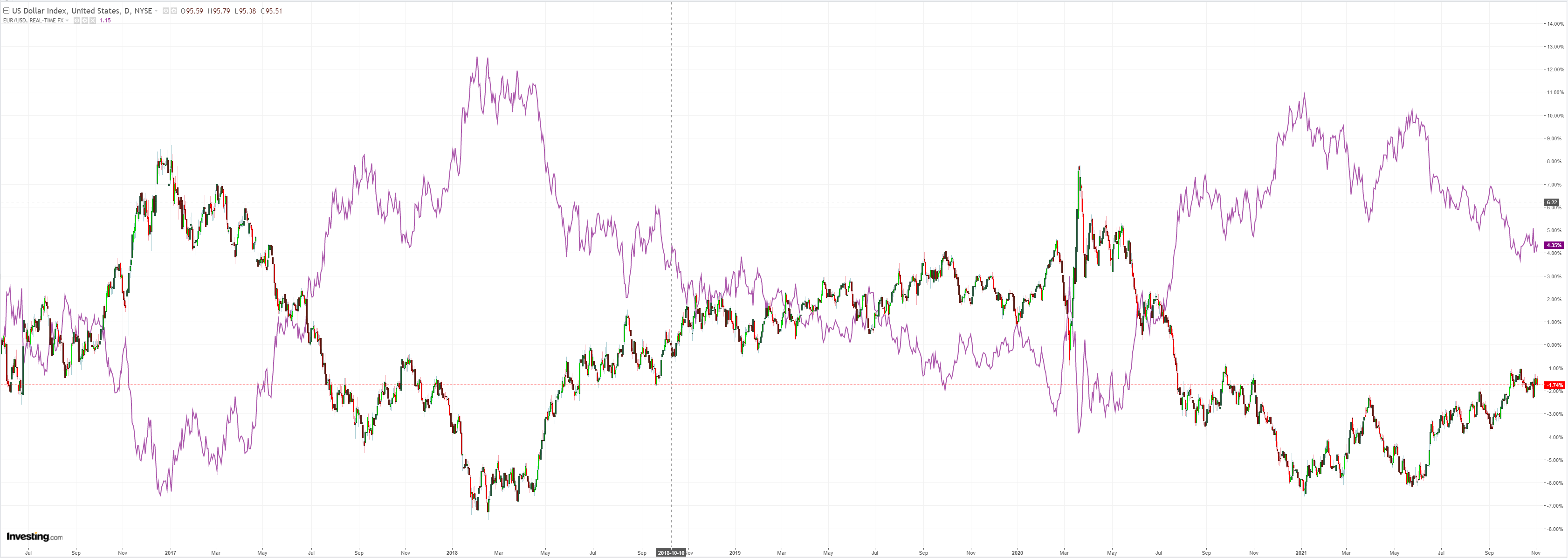

DXY was soft and EUR firm as the Fed delivered taper:

The Australian dollar was bullied up and down:

Oil was hammered as US output and stocks keep rising:

