Street Calls of the Week

DXY is up and away:

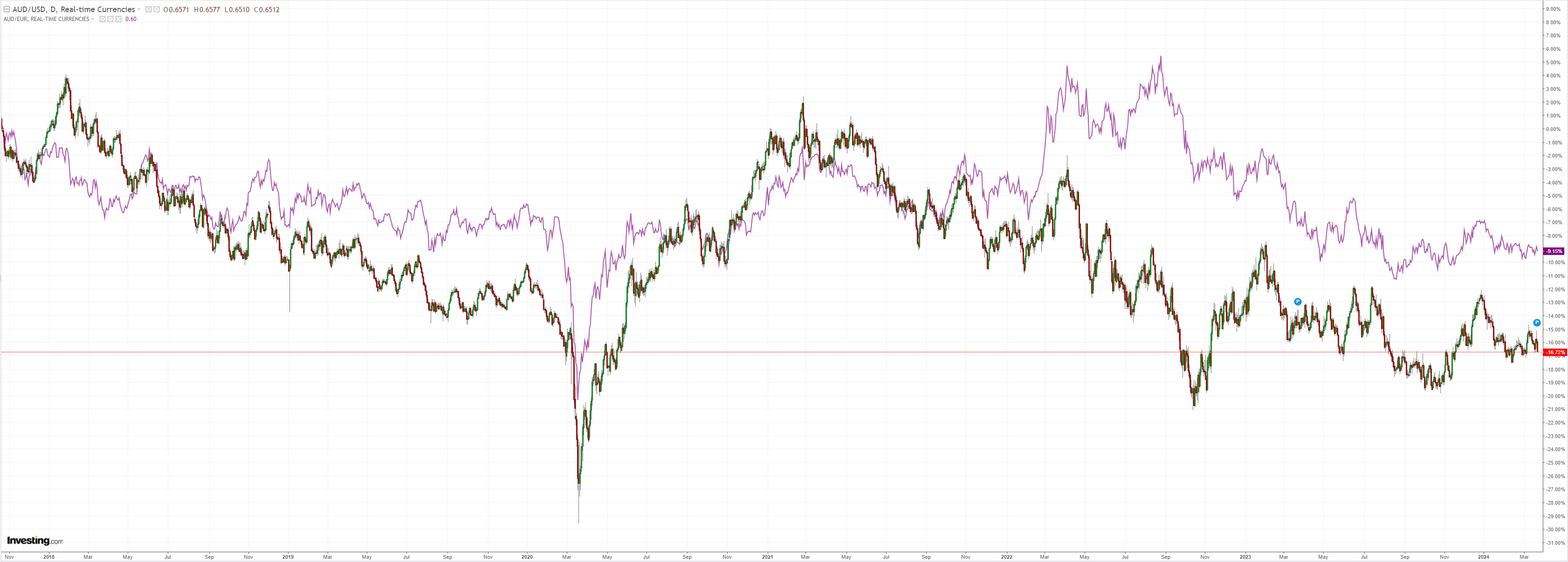

AUD was pounded:

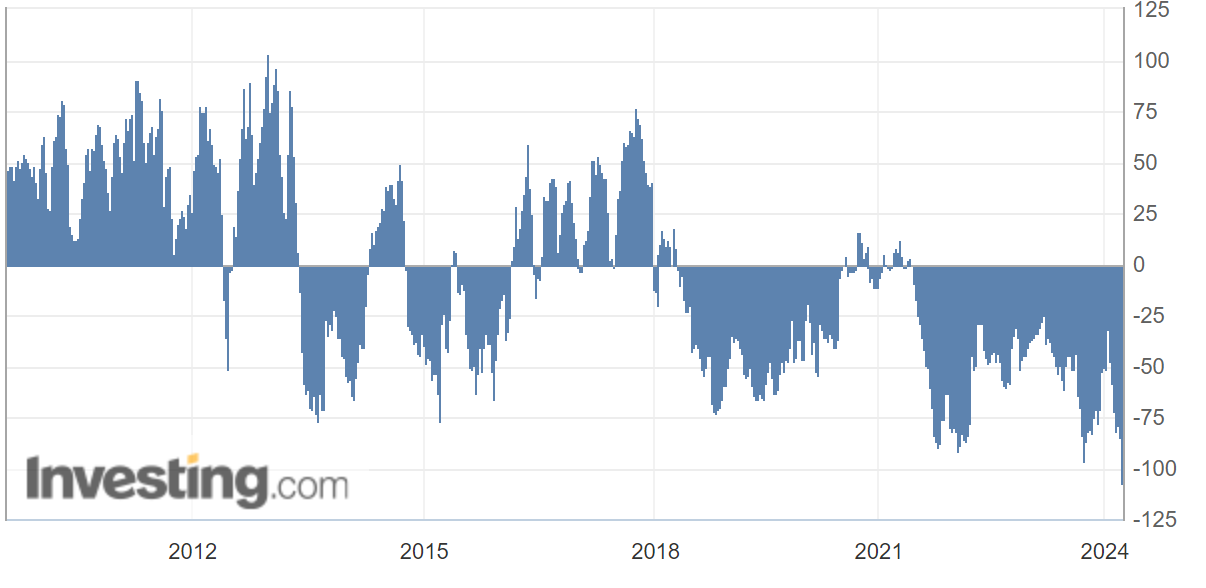

The AUD short is now ludicrous. It will not be easy to push it lower with this. Then again, ludicrous can become preposterous!

CNY broke lower. This does not happen without permission:

Brend and oil sagged:

Copper false break?

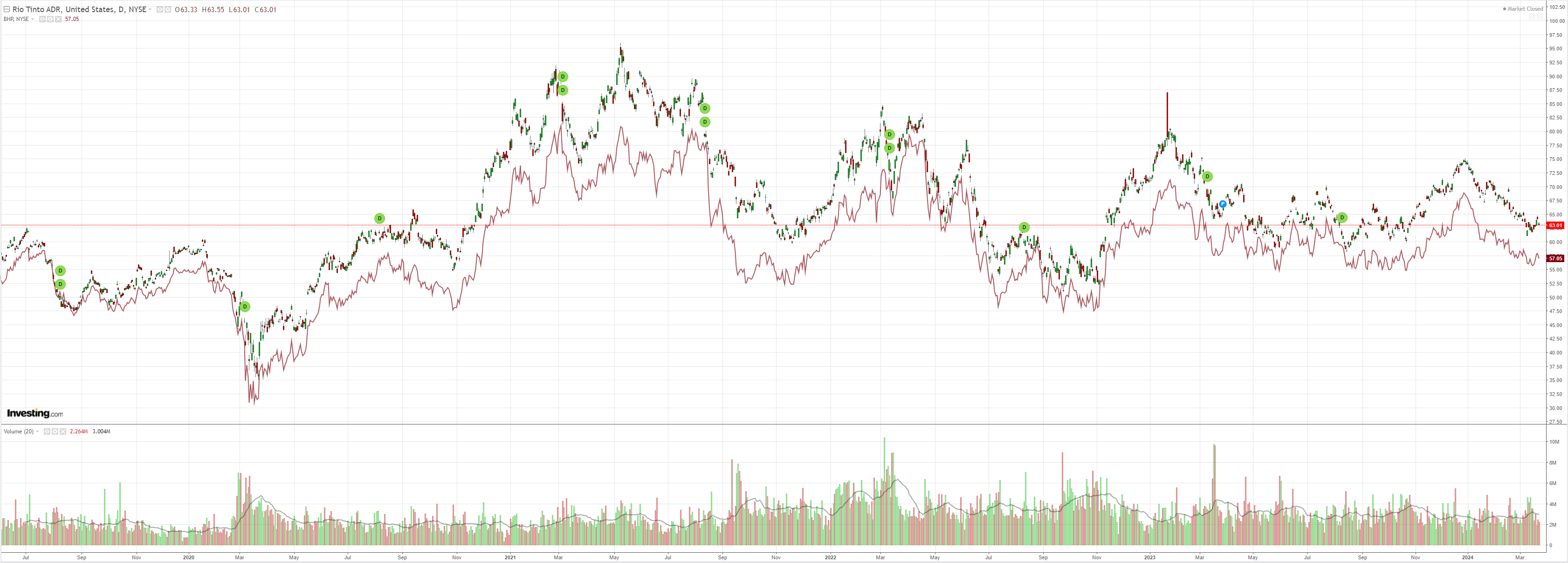

Big miner retest resumes:

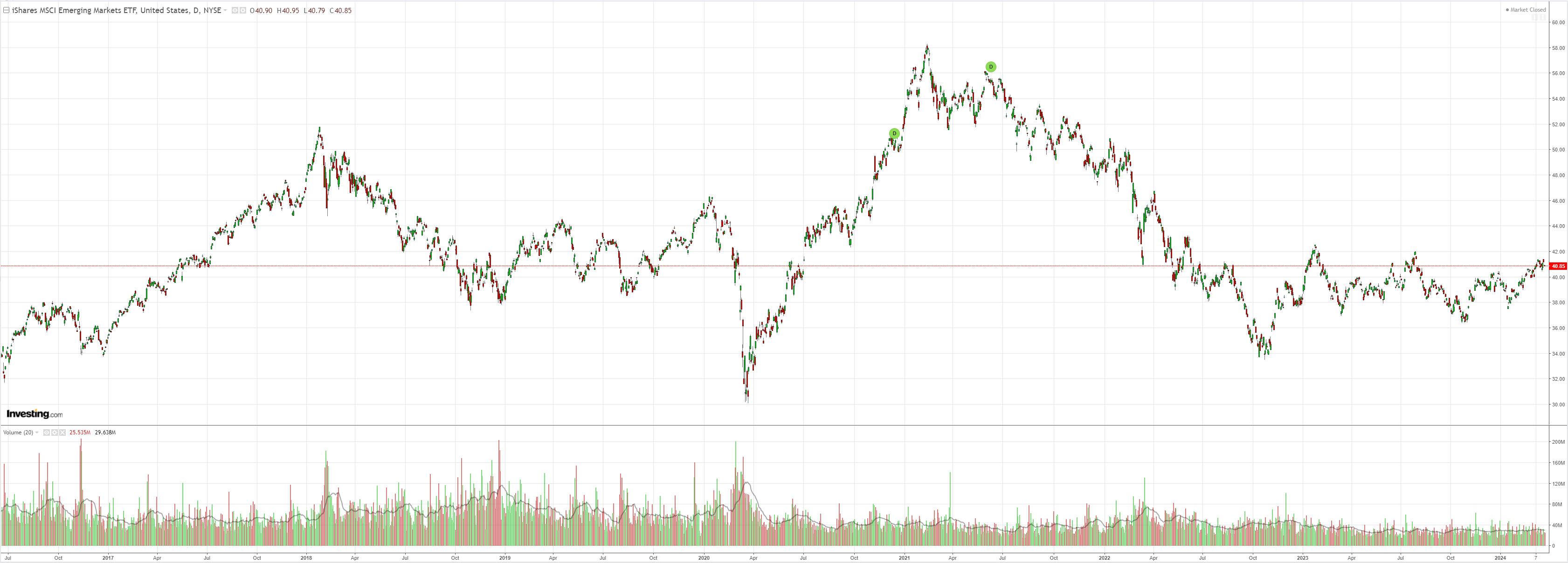

EM is tired:

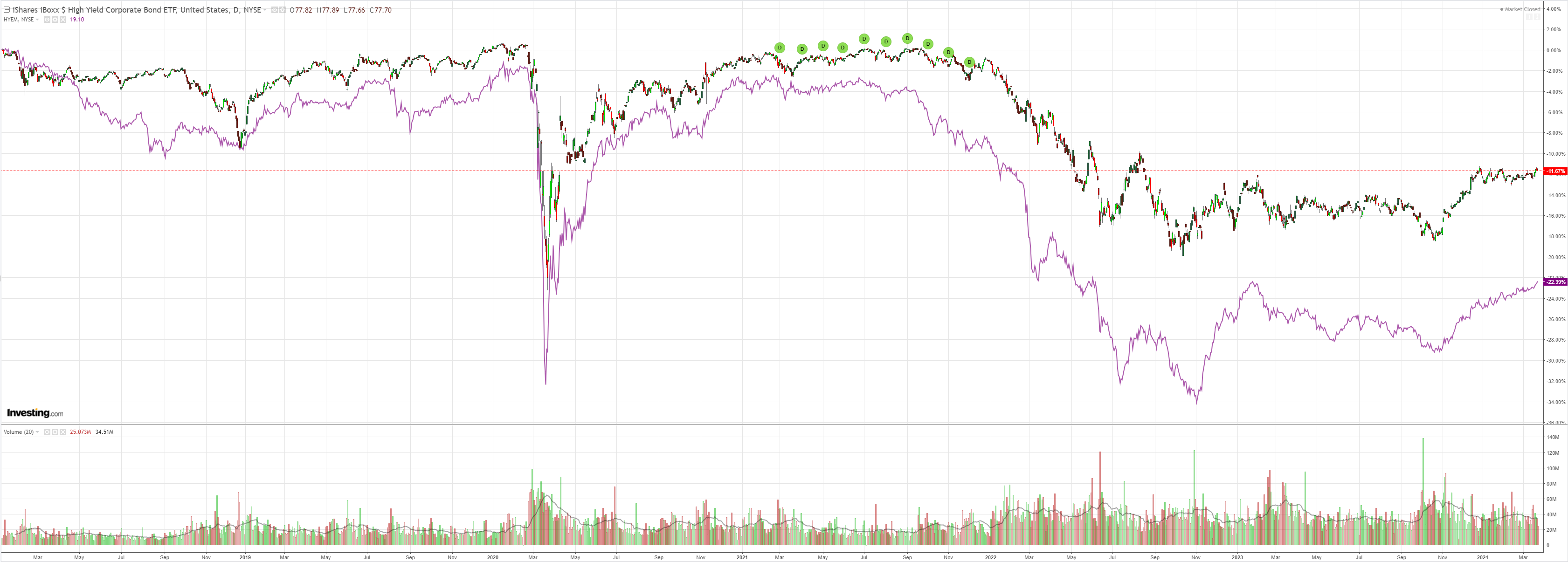

Junk is bullish:

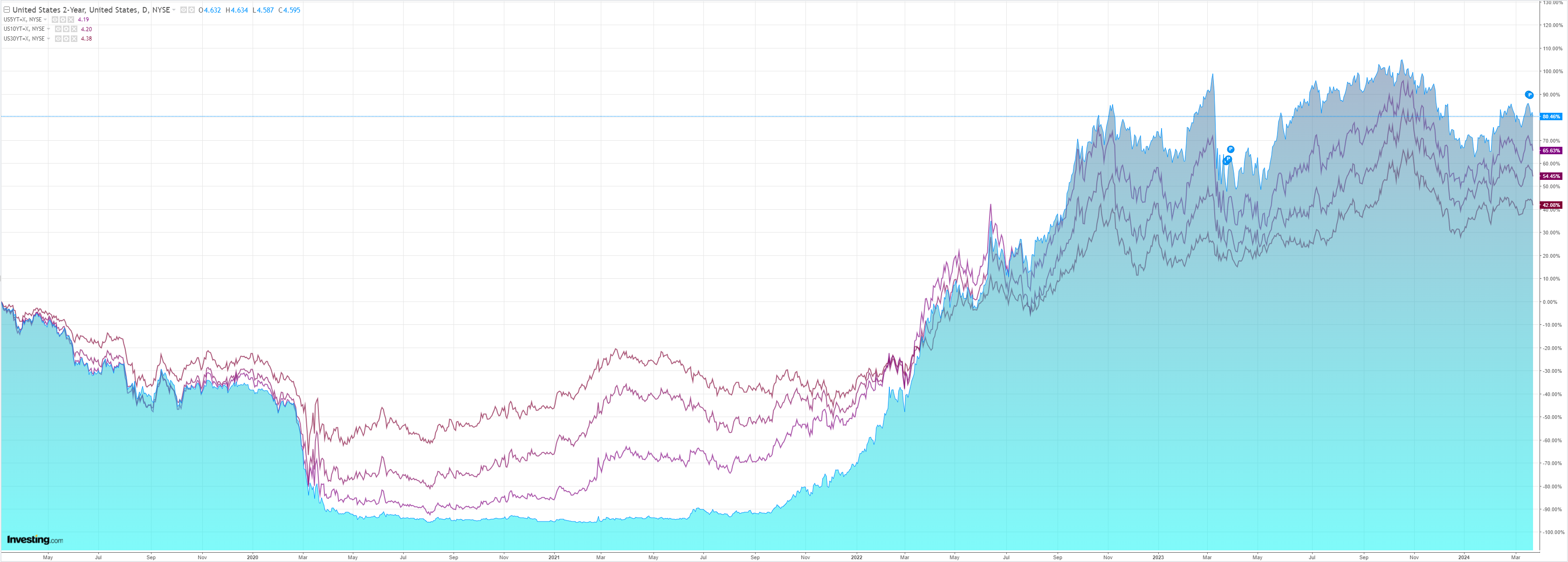

As yields fall again:

Stocks eked out a gain:

The big move is CNY. The absolute lock that Beijing has had on the currency suddenly eased:

China’s tentative loosening of its vise-like grip on the yuan unleashed a slide in the currency and pulled down its Asian peers along the way.

The onshore yuan dropped the most in more than two months after the authorities set a weaker-than-expected daily fixing, fueling speculation they would tolerate further losses. The decline took the currency to within 0.2% of the end of its allowed daily trading band of plus or minus 2% from the fixing.

Perhaps Bejing is satisfied that the Fed is going to cut soon. Or it wants to get some devaluation before the US election. Or it simply can’t let JPY get any cheaper than itself:

If China lets the CNY slide, it will upset everything. DXY will rally. Commodities will fall. Chinese stocks will reverse. EMs will turn even more toxic.

It could trigger a decent correction on Wall Street as well.

The biggest victim will be AUD, which will act as a Chinese proxy, as it gets defenestrated despite the record CFTC short.