Market mayhem continues. DXY was firm and EUR weak:

AUD looks ripe for more falls:

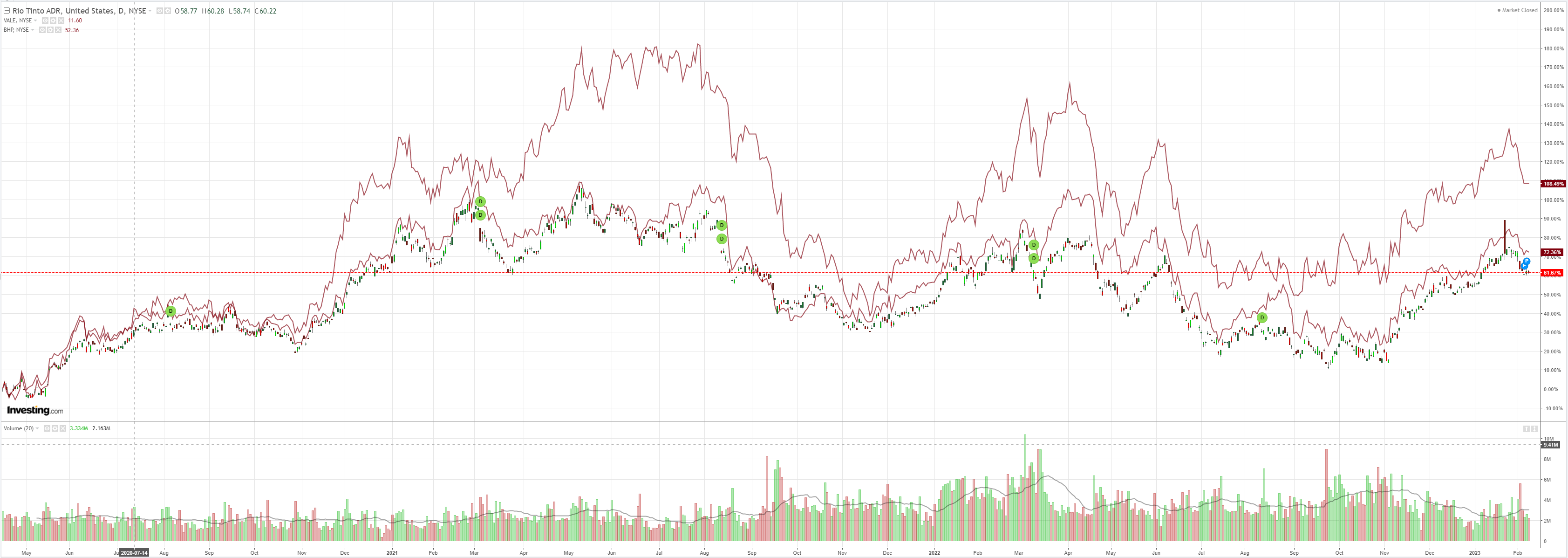

Metals were more circumspect:

Repeat after me: the Chinese reopening is iron ore bearish:

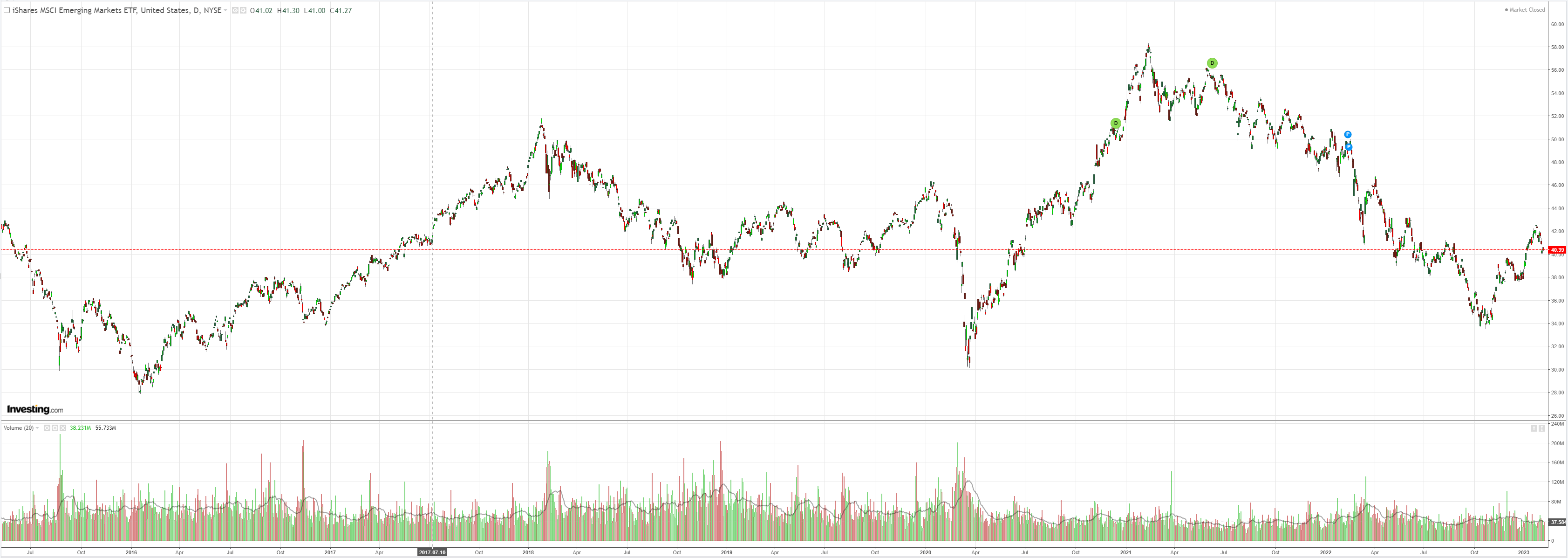

EM stocks (NYSE:EEM) held on:

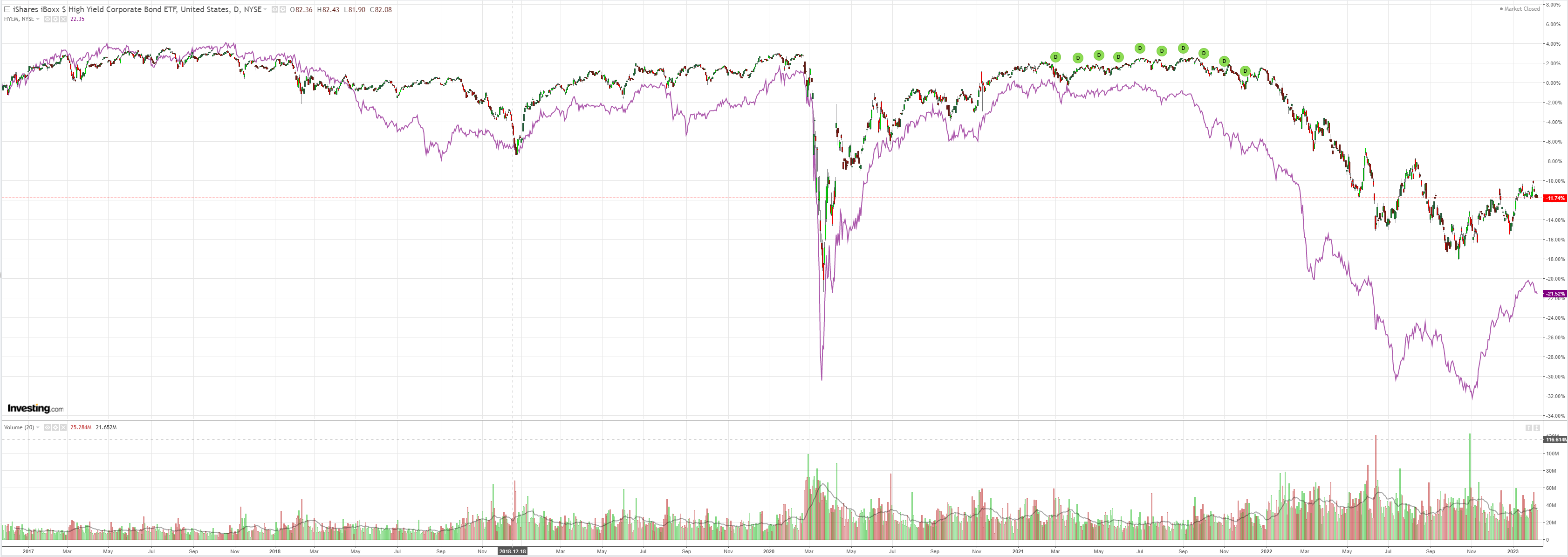

Junk (NYSE:HYG) did not:

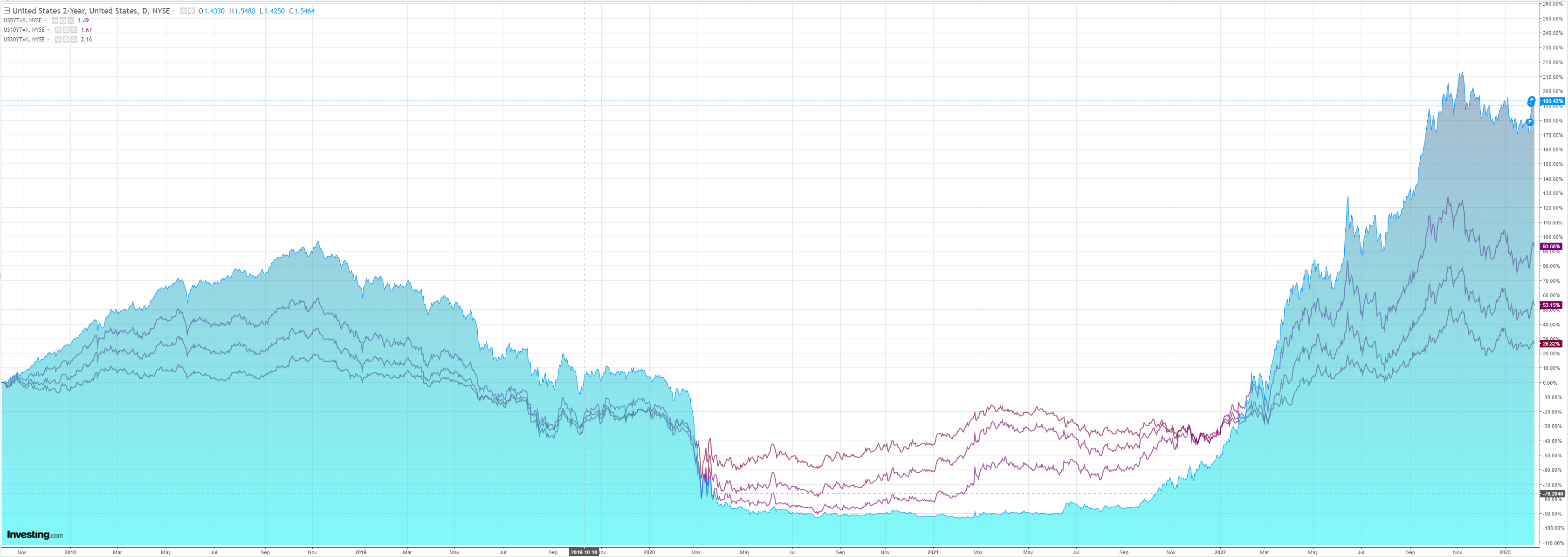

As the curve inversion turned even more bloody:

Stocks folded:

Bloomie has the wrap:

A selloff in tech stocks weighed heavily on trading Wednesday, with the most-recent string of Federal Reserve speakers reinforcing the idea that interest rates will need to keep climbing to quash inflation.

Their tone was clearly intended to catch the market’s attention in what looked like a concerted effort to push back against the dovish read of Jerome Powell’s interview Tuesday, noted Krishna Guha at Evercore ISI. From Fed Bank of New York President John Williams to his Minneapolis counterpart Neel Kashkari and Governor Christopher Waller, the message was clear: policy may need to be tight for a while.

Those remarks just gave credence to the recent hot trade in the rate-options market — where several big wagers on the Fed’s benchmark reaching 6% have popped up. That’s nearly a percentage point higher than consensus. For several market observers, such hawkish positioning makes it tough for equities to keep grinding higher — especially after the rally that brought the S&P 500 to overbought territory.