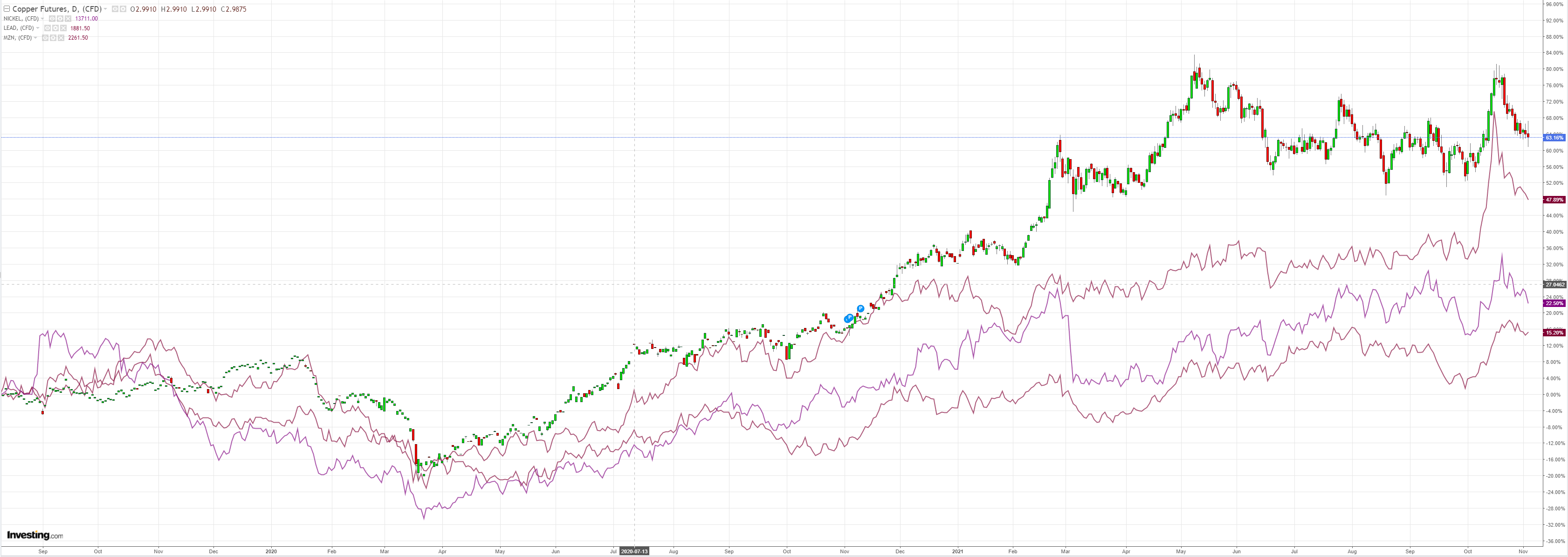

Base metals sagged:

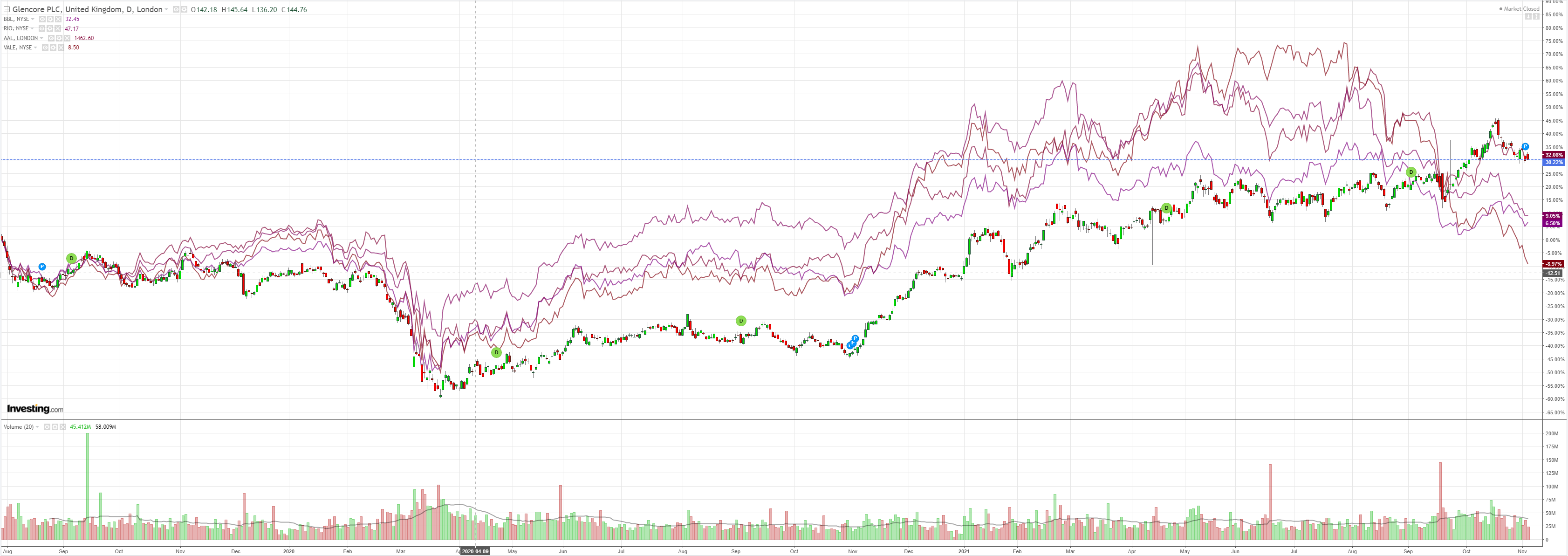

Big miners were mixed with Vale breaking down like a tailings dam:

EM stocks struggled:

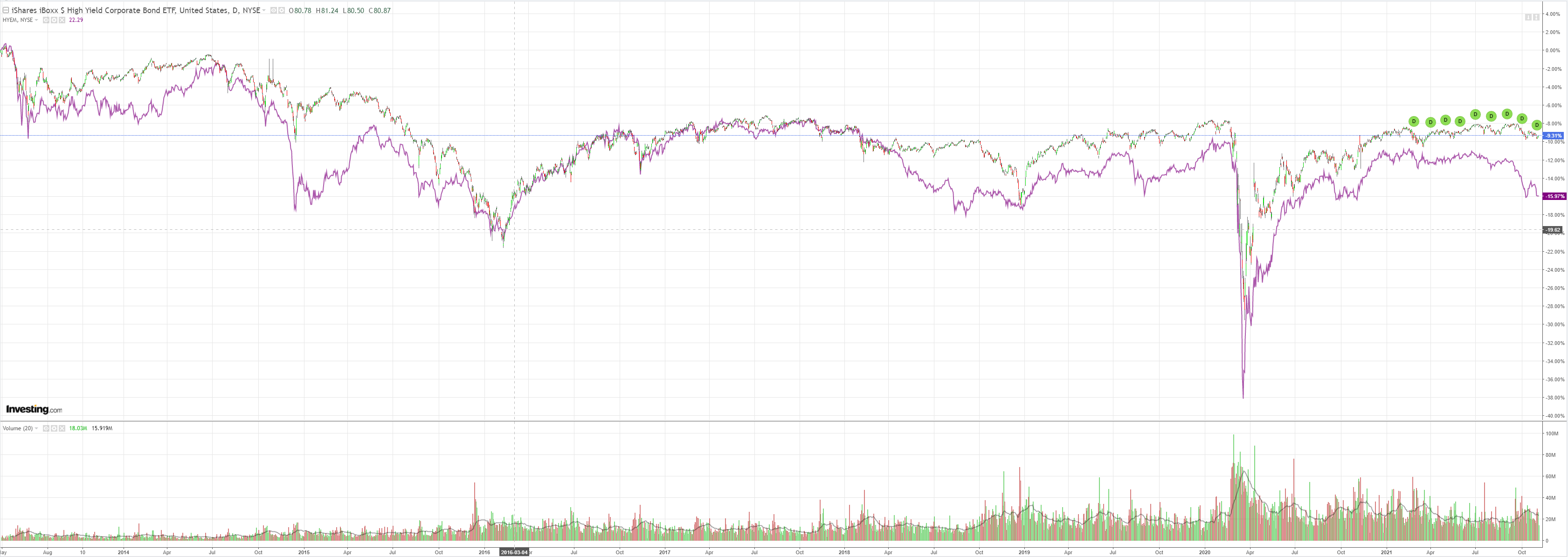

Junk is still warning:

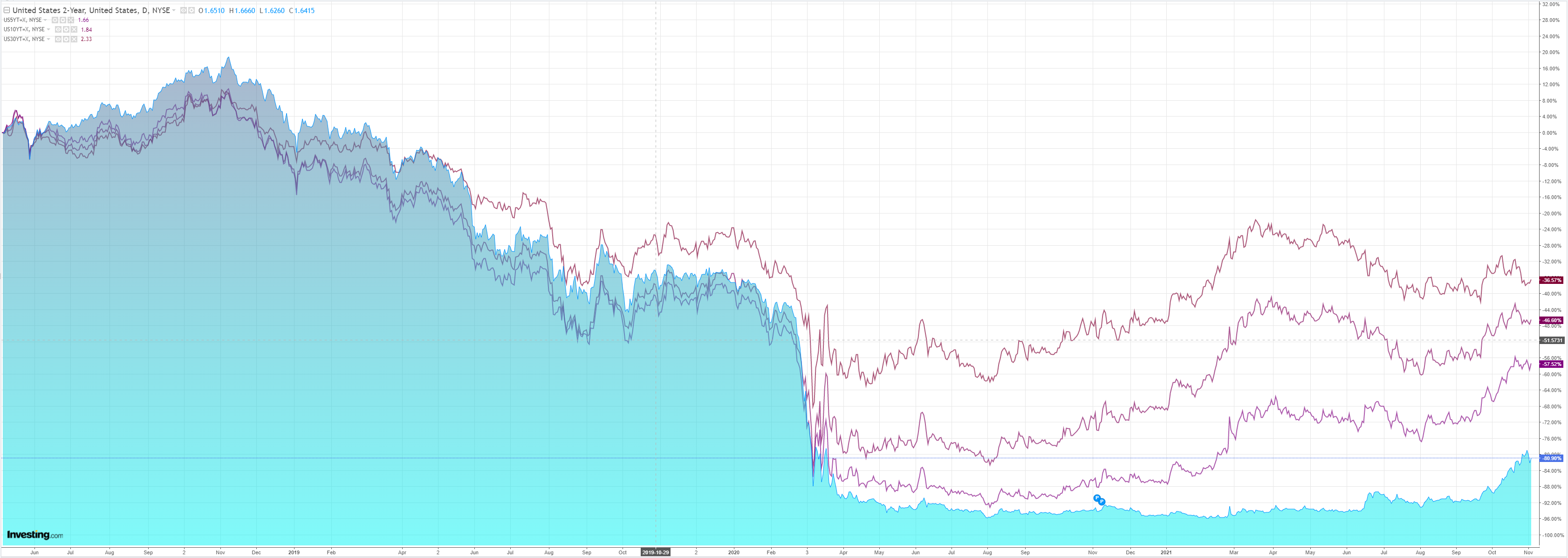

The US curve was roughly flat as yields firmed:

NASA announced an earth-killing asteroid is on a collision course with the planet. Buy stonks, especially GAMMA:

Westpac has the data:

Event Wrap

The FOMC announced a tapering of its QE programme, as was widely expected, while leaving the Fed funds rate band unchanged at 0% to 0.25%. The reduction in asset purchases will begin this month at a $15bn pace, split between $10bn treasuries and $5bn MBSs, and the pace would alter as necessary. On inflation, the statement reiterate that it remains “elevated,” but softened the language about it being transitory to “largely reflecting factors that are expected to be transitory” (versus “largely transitory” in September). The Fed repeated that the economy and the employment situation have “improved in recent months” but Covid has slowed the recovery. There was no interest rate guidance, and the decision was a unanimous 11-0. In the ensuing press conference, Chair Powell ddged avoided discussion of the Fed funds rate and market pricing, saying the focus on this meeting was on tapering, not on tightening. The Fed’s baseline view remains that supply chain bottlenecks will persist into next year, with inflation moving down in Q2 or Q3. “Policy will adapt appropriately” to those dynamics he said.

US services ISM in October surprised with a rise to a record high of 66.7 (est. 62.0, prior 61.9). In addition to further gains in prices paid (to 82.9 from 77.5), new orders rose to 69.7 (from 63.5) – the highest reading since 1997, and business activity rose to 69.8 (from 62.3). ADP (NASDAQ:ADP) private sector employment in October at 571k beat expectations (est. 400k), although September was downgraded by 45k to 523k. There was a 458k gain in services jobs and 113k gain in goods producing jobs. Factory orders in September were solid, +0.2%m/m (est. +0.1%m/m), with ex-transport orders up 0.7%m/m (est. flat).

Eurozone unemployment in September was in line with expectations at 7.4% (from 7.5% in August).

Event Outlook

Australia: The September trade balance is expected to pull back from last month’s high (Westpac f/c: $12.4bn) as a consequence of lower iron ore prices subduing exports and oil prices support for imports. Q3 real retail sales will be hit hard by delta lockdowns (Westpac f/c: -4.5%).

NZ: ANZ commodity prices will highlight the gains for dairy and meat prices in October.

UK: The Bank of England will announce its latest policy decision. Despite mixed data, markets are pricing a rate hike of 15bps to 0.25%; economists however believe the Bank is more likely to remain on hold in November.

US: Initial jobless claims will likely continue their downward trend, albeit at a slow pace. Q3 productivity is expected to print a negative result due to the hit to quarterly growth from delta’s resurgence (market f/c: -3.1%). The September trade release should meanwhile see the deficit widen further to a new record (market f/c: -$80.2bn).

