DXY took a breather Friday night as risk dead cat bounced:

AUD screetched higher:

Oil too which is self-defeating, self-evidently:

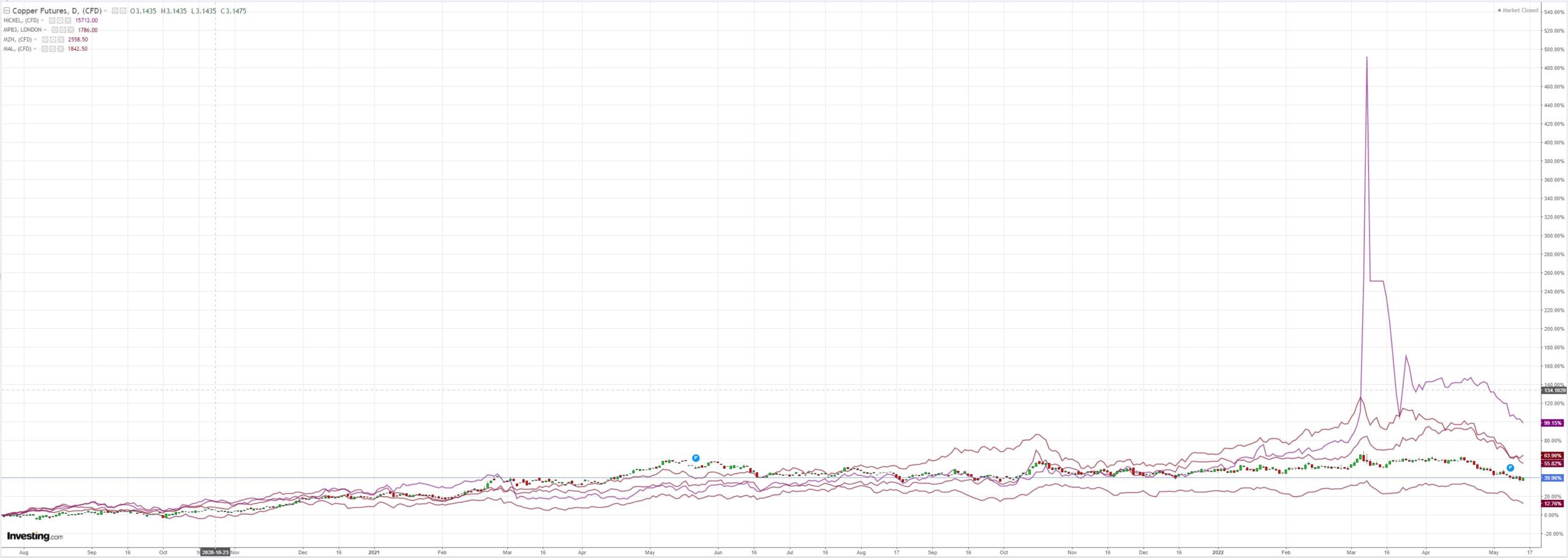

Not so much metals:

Miners (LON:GLEN) eked out gains:

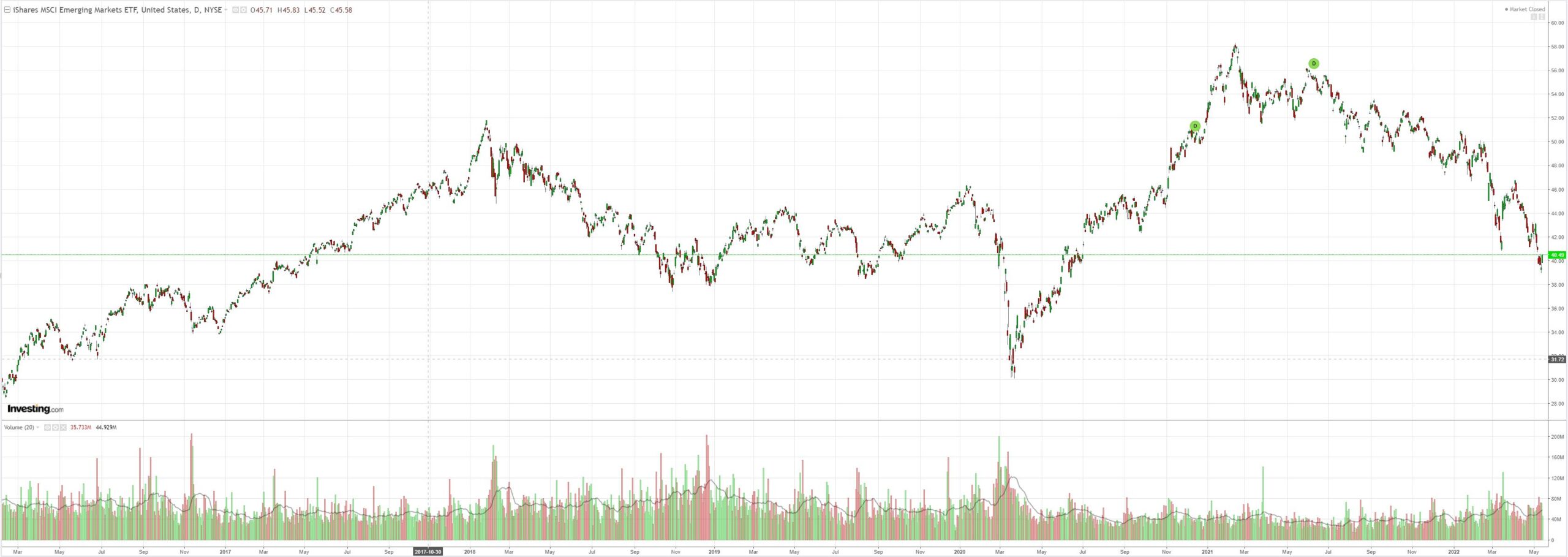

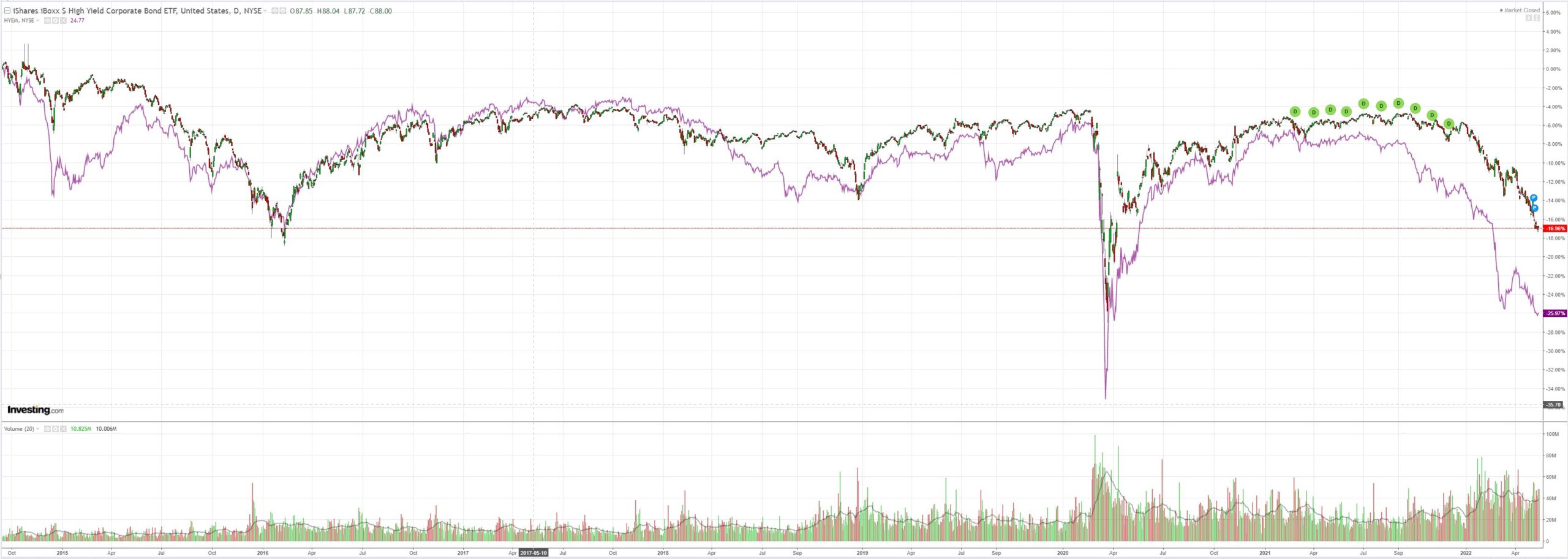

EM stocks (NYSE:EEM) and junk (NYSE:HYG) too:

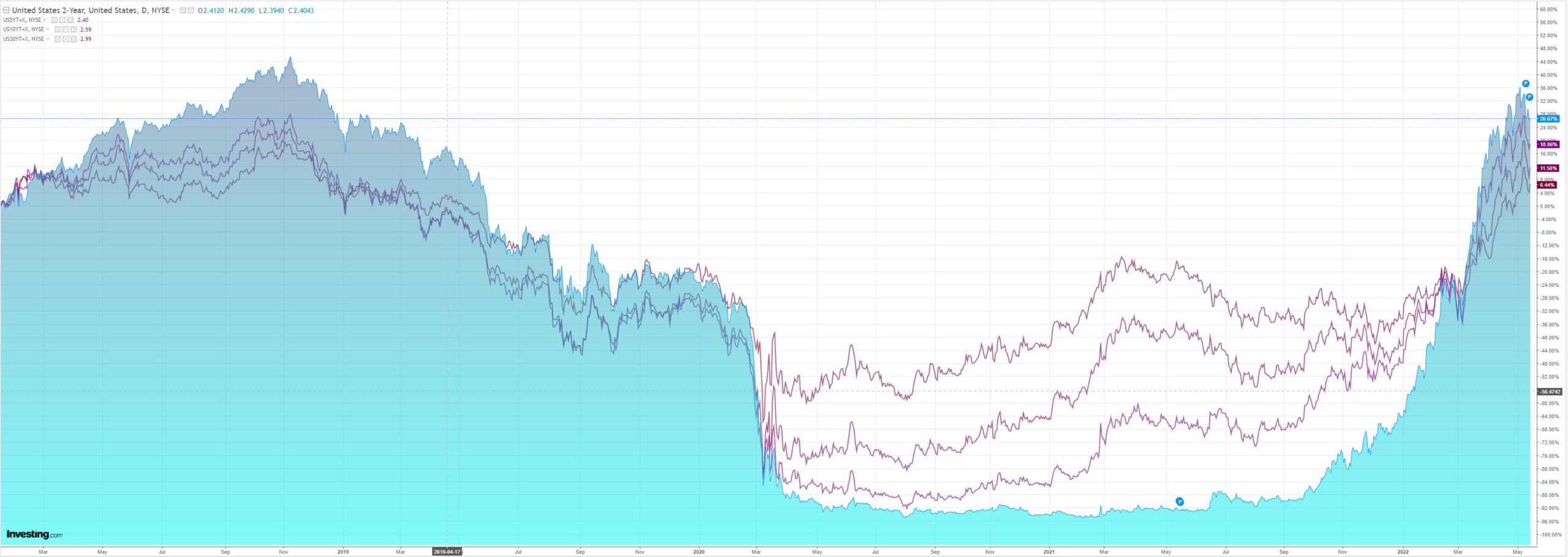

The Treasury curve steepened:

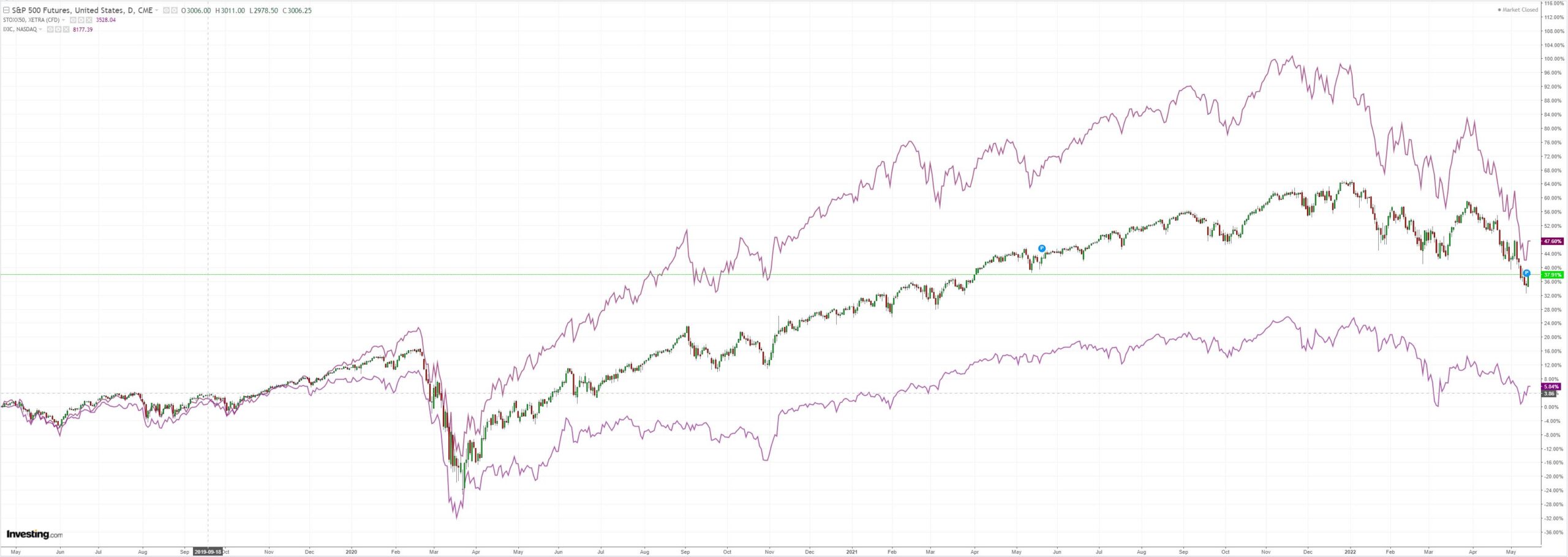

Stocks roared:

Westpac has the wrap:

Event Wrap

US consumer sentiment (Michigan University) disappointed at 59. (est. 64.0, prior 65.2) – a low since 2011, with expectations at 56.3 (prior 62.5, est. 61.5) and current conditions at 63.6 (prior 69.4, est. 69.3). Inflation concerns were cited as driving confidence lower. The inflation expectation expectations components were unchanged at 5.4% for the 1-year ahead and 3.0% for the 5-10 year ahead measures (est. 5.5%). Import and export prices for April were of more interest than usual due to concerns about inflation. Imports rose 12.0%y/y (est. 12.3%y/y, prior 13.0%)) and exports rose 18.0y/y (est. 19.2%y/y, prior 18.6%y/y). The slight slowdown in the annual pace adds to the view that peak inflation may have passed.

FOMC member Kashkari said that inflation is too high and the Fed will do what it needs to do to bring it down. He added if there is some help from the supply side, the FOMC may not have to do as much as expected. Mester supported 50bp hikes in June and July (which Chair Powell has previously signalled and reiterated), adding that the Fed can speed up or slow down the pace of tightening depending on inflation. If pressures do not abate by the fall, however, a faster rate increase is possible.

Eurozone industrial production in March was not as weak as expected, down 1.8%m/m (est. -2.0%m/m), for an annual decline of 0.8%y/y (est. -1.0%y/y).

Event Outlook

NZ: The April BusinessNZ PSI should continue to reflect the return to growth given the peak in Omicron has passed.

China: Ongoing lockdowns are expected to weigh on retail sales in April(market f/c: 1.2%yr ytd), although the building momentum in fixed asset investment and lingering strength in industrial production will provide resilience in the near-term (market f/c: 7.0%yr ytd and 5.0%yr ytd respectively).

Eur: The European trade deficit is set to widen in March due to elevated energy prices (market f/c: -€17.8bn).

US: The Fed Empire state index should indicate a solid level of support for NY manufacturing in May (market f/c: 15.0). The FOMC’s Williams is also due to speak.

All news was bearish but that was enough for a counter-trend rally.

This looks like a classic bear market rally to me. The Fed is still tightening. Chinese credit was an unmitigated disaster and more CNY falls are ahead. Commodities are still far too high.

Everybody knows the selling is overstretched so we’ll get tactical bounces like this, and possibly big ones, but unless or until the Fed is done, energy is much cheaper in Europe, and China has rid itself of OMICRON plus stabilised property, then the AUD is going lower.