DXY is rebounding strongly now:

AUD is fighting and failing:

Partly because CNY is entering free fall again:

Oil faded. Gold is showing no sign of a DXY top:

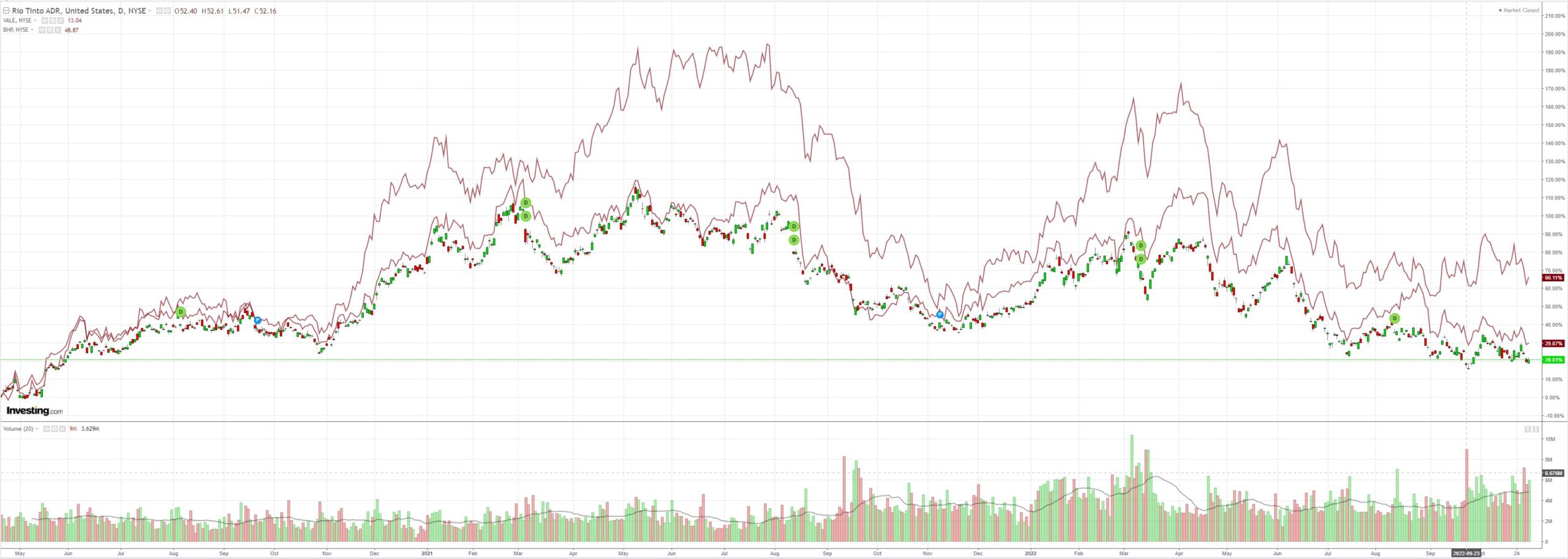

Base metals were whacked and big miners (ASX:RIO) are clinging to support:

EM stocks (NYSE:EEM) are up the creek:

So is junk (NYSE:HYG):