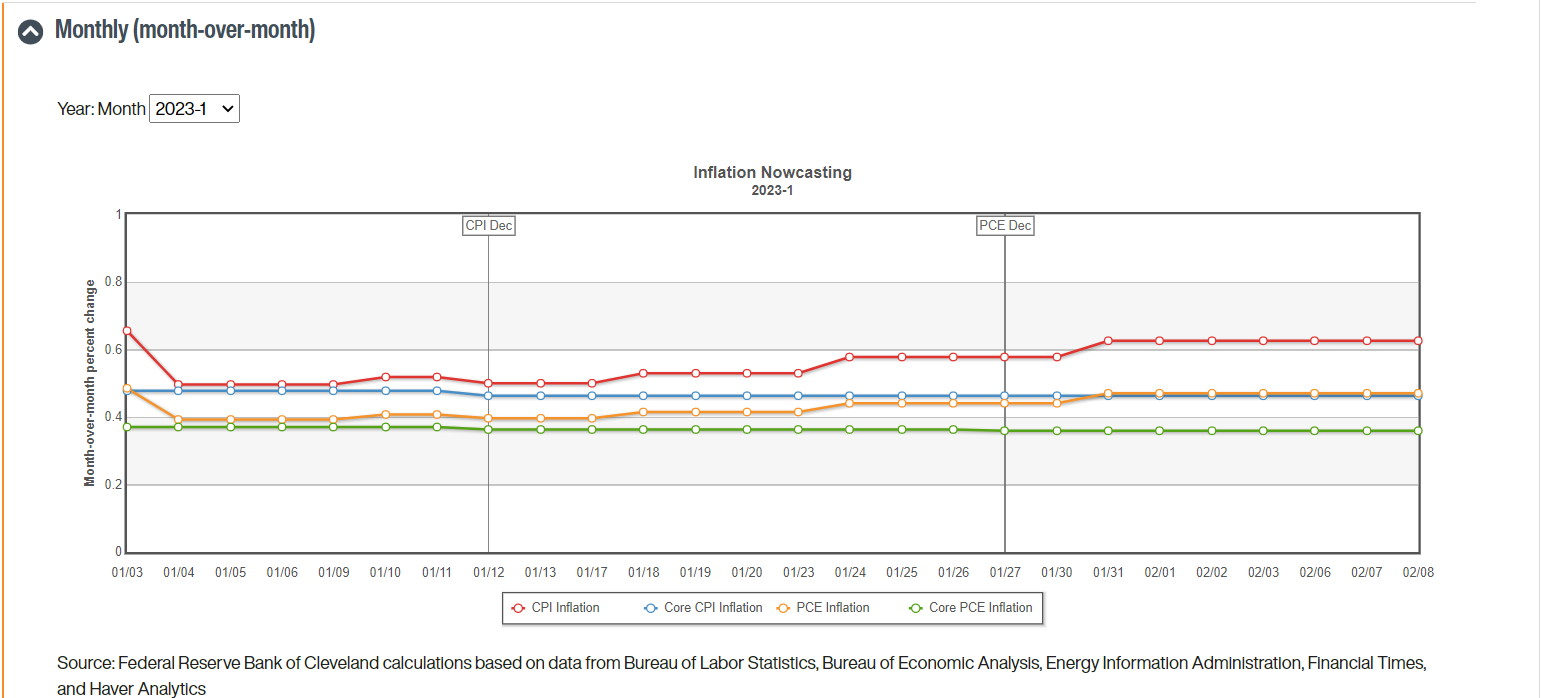

The Fed’s nowcast model of inflation is reaccelerating, though CorePCE so far is not:

Either way, markets are toying with new highs for the terminal rate:

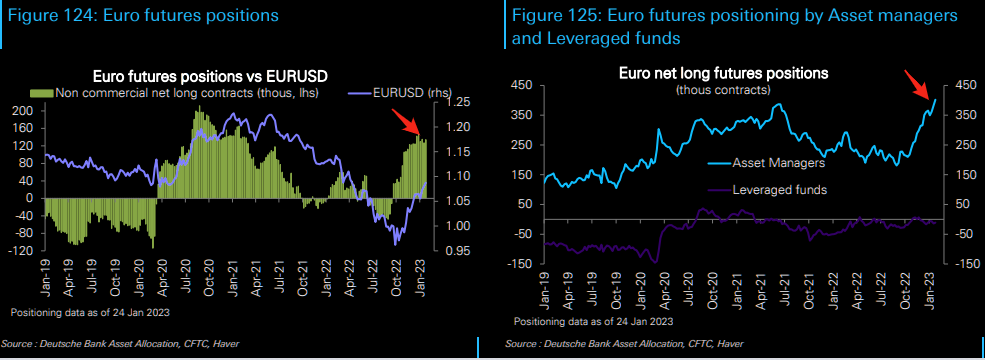

With the ECB pivoting and strong US jobs, there is scope for the risk correction to run as DXY rises. Markets are WAY overbought EUR:

AUD will follow it as, usual.