Interesting dynamics in Forex markets last night as both the USD and AUD rose strongly. DXY crashed EUR:

Yet AUD rose anyway:

Base metals all fell:

Big miners fell:

EM stocks eased:

Junk is still rebounding:

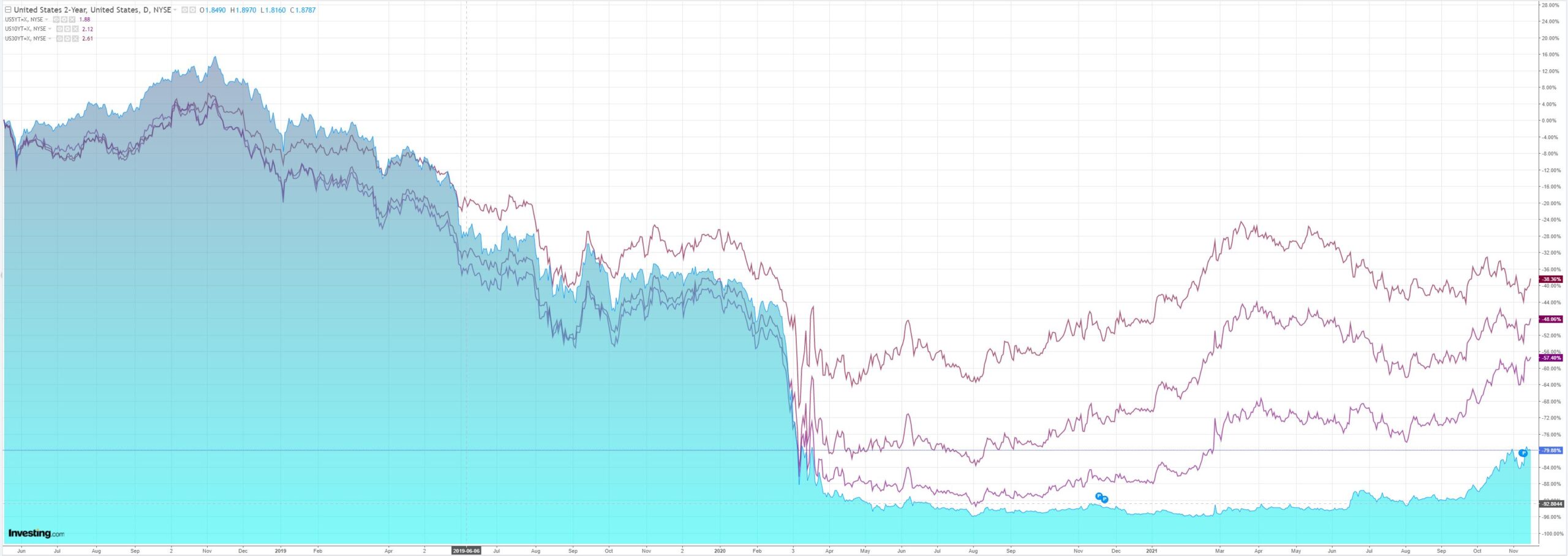

The yield curve steepened:

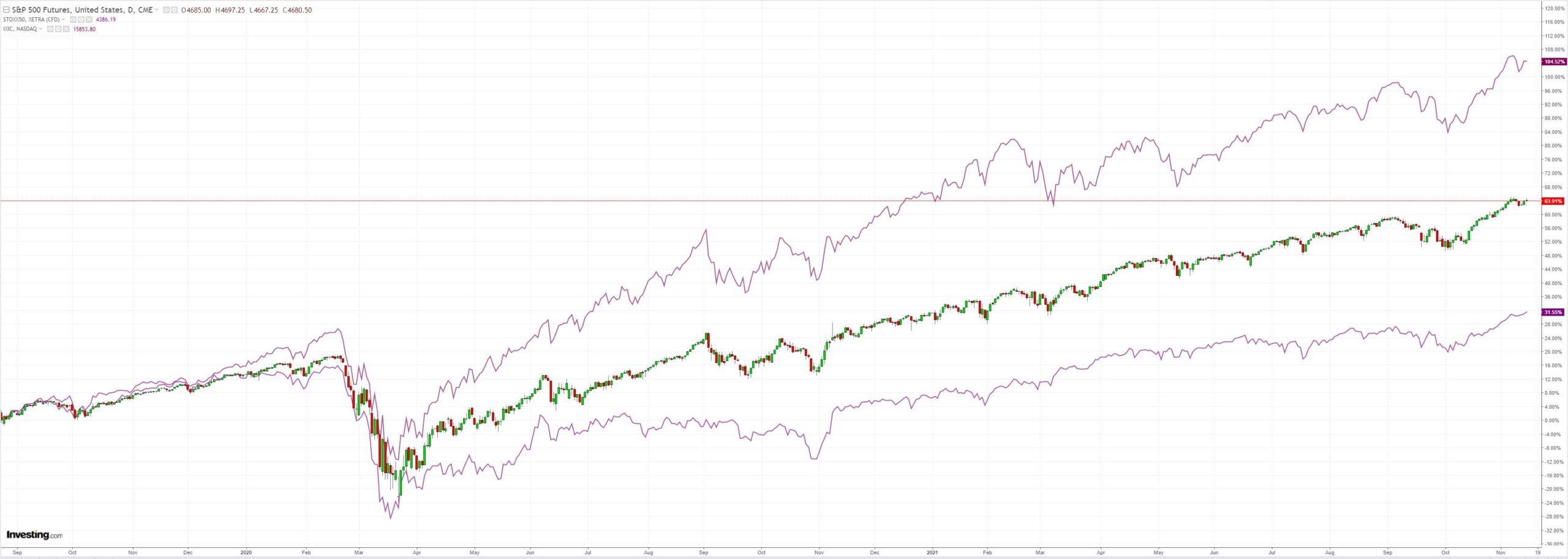

Which stocks did not enjoy:

Westpac has the data:

Event Wrap

The NY Fed (Empire) manufacturing survey was stronger than expected, at 30.9 (vs est. 22.0, prior 19.8). Strength was broad-based.

Ex-New York FOMC members Dudley and Lacker said the policy rate could rise above 3%. Dudley said “they will probably start after June or a little bit later, and go to a higher rate than people think…probably 3% to 4%”, although “the crystal ball is cloudy as you get further out.”

Event Outlook

Aust: The RBA’s minutes for the November policy decision will provide more colour around the Board’s central view and the risks. RBA Governor Lowe will then speak on recent trends in inflation.

Eur/UK: High vaccination rates and a supportive macro-policy backdrop led to strong GDP growth in Q3; the second estimate will provide detail on the contributions to headline growth. The UK’s economic recovery should see the September ILO unemployment rate continue to gradually fall.

US: Retail sales are expected to lift in October as demand evens out between goods and services (market f/c: 1.3%). Meanwhile, delta and supply issues are likely to remain a source of volatility for industrial production in October (market f/c: 0.8%). Business inventories are expected to grow modestly in September but should build further as supply chain issues alleviate. The NAHB housing market index should hold at a historically-high level in November. The FOMC’s Barkin, Bostic and George will speak on racism and the economy, while Daly will give remarks at the Commonwealth Club.

Markets are uncomfortable suspended between US tightening and Chinese easing which is throwing up all sorts of weird correlation breakdowns.

I am still of the view that the Chinese easing is marginal at best so see no reason for it be supportive of much. So as DXY runs on I still think AUD will fall further when bulk commodities break down and with them interest rate expectations as the fixed-rate mortgage shock lands on house prices.