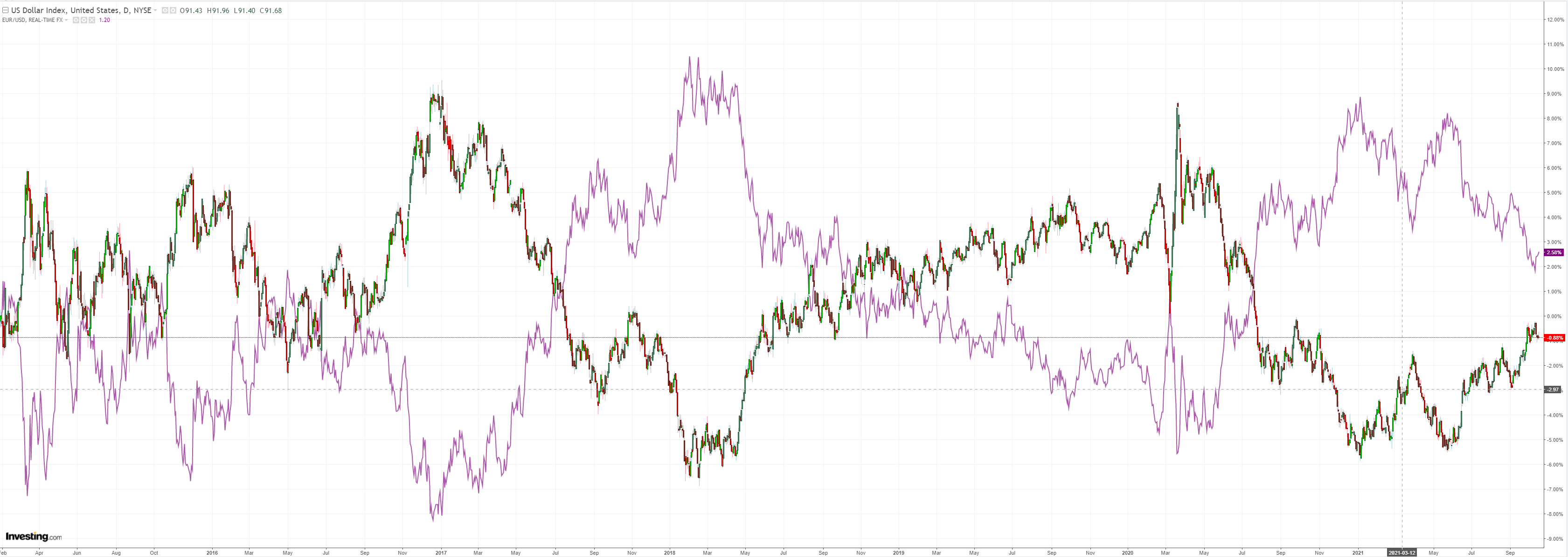

DXY was soft again and EUR rallied:

The Australian dollar rocket paused:

Oil kept going:

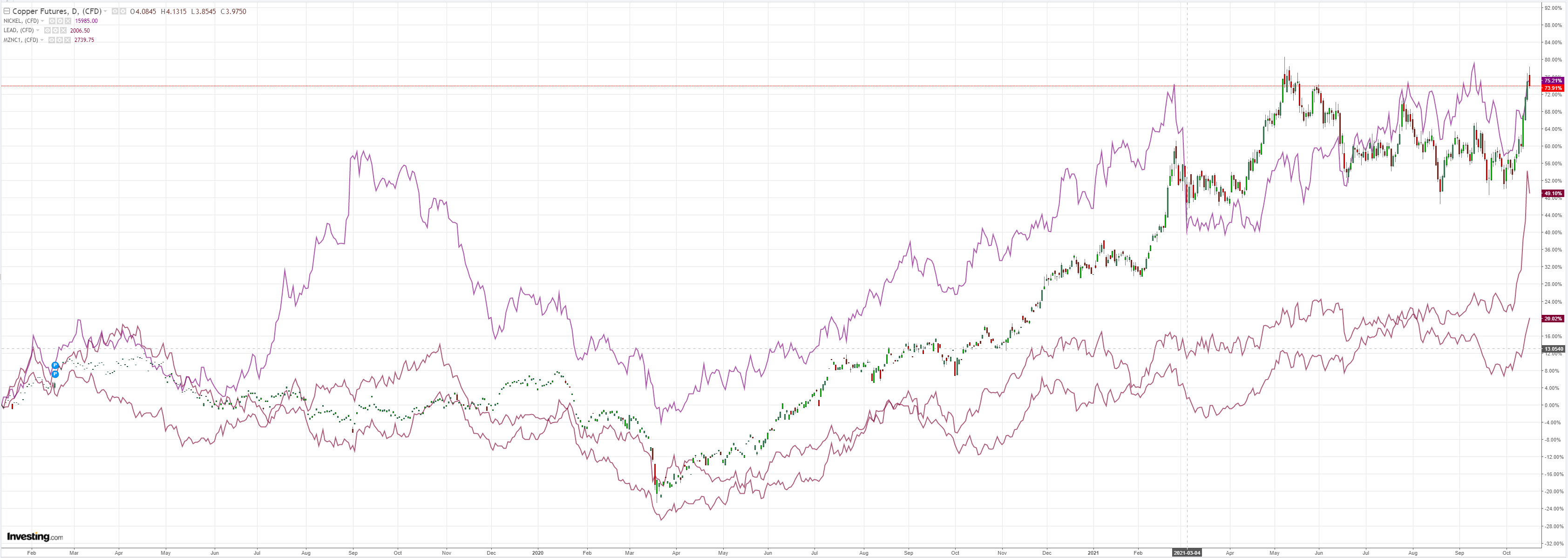

The base metals mania paused:

Miners are still buggered on iron ore anyway:

EM stocks back from the brink again:

Junk has had a few better days:

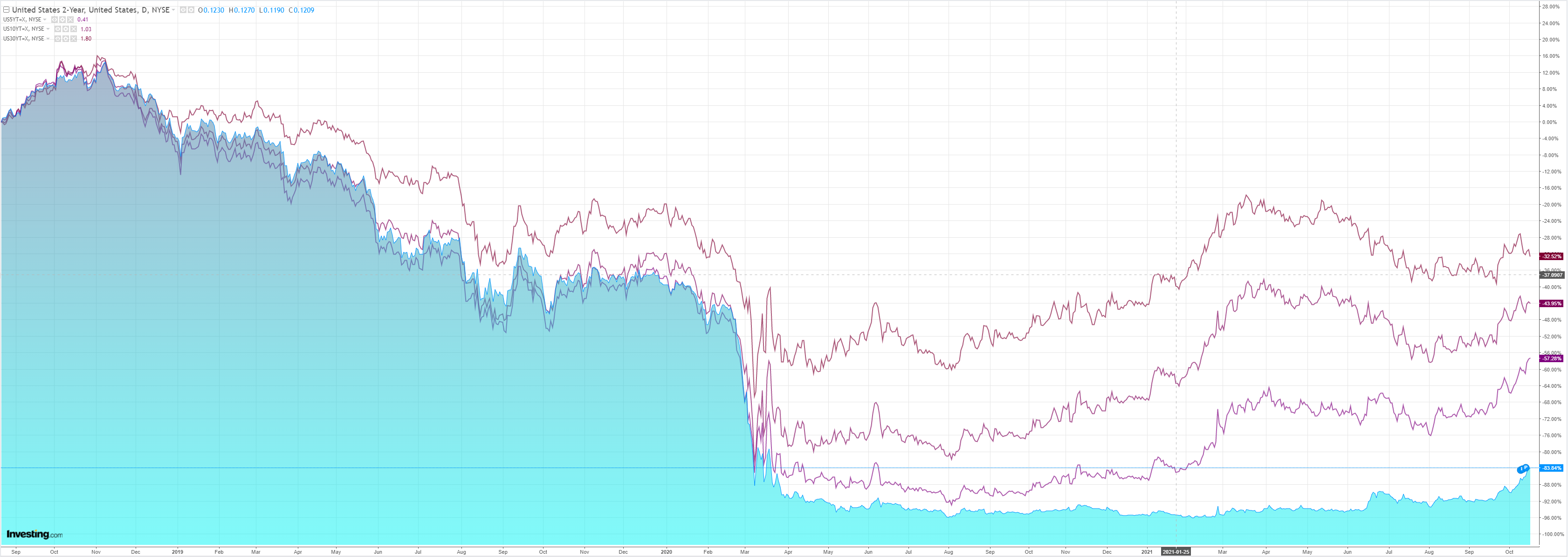

The key change has been a sharp rollover for the curve as markets realise that multiple bubbles, a Chinese hard landing and US taper do not add up for growth:

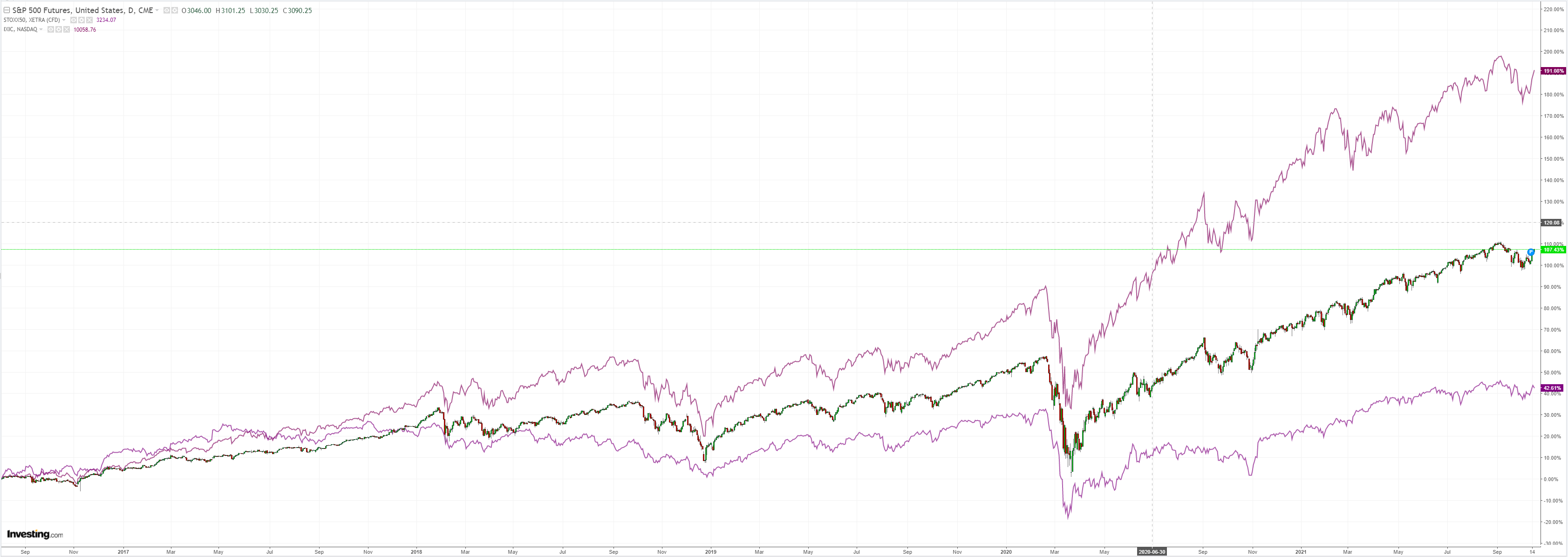

Stocks returned to trading duration:

Westpac has the wrap:

Event Wrap

US industrial production in September disappointed, falling 1.3%m/m (vs. est. +0.2%m/m, with downside revision to August -0.1%m/m from initial +0.4%m/m). Manufacturing fell 0.7%m/m (est. +0.1%m/m, prior revised to -0.4%m/m from +0.2%m/m). Capacity utilisation fell to 75.2% from 76.2% (est. 76.4%). Weather related losses subtracted 0.6% from production, while bottlenecks in vehicle and parts production due to shortages of semiconductors were notable. The NAHB homebuilder sentiment survey rose to 80 (prior 76, est. 75). Demand for single family homes remains strong, but builders continue to face supply and labour shortages.

Event Outlook

Australia: The RBA’s October meeting minutes will provide additional colour around emerging risks as well as their baseline views.

US: Housing starts and permits are expected to give back some of August’s strong gain in September. Demand for new housing is buoyant in the US, but delta, labour shortages and supply disruptions are material headwinds. The FOMC’s Daly will make introductory remarks; Bostic and Waller are also due to speak.

MUFG sums it all nicely for AUD:

The Australian dollar has weakened modestly overnight falling back towards the 0.7400-level against the US dollar. It represents a partial pullback for the Australian dollar after last week’s strong gains when it strengthened just over 1.5%. The Australian dollar and other commodity currencies have been undermined at the start of this week by the release of the softer than expected activity data from China. The release of the latest GDP report revealed that the pace of economic continued to slow to an annual rate of 4.9% in Q3 down from 7.9% in Q2. The softer pace of growth was particularly evident in the seasonally adjusted quarterly growth rate which slowed to just 0.2% in Q3. The Chinese economy has faced a number of headwinds to growth in Q3 including: i)the retightening of COVID-related restrictions to combat fresh outbreaks across a range of regions earlier in the quarter, ii) electricity shortages in a range of provinces towards the end of the quarter, and iii) potential negative spill-overs on the real estate sector from the likely default of property developer Evergrande (HK:3333). The monthly activity data for September revealed weakness in industrial production as the annual rate of growth slowed to 3.1% from 5.3% in August reflecting the impact of the electricity shortages during the month. There has also been a notable slowing in real estate investment which contracted in nominal terms in September. On a more positive note, it was revealed that retail sales growth accelerated to an annual rate of 4.4% in September from 2.5% in August as the easing of COVID-related restrictions from the outbreak earlier in Q3 helped retail sales to bounce back. At the same time, China’s economy continues to derive support from strengthening external demand. China’s trade surplus widened again in September to USD66.8 billion up from USD58.3 billion in Auguston the back of strong export growth. The trade surplus with the US hit a record high for the eighth consecutive month at USD379 billion in September. A trend if sustained that could re-heighten trade tensions between the US and China. Overall, the reports are only likely to trigger minor downgrades to forecasts for growth in China this year which is still expected to expand by around 8.0%. However, the ongoing loss of growth momentum combined with building downside risks to outlook is prompting bigger downward revisions to next year’s growth forecasts when GDP is expected to slow towards 5.0%. It is creating a less supportive backdrop for Asian, emerging market and commodity currencies.

The G10 commodity currencies of the AUD, CAD, NOK and NZD have all outperformed over the past week. The NZD and AUD have been the best performers(+1.6% vs. USD) followed by the NOK (+1.5%) and CAD (1.1%). G10 commodity currencies have recorded their best weekly performance since the week ending the27th August. It has helped to lift our equally-weighted G10 commodity FX basket to its highest level against the USD since the end of June which takes it further above(+4.6%) the low point from 20th August. Last month’s temporary correction lowerforG10 commodity currencies has proven short-lived. In contrast, the recent rebound in EM commodity currencies has been less impressive on the whole. Our equally-weighted EM commodity FX basket (BRL, CLP,RUB & ZAR) hit a fresh low earlier this week and is currently trading close to the low from 20th August. While the rebound in G10 commodity currencies from the 20th August low has been broad-based (NOK +7.3% vs USD, AUD+4.2%, CAD +3.9%, &NZD+3.3%), the performance of EM commodity currencies has been more mixed.The RUB (+4.4% vs USD) and ZAR (+4.2%) have rebounded while the BRL (-2.4%)and CLP (-4.7%) have continued to weaken. The continued weakness in both the BRL and CLP are outliers amongst commodity currency performance. Idiosyncraticweakness appears to be driven more by domestic concerns which are outweighing support from higher commodity prices. The CLP in particular has come under more intense selling pressure ahead of next month’s Presidential election (1st round on21st November & potential runoff on 19th December). Commodity-related currencies are beginning to derive more support from the ongoing rise in commodity prices. Bloomberg’s commodity price index has risen by just over15% since the low from 20th August and extended its cumulative advance so far this year to almost 35%. It has been notable that the CRB’s raw industrials commodity price index has broken higher this month bringing an end to the period of consolidation that had been in place over the previous three months. It now appears that commodity currencies are playing catch up with higher commodity prices. The catch up could reflect an easing of global growth concerns in recent weeks that have been weighing more heavily on commodity currencies since June. However, we still believe it is too soon to confidently conclude that the soft patch for the global economy is coming an end. The global data flow continues to surprise negatively. In these circumstances, we acknowledge that commodity currencies are gathering upward momentum in the near-term but remain cautious over further upside potential while the global economy is slowing. A more supply driven rally in commodity prices should continue to offer less support for commodity currencies. On a relative basiswe favour CAD over AUD given building downside risks to growth in China.

Not just China. The US fiscal cliff is coming to bear as well. And Europe will be hit by both.

The energy bubble will burst directly into a slowing global economy and US taper with rising DXY.

It’s an excellent set-up for a wider commodity and AUD pivot lower.

But not before the great commodity blow-off is exhausted.