DXY is screaming higher and giving one very clear message: global dislocation is here:

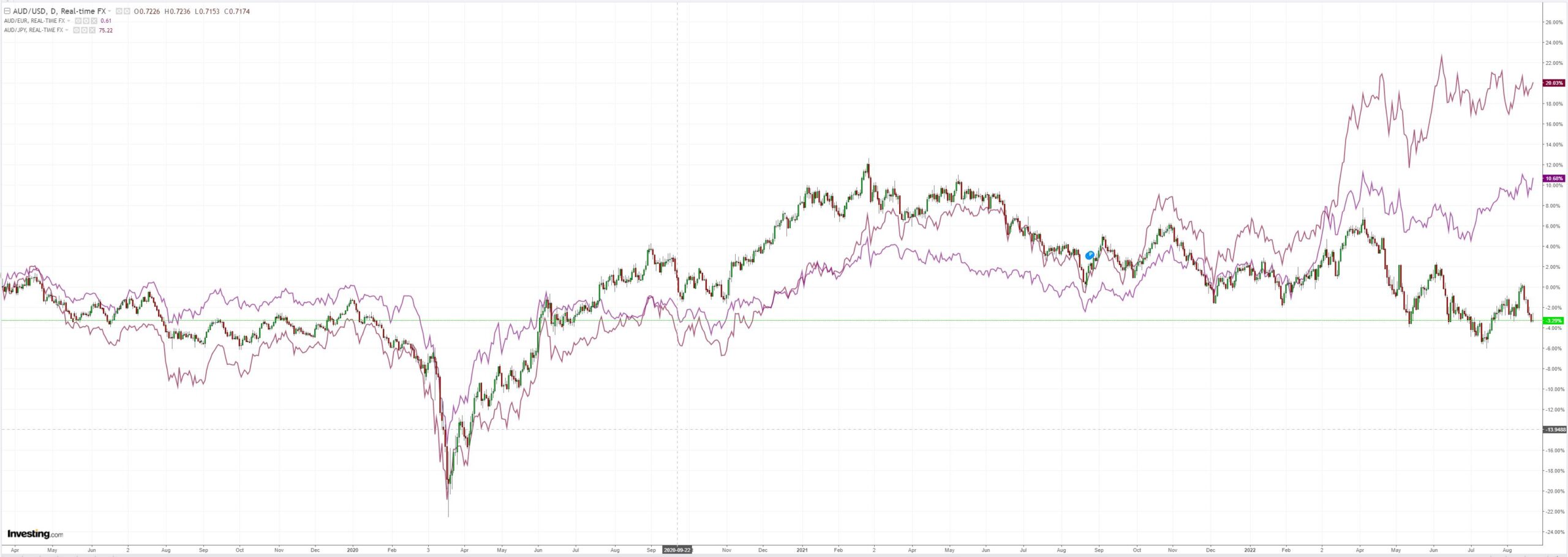

As the EUR collapses, AUD is clinging to the side of cliff:

Oil held, perhaps on hopes of gas substitution:

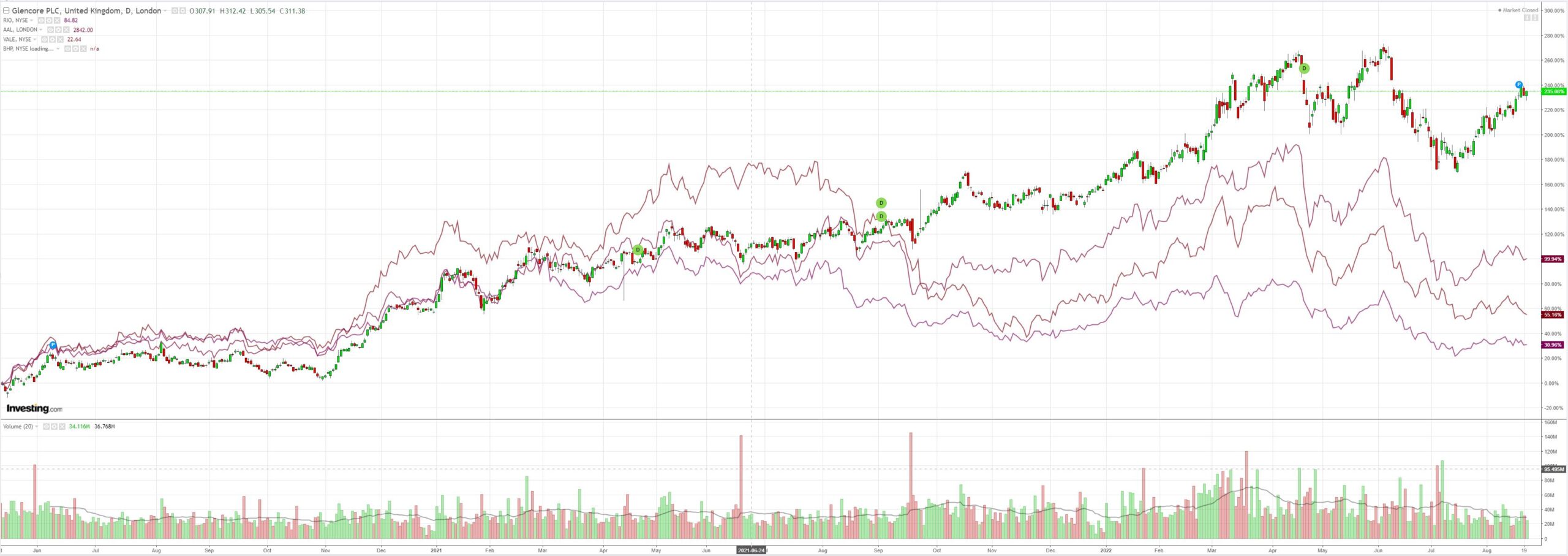

Metals are full of China hope. Nope:

EM stocks (NYSE:EEM) fell:

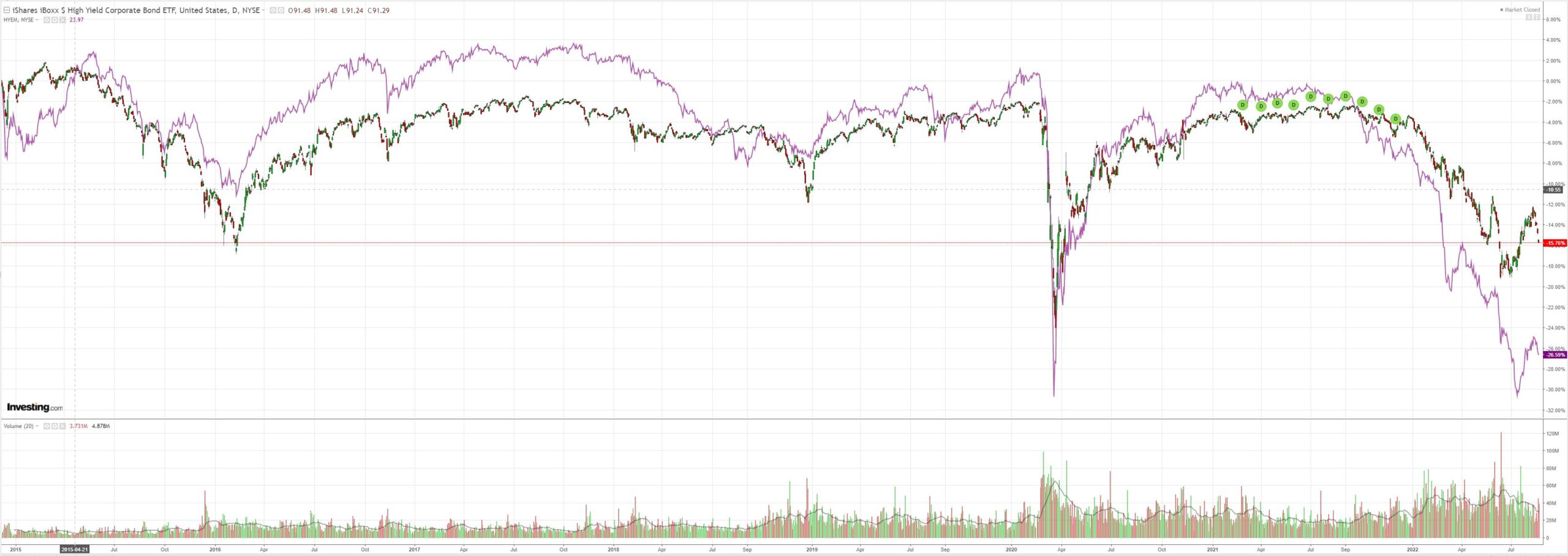

Junk (NYSE:HYG) is telling the tale:

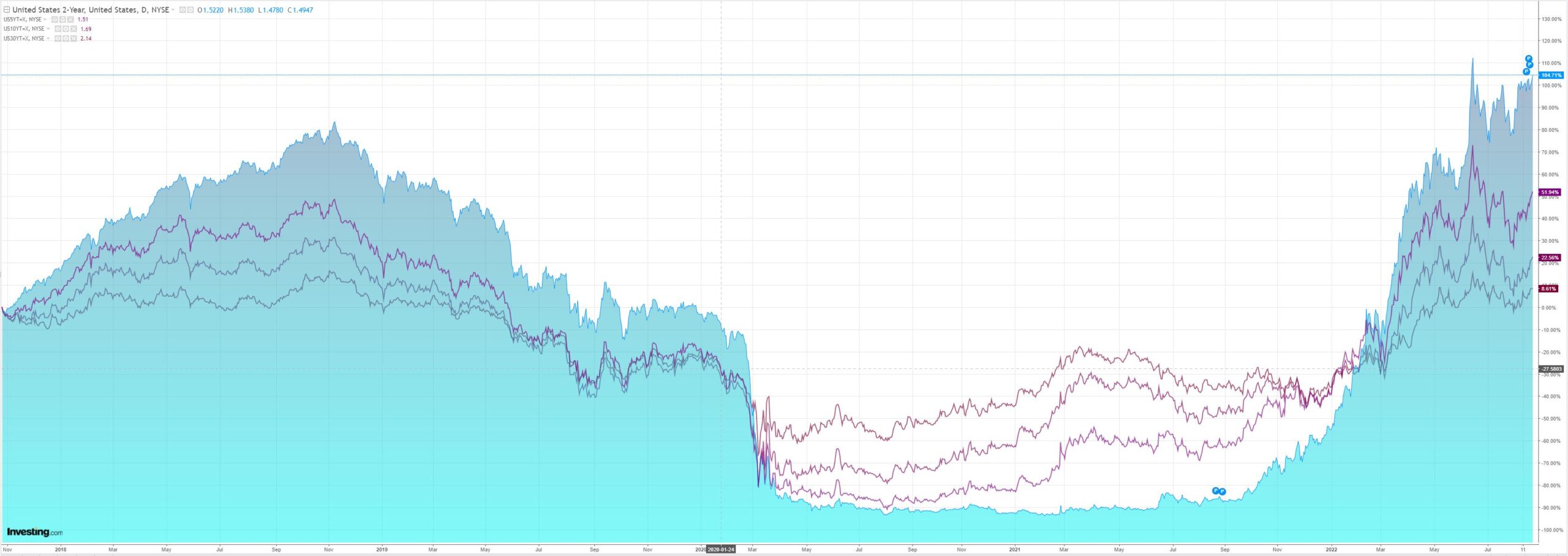

Yields rose as we go down the Jackson Hole:

Stocks were smacked:

Westpac has the wrap:

Event Wrap

The Chicago Fed’s national activity index for July rose to +0.27 (est. -0.25, prior revised down to -0.25 from -0.19). Production related indicators contributed +0.16 to the overall index (compared to -0.19 contribution in June). The report also noted that 55 of the indicators improved while 30 deteriorated.

ECB council member Nagel (Bundesbank) said: “given high inflation, further interest rate hikes must follow…the past few months have shown that we have to decide on monetary policy from meeting to meeting…it will be crucial to keep medium-term inflation expectations stable at 2%”. He acknowledged, though, that the economic situation is not making the situation easier and that “if the energy crisis worsens, a recession seems likely next winter, while inflation could hit 10% in the autumn months…for 2023, the probability is growing that price growth will average above 6%”.

Event Outlook

Japan: The August Nikkei PMIs will provide a timely update on the outlook for services and manufacturing.

Eur/UK: European consumer confidence is expected to remain near its lows in August (market f/c: -28). A further weakening in the Eurozone S&P Global (NYSE:SPGI) manufacturing and services PMIs is also anticipated in August (market f/c: 49.0 and 50.5 respectively). Similarly for the UK, the S&P Global PMIs are expected to decline but remain in positive territory (market f/c: 51.0 and 51.6 respectively).

US: The Richmond Fed index is expected to weaken further in August but near-term volatility remains (market f/c: -5). With the housing sector under significant pressure, another decline in new home sales is anticipated in July (market f/c: -2.5%). The S&P Global manufacturing and services PMIs are pointing to smaller/mid-sized firms facing greater pressure from weakening conditions (market f/c: 51.9 and 50.0 respectively).

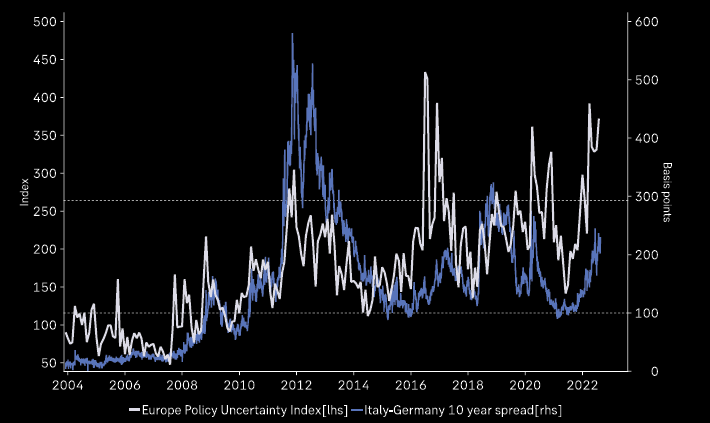

Europe is headed into a disastrous recession as winter comes to the energy shock:

The ECB is tightening into it:

With predictable results:

And so EUR is crashing.

Alas for markets, that’s not the end of the trouble. China is stuffed on zero-COVID and the property bust and, soon enough, the trade shock coming from Europe. So CNY is also crashing.

AUD survived against these enormous downside forces for a night but it can’t possibly last:

And all of that before we get to a hawkish Jackson Hole.

One word for ya: duck.