DXY is flushing its war premium and EUR regaining some poise:

The Australian dollar is falling anyway:

Oil was up:

Base metals were up:

Miners (LON:GLEN) too:

EM stocks (NYSE:EEM) held:

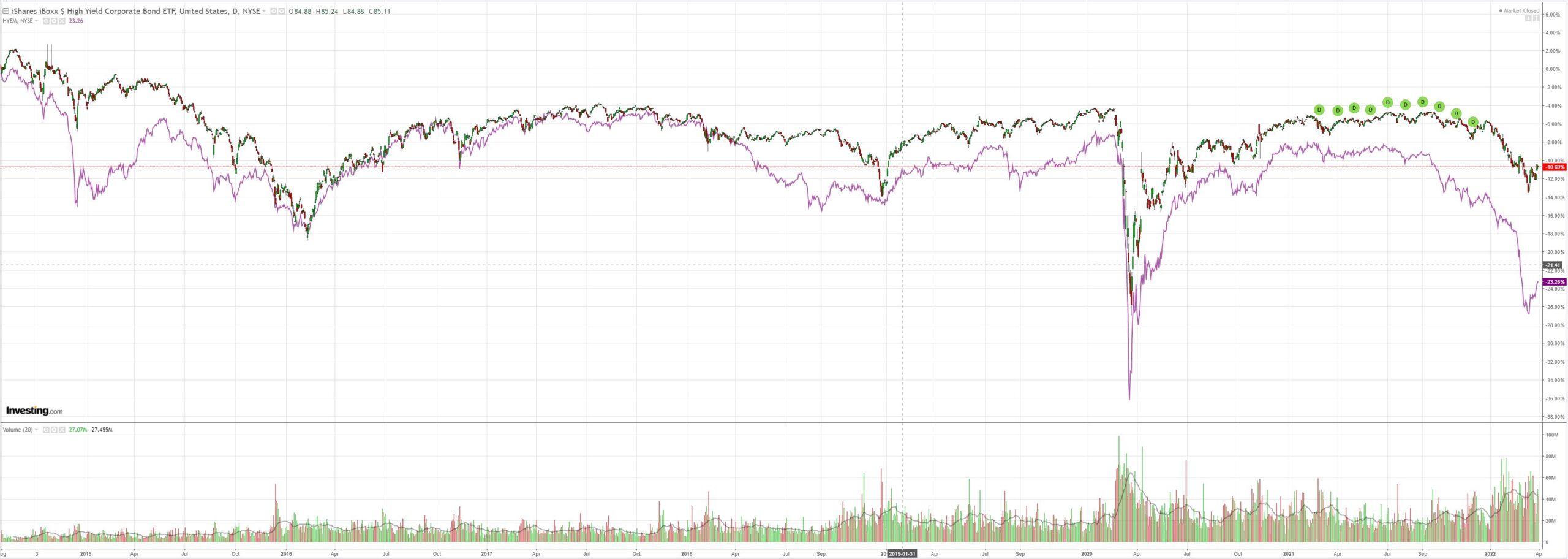

Junk (NYSE:HYG) is still recovering:

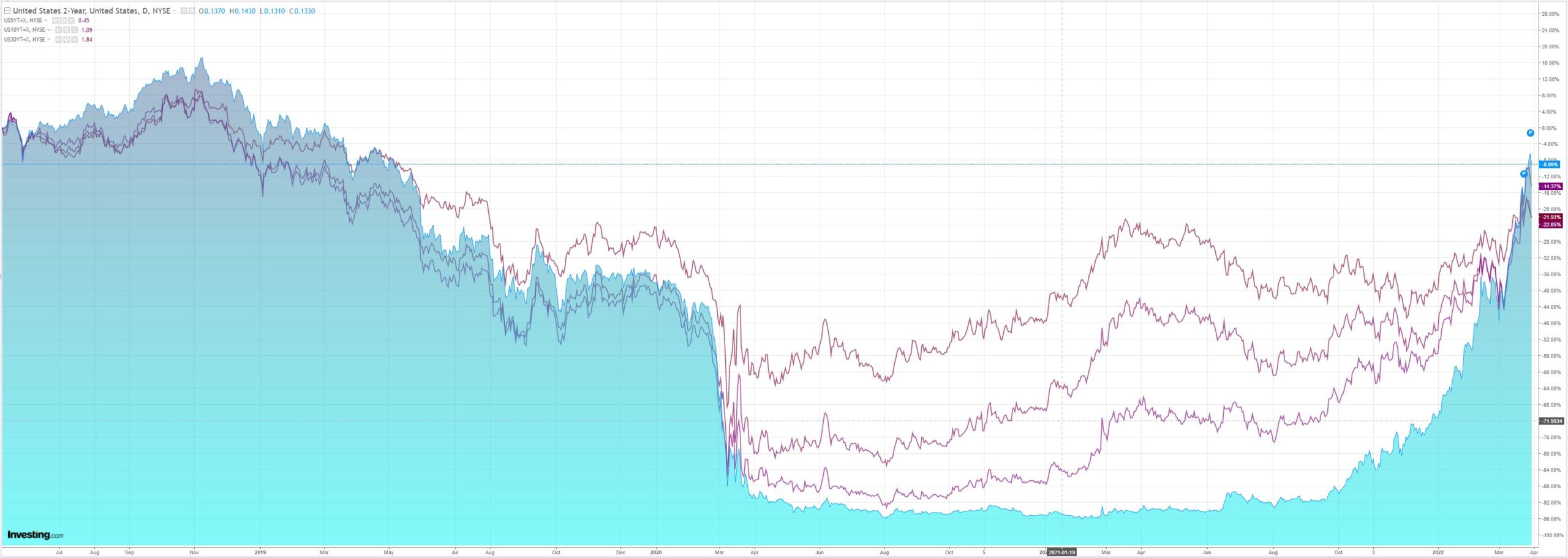

Yields fell as the curve kept flattening:

Stocks flamed out:

Westpac has the wrap:

Event Wrap

US GDP for Q4 was finalised at 6.9% (est. 7.0%, prior 7.0%). Personal consumption disappointed at 2.5% (est. 3.1%, prior 3.1%). ADP private payrolls in March grew by 455k (est. 450k, prior revised from 475k to 486k).

German CPI in March rose 2.5% (est. 1.6%, prior 0.9%), for an annual pace of 7.3%. Friday’s Eurozone inflation data is set for a large upside surprise.

Russia said talks with Ukraine yielded no breakthroughs and that it was regrouping forces in a push to complete the takeover of the eastern Donbas region.

Event Outlook

Aust: A large rebound dwelling approvals is expected in February as the sector recovers from omicron-related disruptions (Westpac f/c: 20%). Meanwhile, record low interest rates are set to provide another sound gain in private sector credit growth in February (Westpac f/c: 0.6%).

Japan: Volatility in industrial production will likely persist in February as supply issues continue to be worked through (market f/c: 0.5%).

China: COVID-19 disruptions are expected to subdue growth in the March manufacturing and non-manufacturing PMIs but the underlying strength of the economy is still clear (market f/c: 49.8 and 50.3 respectively).

Eur/UK: The European unemployment rate is anticipated to fall further in February, laying the foundation for robust wages growth (market f/c: 6.7%). The UK’s Nationwide house price growth should slow as rising mortgage rates cool demand over 2022 (market f/c: 0.5%) and the final estimate to Q4 GDP will highlight the robust health of the UK economy heading into a tightening cycle (market f/c: 1.0%).

US: Weak personal income growth may start to raise concerns over reduced purchasing power (market f/c: 0.5%) given the need for strong personal spending on services to secure above trend GDP growth (market f/c: 0.5%). Meanwhile, PCE inflation should remain near 40-year highs in February with price pressures only gradually abating through 2022 (market f/c: 0.6% headline; 0.4% core). Initial jobless claims are set to remain at a very low level (market f/c: 196k) and the March Chicago PMI should reflect ongoing concerns around supply issues (market f/c: 57.0). The FOMC’s Williams is due to speak.

While the Ukraine war looks more hopeful, both DXY and AUD upside are likely to lose steam.

However, I still see one more bull run for DXY as the Fed outpaces all other central banks. It is unlikely that the AUD will be able to track higher with it unless the war gets worse again and commodities supply chains remain stressed.