DXY is looking a little parabolic:

AUD is back into the 63s:

CNY is grinding lower:

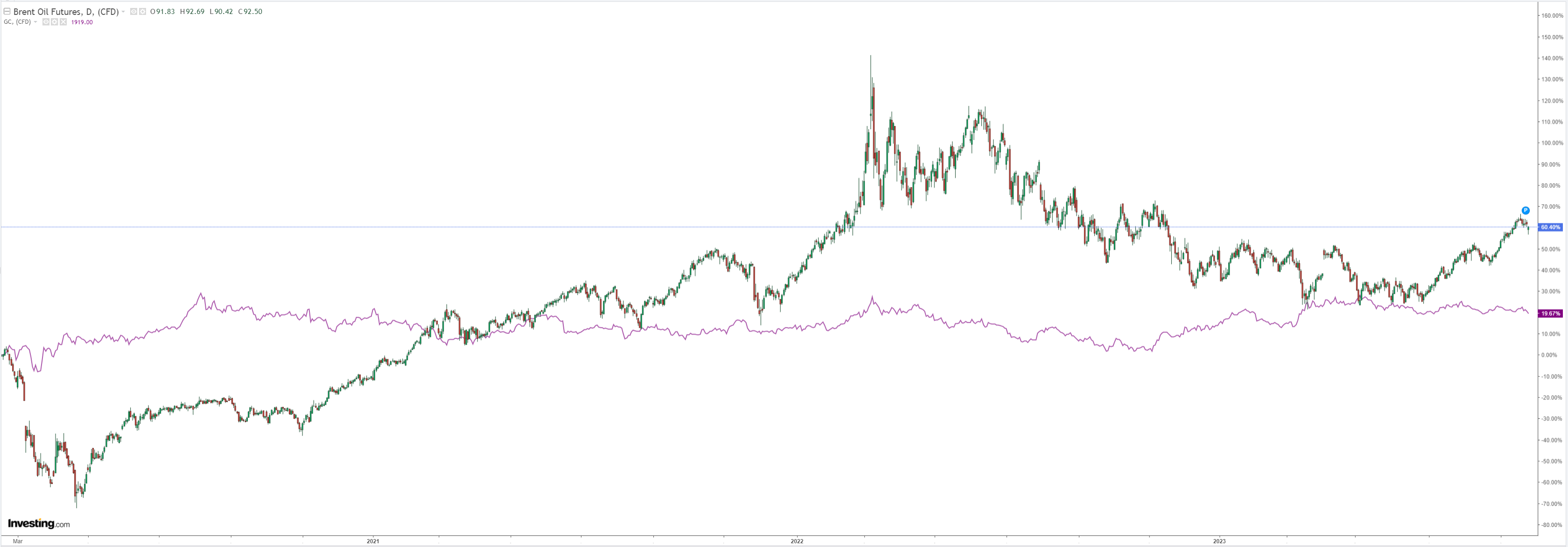

Oil rose a little:

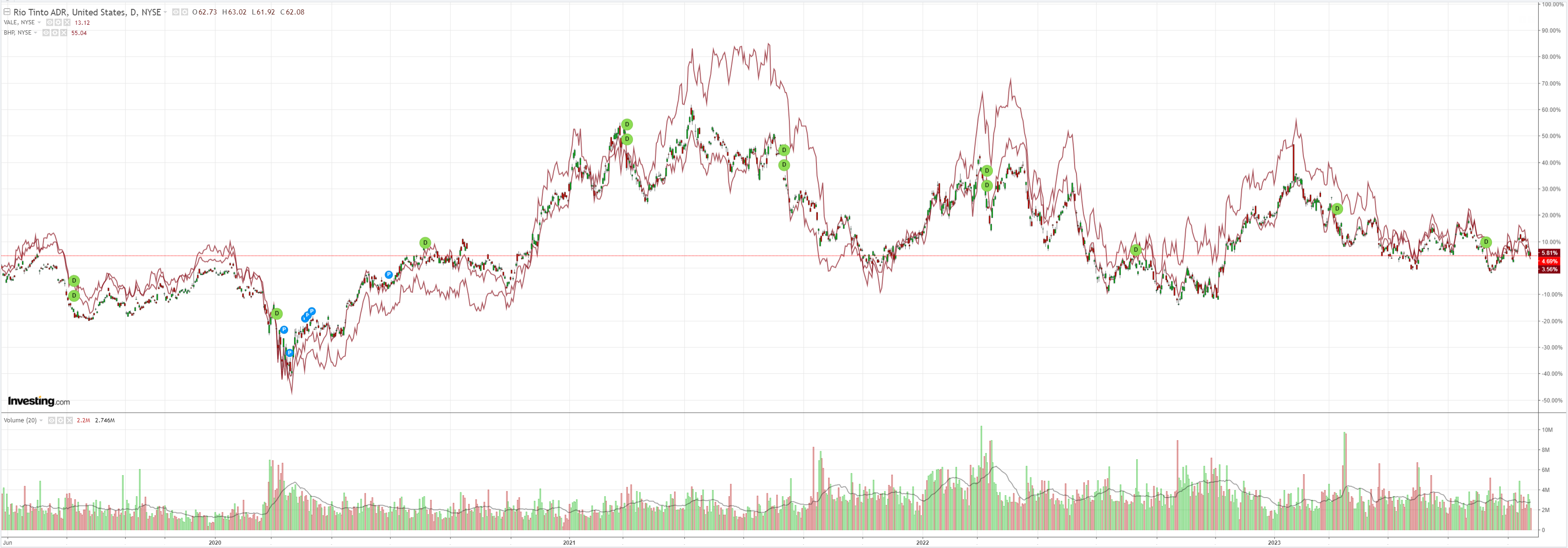

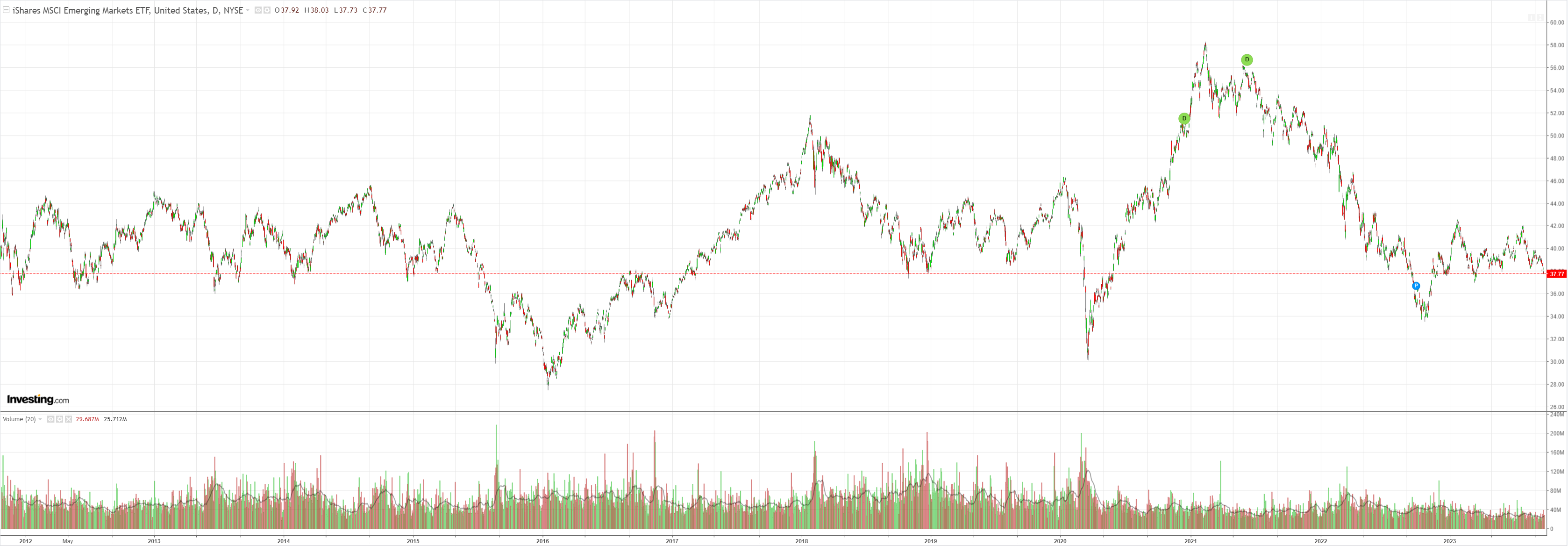

