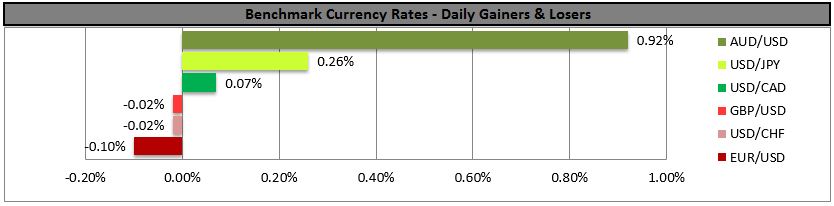

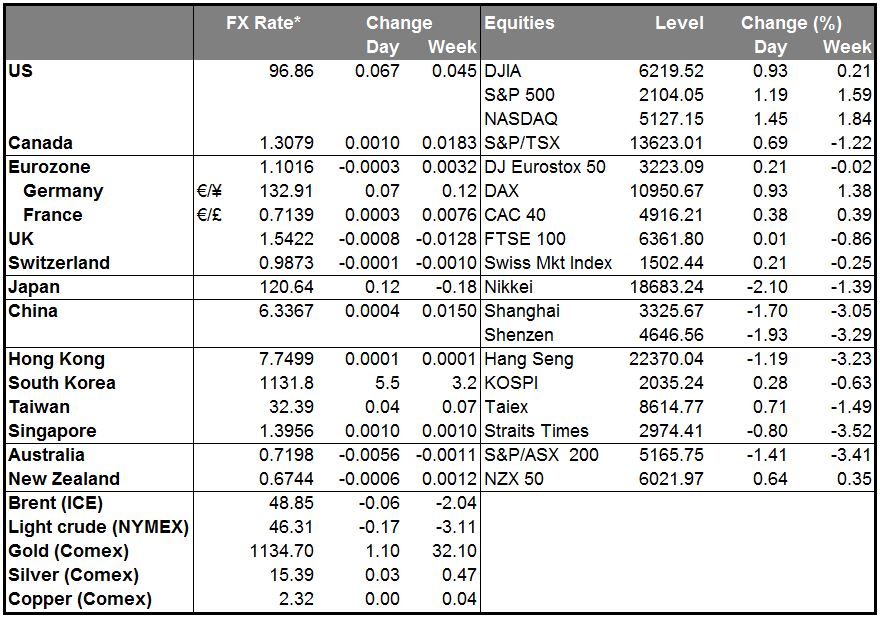

RBA keeps interest rates unchanged The Reserve Bank of Australia kept official interest rates unchanged amid signs of improvement of business conditions over the past year and a somewhat stronger growth in employment. It signaled, however, that low inflation may afford scope for further easing of policy. Although the RBA adopted an easing bias compared to the neutral stance in the last few meetings, the Board judged that the prospects for an improvement in economic conditions had firmed a little over recent months. As a result, it was appropriate to leave the cash rate unchanged at this meeting.

• The probability of a rate cut had increased substantially in recent weeks following increases in market mortgage rates and low inflation. In the statement accompanying the rate decision, the Bank said that “inflation is low and should remain so,” therefore the prospects of a cut at their December meeting is still on the table. It will be important to see how much the underlying inflation is lowered in the Bank’s Monetary Policy Statement to be released on Friday to better assess the future path of policy. AUD/USD plunged ahead of the release but surged afterwards as the Bank stayed pat. The shift to an easing bias and the prospects of a rate cut are likely to put AUD under renewed selling interest in the near future, in my view.

• Today’s highlights: During the European day, we have a relatively light calendar day. The UK construction PMI for October is expected to have declined to 58.8 from 59.9 in September. Investors pushed back rate hike expectations from the Bank of England after a recession in manufacturing and a slump in construction output slowed the UK economy more than expected. Nevertheless, manufacturing PMI beat estimates of a slight deterioration on Monday and showed strong growth for October. As a result, another positive surprise in the construction index is likely to add to evidence that the economy started to improve in Q4 and may support to GBP.

• In the US, factory orders for September are expected to have fallen again, but at a slower pace than in August.

• In late US session, New Zealand’s employment report for Q3 is coming out. The forecast is for the unemployment rate to increase a bit, which could put NZD under renewed selling pressure.

• We have three speakers on Tuesday’s agenda: ECB President Mario Draghi and SNB Chairman Thomas Jordan. ECB Draghi’s speech is likely to help investors to understand in what extent to adjust their expectations for further easing at the December meeting. We will be also watching SNB’s Jordan’s speech for clues on whether he believes further rate cut would be appropriate.

