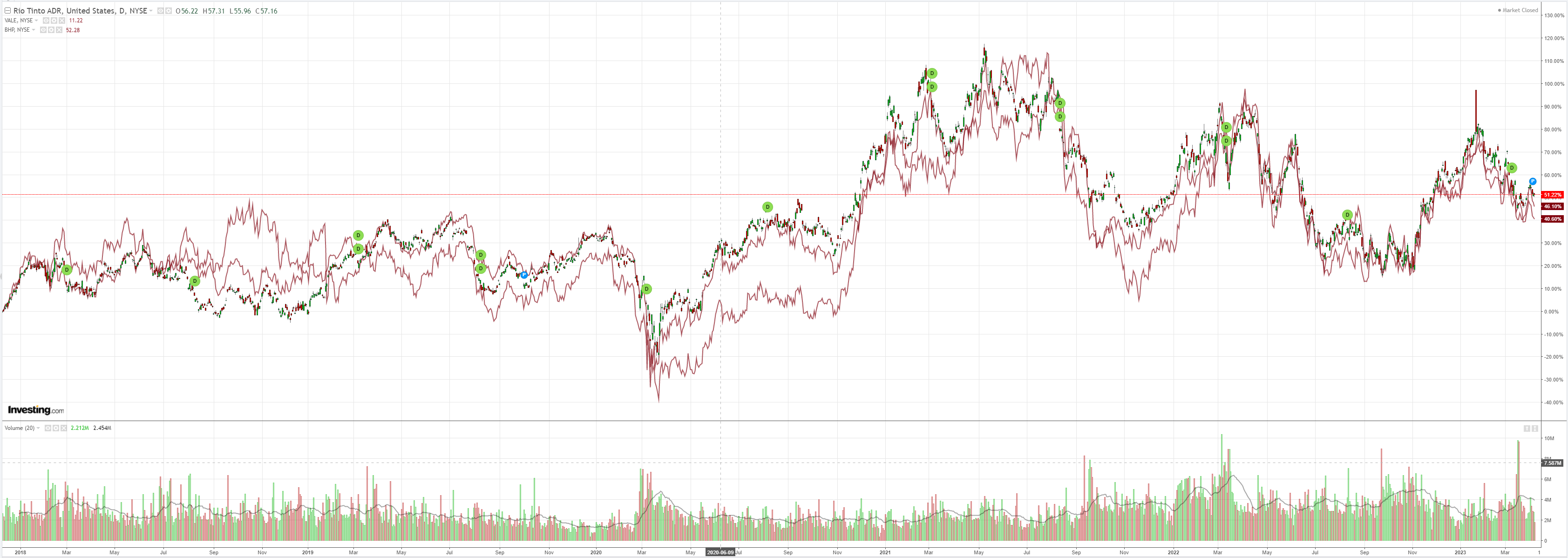

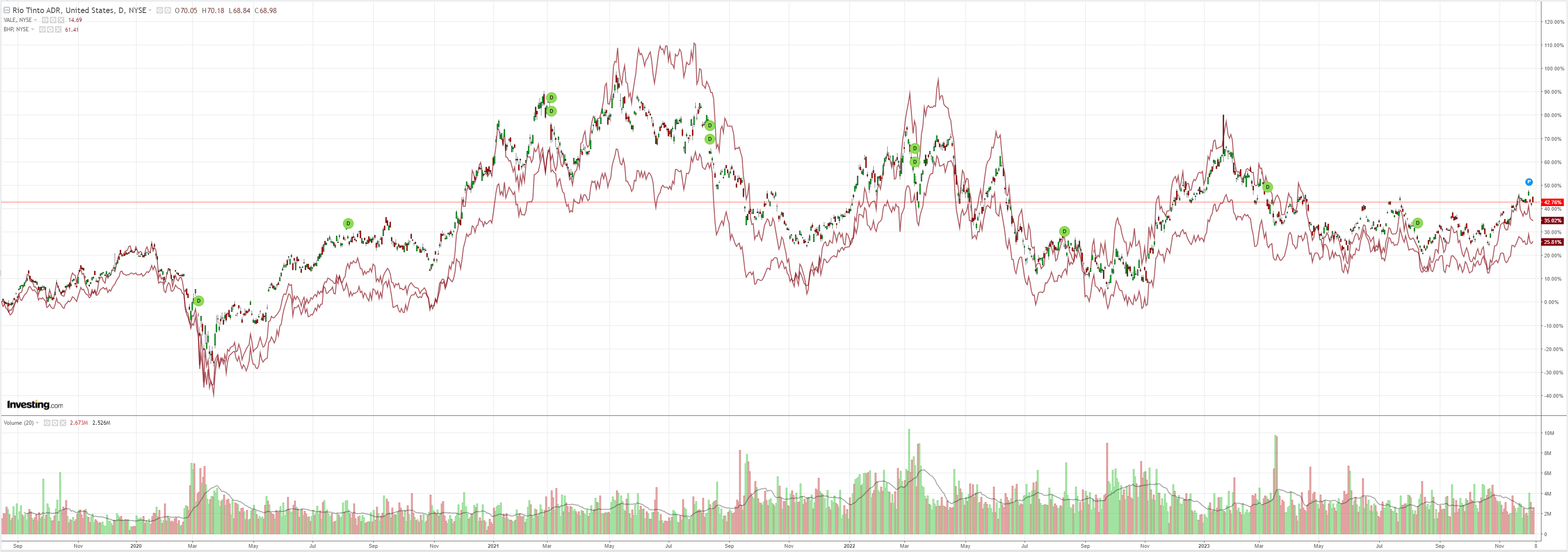

Dirt was OK:

Miners (NYSE:RIO) fell:

EM stocks (NYSE:EEM) stalled:

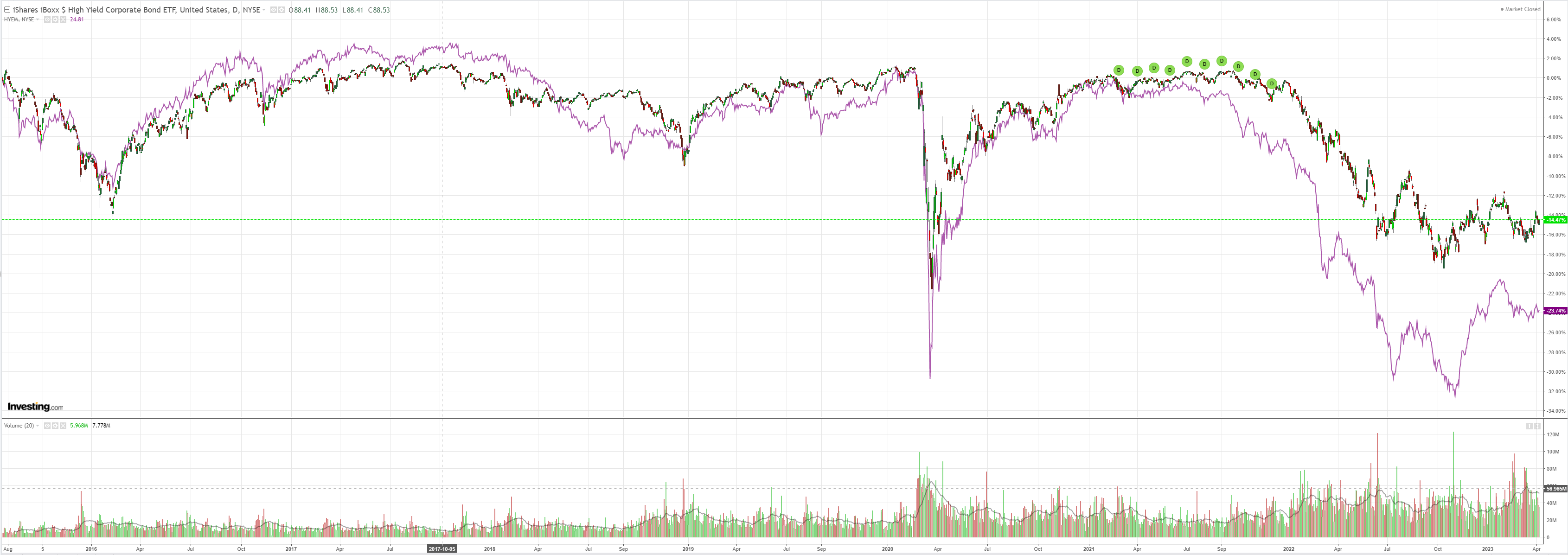

Junk (NYSE:HYG) too:

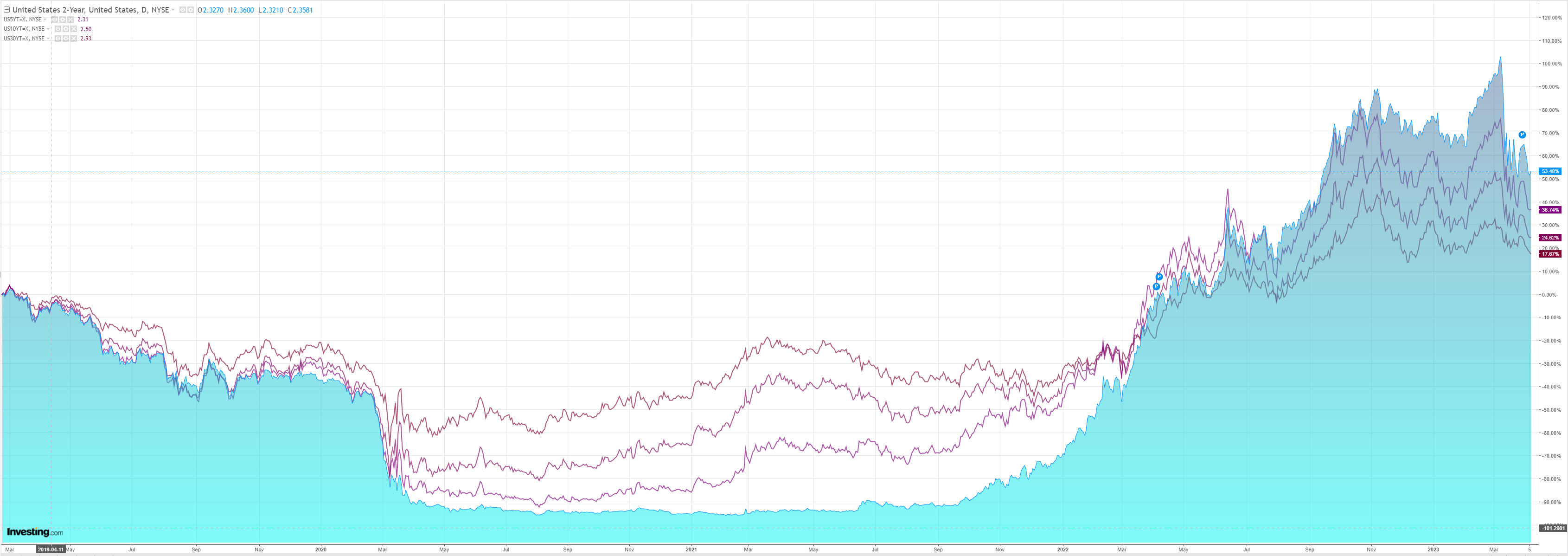

The Treasury curve steepened:

Stocks firmed:

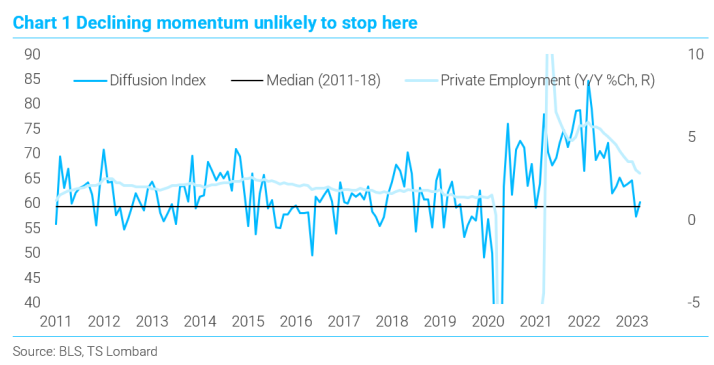

I will let Steven blitz at TS Lombard tell the tale of US jobs.

