DXY continued its one-way swoon Friday night as EUR launches:

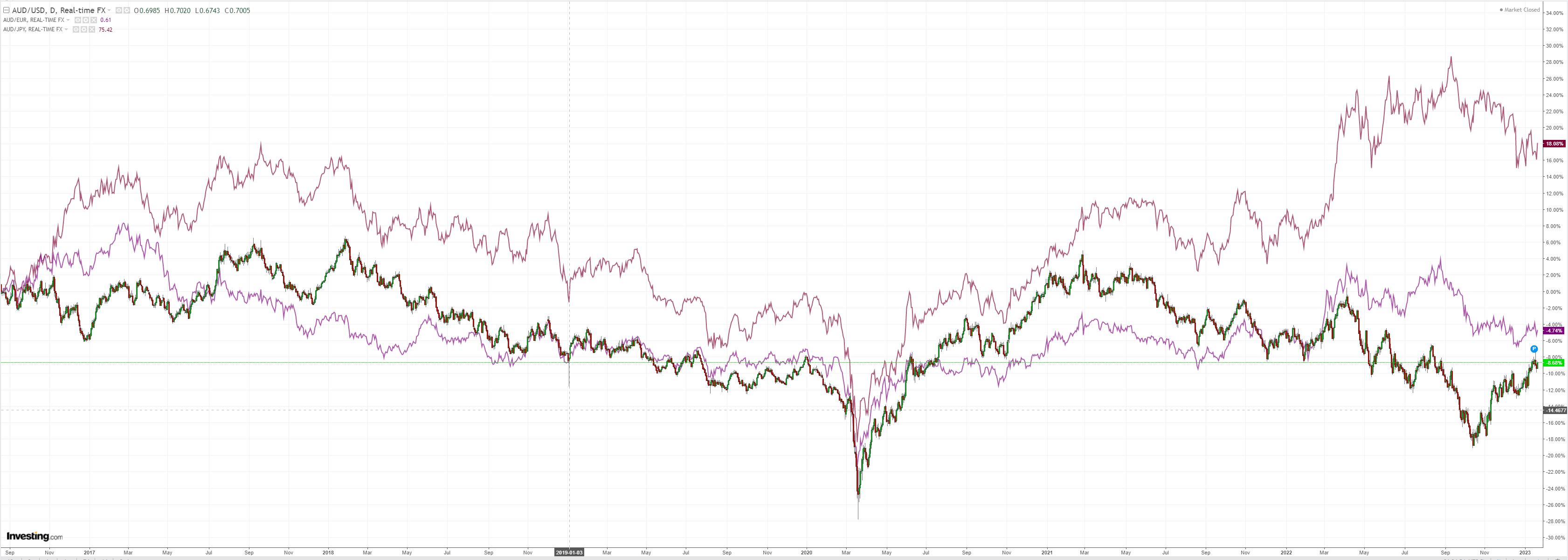

AUD popped:

Base metals climbed:

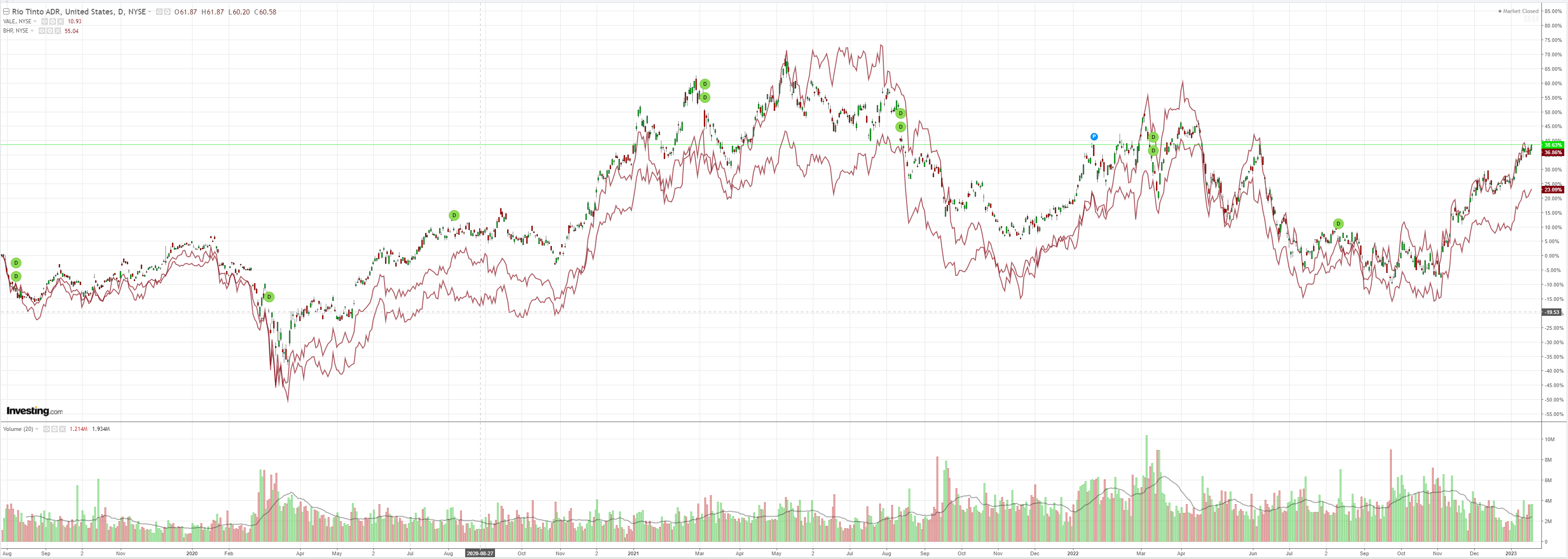

And miners (NYSE:RIO):

