DXY was all over the place last night:

AUD was weak and wants to test the recent lows:

Oil broke:

Metals too. Copper took out critical support:

Miners (LON:GLEN) are in free fall:

EM stocks (NYSE:EEM) are right at the cliff’s edge:

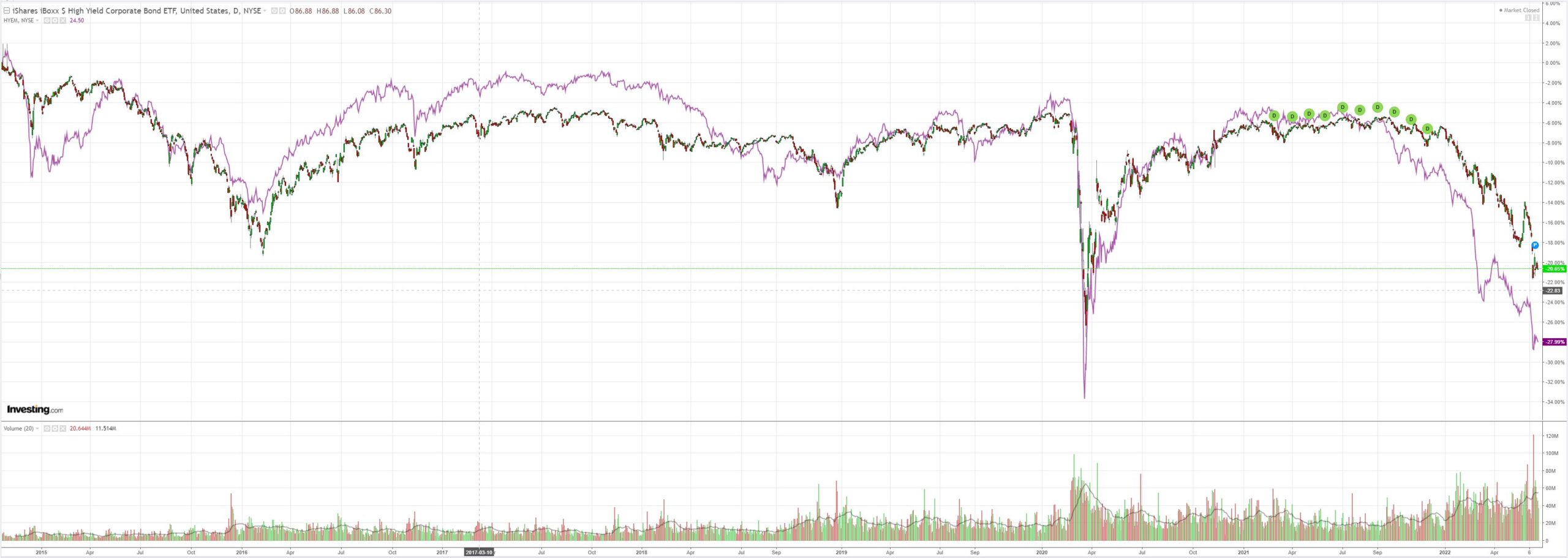

The message from junk (NYSE:HYG) is unchanged: sell:

As oil fell, Treasuries got a bid:

Stocks tried but failed to bounce:

Westpac has the wrap:

Event Wrap

Fed Chair Powell’s semi-annual Congressional testimony referenced a possible peaking in inflationary pressures while also affirming the Fed’s intent to act against inflation. The challenge was to achieve a soft landing. He said there were signs that activity was slowing and labour market tightness was easing in response to their actions. The funds rate will probably be above 3% by year-end, and they would need to see evidence of inflation slowing before contemplating a change of course.

Eurozone consumer confidence failed to stabilise fell to -23.6 (est. -20.5, prior -21.2) and remains at risk of breaching the pandemic record low of -24.4.

UK inflation data was close to estimates. CPI in May rose 0.7%m/m and 9.1%y/y (a 40-year high), as expected, but core inflation fell to 5.9%y/y (est. 6.0%y/y, prior 6.2%y/y).

Canadian CPI in May rose 1.4%m/m and 7.7%y/y (est. 1.0%m/m and 7.3%y/y) – the highest since 1983., with the average of core measures rising to 4.7%y/y.

Event Outlook

NZ: The Westpac-MM employment confidence index should receive support from strong job vacancies in Q2; evidence of higher pay is also of interest.

Japan: The easing of health restrictions should buoy the Nikkei services PMI in June; however, the lack of Chinese demand and supply issues are risks to the Nikkei manufacturing PMI.

Eur/UK: Ongoing cost pressures and supply chain issues are key concerns to European manufacturing and services in the June S&P Global (NYSE:SPGI) PMI report (market f/c: 53.8 and 55.5). The UK’s S&P Global PMIs are facing similar risks and a sharp slowdown in activity is on its way (market f/c: 53.6 and 52.9).

US: The US are weathering similar headwinds, but prices pressures are also an ongoing risk to the S&P Global manufacturing and services PMIs (market f/c: 56.0 and 53.5). Meanwhile, initial jobless claims are set to remain at a low level (market f/c: 226k) and the Kansas City Fed index should reflect a positive but fragile manufacturing outlook (market f/c: 15). FOMC Chair Powell will deliver a semi-annual monetary policy testimony before the House Financial Services Committee.

The Fed is now winning its battle with oil which is great news for everybody except a few dictators. Global recession is now being priced into most commodities as well as the Johnny-come-latelies of commodity trading learn the lesson that it is always up the escalator and down the lift with dirt.

The US economy is beginning to fray. The European economy is already unraveling. China cannot save, either, especially since it will be hit harder than anybody else as the US consumer buckles.

Inflation is still far too high for Fed comfort and, if it’s got any brains, it will want to see oil much lower before it pivots. I’m talking $60 given the moment that it turns, oil will take off again.

Global recession and lower AUD still ahead.