DXY flamed out last night:

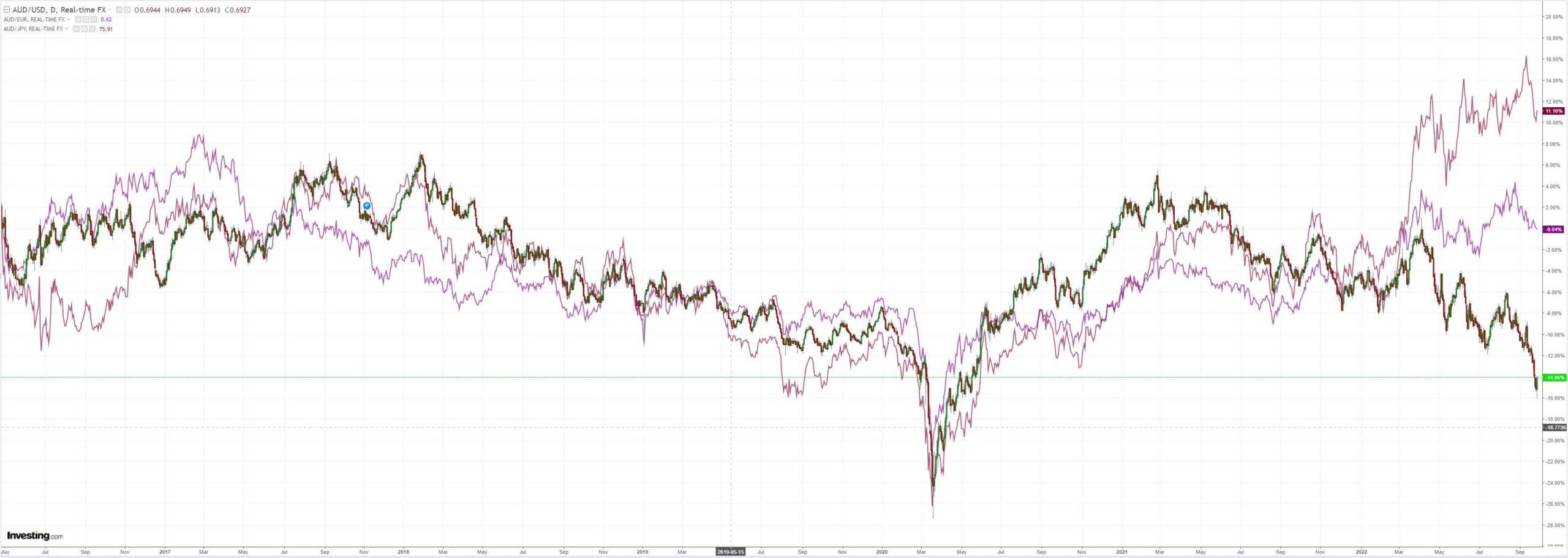

Everything else reversed out of the swan dive. AUD:

Oil:

Miners (NYSE:RIO):

EM stocks (NYSE:EEM):

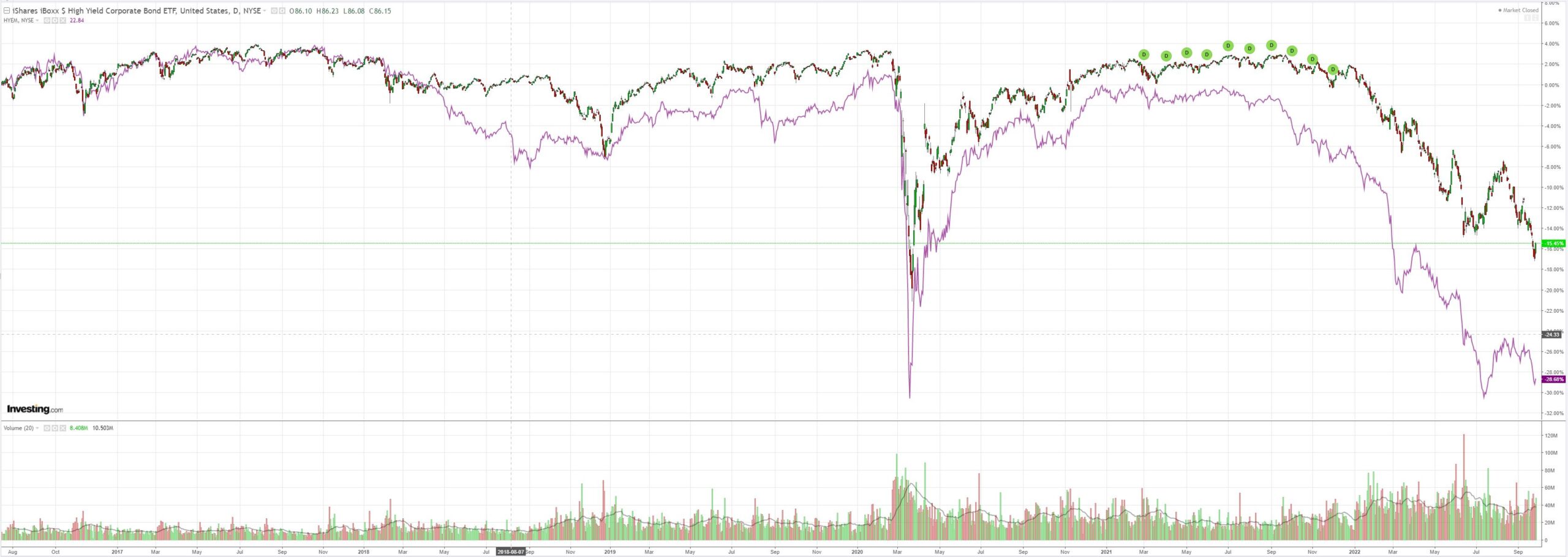

Junk (NYSE:HYG):