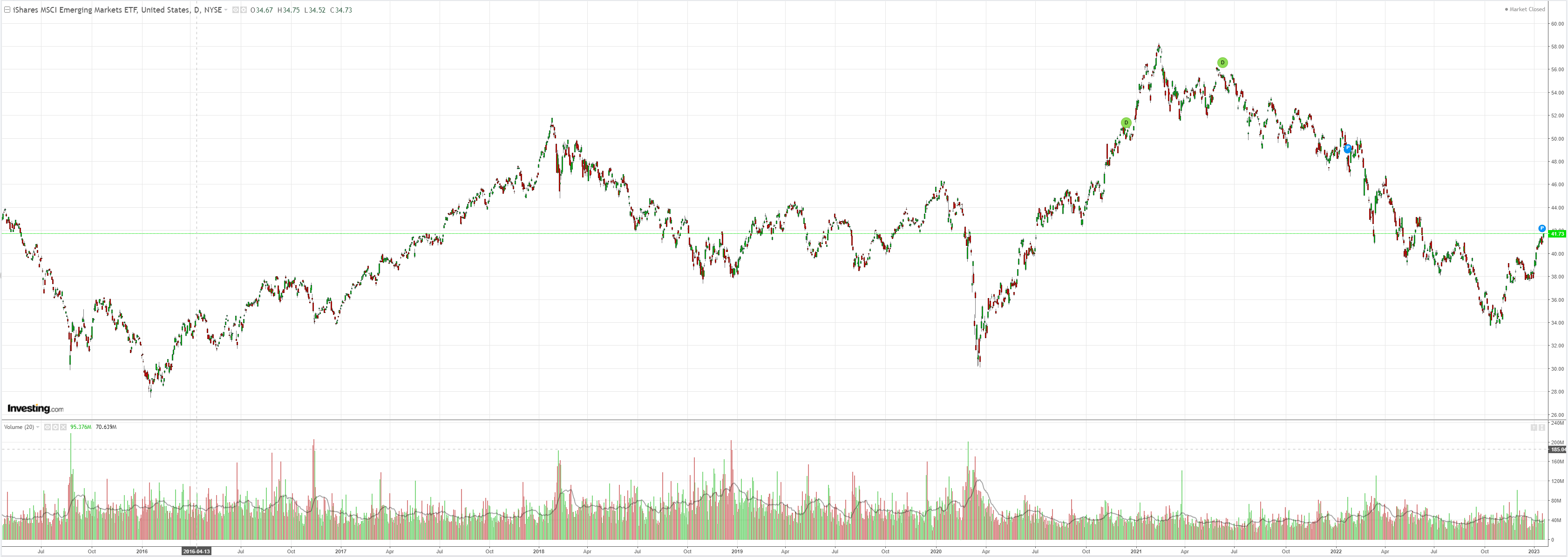

Plus EM stocks (NYSE:EEM):

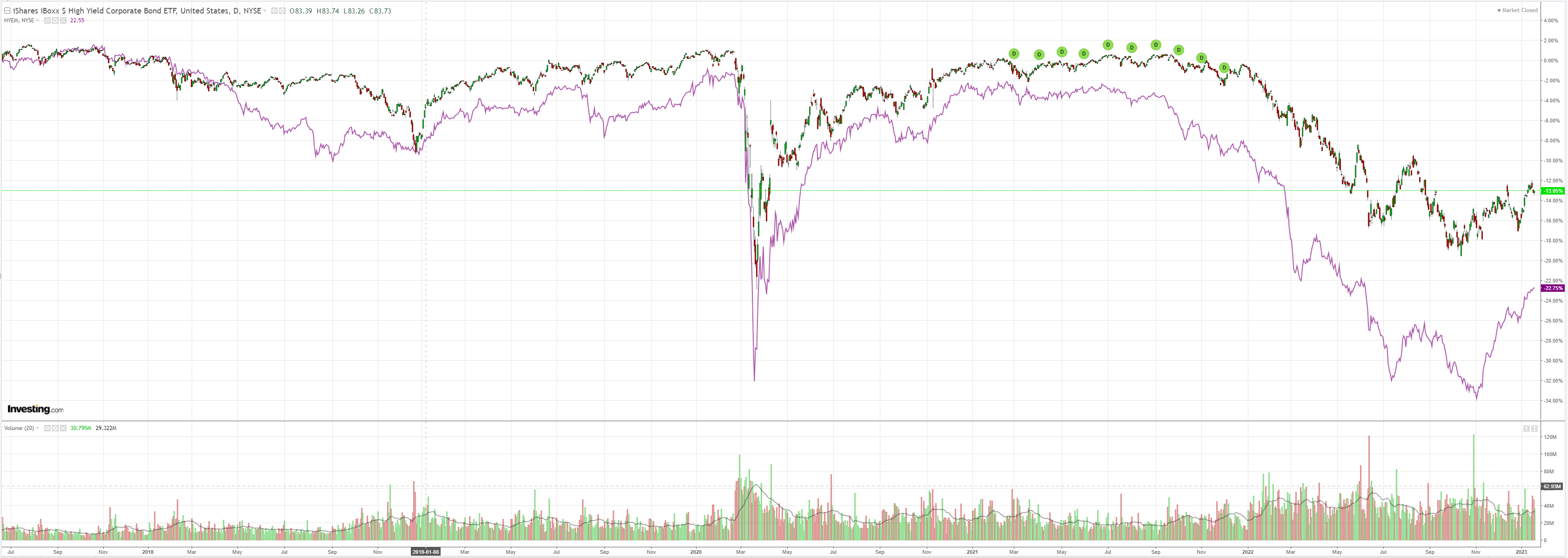

And junk (NYSE:HYG):

