Goldman with the note:

USD: A tactical turn; not “persistent.

”The FOMC meeting was “dovish at the margins” but made it clear that the Fed does not feel the need to hike just because activity data are strong.

Most strikingly, Chair Powell argued that it is “only a good thing” that growth has been strong, and he theorized that supply-side improvements could mean that potential growth is higher-than-normal right now.

That is of course not as supportive for the Dollar and helps explain the market reaction following the decision.

The employment report on Friday only added to this narrative, with another solid headline gain but no evidence of tightness in the unemployment rate or wage trend.

We therefore think the tactical turn in risk assets can extend, and we are making adjustments to our trade recommendations: we recommend taking profit on long CHF/SEK (for a potential return of about +2%) and are initiating a new tactical trade recommendation to go short EUR/AUD (targeting 1.62, with a stop at 1.67), which scores as one of the best FX expressions for stronger equities and lower real rates in our new FX clustering framework.

This turn should also continue to support a further relaxation in LatAm carry, consistent with the strong market response already.

That said, we think this is a tactical turn rather than a structural shift in the Dollar, for three reasons.

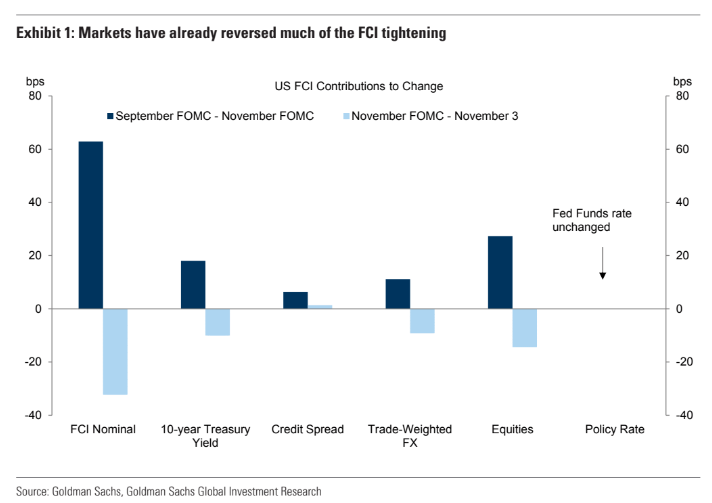

First, Chair Powell suggested that the FOMC would welcome a “persistent” shift in financial conditions as a substitute to further action, but markets have already reversed nearly half of the tightening since the September FOMC meeting (which, in our view, also undermines the Fed’s argument that the move higher in back-end yields was somehow “exogenous” to policy expectations) (Exhibit 1).

Second, as we have been saying all year, FX is a relative asset, and it is difficult to get structurally negative on the Dollar given the divergent dataset, including a building case for earlier rate cuts in Europe, especially following a period where policy anchors kept the Yen and Yuan stronger than they otherwise would have been.

Third, the heart of the FOMC’s argument—positive supply-side news—is fundamentally positive for the currency, especially when peer policymakers are making revisions in the other direction, with the BoE this week revising growth down and inflation higher.

We have been arguing that the Dollar’s high valuation is supported by capital inflows seeking better returns in the US, and a structurally negative Dollar outlook would require better return prospects in the “Challengers.”

The recent supply-side divergence cuts in the other direction, and that should continue to make the Dollar a high bar to beat for long-term capital allocation.

Seems sensible to me.