DXY was soft last night:

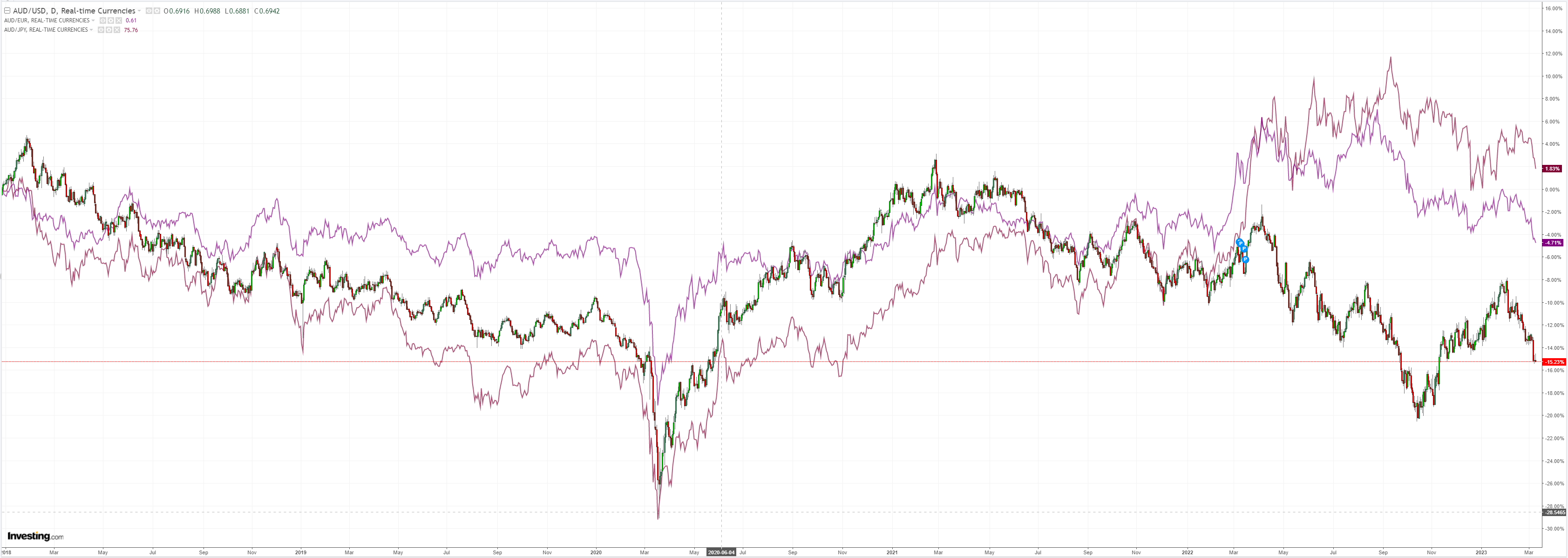

AUD was flogged:

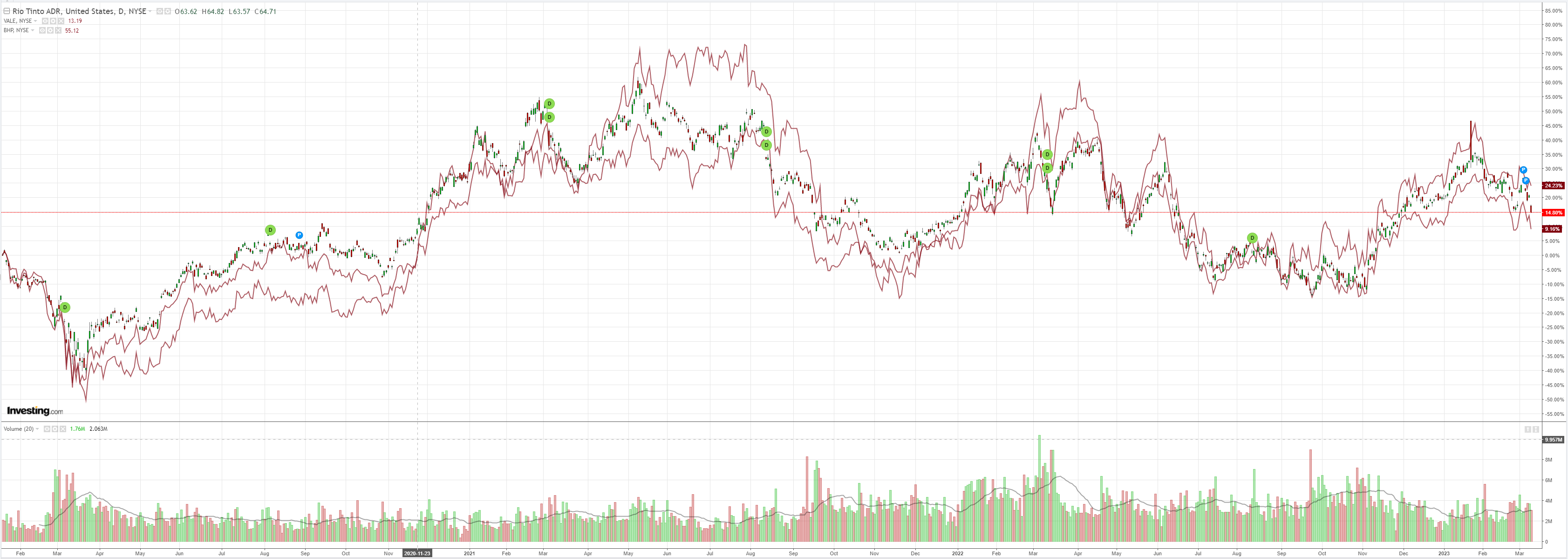

Dirt fell:

Miners (NYSE:RIO) were hosed:

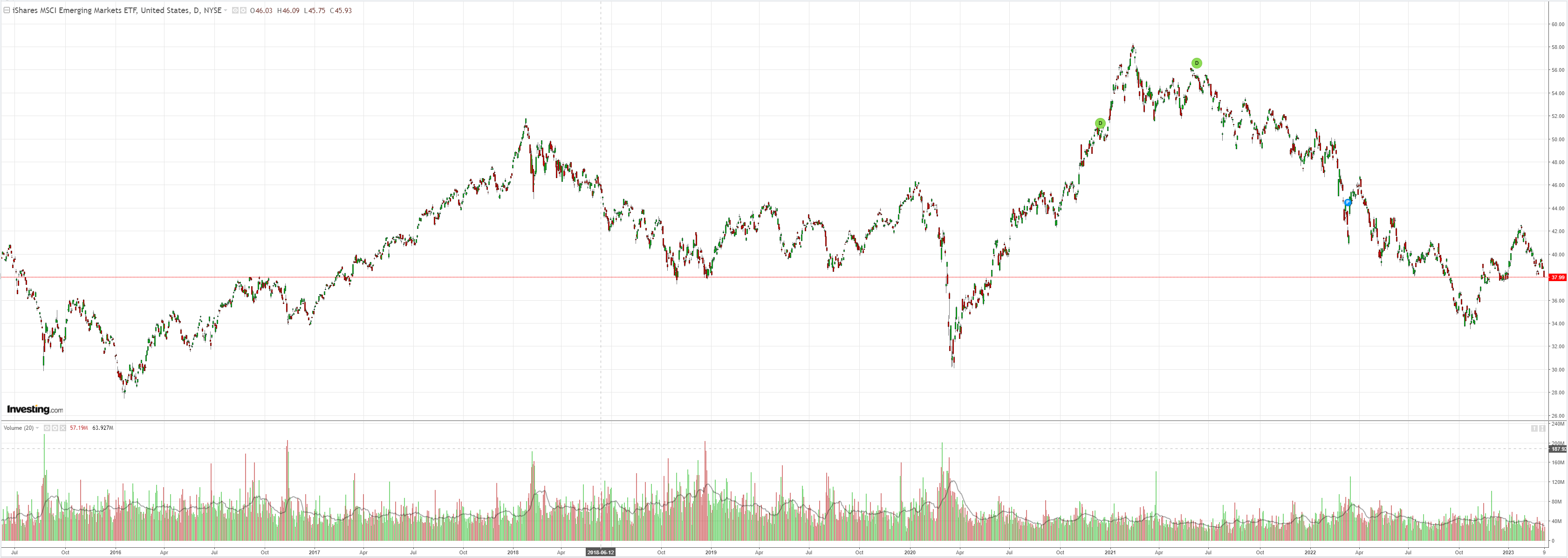

EM stocks (NYSE:EEM) too:

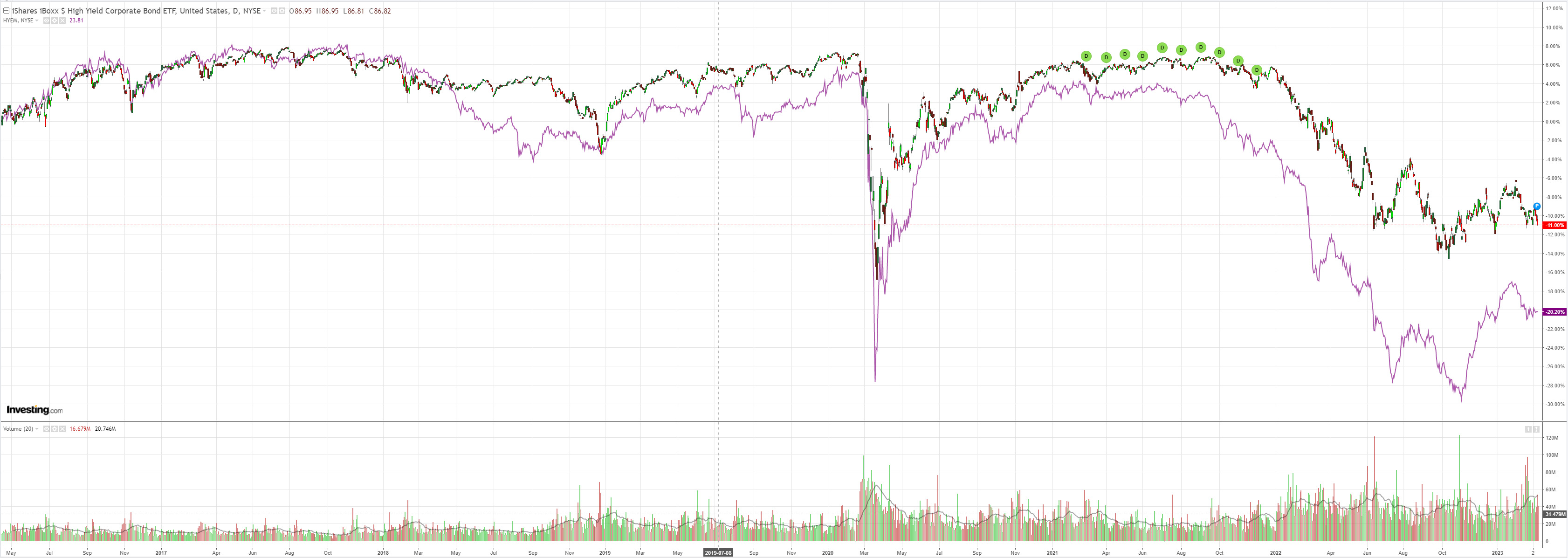

DM junk (NYSE:HYG) is not well. EM did better:

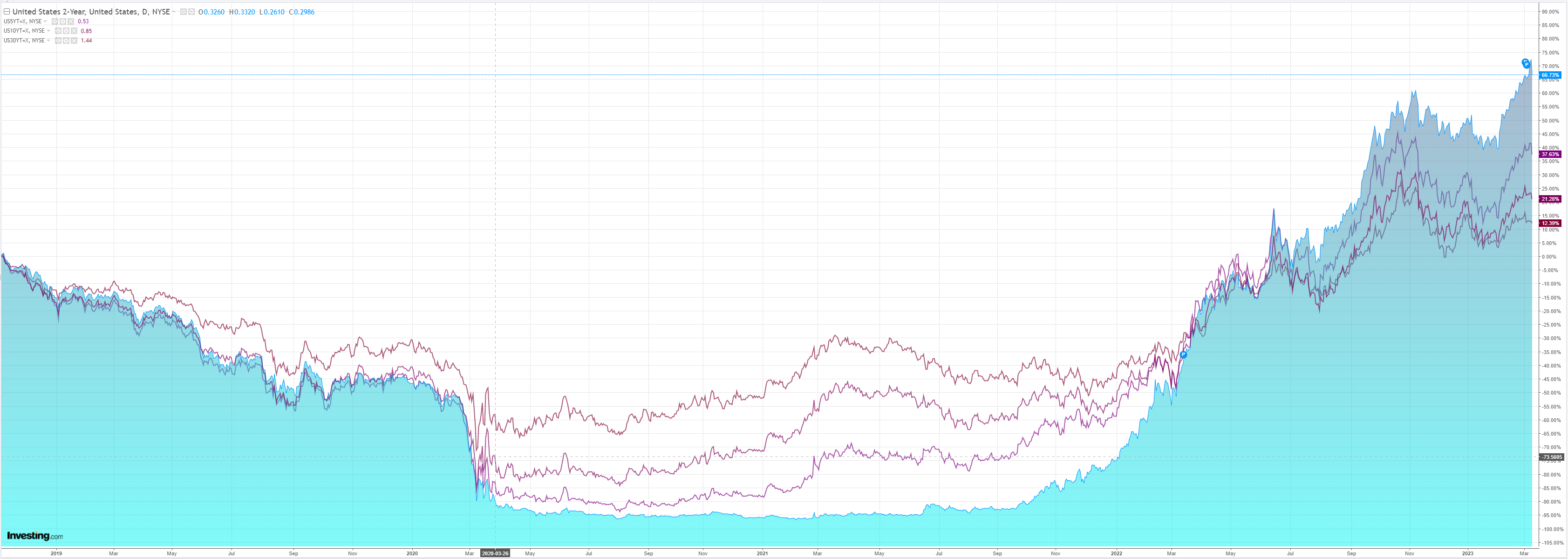

The Treasury curve took off:

And stocks slumped:

That is a very big change from 2022 dynamics. Yields and stocks fell together. The culprit was a mini-bank panic in the US as three entities delivered bad news:

- Silvergate Crypto was wound up.

- There’s a run on Signature Wank equity owing to its blockchain leadership.

- And JPM went down on unfortunate connections with Jeffrey Epstein.

This all looks more idiosyncratic than it does systemic so I am not sure it is the beginning of the final washout. But it is precisely the kind of thing that will ultimately happen.

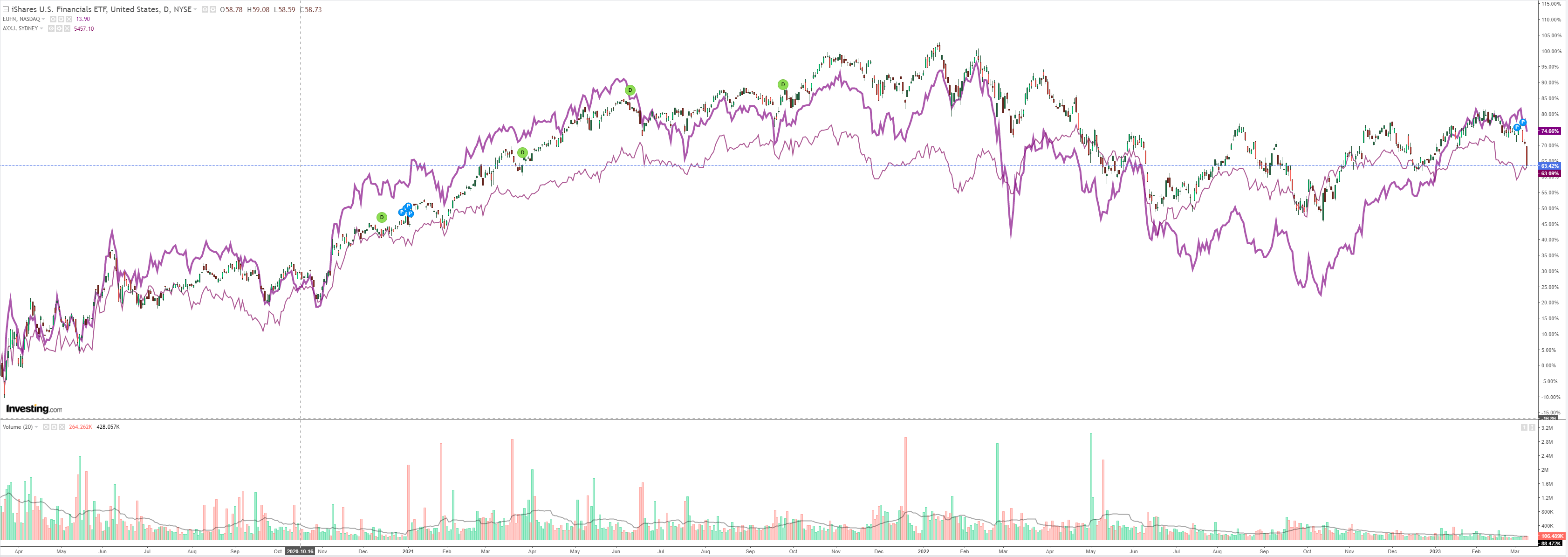

US banks (NYSE:IYF) were smashed. European banks tumbled. Leaving Australian banks, the most exposed to the looming recession, massively exposed:

It’s still all about tonight’s NFP. But this is a taste of things to come for bonds, stocks, and the Australian dollar.