The Australian dollar has posted losses on Tuesday, as the pair trades at 0.7160. On the release front, it is a quiet day. We’ll get a look at the week’s first key event, with the release of US New Home Sales. The markets are expecting the indicator to improve in the April report, with the estimate standing at 521 thousand. Later in the day, Australia will release Construction Work Done, with an estimate of -1.4%. On Wednesday, Australian Private Capital Expenditure, a key release, will be published.

The Australian dollar has resumed its downward trend, and is currently trading at 10-week lows. Much of the Aussie’s woes can be attributed to the RBA, which unexpectedly cut rates in early May. Last week, the RBA minutes hinted at another rate cut, as inflation levels remain stubbornly low. The currency lost more ground on Tuesday, as RBA Governor Glenn Stevens defended the RBA’s monetary policy, saying that there was no need to change the 2 percent to 3 percent target band for inflation. The RBA has put the markets on notice that it is considering further rate cuts, but the Australian dollar’s 500-point plunge since late April has given the central bank some breathing room. We’re unlikely to see the RBA make any moves prior to August, since the government has called an election for July 2.

AUD/USD Fundamentals

Tuesday (May 24)

- 10:00 US New Home Sales. Estimate 521K

- 21:30 Australian Construction Work Done. Estimate -1.4%.

Upcoming Key Events

Wednesday (May 25)

- 21:30 Australian Private Capital Expenditure. Estimate -3.2%

*Key releases are highlighted in bold

*All release times are EDT

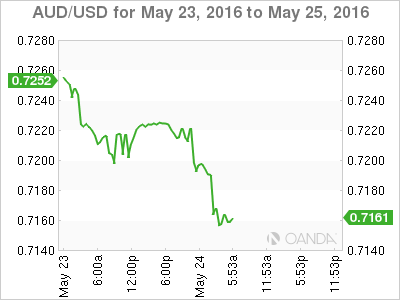

AUD/USD for Tuesday, May 24, 2016

AUD/USD May 24 at 5:25 EDT

Open: 0.7217 Low: 0.7155 High: 0.7224 Close: 0.7158

AUD/USD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 0.6843 | 0.6916 | 0.7049 | 0.7160 | 0.7251 | 0.7339 |

- AUD/USD has posted losses in the Asian and European sessions

- 0.7160 is fluid and currently a weak resistance line. It will likely see further action in the Tuesday session

- 0.7049 is providing support

- Current range: 0.7049 to 0.7160

Further levels in both directions:

- Below: 0.7049, 0.6916 and 0.6843

- Above: 0.7160, 0.7251, 0.7339 and 0.7472

OANDA’s Open Positions Ratio

AUD/USD ratio is showing little change on Tuesday. Long positions have a strong majority (60%), indicative of trader bias towards AUD/USD breaking out and moving higher.