DXY is pouring it on:

AUD has no bid:

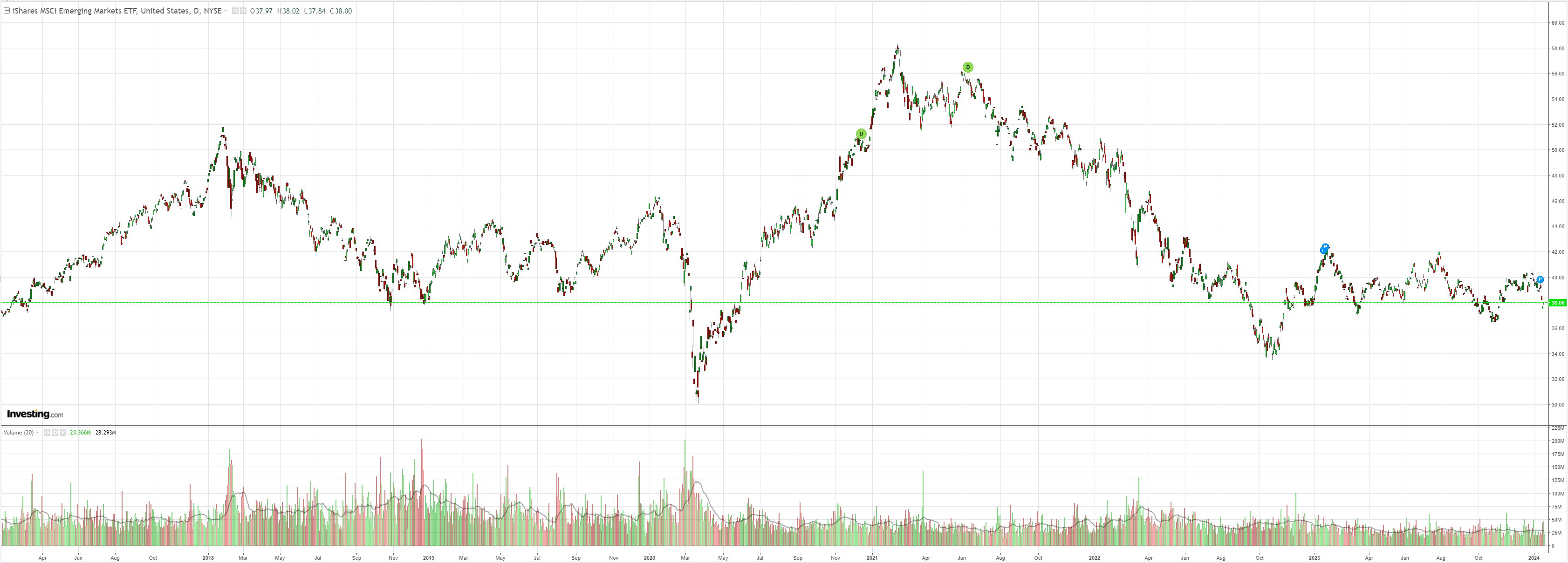

As the north Asian sinkhole deepens:

Oil and gold both bucked the trend:

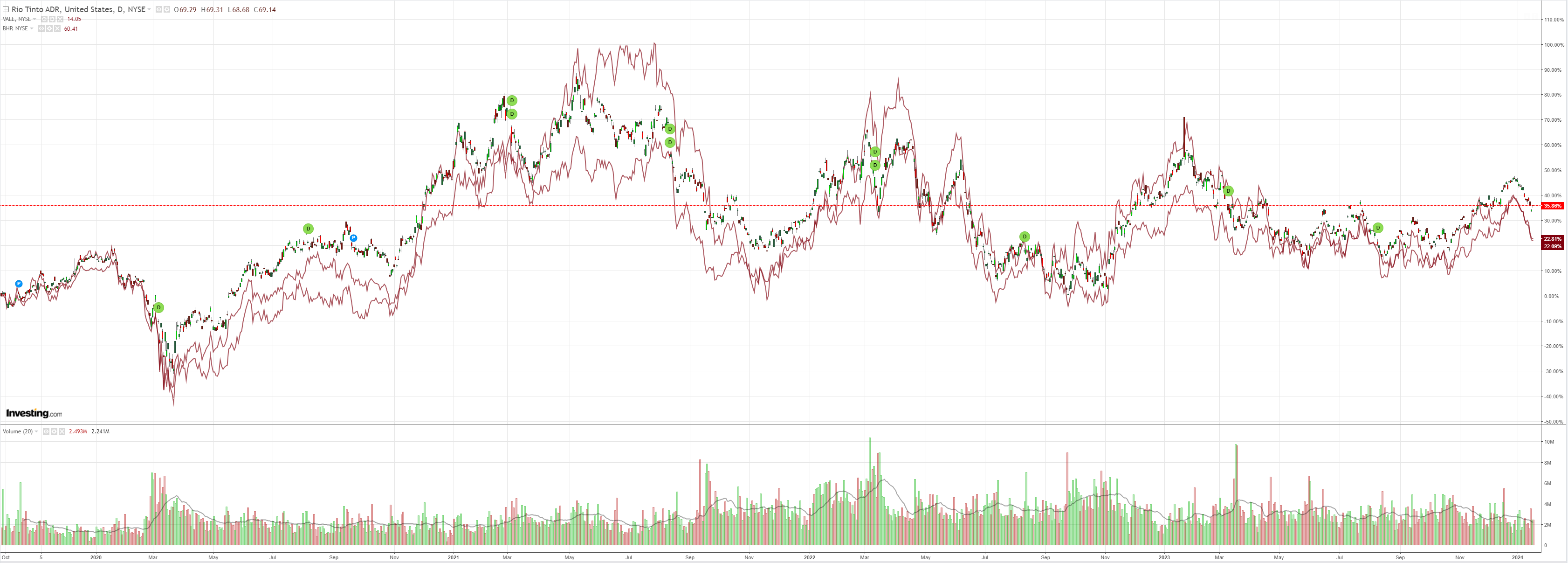

Dirt is done:

Miners missed out:

EM lol:

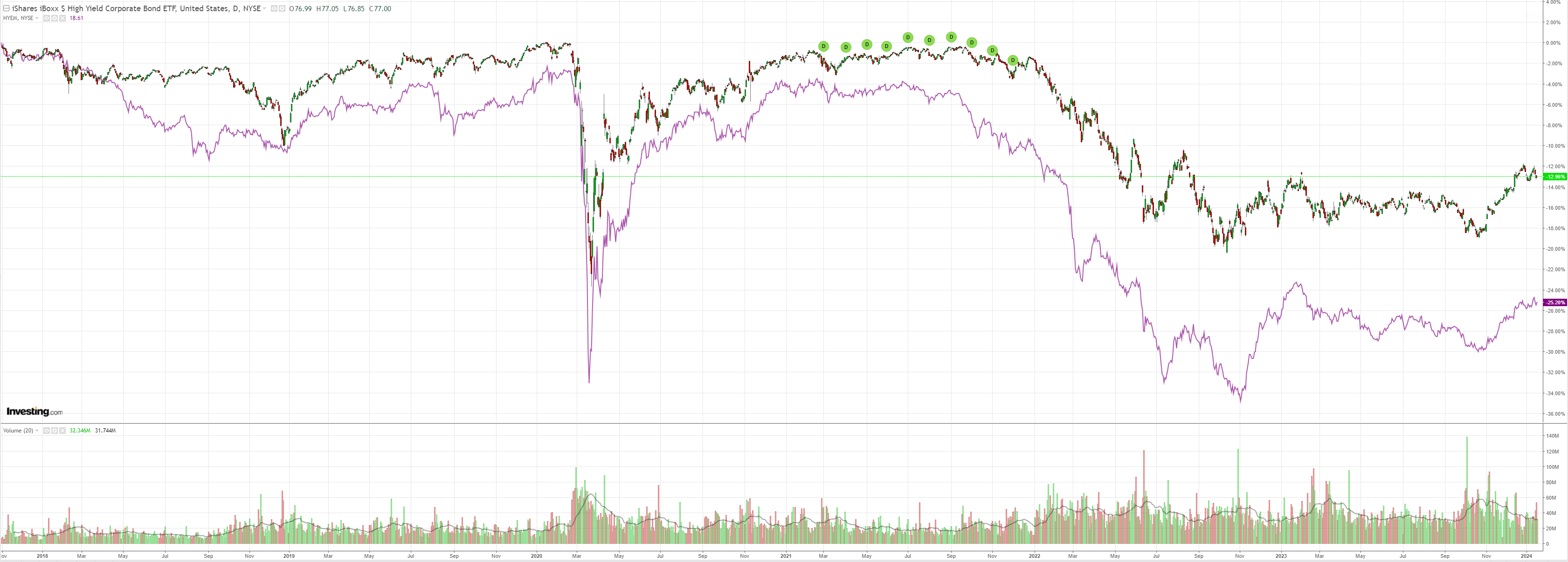

Junk hope:

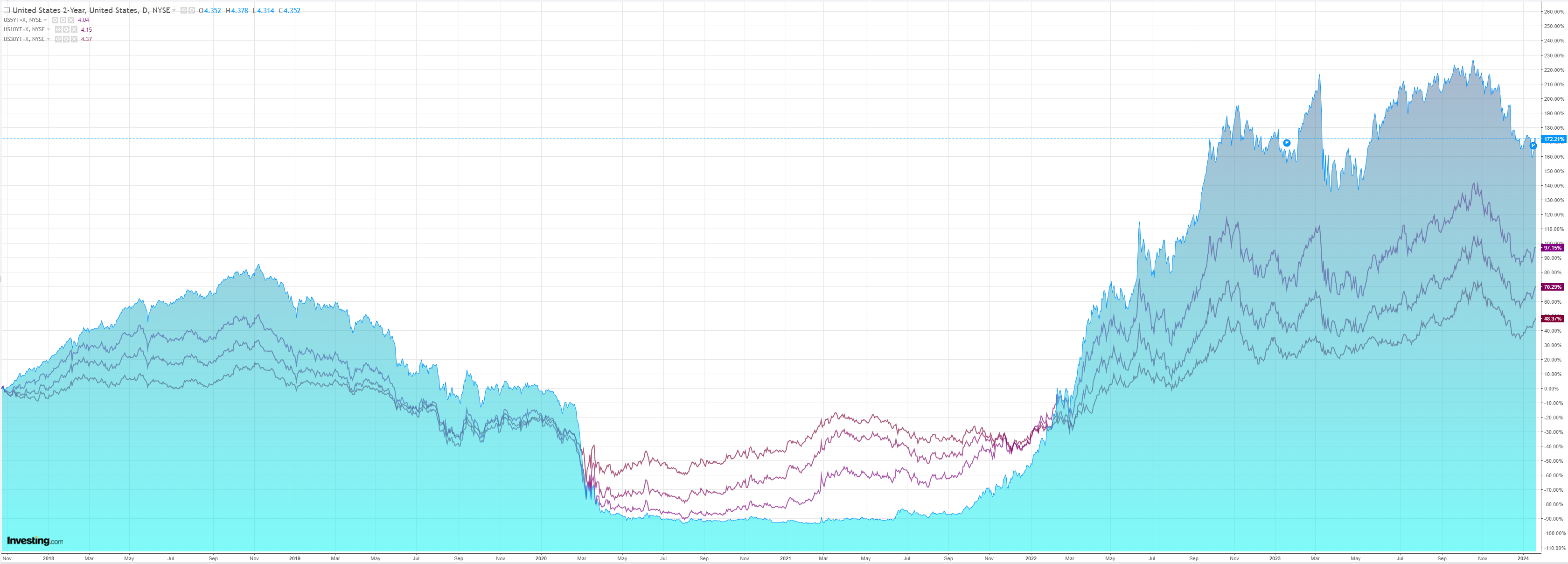

Yields are still in an uptrend:

Stocks mania:

There was not much to add to anything overnight; that was enough for stocks to BTFD and fly.

AUD missed out almost entirely on BTFD as markets rerun the US growth leadership case again.

If that continues and yields resume rising then stocks will come under pressure. It is now a quality tech rally again, and rising yields are poison for that:

But the tailwind of a friendly Fed and the looming election will be supportive and prevent a meaningful drawdown.

If the US does not slow, as I still expect, then Fed cuts will be shallower than expected this year, and the AUD will get murdered as the Aussie cycle surpasses US weakness, principally via a fast-fading labour market destroyed by Albo’s immigration lunacy.

Add the North Asian sinkhole as Japanese inflation fails and China sinks deeper into deflation, and you have the perfect downside storm for the AUD.