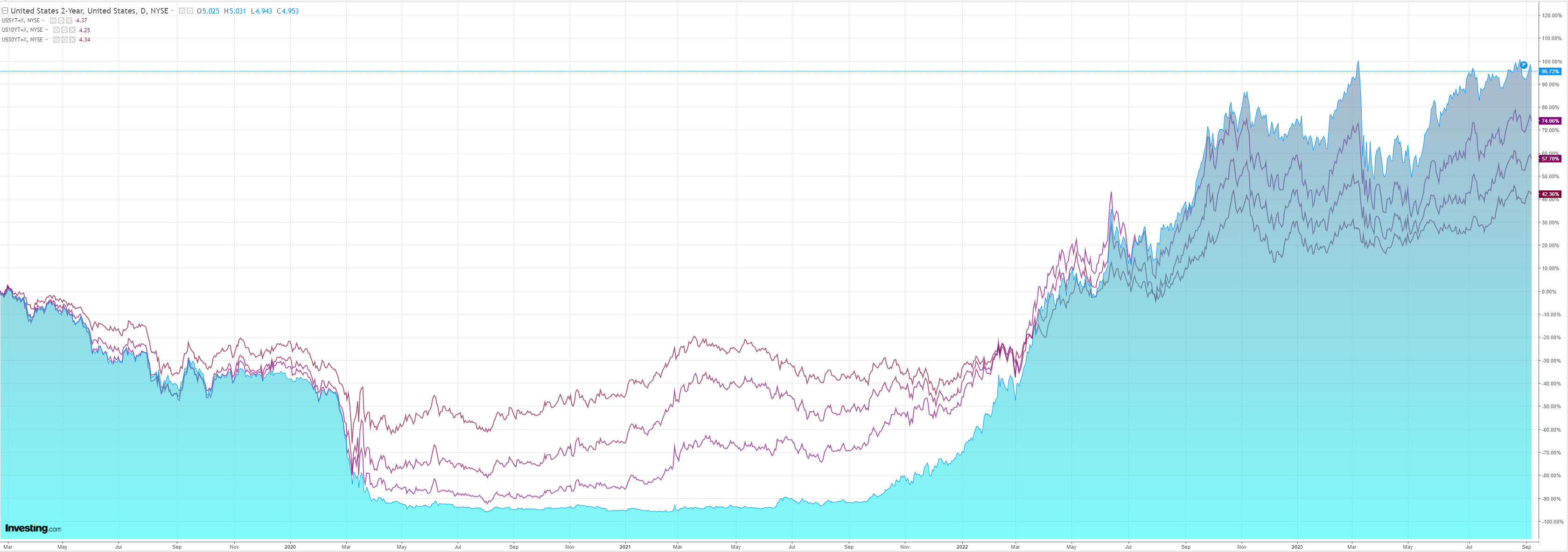

DXY is rampant:

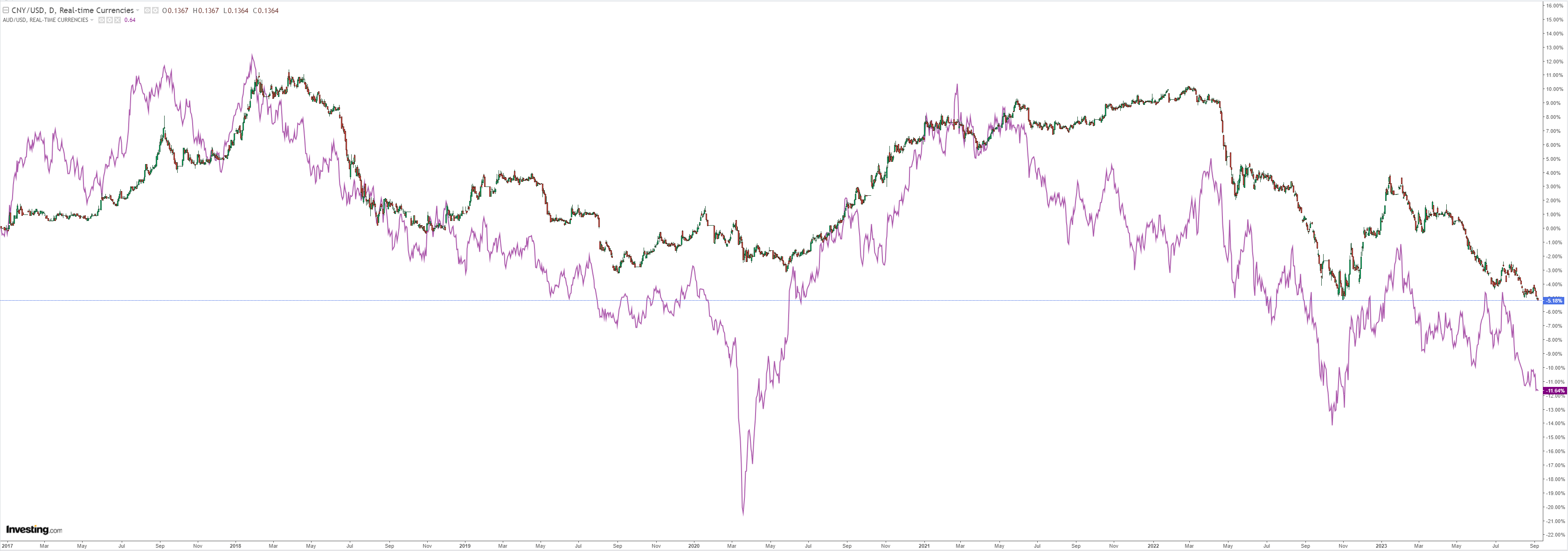

AUD is clinging to its recent lows, but it cannot hold if DXY continues:

China has thrown the kitchen sink at CNY support. It is failing:

DXY has capped oil at least:

Dirt fell:

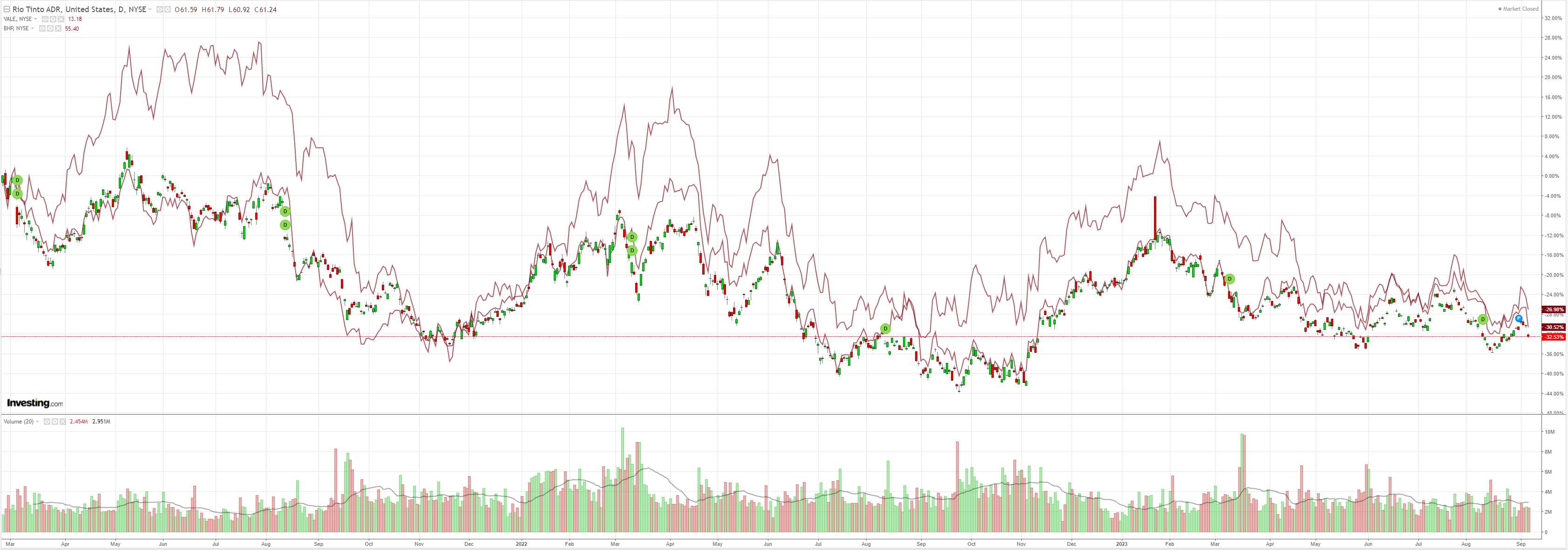

Miners were clobbered:

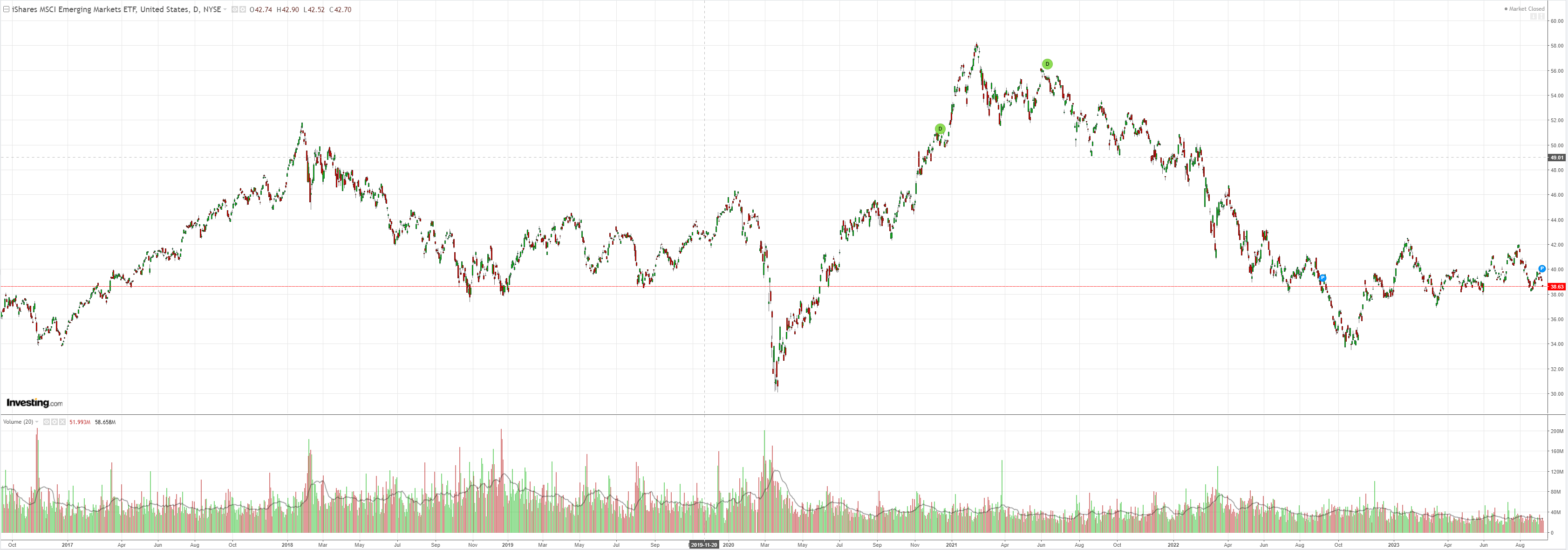

Welcome back to the Third World:

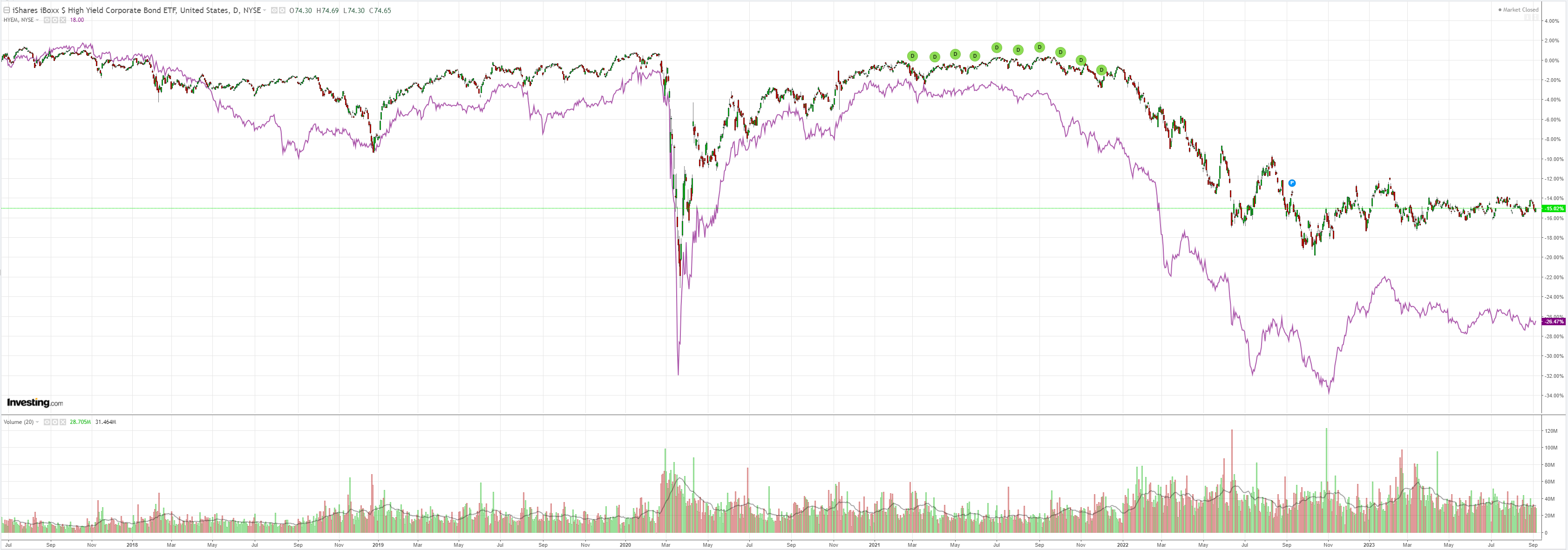

Junk did OK:

As yields eased:

Stocks fell:

Goldman sums it up nicely.

An attractive funding currency for carry trades with a managed and gradual depreciation against USD. CNY faced significant depreciation pressures in August, due to weakened economic data and shaky confidence in GDP growth. The surprising policy rate cut also reminded investors of large interest rate spreads, suggesting that the authorities might prioritize growth over exchange rate stability. Instead, the PBOC stepped up efforts to slow CNY depreciation via other instruments. Over the past two weeks, the authorities signaled discomfort via strong CNY fixing (i.e., a negative CCF), followed up by active CNH liquidity management, and FX deposit RRR cut. Although CNH liquidity management could be sustainable and effective to push back against one-way depreciation expectations, current conditions still suggest weakening pressures on CNY, especially as the USD strengthens. With expectations of more monetary policy easing, CNY is likely to remain an attractive funding currency for carry trades. In our client conversations, hedge fund investors have shown rising interest in riding the waves of FX interventions via CNH-CNY basis trades and NDIRS/CCS spread trades.

CNY continues to fall despite China’s best efforts to support it. As it should given the structure of China’s economy.

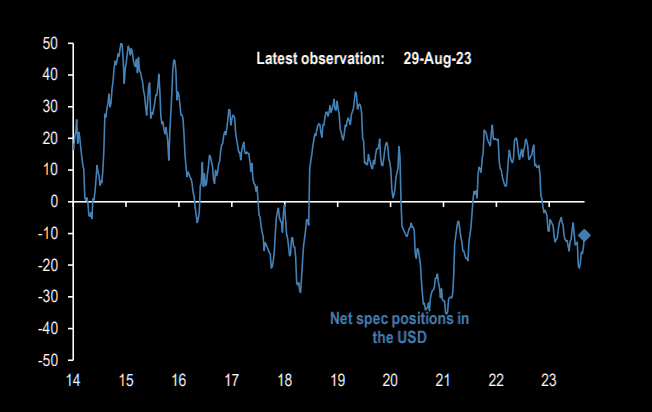

Worse for AUD, hedge funds are still short DXY:

The AUD is being crushed between superpower currencies and is not over by a long shot.