Hooray! Everything is fixed! Goldman:

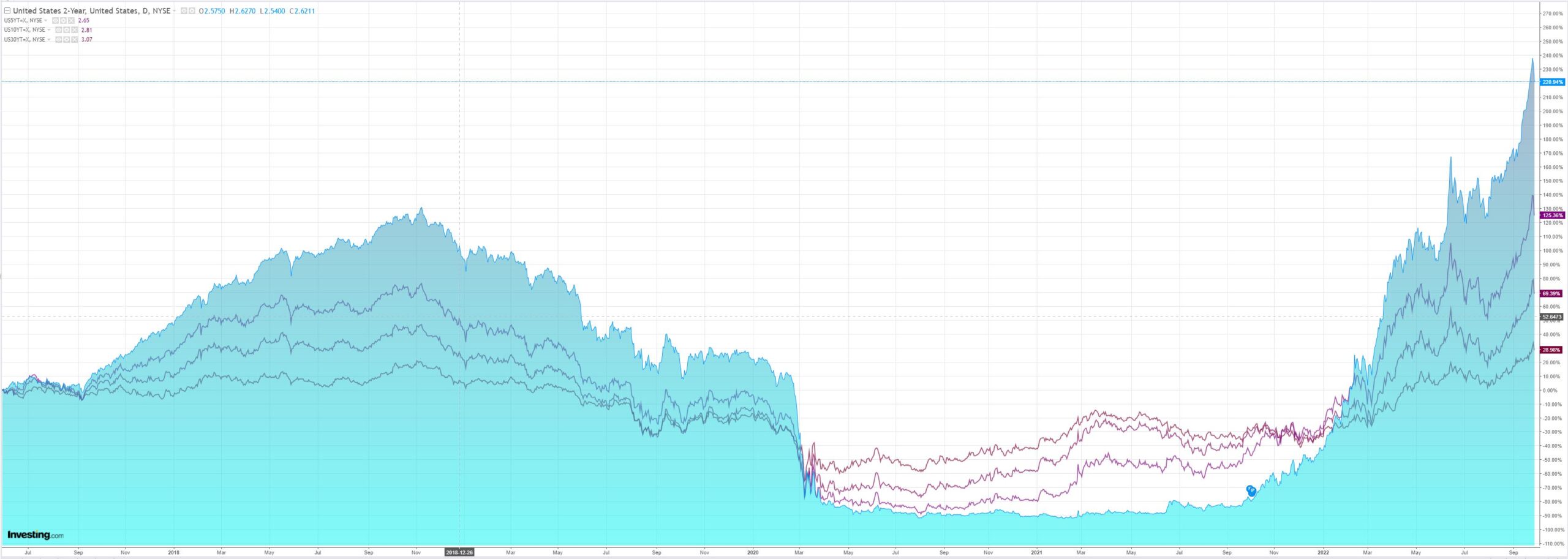

BOTTOM LINE: The BoE has just announced that it will carry out temporary purchases of long-dated UK government bonds from today until 14 October, in order to restore orderly market conditions. The BoE stated that it stands ready to purchase bonds “on whatever scale is necessary” and confirmed that the operation is fully indemnified by HM Treasury. In response, the MPC agreed to delay the start of active gilt sales until 31 October, originally scheduled to begin on 6 October. However, the MPC’s annual target of an £80 billion reduction in the stock of gilts is unaffected by today’s decision. The MPC will “not hesitate to change interest rates by as much as needed” to return inflation to 2%.

MAIN POINTS:

1. The BoE has just announced that it will carry out temporary purchases of long-dated UK government bonds from today until 14 October, in order to restore orderly market conditions. The Financial Policy Committee noted that there are currently risks to UK financial stability from dysfunction in the gilt market.

2. The BoE stated that it stands ready to purchase bonds “on whatever scale isnecessary” and confirmed that the operation is fully indemnified by HM Treasury. In a separate statement today, Chancellor Kwarteng committed to the BoE’s independence and to work closely with the BoE to support its financial stability and inflation objectives.

3. In response, the MPC agreed to delay the start of active gilt sales until 31 October, originally scheduled to begin on 6 October. However, the MPC’s annual target of an £80 billion reduction in the stock of gilts is unaffected by today’s decision, implying a faster rate of gilt sales further out.

4. Consistent with the message from Governor Bailey’sstatementon Monday and Chief Economist Pill’s speech yesterday, the MPC confirmed that they intend to make a full assessment at the November meeting, but will “not hesitate to change interest rates by as much as needed” to return inflation to 2%.

So, the UK is now printing GBP to fund tax cuts and that’s bullish for the currency? Let’s see how we go after a little bear market bounce. Voodoo is voodoo over the long run.

For me, the more remarkable event of yesterday was the disorderly rout in CNY. It, too, has partially reversed:

But it has now been proven that it can be done. The PBoC’s impossible trinity is broken and it has lost control of the Chinese currency.

This is a profound development that spells the end of China’s growth period and the start of something else. A fight to the death over declining global demand growth among the great powers.

Therefore, I am not convinced that yesterday was anything more than another tactical bottom.

The Fed is not done with inflation. Putin is not done with Europe. Most remarkable, China is done with growth.

AUD lower yet.