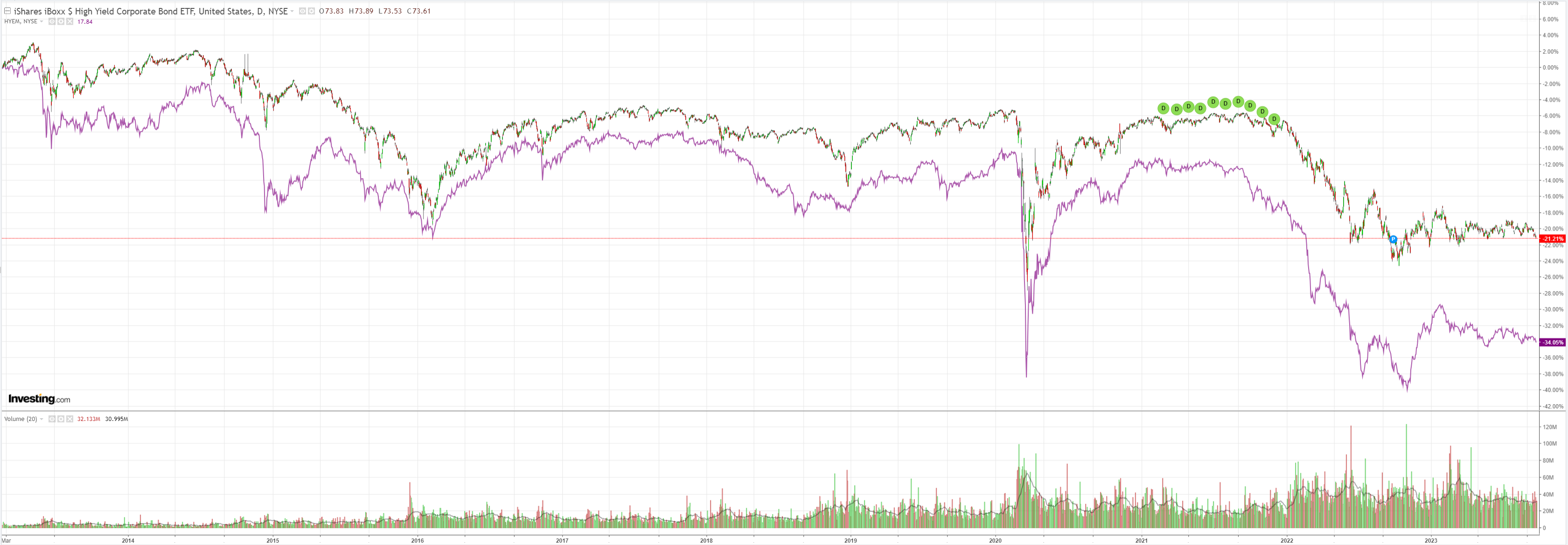

The Complex of dirt, miners, EM and junk all fell through the trap door:

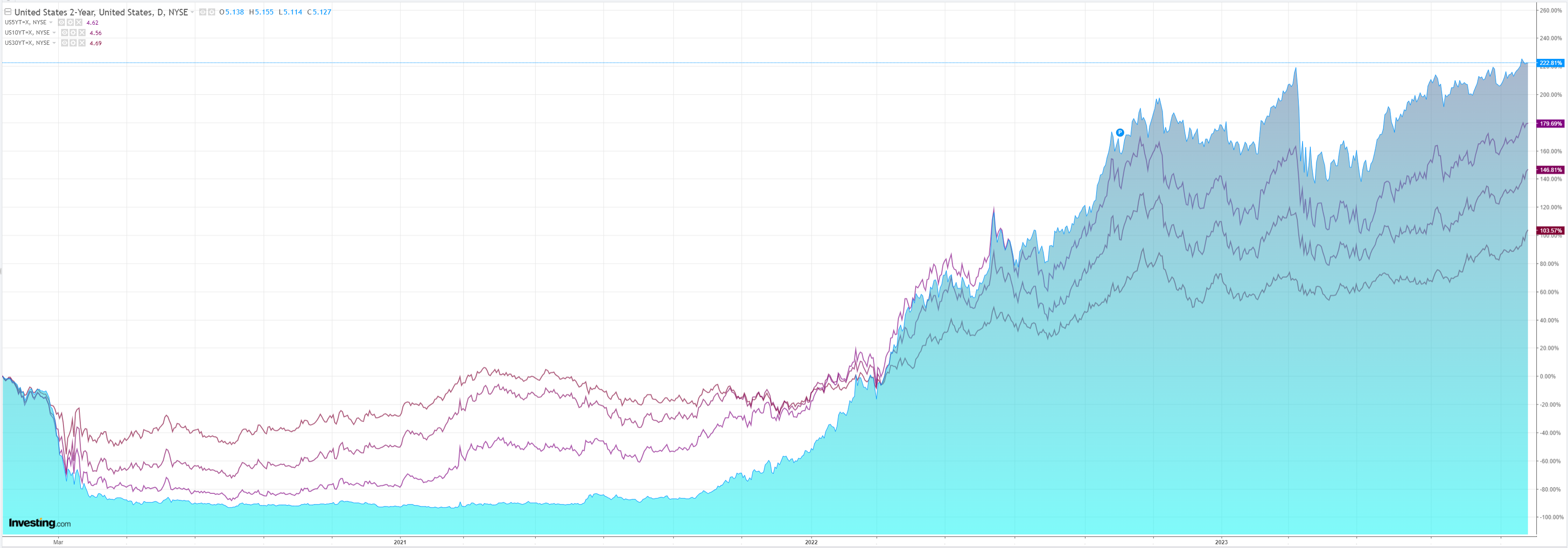

As the bull steepening, which sure ain’t bullish, wreaks havoc:

Stocks took out support:

Credit Agricole (EPA:CAGR) wraps the market:

USD: all too real? Asia overnight It has been another day of soft investor sentiment in Asia. Chinese developer Evergrande (HK:3333) Group missed debt payments adding to the weight on Asian equities already coming from the march higher in UST yields. At the time of writing, most Asian bourses and S&P500 futures were trading in the red. While the USD remains dominant, it only edged higher against the rest of the G10 during the Asian session. The NOK and CAD were the biggest underperformers during the Asian session. While there was further verbal intervention by Japan’s Minister of Finance, Shun’ichi Suzuki, this had little impact on the JPY, which remains trapped in arange against the USD.

The USD’s outperformance vs other FX majors had longer legs yesterday, with notable fresh multi-month highs being reached in the process (sub-1.06 forEUR/USD, shy of 149 for USD/JPY and sub-1.22 in GBP/USD). The extended sell-off in long-dated UST yields was surely to blame, especially given that it was primarily driven by the real rate component, with the 10Y rising to its highest level since 2008 at around 2.15%. Such rosy market pricing is quite remarkable at a time when US growth is not expected to reach this sort of level for the next few years, and when many domestic pitfalls lie just ahead with the lingering threats of a government shutdown or the uncertainties around the resumption of student loan repayments next month.

Today’s set of rather second-tier US macro data, in particular the latest US consumer confidence survey, may possibly temper any eventual over-optimism with regards to the near-term US outlook, while the market could also closely scrutinise whether inflation expectations for the year ahead experience as large a decline as the one recently seen in the University of Michigan report. Besides, the markets should not be too overwhelmed by any hawkish comments from one of the well-known FOMC uber-hawks, as Michelle Bowman already recently stressed that she favours more than just one rate hike. All in all, we still struggle to see how the overbought USD could durably stay at these lofty levels, while cautioning that month-end and quarter-end flows may possibly make trading choppier for the rest of the week.

It can’t stay at lofty levels forever, but it can stay up here while the market reprices the outlook, which is what is happening.

The market was set up for a seamless transition to a soft landing, delightfully fading inflation, and an effortless rebound in American profits. It was always an illusion.

Now, it has to price stagflation via oil, followed by a global recession.

DXY will outperform in these circumstances, and AUD will keep falling.