Street Calls of the Week

DXY has very constructive ascending triangle pattern. If it breaks above 106, it is off to the races:

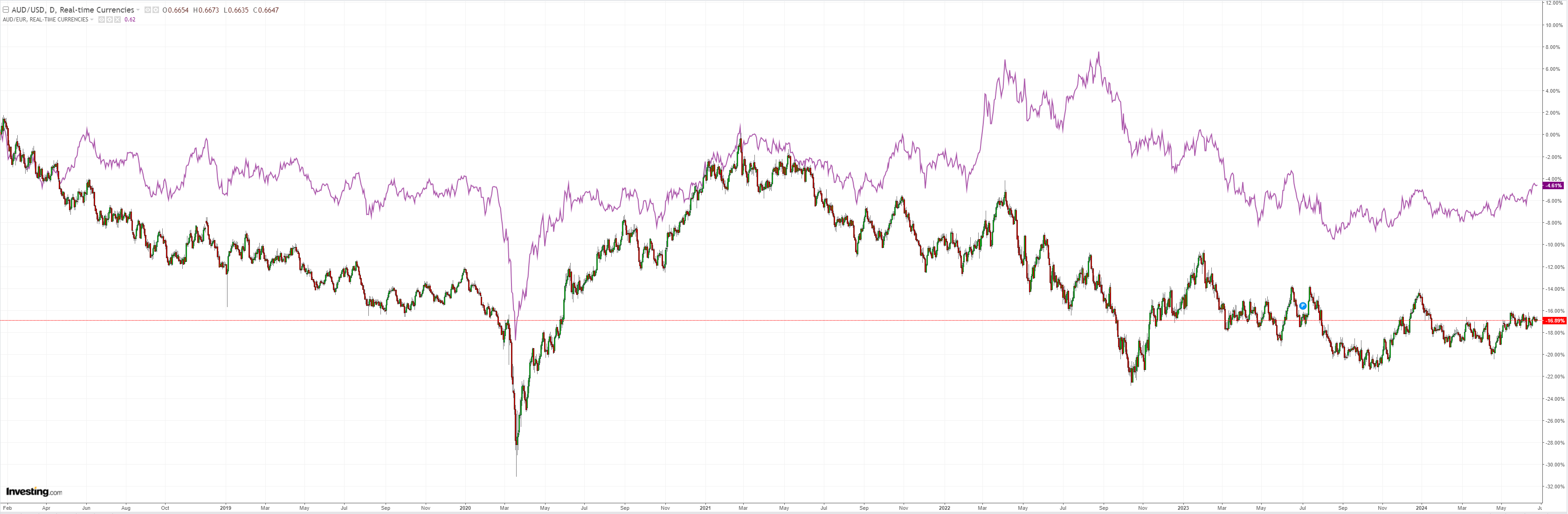

AUD is hanging in there:

North Asia is sliding inexorably:

The oil squeeze is done:

Back from whence you came, copper:

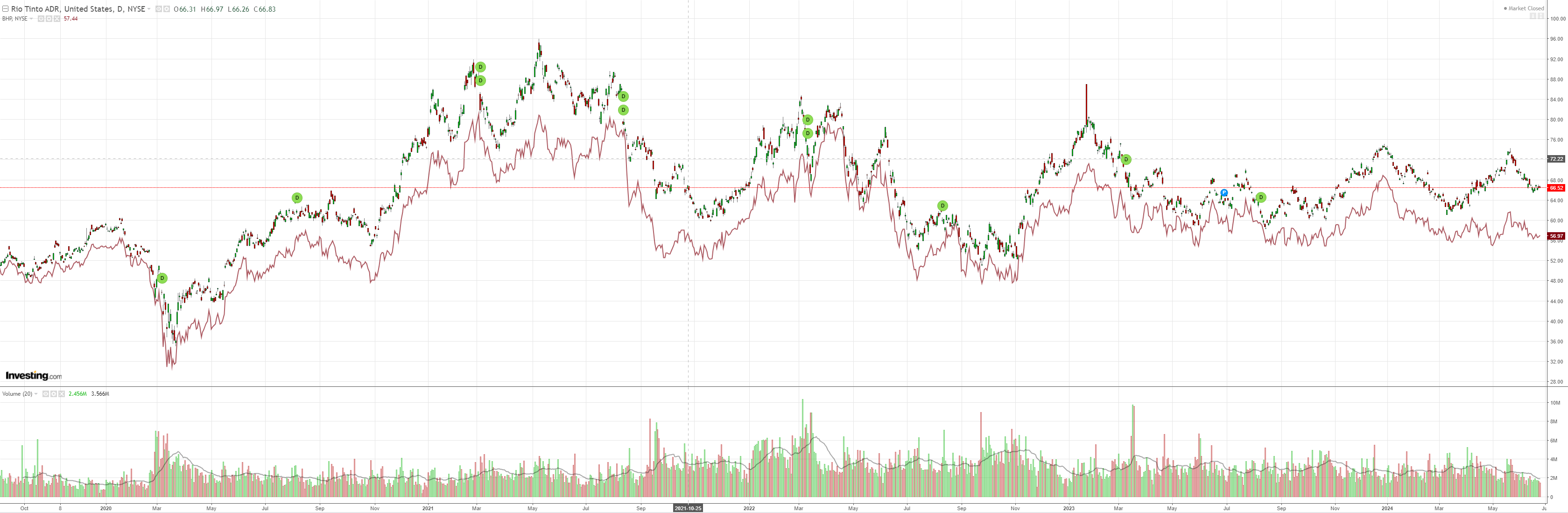

Miners should be much lower given the outlook:

EM holding support…so far:

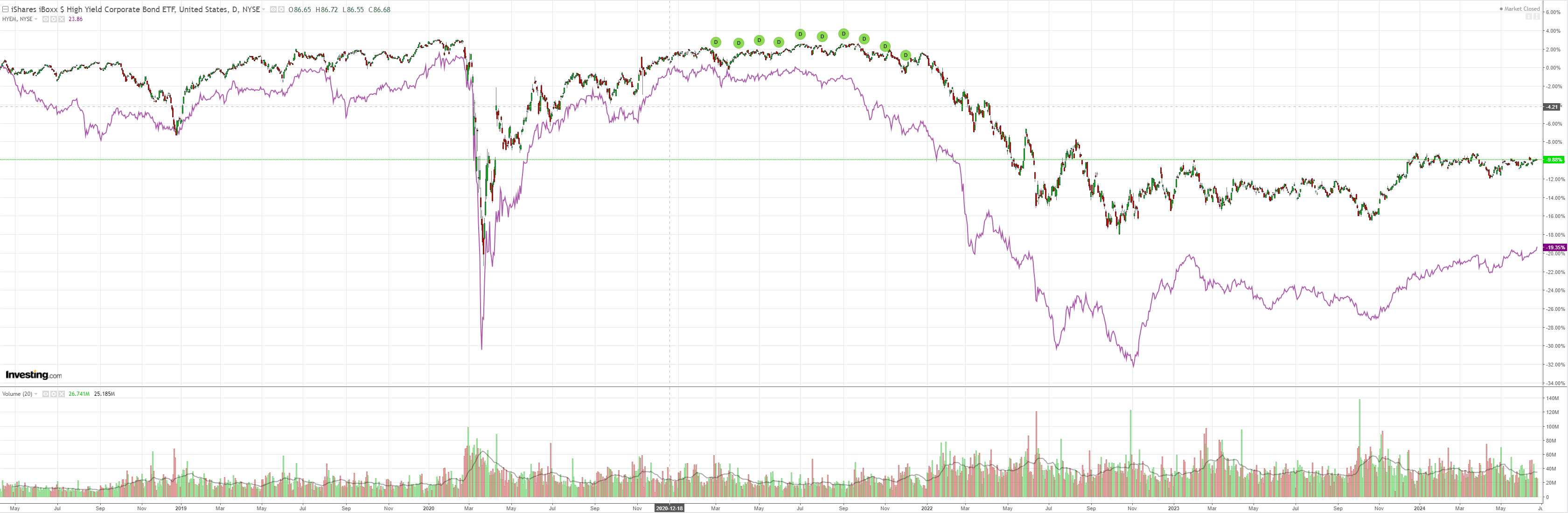

Junk lifted, good for stocks:

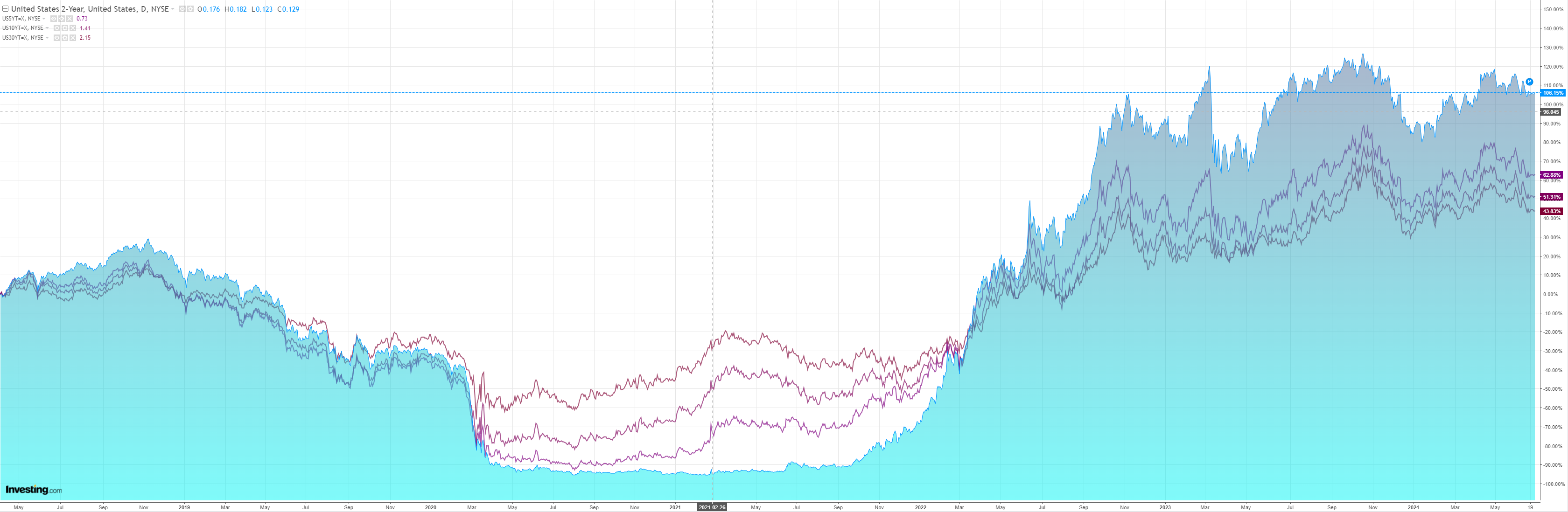

As the US curve keeps flattening:

You can’t keep a good AI bubble down:

Not much in data last. The big ones are today’s local monthly inflation and tonight’s PCE report in the US.

Local inflation might remain firm given energy rebates haven’t kicked in yet. I expect a soft PCE.

That might give us a short-term bounce in AUD but the gravity well of the US election has a grip as we head into H2.

With El Trumpo still firming as favourite, auguring 60% tariffs, a border smash to crunch immigration, and more tax cuts, DXY is not likely to weaken, nor will CNY strengthen, any time soon.

It is a lot to ask AUD to take on both superpower currencies at once.

Lower ahead.