DXY faded last night as EUR caught a bid:

AUD bounced:

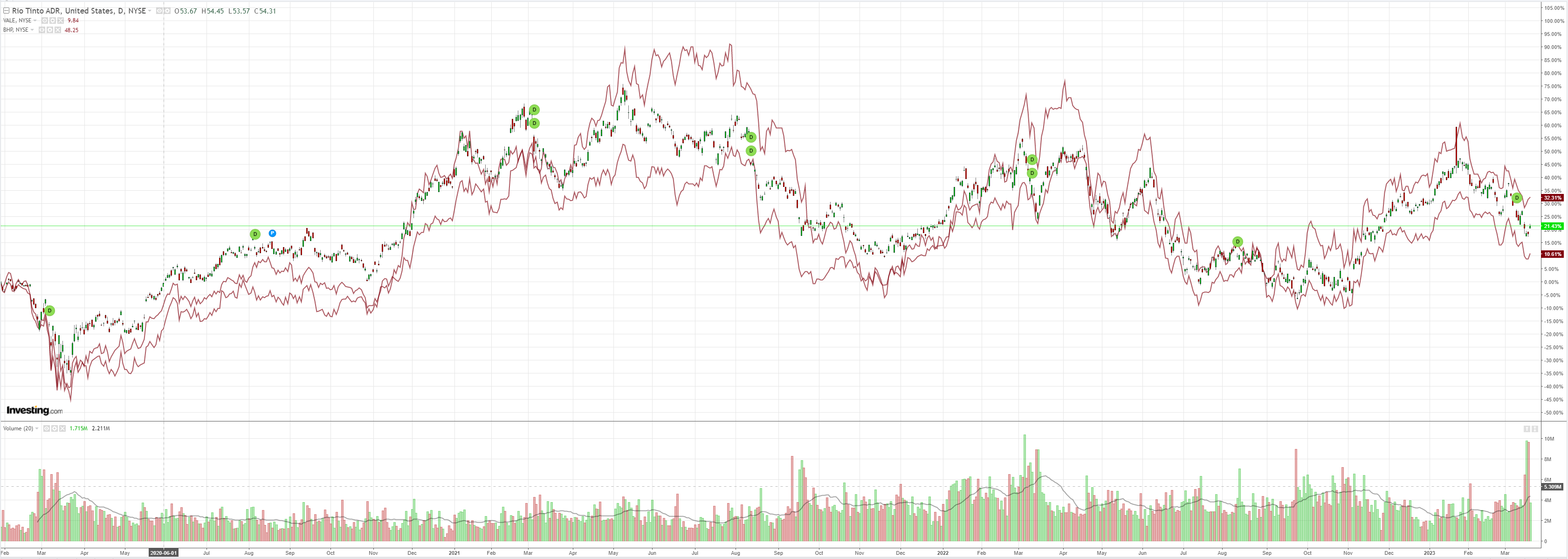

Commods too:

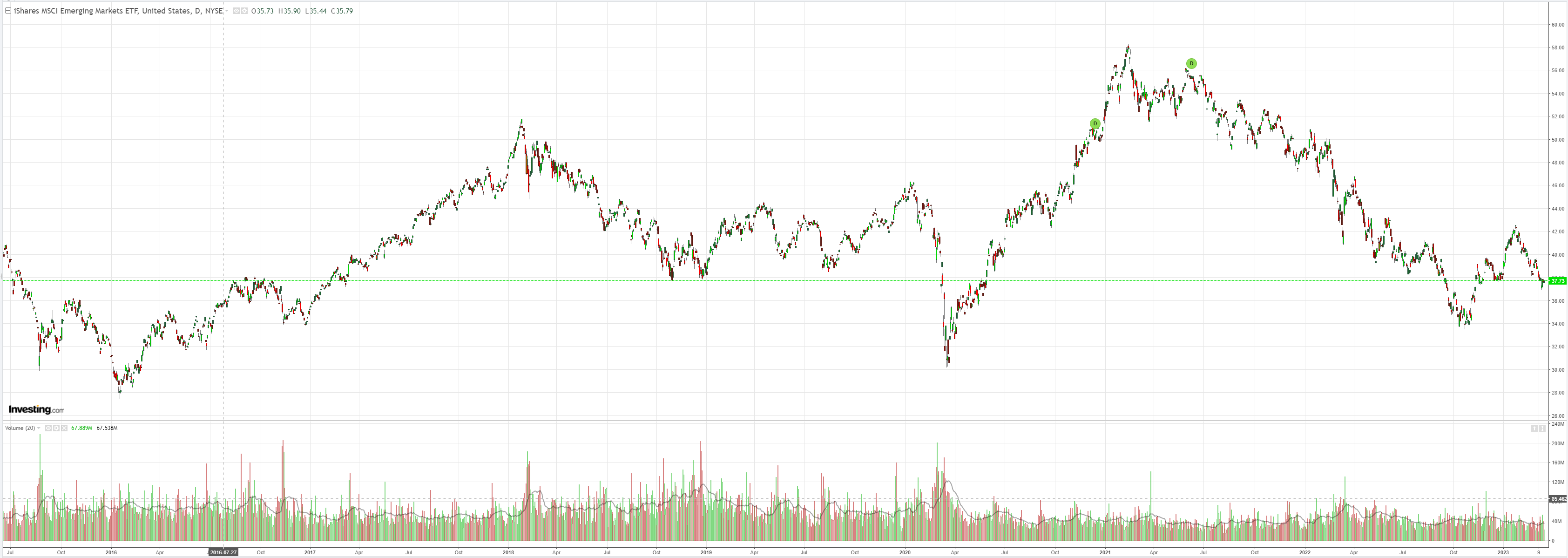

EM stocks (NYSE:EEM) are struggling:

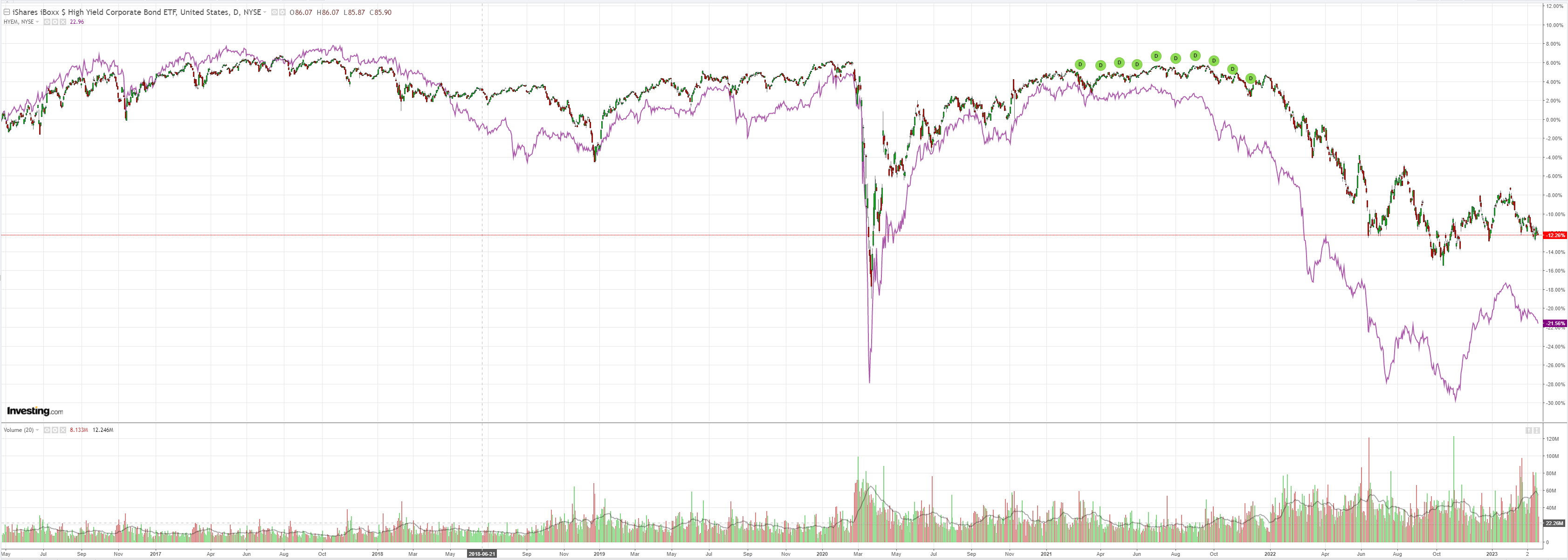

Junk (NYSE:HYG) is breaking down:

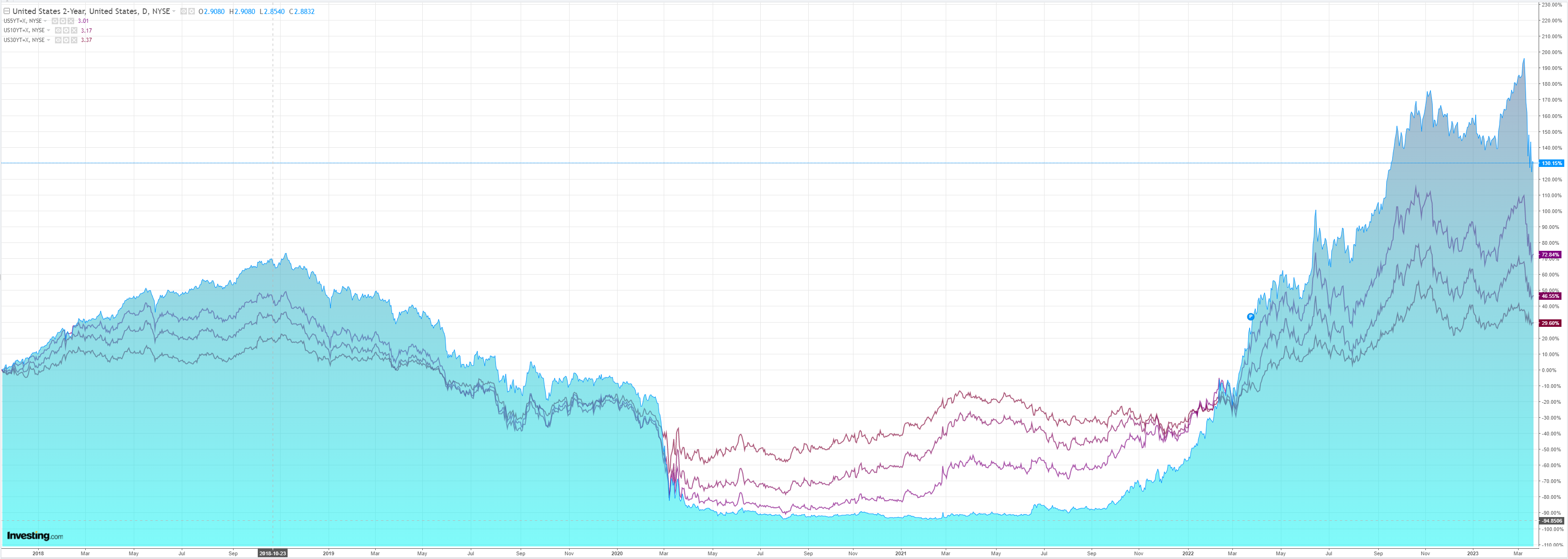

Treasuries were sold:

And stocks bought:

You have to have lived through one of these bear markets to understand how stupid they can get. The writing is clearly on the wall for the business cycle but every tick down in risk is met with another bid.