The Market

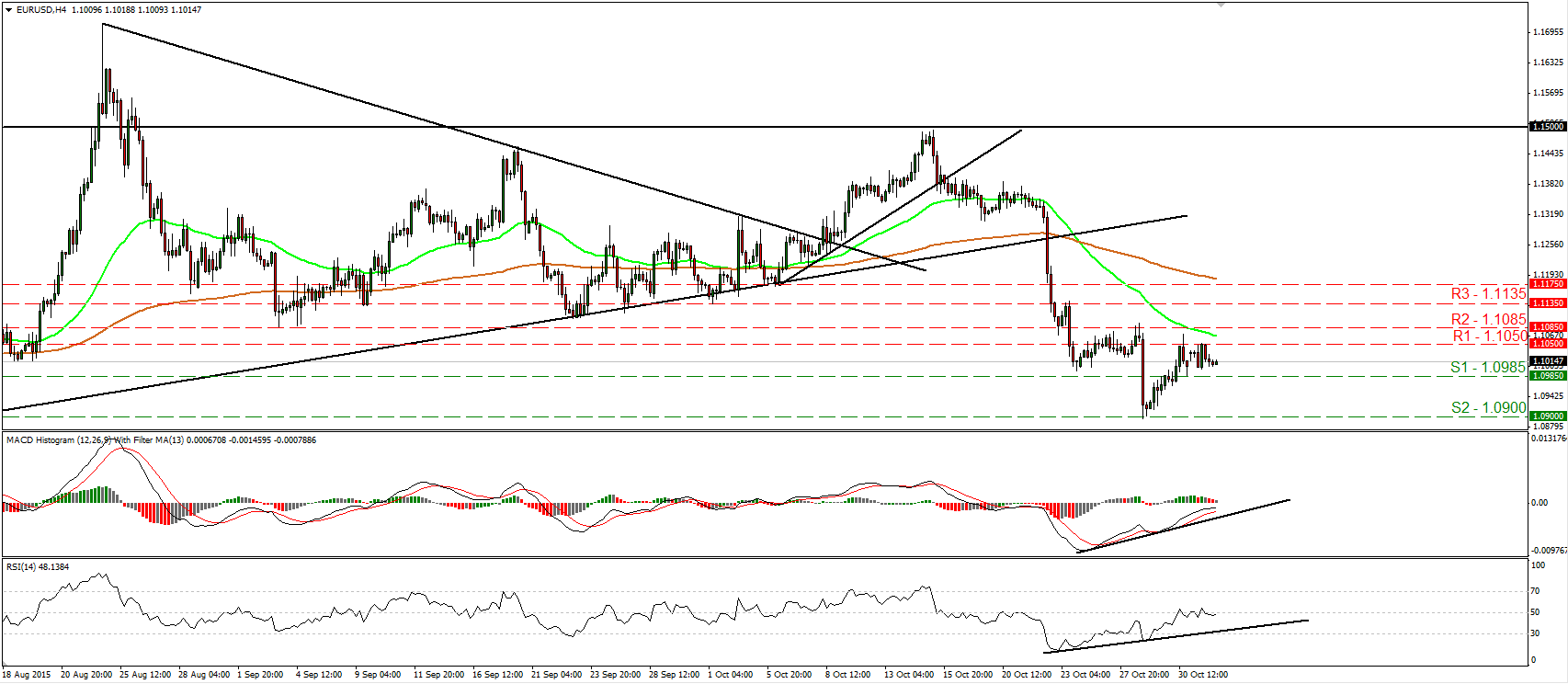

EUR/USD trades in a consolidative manner

• EUR/USD traded in a consolidative manner on Monday, staying between the support of 1.0985 (S1) and the resistance of 1.1050 (R1). On the 4-hour chart, the short-term picture still looks somewhat negative. Therefore I would expect the bears to regain control at some point and drive the battle lower. A clear move below 1.0985 (S1) is likely to confirm the case and perhaps open the way for another test at the 1.0900 (S2) zone, defined by the low of the 28th of October. Nevertheless, given the positive divergence between our short-term oscillators and the price action, I see the possibility for further rebound before the next negative leg. In the bigger picture, as long as EUR/USD is trading between the 1.0800 key support and the psychological zone of 1.1500, I would maintain my neutral stance as far as the overall picture is concerned. The short-term downtrend could be headed towards the lower bound of the range, but I would like to see a clear break below the 1.0800 hurdle before assuming that the longer-term trend is back to the downside.