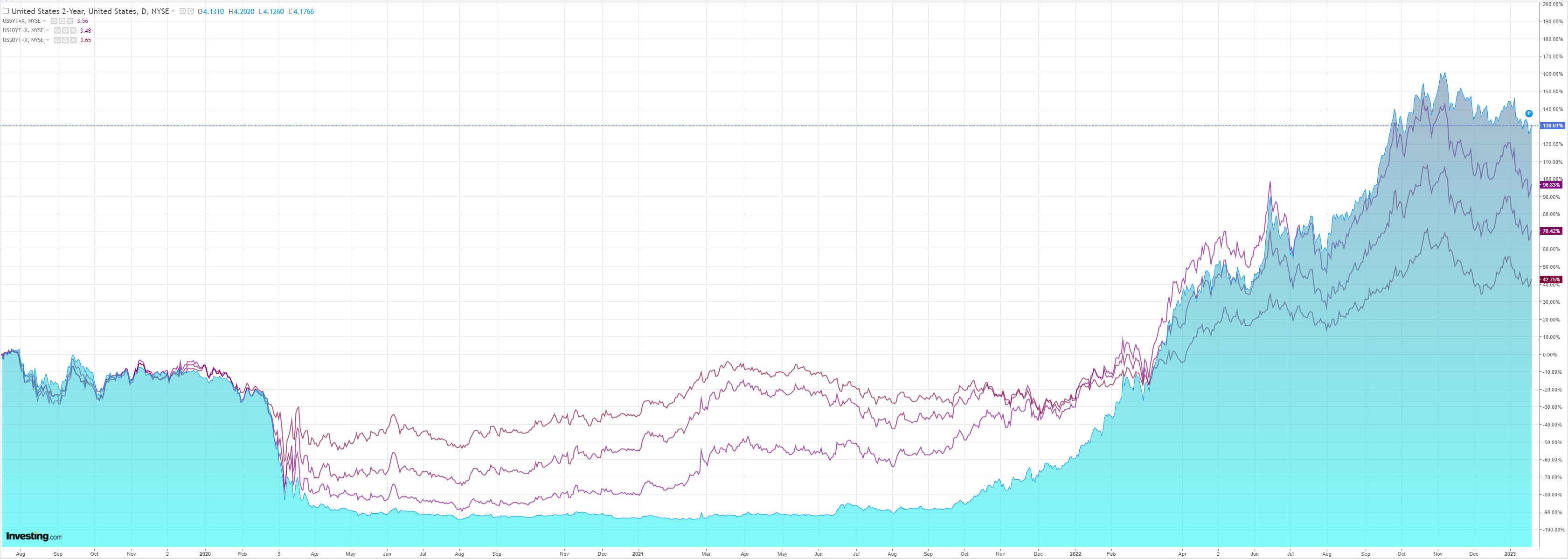

US yields lifted:

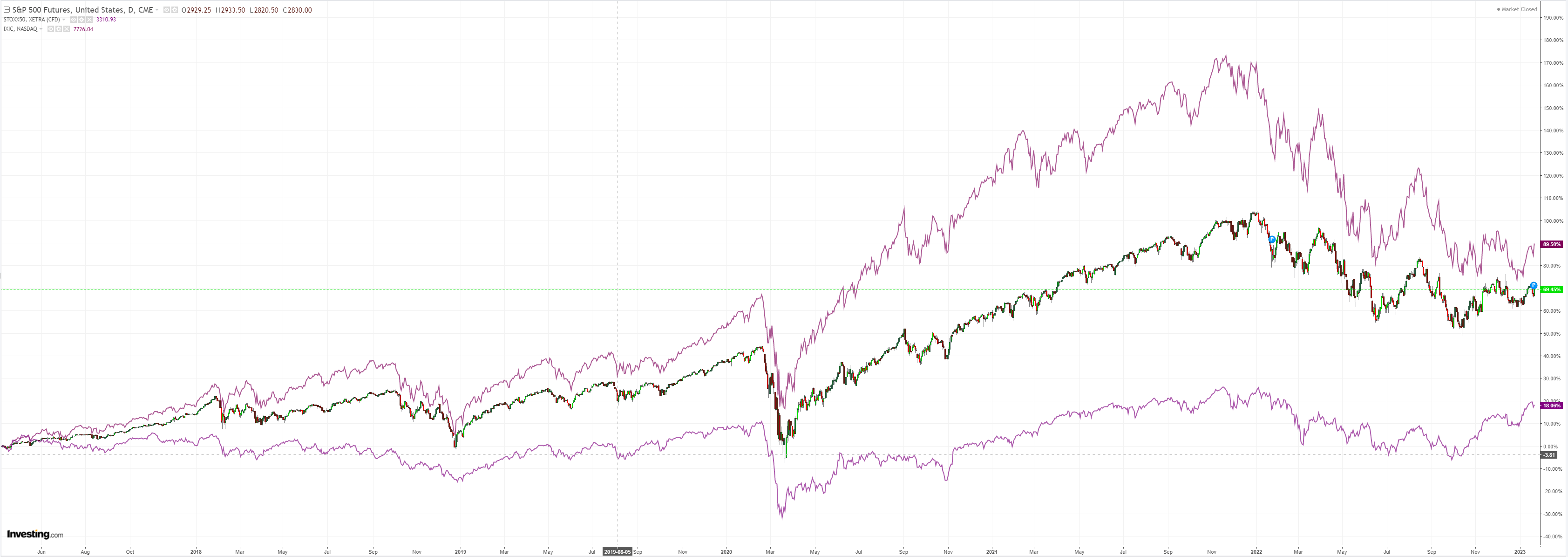

And stocks surged:

Not much rationale there. But the crashing DXY is all that matters. JPM summarises it:

Outlook: Cyclical dataflow show no signs of derailing the dollar downtrend. JPM no longer sees a recession in Europe, while full year 2023 China growth has been upgraded (again) to 5.6%. Risk appetite metrics suggest near peak short-term EM FX bullishness / USD bearishness. Medium-term direction of travel remains towards policy normalization for BoJ despite inaction and keeps Yen bullishness intact. UST hit its debt limit this week; USD can weaken vs reserve currencies in periods of political dysfunction.

Macro Trade Recommendations: Add exposure to China reopening but remain cautious of US growth risk; rotate CAD shorts from USD to AUD. Neutralize CHF longs vs. high beta FX in the euro bloc on upturn in growth. Look for CHF to underperform JPY; initiate shorts. Keep trades that balance economic divergence and risk aversion: short GBP/AUD, CAD/JPY, NZD/JPY, GBP/USD and long EURSEK, AUD/NZD. EUR/NOK call spd expired but still bearish NOK.

Emerging Markets FX: We stay MW EM FX in the GBI-EM Model Portfolio. In EMEA EM, hold onto MW stance, with an UW HUF vs OW RON. Elsewhere, remain OW EGP. In EM Asia, the reopening rally can continue to run but some USD/Asia pairs are starting to look too low. In Latam, the idiosyncratic stories warrant differentiated views. Stay OW MXN and OW UYU vs. UW COP and UW CLP.

FX Derivatives: Long-dated BRL/JPY calls offer value if BoJ is to stick to YCC in future meetings while USD/JPY 6M6M forward vol offers a good entry point for a policy change in H2. Recommend long PLN vol vs short HUF vols RV.

FX Technicals: EUR/USD stalls at resistance, triggers cluster of sell signals. GBP/USD retests important resistance; look for signs of deceleration. USD/JPY tries to mount rebound from support. AUD/USD pulls back after the recent overshoot of resistance. USD/KRW 4Q22 mean reversion extends.

In short, so long as the world is seen as growing faster than the US, critically in China lifting Europe, DXY will fall and global reflation transpire.

It remains my view that a US recession sinks all boats but until that is obvious this trade wins the day.

With AUD at the centre of it.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI