DXY support broke last night. EUR is on a tear:

AUD likewise broke out:

Gold is running. Oil not so much:

Base metals to the moon:

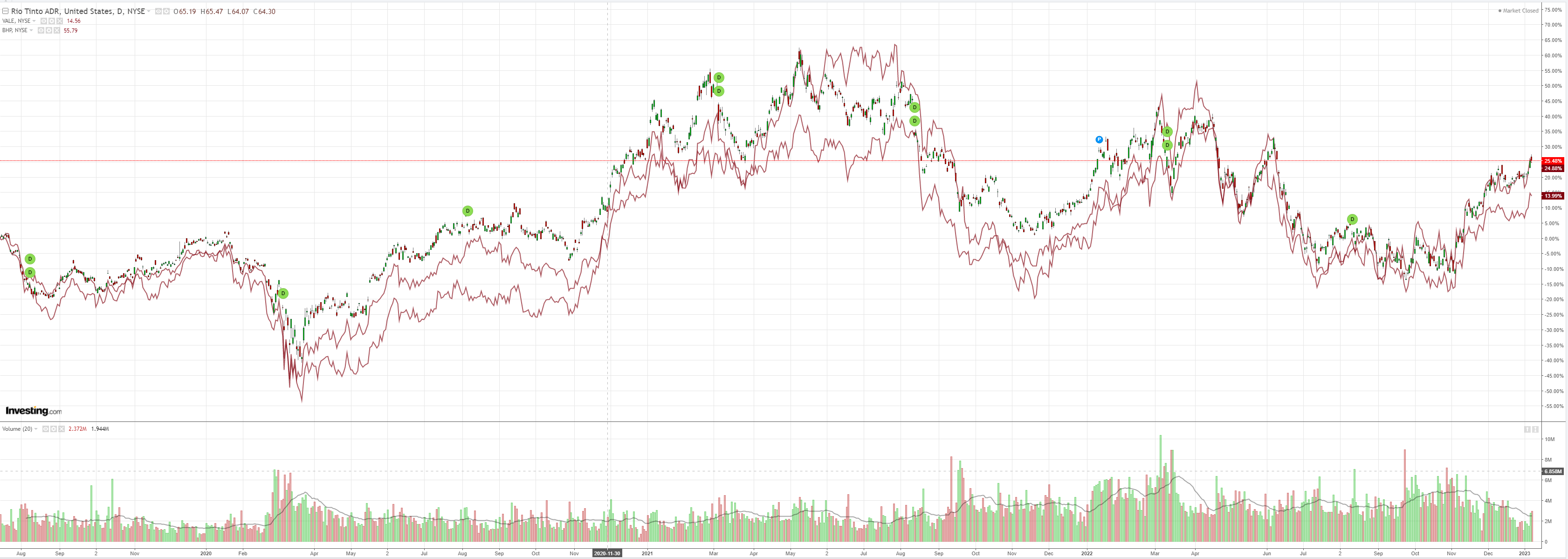

Big miners (NYSE:RIO) not paused:

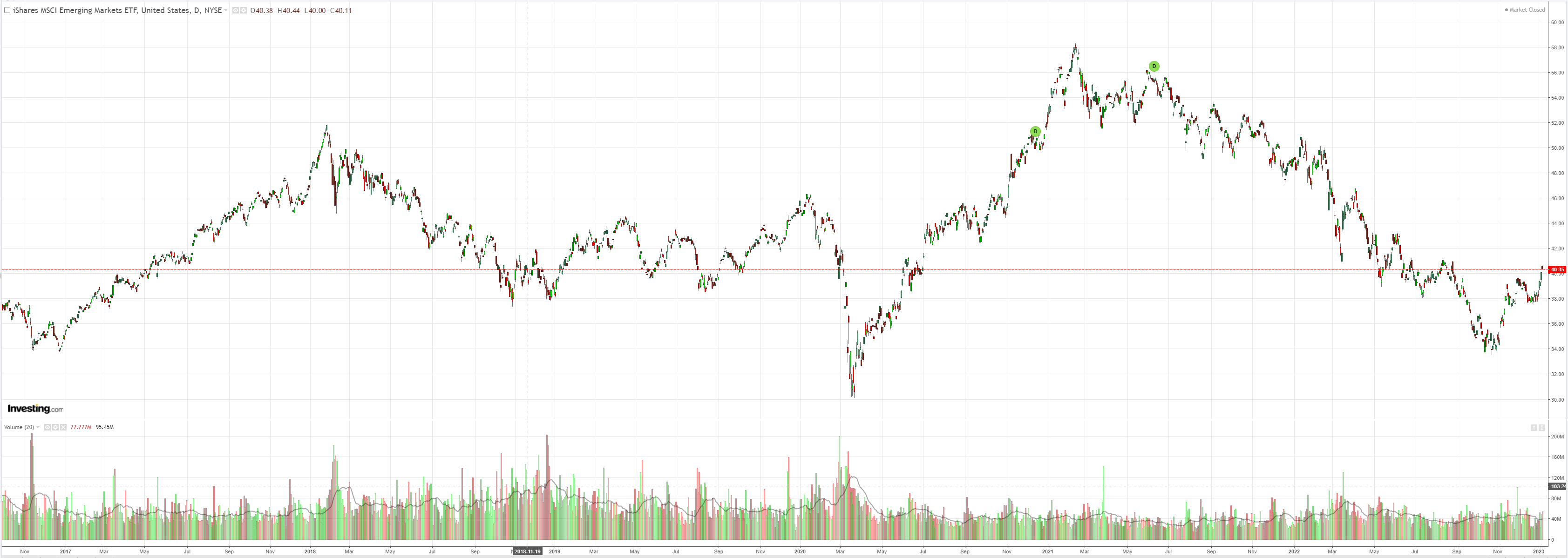

EM stocks (NYSE:EEM) ran:

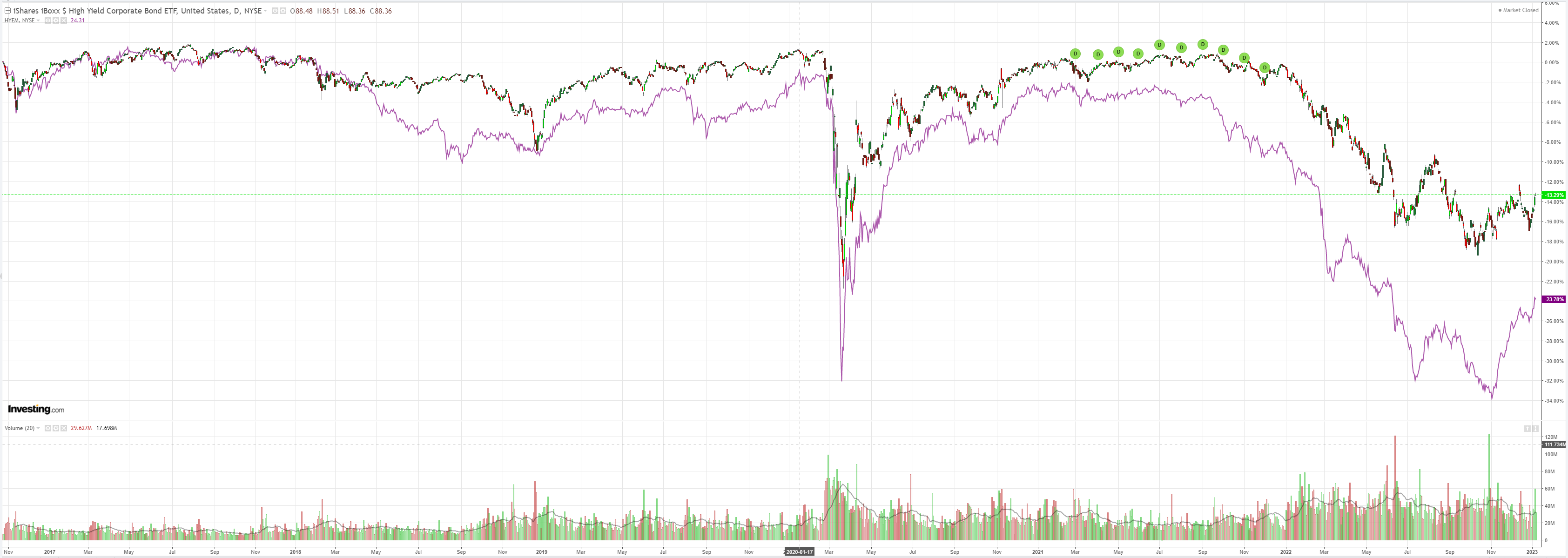

Junk (NYSE:HYG) paused:

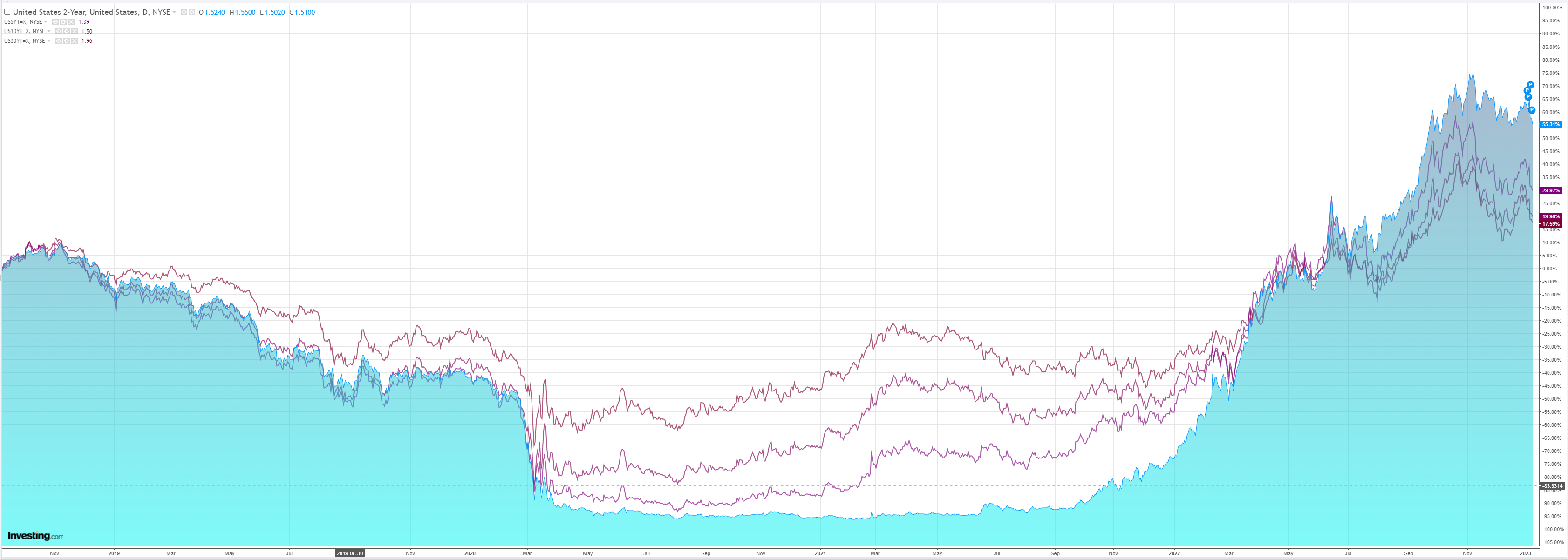

The US curve steepened:

Stocks stalled but Europe is out of control:

What is at issue here is can the Chinese reopening and easing in the European energy crisis offset a US recession for global growth? If the latter can do so then DXY strength is done and dusted, even if its stock market keeps falling on a crash in domestic demand.

The mere prospect of this is unwinding the 2022 DXY long which is exacerbating the trend.

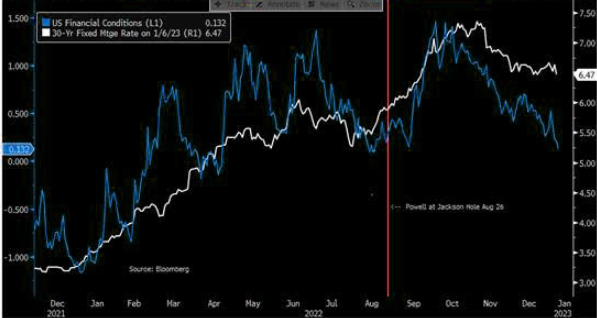

Overlaying that, of course, is falling inflation, which will continue at pace. The end result is that markets are now reflating the US economy as well at speed. Check out the collapsing FCI. Basically, 125bps in Fed tightening since October is gone!

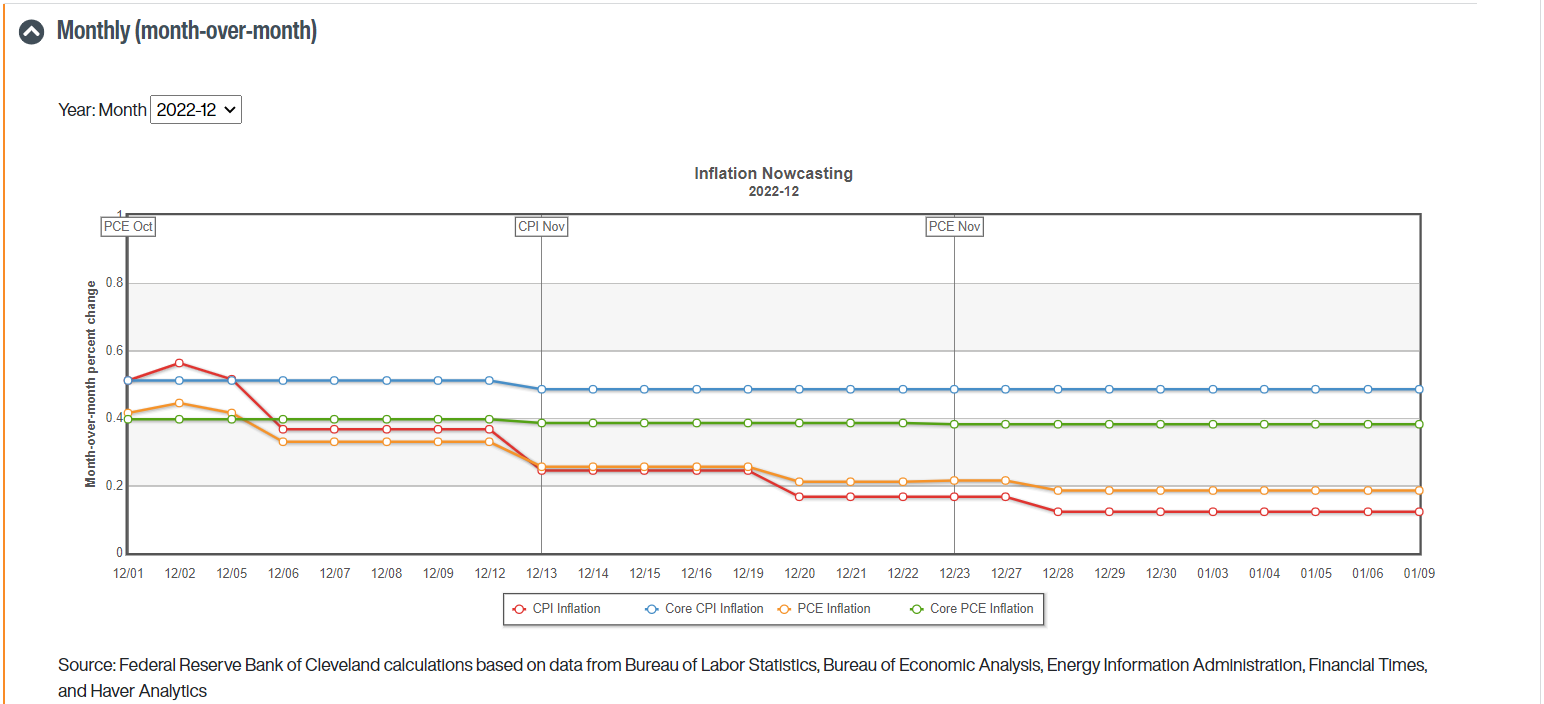

I do not think that this will please the FOMC. Inflation is coming down but is still very high. Especially CorePCE:

My own view remains that the US recession is going to get worse and be very nasty for earnings as margins collapse into destocking inventory. This is still going to turn into an external shock for China and Europe but both now have each other as some kind of offset.

European weather is a wild card in this now, as is the speed of rebound in the Chinese consumer.

Wild stuff and I am tempted to pivot bullish AUD but still think the base case is another reversal down before we are done.