• Support: 1.0985 (S1), 1.0900 (S2), 1.0850 (S3)

• Resistance: 1.1050 (R1), 1.1085 (R2), 1.1135 (R3)

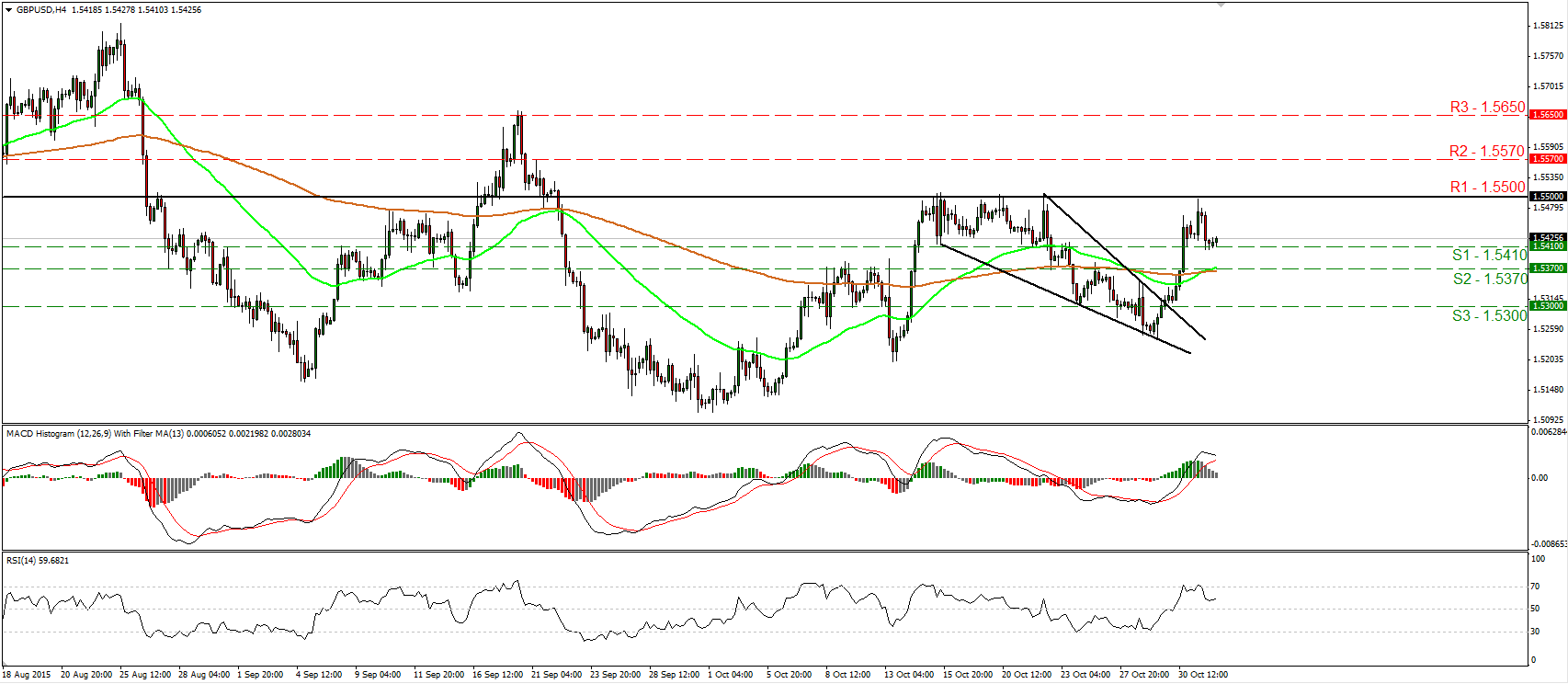

GBP/USD hits once again the psychological zone of 1.5500

• GBP/USD spiked following the unexpected jump in the UK manufacturing PMI for October. Nevertheless, cable found resistance once again at the psychological barrier of 1.5500 (R1) and then it tumbled to hit support near 1.5410 (S1). The short-term picture looks somewhat positive, but I would prefer to wait for a clear close above 1.5500 (R1) before getting confident on the upside. Today, we get the UK construction PMI and expectations are for the index to have declined in October. Something like that could extend yesterday’s setback and could push the rate below the 1.5410 (S1) line. On the other hand, another surprise is likely to pull the trigger for another test near the key obstacle of 1.5500 (R1). On the daily chart, the rate oscillates above and below the 80-day exponential moving average. Having that in mind, and that there is no clear trending structure, I would still hold a “wait and see” stance as far as the overall outlook of the pair is concerned.

