Street Calls of the Week

The DXY false break is confirmed. Up we go as EUR plunges:

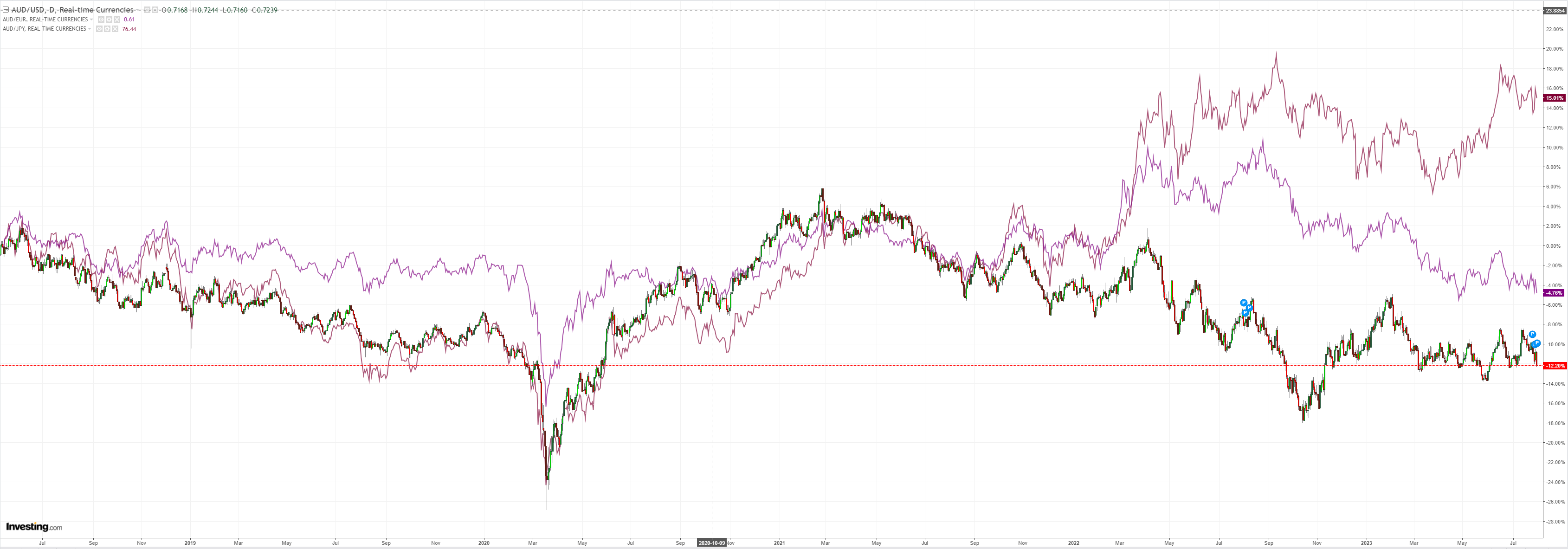

AUD was bashed to new lows:

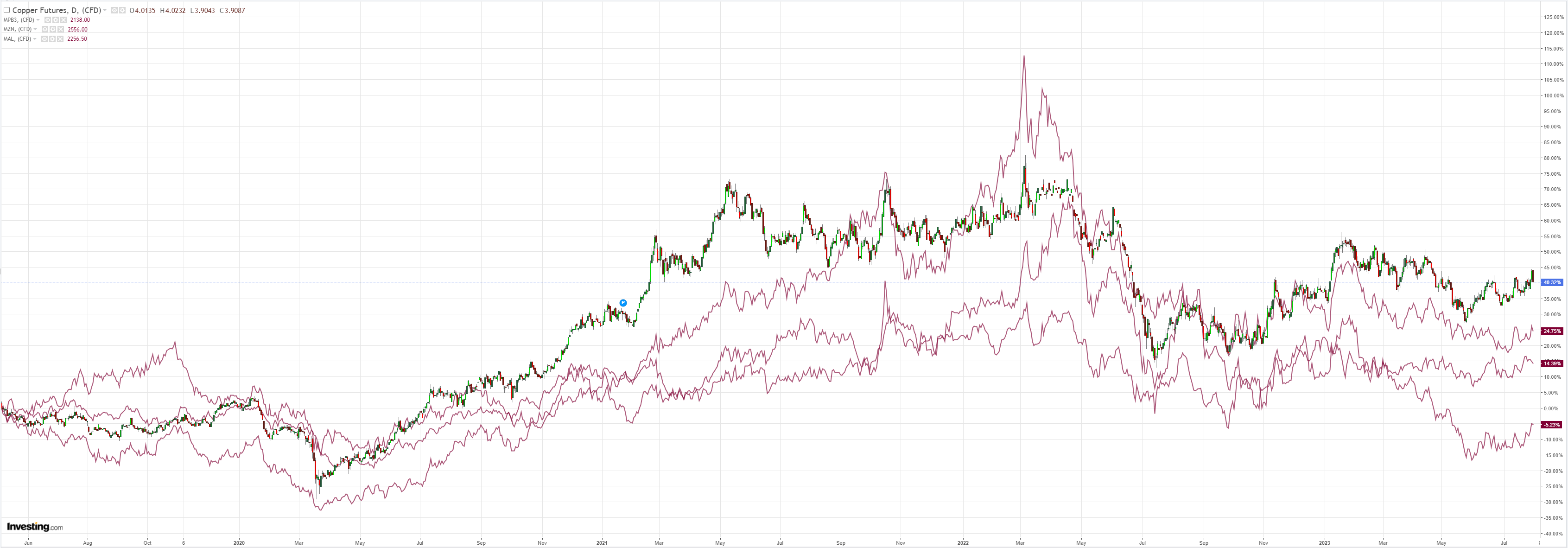

The entire Complex of commods, miners, EM and junk – reversed. Oil and gold led it:

Dirt was hosed:

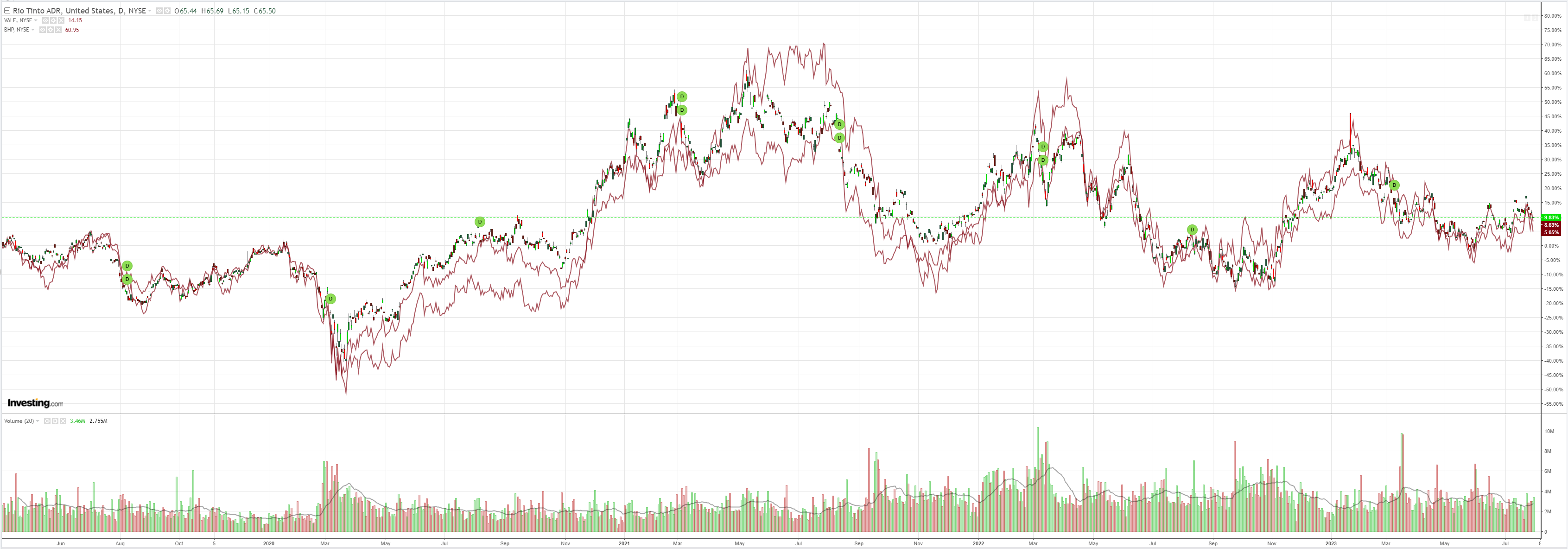

Miners (NYSE:RIO) are going to retest lows:

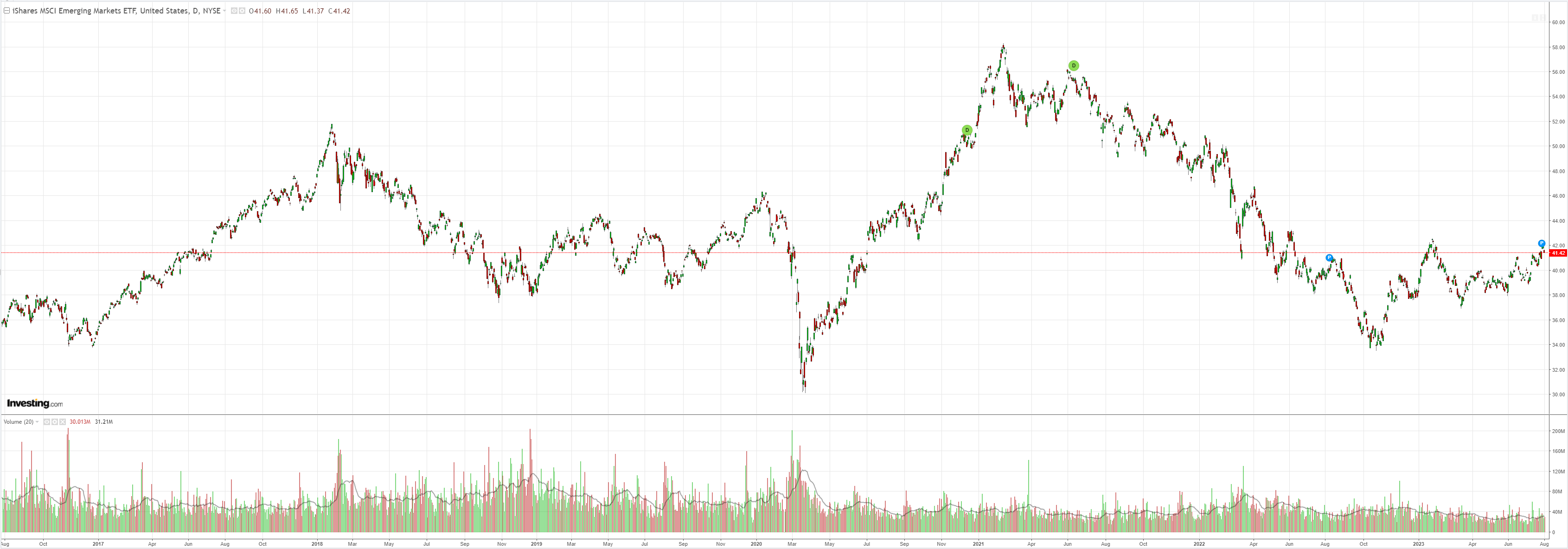

EM (NYSE:EEM) may never be investable again:

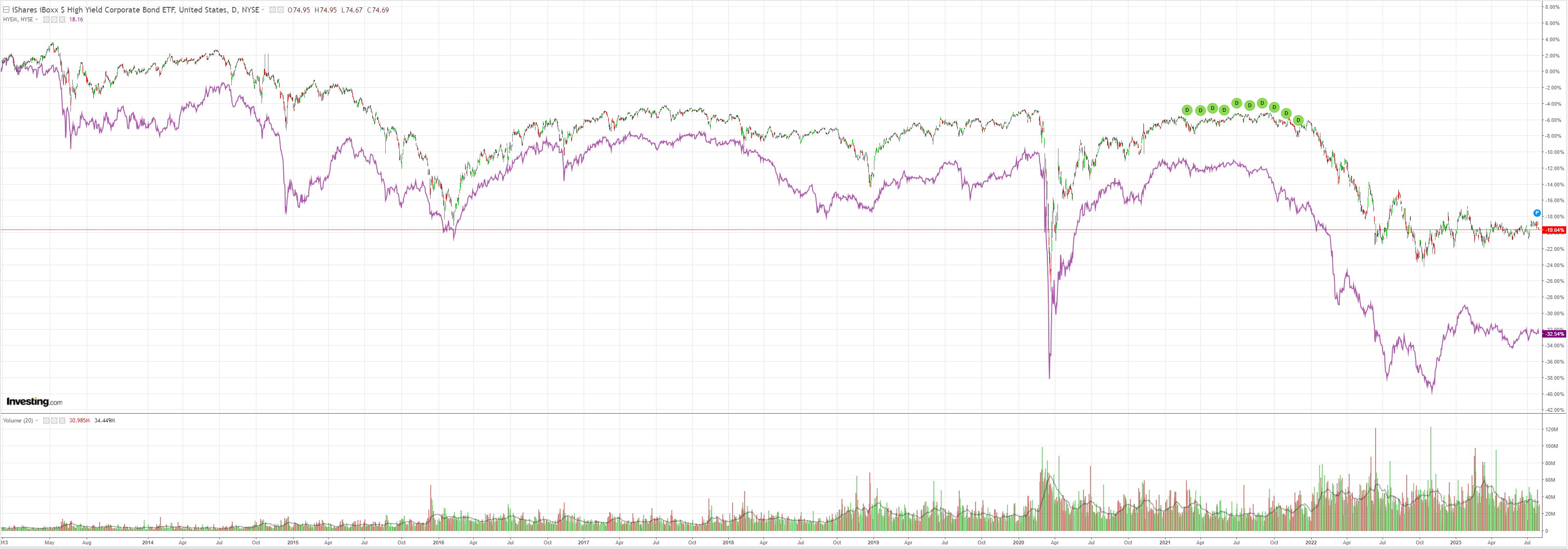

Junk (NYSE:HYG) is unequivocal that there is a problem:

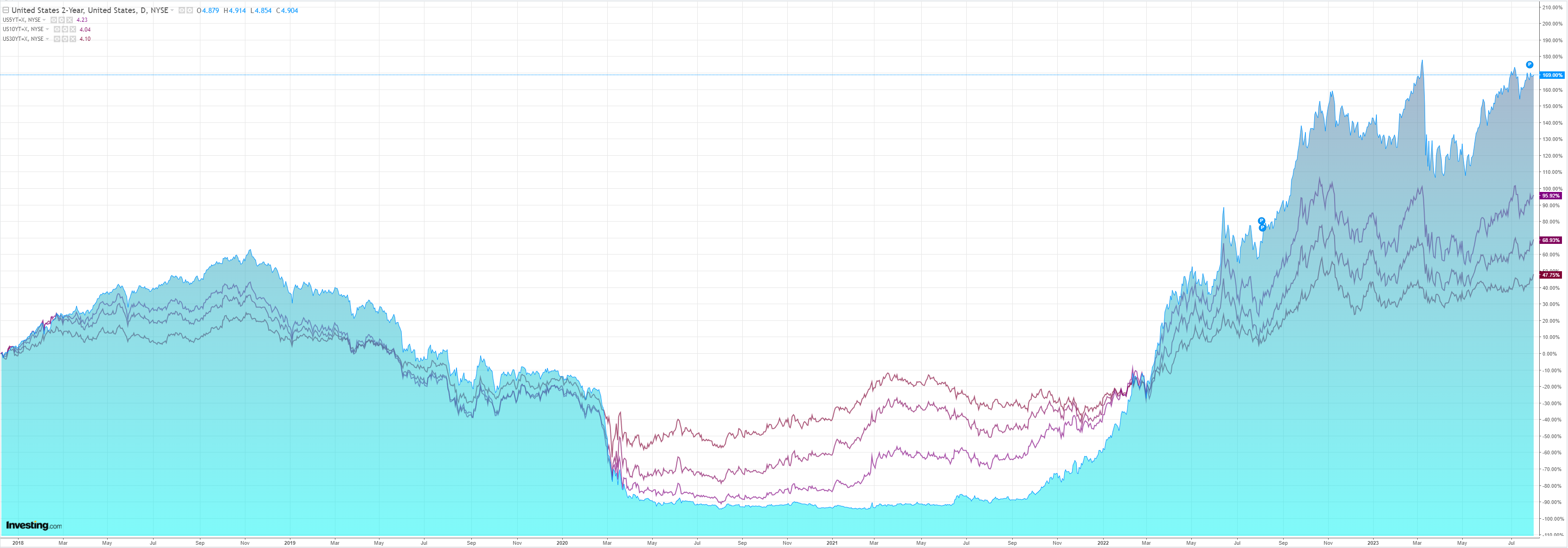

But US long-end yields are marching higher:

Stocks faded:

The setup is not there for the much-vaunted “soft-landing”. DXY will need to keep falling so that US earnings keep rising and the global economy is reflated.

Instead, we have a resilient US economy driven in part by a share market bubble and everywhere else dying:

- China is in the early innings of a long-cycle property bust that will worsen as stimulus lags the reality. This is structural. Chinese growth leadership is over, throwing huge questions over the EM investment case.

- Europe has over-tightened, and its economy is about to crash into a genuine recession. Earnings are tumbling, and its all-time stock market highs make no sense at all. It’s days of leveraging off China are also over, as Chinese EVs eat it for breakfast and luxury item exports deflate with Chinese property.

This is an environment in which US yields are higher than elsewhere for longer. DXY can’t fall; it must rise, and before long, that will hurt its runaway stock bubble, most notably in tech.

Worse, the AI story exacerbates the above, with the US being the winner.

At some stage, US inflation will fall far enough that the FOMC can ease and reverse this global forex liquidity tightening, but the higher US stocks go, the less likely that this is.

Markets need a risk-off event to prevent a risk-off event.

AUD weakness is the dead canary.