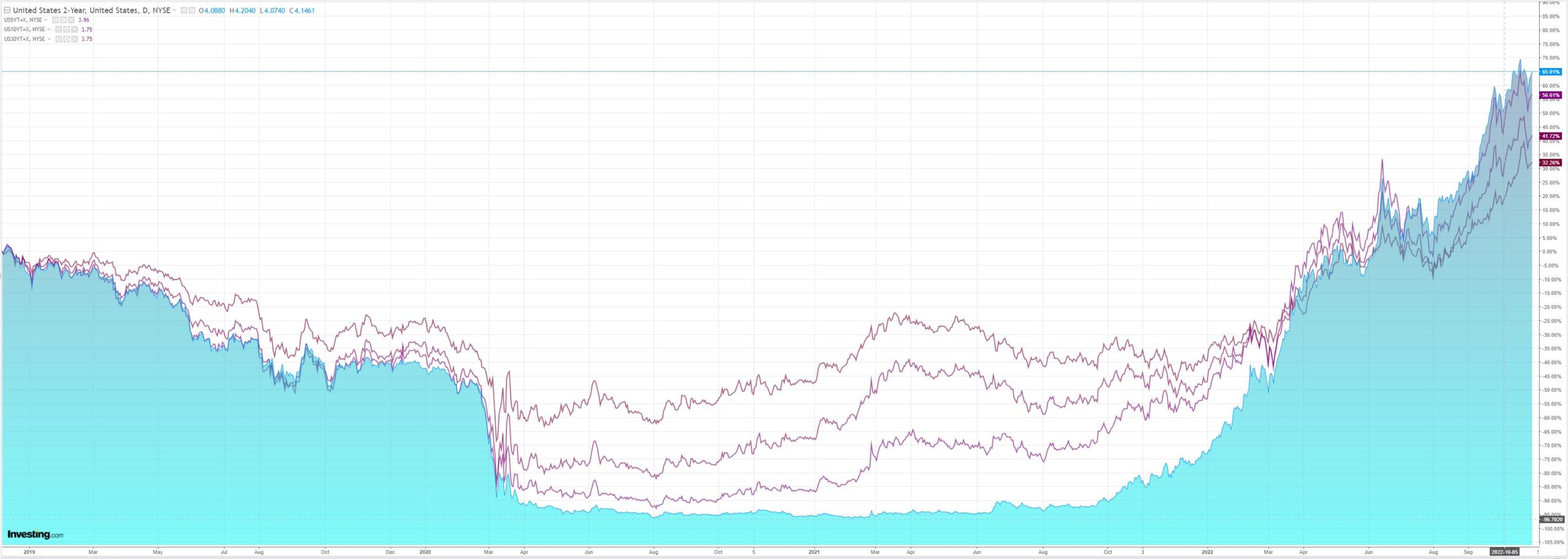

As US yields took off and curve was pancaked:

Which stocks did not like:

Credit Suisse (SIX:CSGN) wraps it up. My own view is AUD will have a deep 5-handle before the trend is up again.

Movements in macro markets over the past week have worked in favour of our bullish USD view. Long-held key end-Q3 targets like EURUSD 0.9700 have been breached, while our favourite punch bag GBP has entered into a “basket case” realm even beyond our worst-case expectations for this quarter. Sharp moves higher in US long-end rates are a new disturbing feature for markets, and are driving both global rates higher and at the same time hurting risky assets and tightening monetary conditions further. Commodity prices too are under pressure as concerns about global recession grow, weighing on commodity bloc currencies like CAD and AUD too in the process.

From our perspective, the move in Fed terminal rates to 4.50% is reasonable but the disinversion between Mar’23 and Mar ’24 rates we wish to see before calling an end to USD strength is not apparent yet. Indeed yesterday saw a pivot in the SOFR futures strip, with maturities up to Dec ’24 seeing lower implied yields and those from Mar ’25 onwards tracking the move in 10-year yields higher. This suggests to us a market pricing in the risk of the Fed not getting on top of inflation even after a 2023 growth shock / recession. The main risk to retaining a USD bullish view from a US economy perspective remains a sudden and surprising slowdown in inflation or a shocking jump in unemployment, as has been the case for many months already.

Having reached most of our Q3 targets in the G10 cyclical FX space, we look for an extension of the bearish trend in Q4. We now target 0.6200 in AUDUSD (prev. 0.6550), 1.1700 in AUDNZD (prev. 1.0920), 1.4200 in USDCAD (prev. 1.3000), 10.7000 in EURNOK (prev. 10.0000) and 11.3000 in EURSEK (prev. 10.8000). Our 27 Sep expiry AUDUSD 0.6800/0.6480 put spread expired in the money yesterday: we replace it with a 20 Dec expiry AUDUSD 0.6443 / 0.6100 put spread instead.

With the end of the quarter in sight we take stock of our views in cyclical G10 FX. Outside of the notable CAD exception, our targets across this traditionally risk-sensitive portion of the G10 FX spectrum had been firmly bearish throughout Q3, and yet most currencies managed to trade weaker than we anticipated. The underperformance was slight in the case of AUD and SEK (we targeted AUDUSD 0.6550 and EURSEK 10.8000 in Q3), somewhat more pronounced in NOK and NZD (where we projected EURNOK at 10.0000 and NZDUSD at 0.6000), and substantial in CAD, where our call for loonie

divergence and our related USDCAD 1.3000 target have proven clearly incorrect.

Looking ahead into Q4, our core view is that the theme of FX underperformance vs the USD has space to play out further in the cyclical G10 space. As such we now set our Q4 targets at 0.6200in AUDUSD, 1.4200 in USDCAD, 1.1700 in AUDNZD, 0.5300 in NZDUSD, 10.7000in EURNOK and 11.3000 in EURSEK. Along with the theme of broad divergence vs the USD, we also anticipate realized volatility to stay elevated in Q4, which leads us to set wider trading range for these pairs. Specifically, we now see AUDUSD trading between 0.6700 and 0.6000 in Q4, we see USDCAD in a 1.3250- 1.4300 range, AUDNZD between 1.1300 and 1.1900, EURNOK in a 10.0000-10.9000 range and EURSEK between 10.6500and 11.4200.

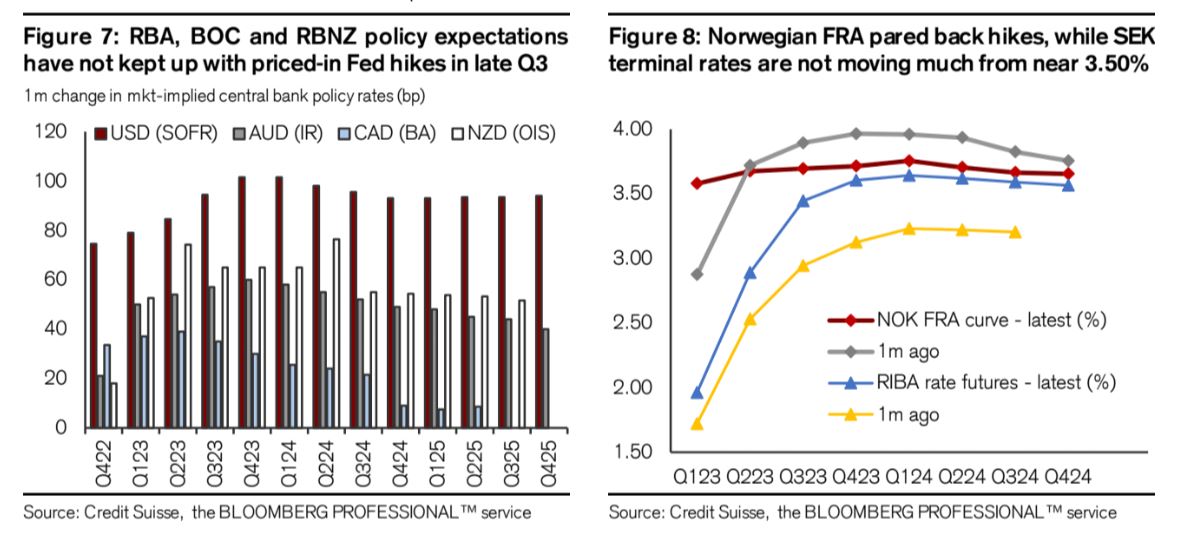

The core driver of our view relates to local central banks’ unwillingness to keep up with the Fed’s hawkish stance. We also see fears of a global growth slowdown-induced pullback in current account balances as an additional potential kicker.