Street Calls of the Week

DXY reversed upwards:

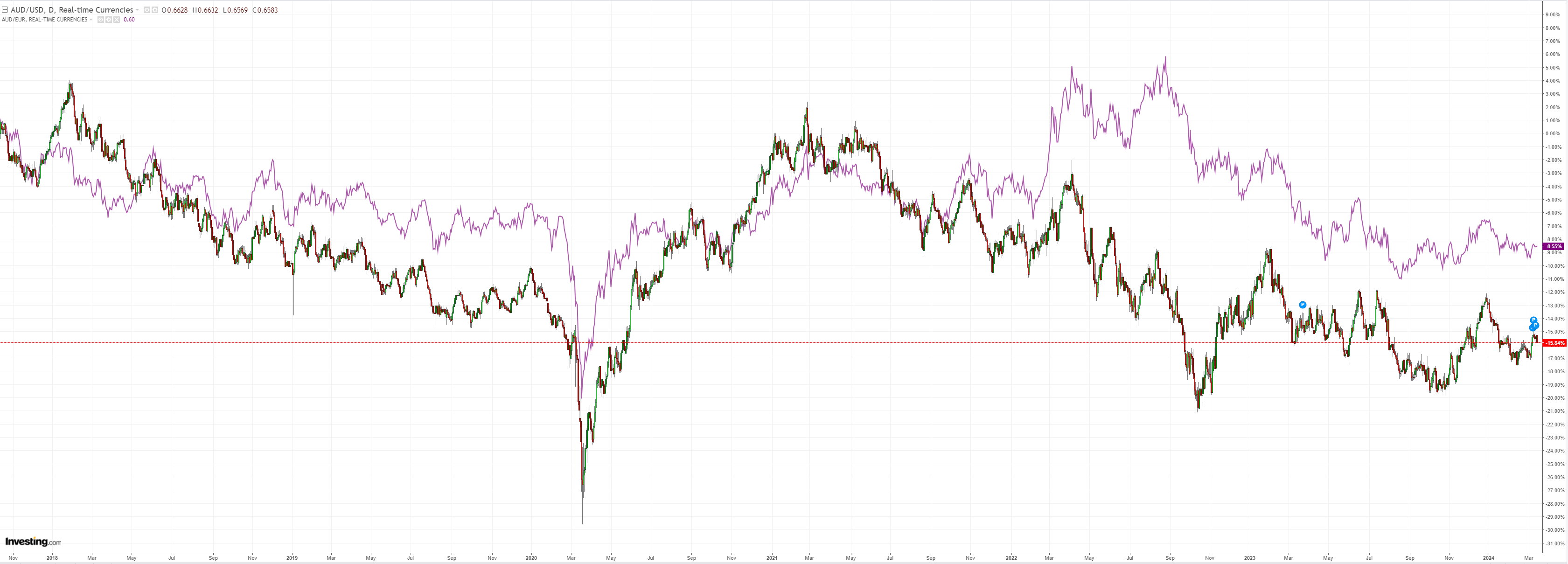

AUD did the Costanza:

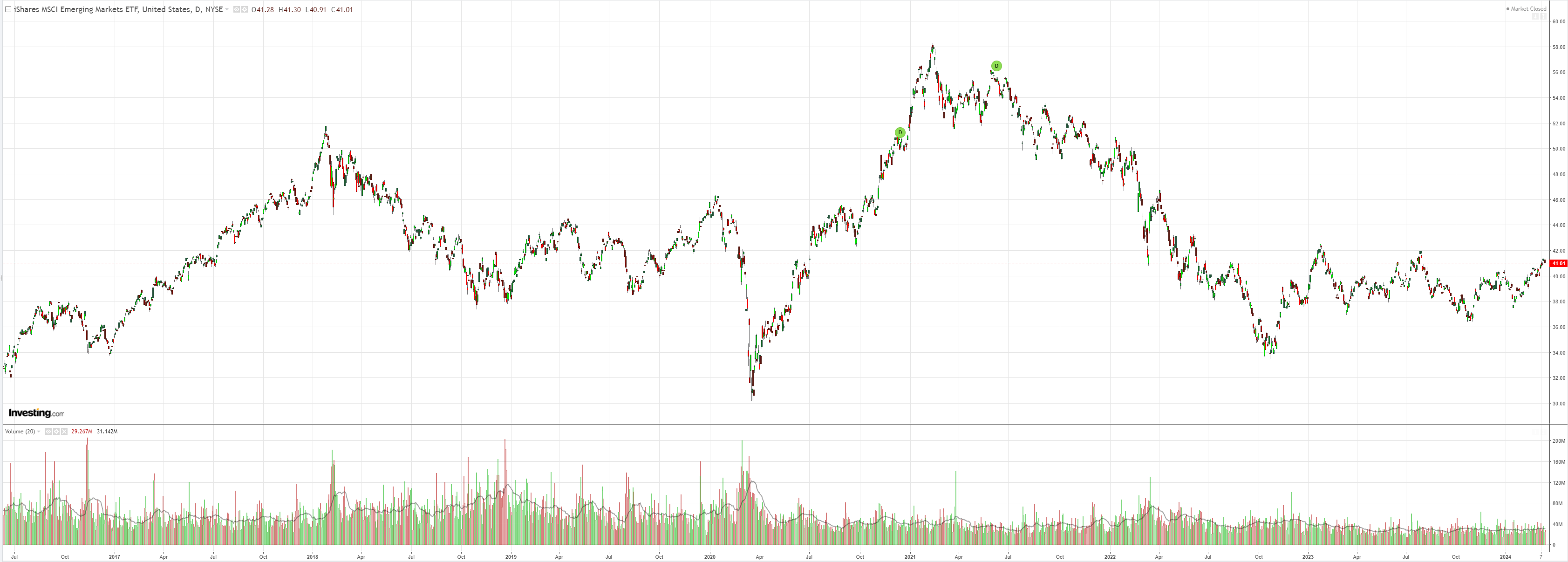

North Asia too:

Oil and copper broke out sending an unambiguous no-landing signal:

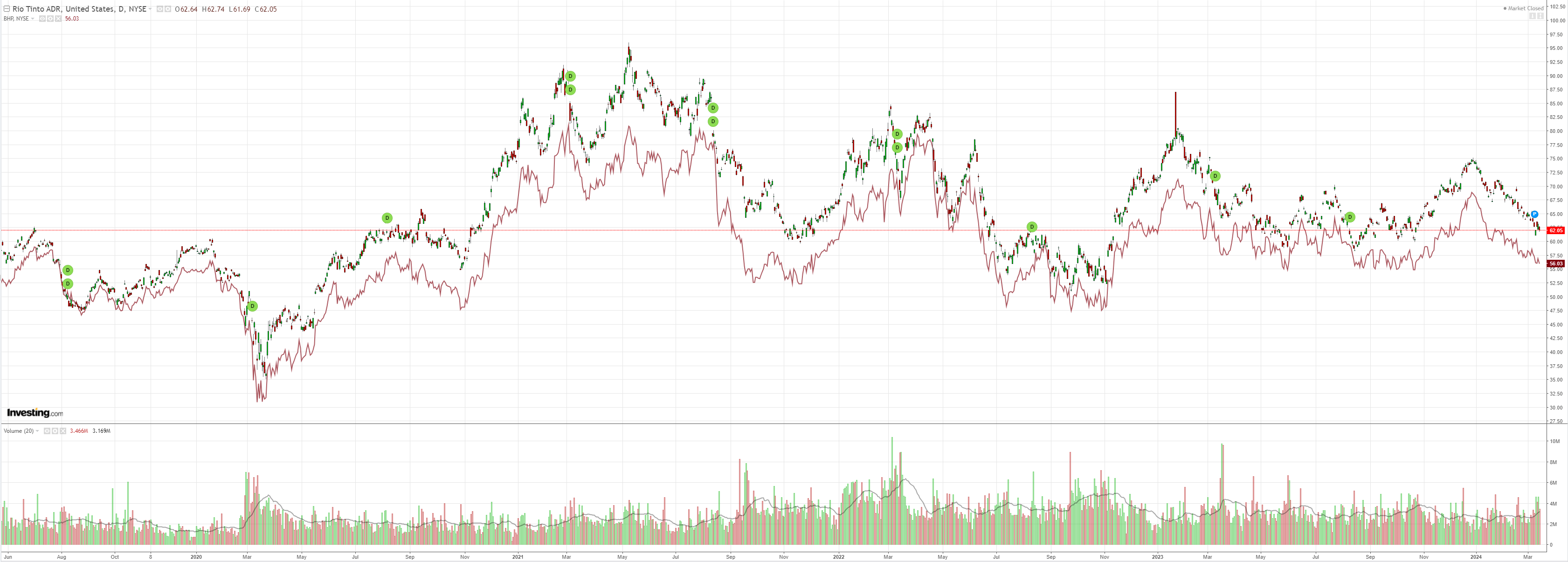

Miners are fooked as iron ore heads for the cost curve:

EM fell:

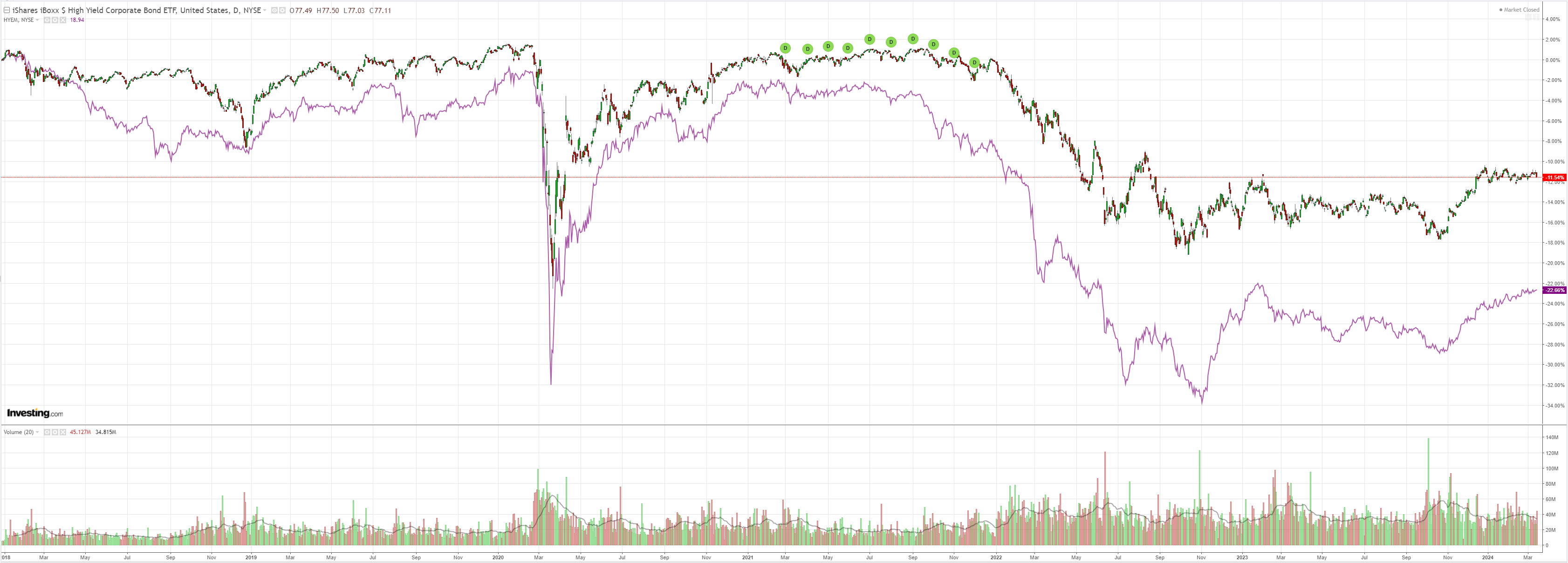

Junk did OK:

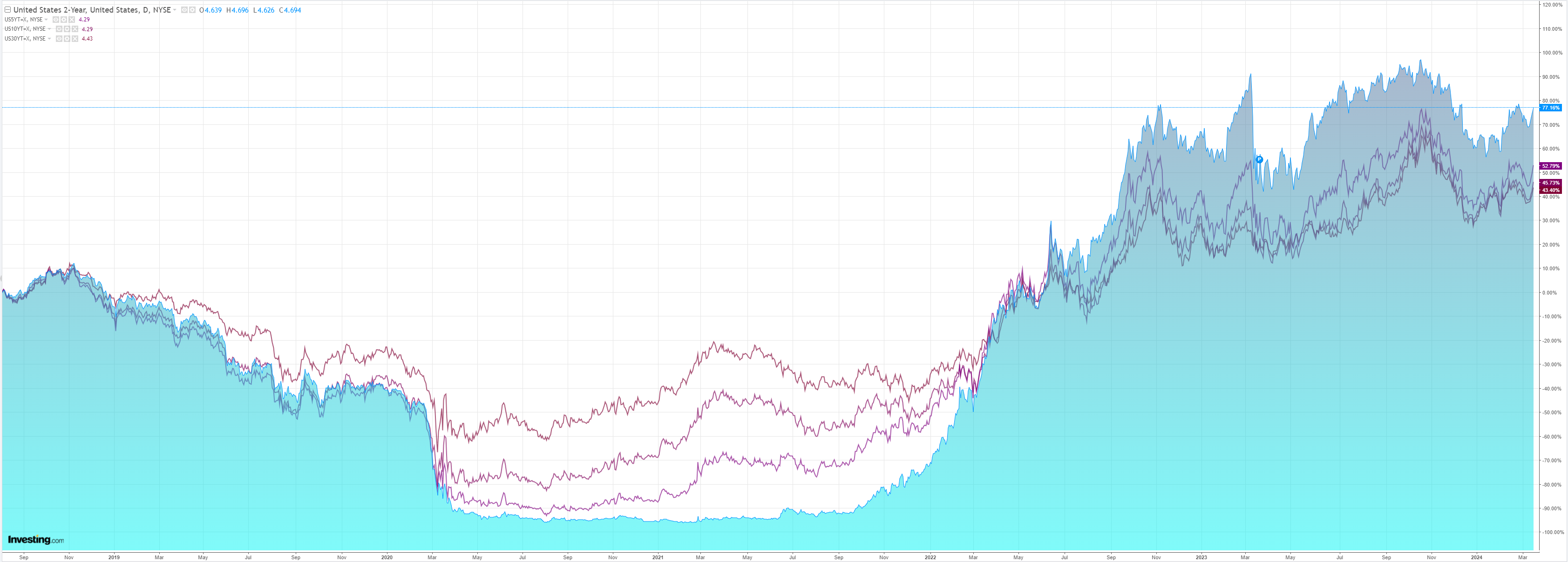

Given the yield back-up:

Stocks held on:

US PPI was a shocker at 0.6 versus 0.3 expected, largely on oil. This is a direct input into PCE, so it will not please El Fedo.

Worse, the IEA swung oil hawkish:

Global oil markets face a supply deficit throughout 2024, instead of the surplus previously expected, assuming that OPEC+ continues output cuts in the second half of the year, according to the International Energy Agency.

This certainly can delay the Fed, which will challenge the risk rally for a time.

Though the asymmetry of cuts to more hikes is still very favourable to risk so I wouldn’t get too cautious.

If oil runs, AUD will run away.