The recession did not start in March, but momentum is still heading in that direction, and the Fed will hike on May 3. The Fed will see March employment data as evidence of sustained demand for labor and conclude that their hiking tack has not yet crossed the finish line. To be clear, this is unlike recent past periods when employment growth slowed during extended expansions because of shifts in Fed policy. This FOMC has no intention of reversing any slowdown – a higher unemployment rate is, after all, their intention (how intent once unemployment begins to rise is up for debate). The economy’s flagging momentum will feed on itself, and net hiring eventually flips negative. Recent behavior of 2s/10s confirms as much.

The diffusion index for private sector firms is hovering around its 2011-18 median (Chart 1), consistent with 2% Y/Y growth in private sector employment. The current Y/Y growth rate is 2.8%, 2.5% for the past six months, 2.4% in the past three months, and 1.7% M/M. Looking forward, stasis is unlikely given the inverted curve (though now less inverted, see below for discussion) and the real funds rate is becoming more positive as core inflation ebbs (not to 2%, but ebbing nevertheless).

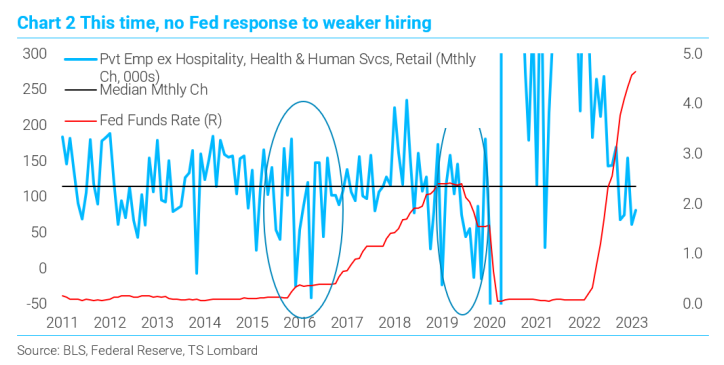

There have been two recent instances of weakening private sector employment (excluding hospitality, health & human services, and retail) and each time the Fed reacted. In 2016, they did not hike for a year, and in 2019 the Fed cut the funds rate 100BP (Chart 2).

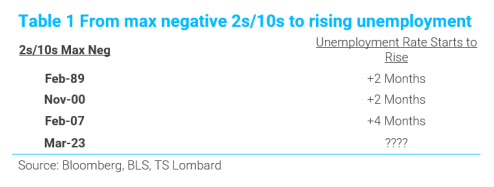

What does the market know? The 2s/10s yield curve reaches its most negative level around two to four months prior to the unemployment rate beginning its recessionary tack (Table 1). The curve tends to flip positive in the month that unemployment rises. In the current cycle, March was the curve’s most negative position (-111BP).

Assuming that this low is not taken out, May is pinned as the first month of rising unemployment, perhaps as late as July. A July start for rising unemployment would sync with my model forecast (based on the NAHB HMI) – and my call for a mid-year start to the recession.

In sum, the economy and the FOMC continue their orchestrated waltz towards recession. March employment data add to the slowing momentum for hiring that the Fed has no intention of reversing. They are, instead, encouraging this slowdown and will get what they want in a few months – unemployment heading towards 4.5%. My grandmother used to say, “careful what you wish for, it might come true”. They “hike in May and go away.” Funds rate at 3% by year’s end.

Be careful, indeed. There is no need to hike again but if they do it will only make it worse. My own view is the we are likely to see a garden variety moderate recession.

And bare in mind that every time the NBER has declared a US recession (that is 1990, 2000 and 2008), the Fed has cut 500pbs, not 200bps. Recessions are not inflationary.

As the recession piles in, I prefer JPY as the safe haven of choice for AUD.