DXY caught a bid Friday night as EUR swooned:

AUD was hit across the board:

Oil has declared OMICRON over:

Dirt flamed out:

As did miners (LON:GLEN):

The EM stocks (NYSE:EEM) bear market is setting up another down leg:

As it chases the screaming meteor of EM junk (NYSE:HYG):

Be warned that EM and DM equity do not usually diverge directionally for long:

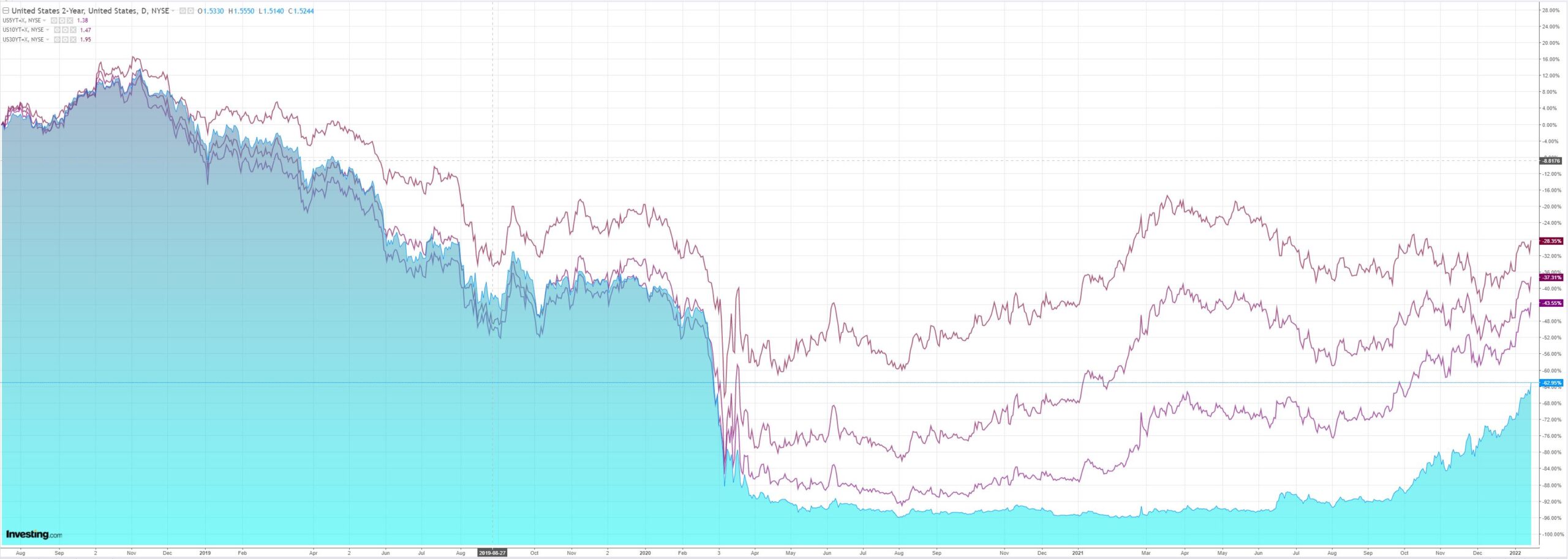

As US yields back up again despite deep robot over-selling:

Which cut short a relief rally in stocks:

Westpac has the data wrap:

Event Wrap

US retail sales in December disappointed expectations, falling 1.9%m/m (vs. est. -0.1%m/m, prior revised to +0.2%m/m from +0.3%m/m), while the closely watched control group (strips out energy and food) fell 3.1%m/m (est. flat, prior revised to -0.5%m/m from -0.1%m/m), with the most notable declines in discretionary and large item spending. Media suggest that inflationary effects on discretionary spending were at play. Industrial production disappointed, falling 0.1%m/m (est. +0.2%, prior revised to +0.7%m/m from +0.5%m/m), while manufacturing production fell 0.3%m/m (est. +0.3%m/m), with capacity utilisation falling to 76.5% (est. 77.0%. prior revised to 76.6% from 76.8%). Consumer sentiment (University of Michigan) in January fell, with inflation cited as an increasing concern, inflation expectations rising more than anticipated. Sentiment fell to 68.8 (est. 70.0, prior 70.6), with both current conditions 73.2 (est. 73.8, prior 74.2) and expectations 65.9 (est.67.0, prior 68.3) soft. 1yr-ahead inflation expectations rose to 4.9% (est. unch. at 4.8%), while 5-10yr ahead expectations rose to 3.1% (prior 2.9%) – the highest since the spike to 3.2% in 2011.

FOMC member Williams said that the Fed is approaching a decision to begin raising interest rates: “The next step in reducing monetary accommodation to the economy will be to gradually bring the target range for the federal funds rate from its current very-low level back to more normal levels…given the clear signs of a very strong labour market, we are approaching a decision to get that process underway.” Daly said officials are “going to have to adjust policy” because inflation could remain elevated.

UK production data for November surprised to the upside across the board. GDP rose 0.9%m/m (est. +0.4%m/m), with industrial production +1.0%m/m (est. +0.2%m/m) and services +0.7%m/m (est. +0.5%m/m).

BMO tackles the question de jour:

- Global equity markets performed poorly overnight, following losses on Wall Street into the close on Thursday. The Eurostoxx 50 is 0.8% lower, partly reflecting selling in Asian shares, and the Nasdaq Composite future is pointing to further losses once the US cash market opens. In spite of that ‘risk-off tone’, the 10Y US Treasury yield climbed by 3.5bps to 1.736%. In FX, additional pressure on USD long positions pushed the BBDXY to a new low for the year, but the Index has recovered slightly since the first-half of the London morning. Oil and natural gas prices continued to show signs of strength (Brent crude +0.8%, Dutch TTF natural gas +8.2%).

- In yesterday’s FX Daily, we covered the potential imbalance between fundamentals and flows in relation to EURUSD. Today, Eurostat reported the Euro Area’s first merchandise trade deficit in basically a decade for the month of November. The external goods balance deteriorated to -€1.3bln from +€1.8bln prior, while the EU-27’s trade deficit with the world widened to €8.1bln (the widest goods trade deficit since 2008). The Euro Area’s trade deficit with Asia worsened to nearly €25bln — the bloc’s largest deficit on record vis-à-vis Asia, and its trade surplus with the United States fell by approximately €1.0bln.

- The aforementioned dynamic may have partly influenced China’s trade data for the month of December. The combination of slower import growth and steady export growth pushed the nominal merchandise trade surplus to a record $94.5bln. Exports to the EU increased to $519bln in 2021 from $385bln in 2020, just below the level of exports to the US, which totaled $576bln in 2021 (up from $440bln in 2020). For a variety of reasons, some of which were covered in the 2022 FX Outlook, we think the better trade performance of China and other portions of Asia is a trend which is likely to persist, even if the degree of outperformance moderates in 2022. The results will probably be felt in FX markets through constraints on topside in USDRMB and EURRMB. The improvement in China’s external position may also reflect the CCP’s ‘Made in China 2025’ policy, which is set to encourage trade surpluses partly through import suppression and re-shoring of production.

- Bloomberg reported late yesterday (as did other outlets) that Sarah Bloom Raskin will be nominated as the Fed’s Vice Chair for Supervision (and also a voting member of the FOMC). Bloomberg also reported that Lisa Cook and Philip Jefferson would be nominated to the Fed’s Board of Governors (also FOMC voters every year). Yesterday’s confirmation hearing for Lael Brainard probably offered a preview of how the nomination process for Raskin will go. Brainard was asked extensively whether the Fed’s mandate allows it to channel capital toward certain banks/industries and away from others based on environmental policy considerations. After Brainard said that is not in the Fed’s mandate, one Republican senator asked her to issue a written statement saying that. Where Raskin has been a public advocate of such an approach, her confirmation process is likely to be particularly rocky.

USD Index: We have received many questions from clients this week about why the USD is falling this year when US yields have been rising. We had already been asking that question of ourselves (if you haven’t already, give our podcast entitled a listen). We don’t feel like we have found the answer(s) to the question, but we do have a clarification that is helpful. As shown below, this is NOT a phenomenon that began on January 3, 2022 (the first trading day of this calendar year). Rather, it is a phenomenon that seems to have begun on December 16, 2021 (the day after the last FOMC). In the period between the December FOMC and year-end, the benchmark US2Y yield rose by 7bps (from 0.66% to 0.73%) and its 10Y friend rose by 15bps (from 1.46% to 1.61%). Over that interval, the BBDXY index fell by 1.0%. Our first-blush lazy reaction to that 2W correlation breakdown was to say that it was the result of year-end position squaring and/or the easing of turn pressures. However, the CFTC data on IMM positions shows that leveraged funds increased their USD shorts over that interval. If this is indicative of the broader market, then we have to throw away the position-squaring argument. We can probably throw away the easing of turn pressures argument because of the way the phenomenon has continued this week, when we should have been long past that stage. So we are left searching for an explanation. Our foremost explanation is that global investors were extremely long US stocks and bonds relative to their benchmarks and the Fed’s tightening has driven them toward a more neutral weight of US assets. That could create a wave of USD selling, even if the outlook for the currency itself has become more bullish based on accelerated Fed tightening. If it’s not that, then we have to start to look at theories that might sound a bit like conspiracy theories. One would be that Russia and/or China are withdrawing capital from the USD in anticipation of possible sanctions in coming weeks and months. Another is that G20 central banks have coordinated (via their reserves management policies) to push down the USD as the Fed does them the favor of taking a leadership role on tightening. Where we honestly don’t know the explanation, we will remain tepidly USD bullish for H1, but with the caveat that we might change our mind if either of those latter explanations proves true over coming days and weeks.

That seems about right to me. I will add that the less that DXY rises, the more the Fed will have to tighten, so there is a paradox here that still makes another leg higher for DXY the base case. Especially since, as OMICRON pressures supply chains in China, more persistent inflation offers another excuse to bid commodities (note I say excuse not reason, it is a narrative, not fundamental trade given there is plenty of everything) which means that to end inflation the Fed will have to keep tightening until it suppresses demand enough to pop the commodity bubble. That will mean over-tightening and a big market reckoning delivering a safe haven bid to DXY.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.