That’s what 15 years of BTFD and a new generation of traders have done. They simply have no experience of a bear market that will suck them in over and over and over and still keep going lower.

The AUD is nothing more than an observer in this.

Credit Agricole (EPA:CAGR) has a go at it:

Banks, financial conditions, risk sentiment and FX

Global markets have breathed a collective sigh of relief following the UBS takeover of Credit Suisse on Sunday. The developments are further coupled with growing hopes that the worst of the US banking sector turmoil is behind us. The resilience of market risk sentiment will remain the main FX market driver at the start of the new week. We doubt, however, that global risk appetite could rebound significantly further given that calmer financial market conditions would allow global central banks to continue their fight against inflation with more rate hikes. Moreover, while the recent liquidity measures to stabilise the US banking sector have partially offset the impact of Fed’s QT, we expect global banks to tighten their lending standards and thus tighten global financial conditions from here in a blow to the real economy. In turn, this could prevent any meaningful rebound of risk sentiment.

The Fed, BoE, SNB and Norges Bank meetings will dominate FX price action this week. In that, we think that persistent Fed hawkishness – eg, a rate hike and a pushback against the aggressive market rate cut expectations – could weigh on risk sentiment in a boost to the high-yielding, safe-haven USD vs risk-correlated currencies with relatively less hawkish central banks like the GBP and NOK. At the same time, evidence that the SNB remains focused on taming Swiss inflation through rate hikes in the wake of the Credit Suisse takeover could give the CHF a boost. Ahead of all that, focus today will be on the speech by ECB’s Christine Lagarde and Mario Centeno. We think that the Swiss banking sector consolidation should boost the credibility of the ECB’s hawkish stance and thus underpin the EUR especially vs the likes of the GBP and NOK as the week progresses.

AUD: RBA to keep calm and carry on hiking?

RBA Assistant Governor of Financial Markets Group, Christopher Kent, in a speech today focused on the current lagged and variable impact of monetary policy in Australia. Higher–than-usual levels of savings as well as fixed-rate mortgages are lengthening the amount of time it takes monetary policy to impact the economy by changing households’ spending patterns via pushing up their monthly mortgage payments, according to Kent. It is also adding to the uncertainty of the impact of monetary policy. But Kent also noted that the other transmission mechanisms were working as per usual, which can be seen in falling borrowing by households as well as weakening domestic consumption. The AUD is also stronger than it would be in the absence of rate hikes, which is helping to curtail imported inflation. In terms of the volatility generated by SVB Financial Group (NASDAQ:SIVB) and Credit Suisse Group AG (SIX:CSGN), Kent was calm pointing to several reassuring factors: (1) Australian banks are already ahead in terms of their bond issuance for meeting their funding requirements for 2023 and so could postpone further issuance and ride out current market volatility if needed; (2) Australian banks are well capitalised due to APRA’s strong prudential requirements, rules and enforcement; and (3) despite a cheap source of banking financing in the form of the RBA’s TFF rolling off this year, this funding is maturity matched with fixed-rate mortgages and so banks will readily pass higher funding costs onto households’ rolling over their mortgages. Overall, Kent painted a picture of a well-capitalised and stable banking system that is not an obstacle for further rate hikes. Indeed, strong domestic data, especially a very tight labour market with the unemployment rate dropping back at 3.5% and close to a 50Y low, keeps the

pressure on the RBA to carry on hiking rates. This stands in contrast to current Australian rates market pricing for the RBA to cut rates by July. The RBA Minutes to the March meeting will be published on Tuesday. RBA Governor Philip Lowe has clearly indicated a pause in rate hikes is an option at the April meeting. The Minutes could provide an indication of how close the central bank is to a pause on rate hikes.

The RBA is done. The Fed has done enough as well. The ECB is overshooting as usual. The global business cycle is done as a credit crunch sweeps the US economy, then Europe.

Unless something really weird happens, which is always possible, AUD is done too.