The Fed announced taper but was otherwise pretty soothing:

With progress on vaccinations and strong policy support, indicators of economic activity and employment have continued to strengthen. The sectors most adversely affected by the pandemic have improved in recent months, but the summer’s rise in COVID-19 cases has slowed their recovery. Inflation is elevated, largely reflecting factors that are expected to be transitory. Supply and demand imbalances related to the pandemic and the reopening of the economy have contributed to sizable price increases in some sectors. Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.

The path of the economy continues to depend on the course of the virus. Progress on vaccinations and an easing of supply constraints are expected to support continued gains in economic activity and employment as well as a reduction in inflation. Risks to the economic outlook remain.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. With inflation having run persistently below this longer-run goal, the Committee will aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time and longer‑term inflation expectations remain well anchored at 2 percent. The Committee expects to maintain an accommodative stance of monetary policy until these outcomes are achieved. The Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time. In light of the substantial further progress the economy has made toward the Committee’s goals since last December, the Committee decided to begin reducing the monthly pace of its net asset purchases by $10 billion for Treasury securities and $5 billion for agency mortgage-backed securities. Beginning later this month, the Committee will increase its holdings of Treasury securities by at least $70 billion per month and of agency mortgage‑backed securities by at least $35 billion per month. Beginning in December, the Committee will increase its holdings of Treasury securities by at least $60 billion per month and of agency mortgage-backed securities by at least $30 billion per month. The Committee judges that similar reductions in the pace of net asset purchases will likely be appropriate each month, but it is prepared to adjust the pace of purchases if warranted by changes in the economic outlook. The Federal Reserve’s ongoing purchases and holdings of securities will continue to foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

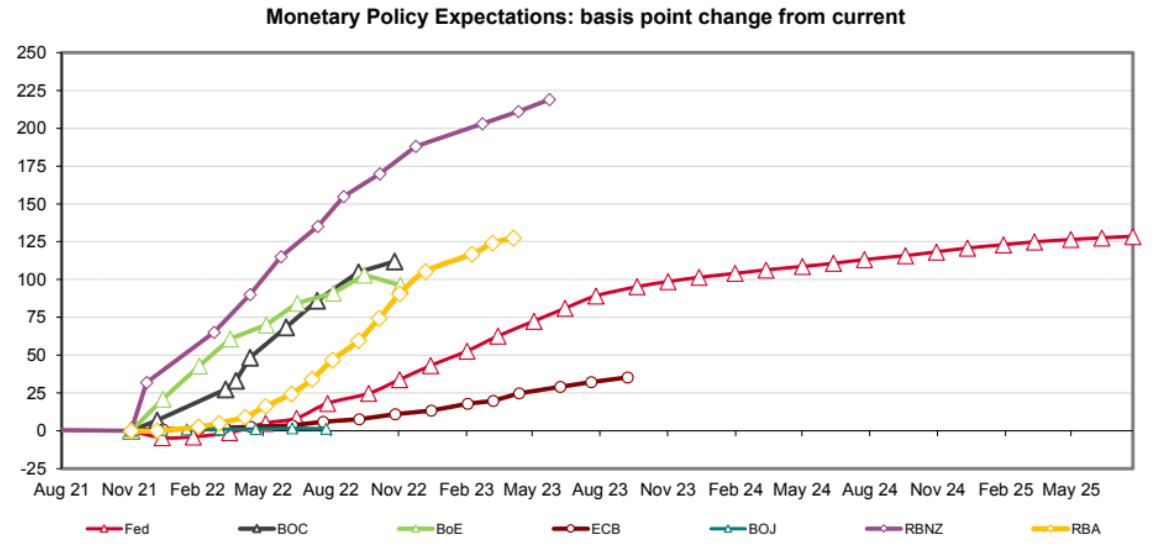

Pretty much as expected. A glance at where rate hike expectations are now from Westpac offers a good chortle:

If that is the path ahead for Australian interest rates then expect the economy to be a smoking ruin this time next year. We can add a house price crash to the Chinese hard landing, a stalled US, a sagging Europe, collapsing supply-side congestion and commodity prices throughout 2022.

While we wait for this simple truth to dawn upon the latest COVID market perversity, what of the AUD? For now, it is a battle of central banks. A struggle that we have been losing for a few months thanks, in part, to the other small Anglo economies that do have a few inflation issues.

It will take time for Australia’s deflationary reality to separate out but should happen especially as our key commodities are eviscerated over the next few quarters.