DXY is telling us that something is wrong with the global economy. That something is China and Europe:

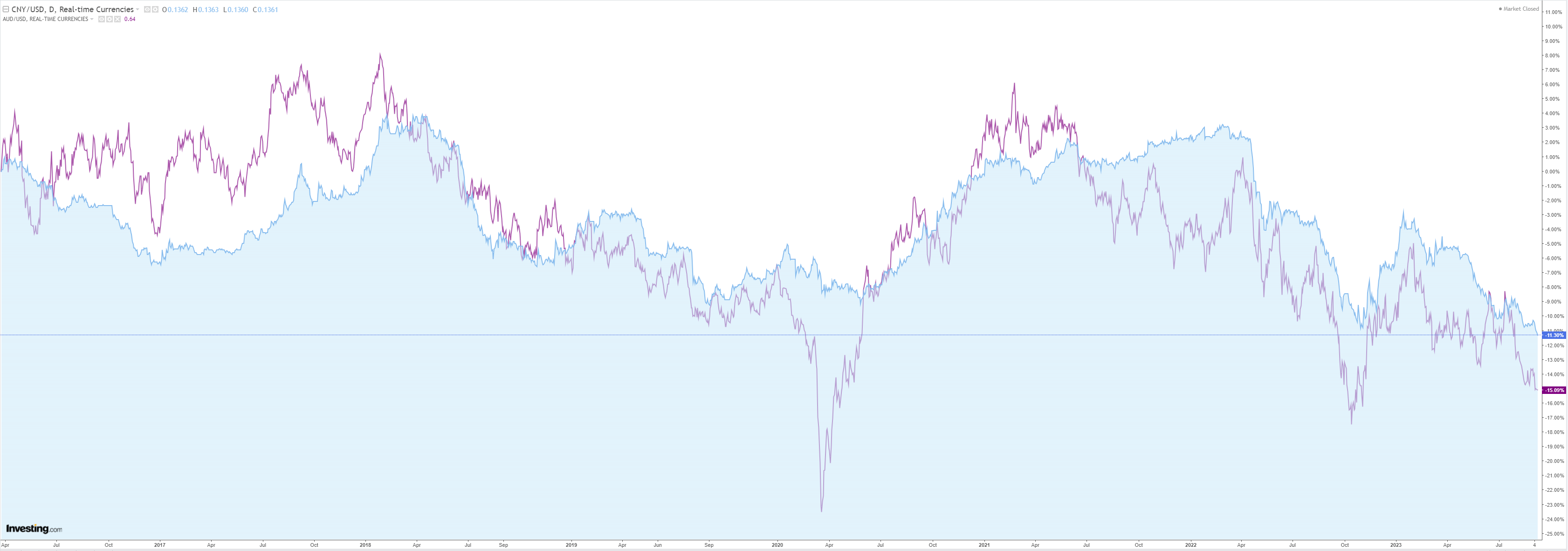

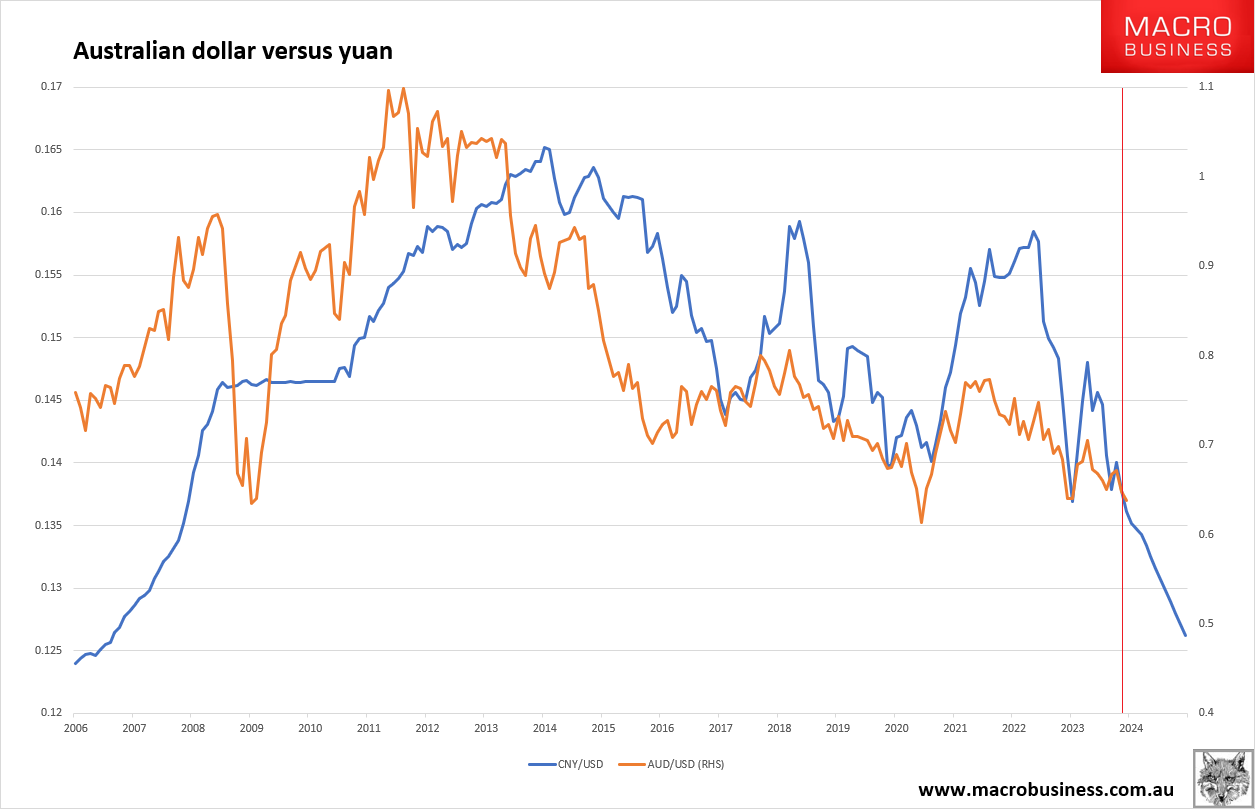

AUD is crawling along the cliff top:

As CNY let go. Lowest in 16 years:

DXY is helping but oil looks like its consolidating for another push higher:

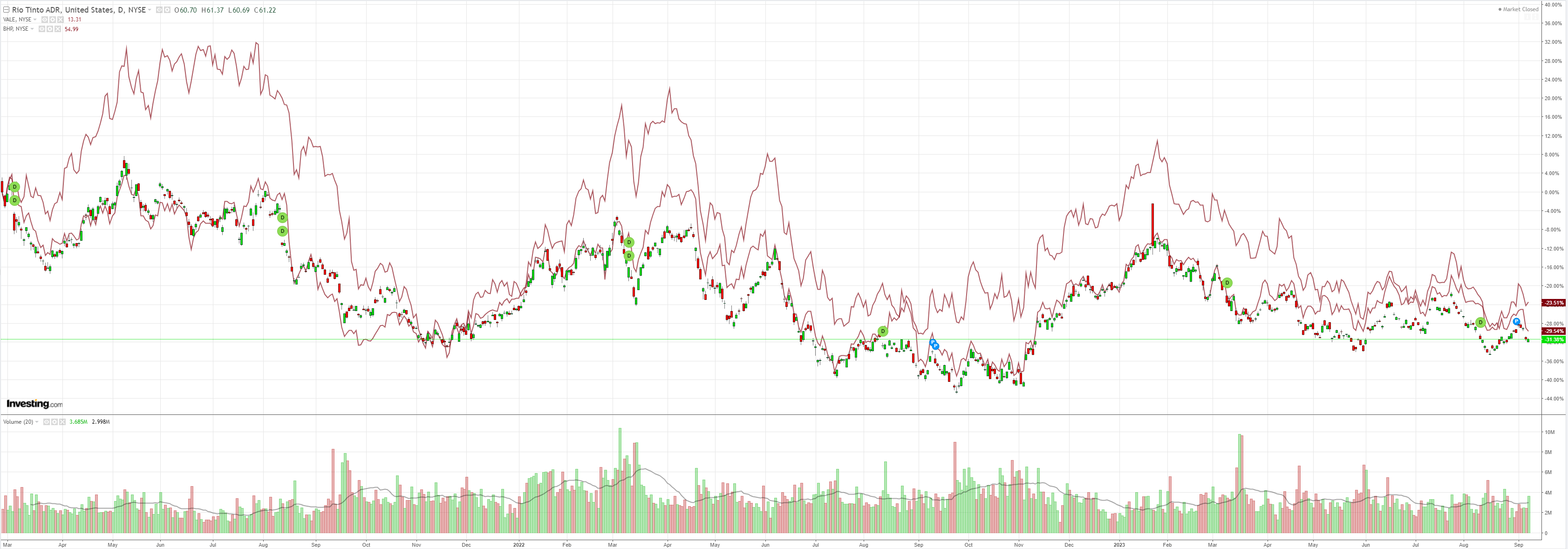

Dirt has decoupled:

Miners held:

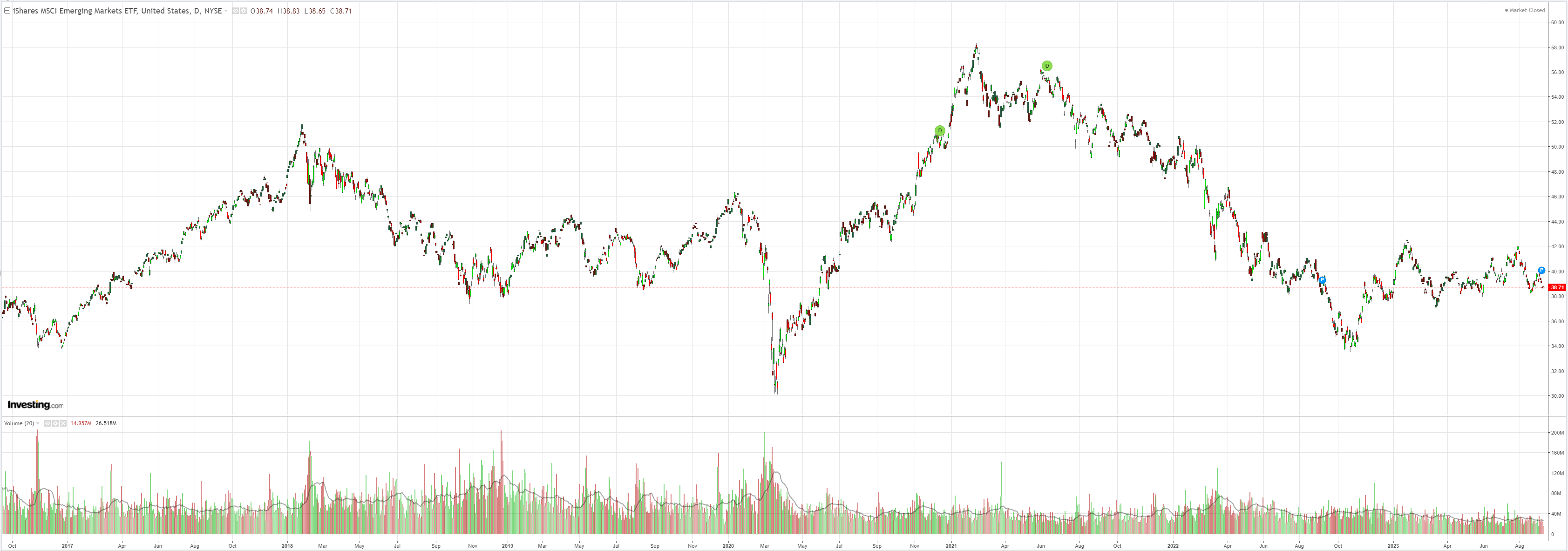

EM stocks are over:

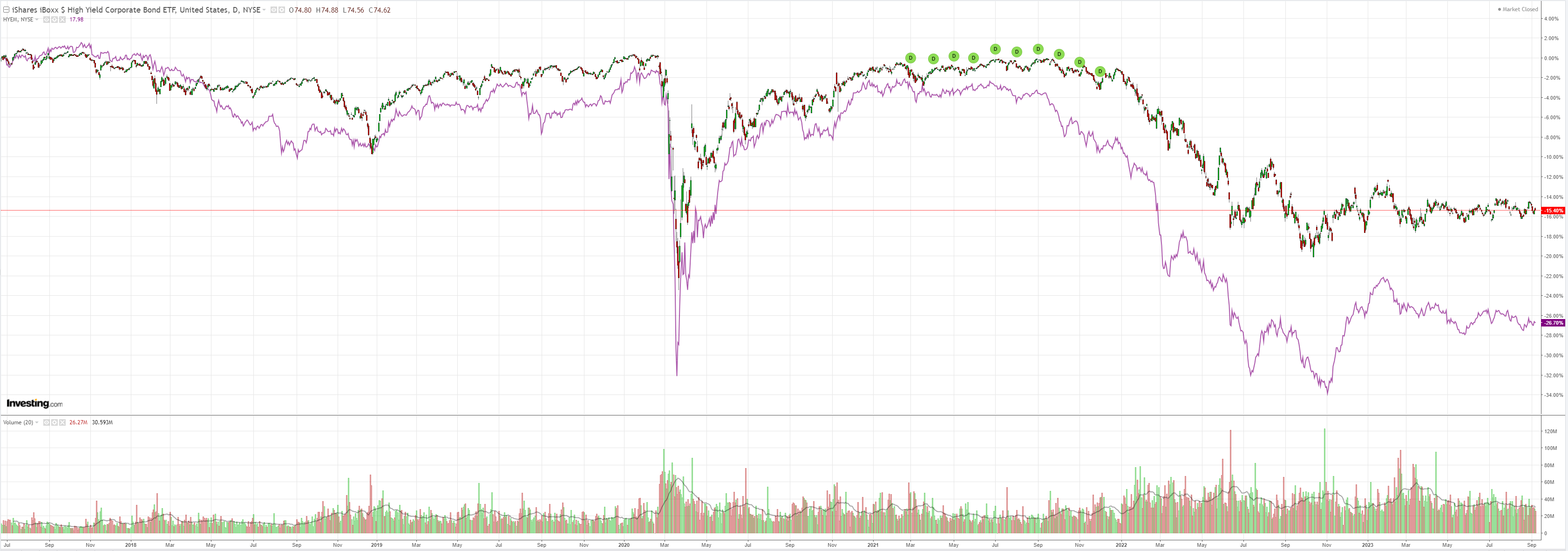

Junk is undead:

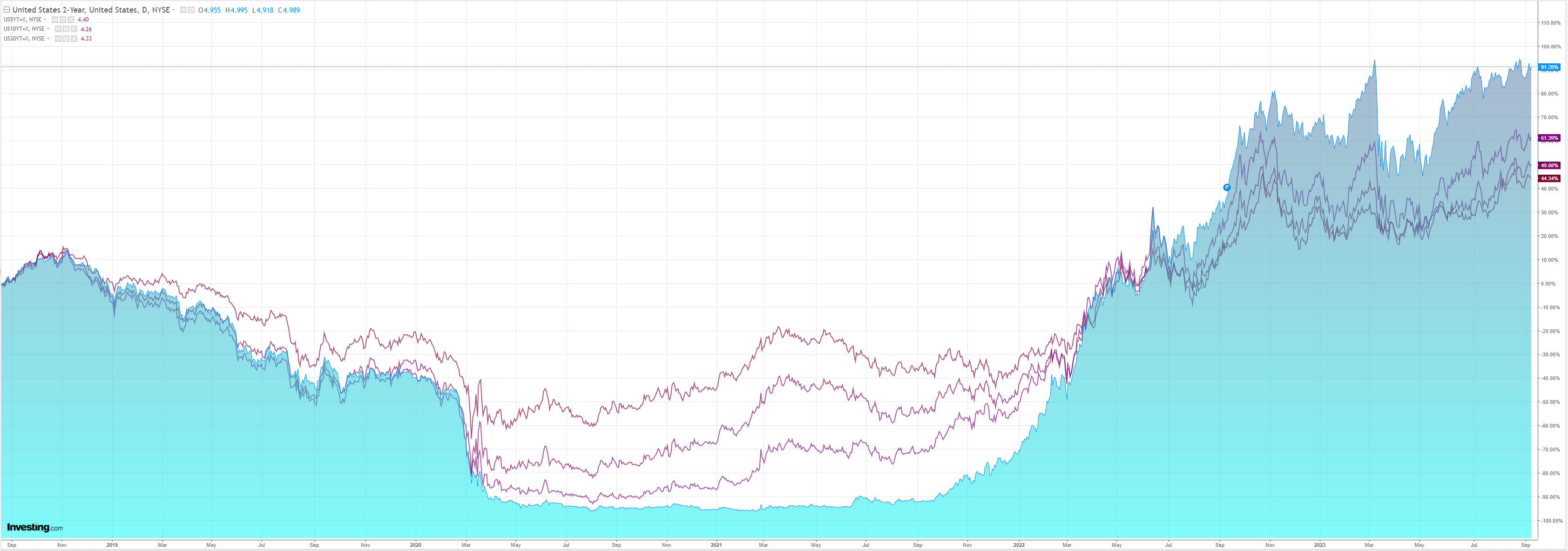

The curve steepened:

Stocks held:

China has let go of CNY:

The offshore yuan weakened toward its lowest on record against the dollar, as a cut to the daily reference rate for the managed currency stoked bets China is comfortable with a gradual depreciation.

…The PBOC is faced with a daunting task of maintaining the so-called impossible trinity, where it needs to stabilize the exchange rate and prevent capital outflows while keeping an independent monetary policy. But China’s sluggish economy and dovish policy are heaping pressure on the yuan, especially as resilient US data and a high interest-rate differential there has traders favoring the dollar.

“The weaker fixing shows the PBOC is willing to accept a higher dollar-yuan rate as long as it is not an isolated case,” said Kiyong Seong, lead Asia macro strategist at Societe Generale (EPA:SOGN) SA. “The yuan’s future path largely depends on the general dollar movement which is hard to say at this juncture. But recent developments appear to support our year-end forecast of 7.60.”

…“Sentiment is also affected by the lack of real improvement in the economy and corporate profits,” said Gary Ng, a senior economist at Natixis in Hong Kong. “Until then, the yuan will likely face depreciation headwinds.”

As Chinese growth shunts lower permanently, I expect we’ll breach 8 for USD/CNY in 2024/25—a full round trip back to the exchange rate present when China acceded to the WTO.

How low would this equate to AUD? Here’s the chart:

If CNY falls that far, and the relationship with AUD is intact, our currency will be in the high 40s over 2024/25.

Unless we see a panic stimulus, the relationship should hold as China structurally slows via a real estate shock.

It will be severe enough for Australia’s key commodity prices to keep falling.

For Australia, that will mean trashed nominal growth, a wrecked budget, tumbling mining stocks, an income shock, crushed wages, mass deflation and perpetual per capita recession.

The RBA will be slashing rates faster and harder than all other developed markets,.