• Support: 1.5410 (S1), 1.5370 (S2), 1.5300 (S3)

• Resistance: 1.5500 (R1), 1.5570 (R2), 1.5650 (R3)

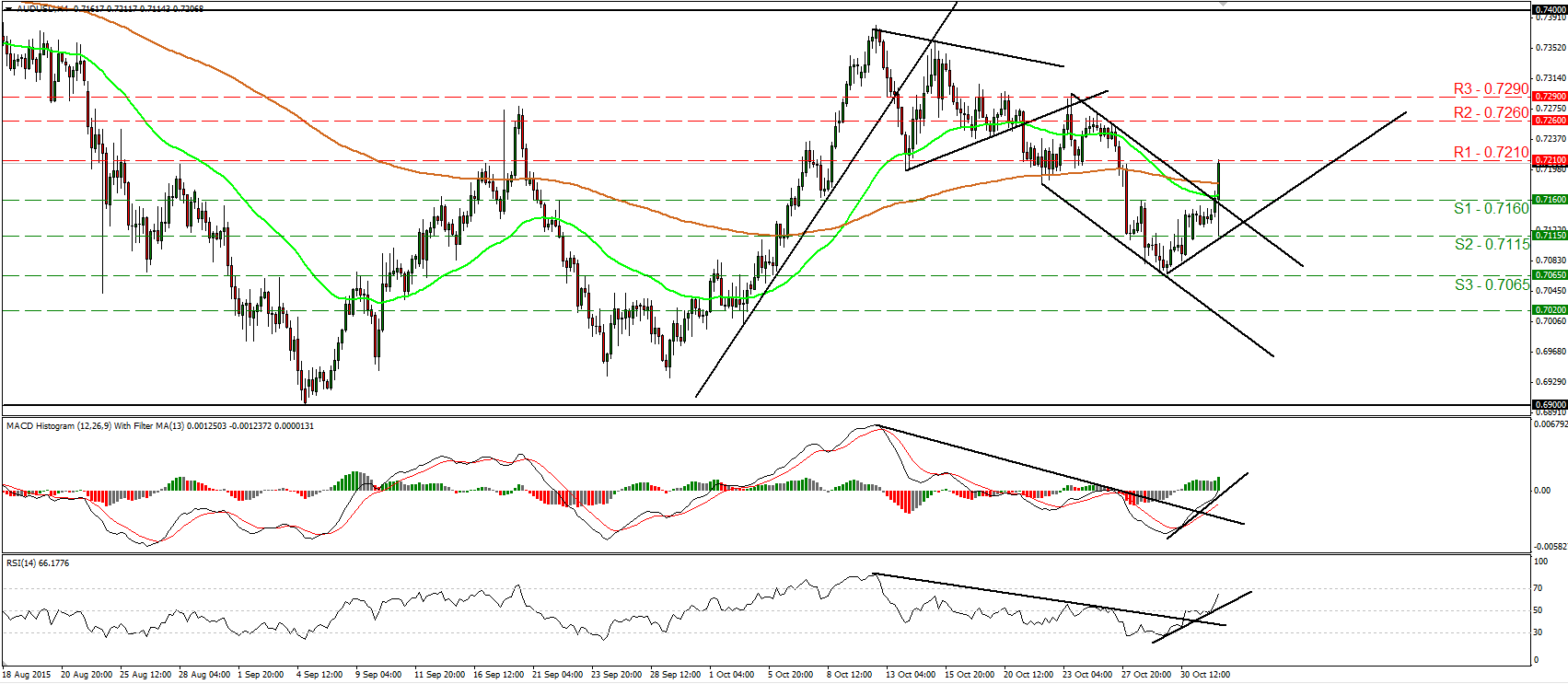

AUD/USD surges following the RBA decision

• AUD/USD surged during the Asian morning Tuesday after the RBA decided to keep its cash rate unchanged and said that the outlook for the economy had actually firmed a little in recent months. The pair emerged above the upper bound of the downside channel and hit resistance at 0.7210 (R1). In my view, the short-term picture has turned somewhat positive and as a result, I would expect a clear break above 0.7210 (R1) to open the way for our next resistance at 0.7260 (R2). Our short-term oscillators support the notion as well. The RSI edged higher after crossing above its 50 line, while the MACD has just turned positive and points north. On the daily chart, I see that AU/USD oscillates between 0.6900 and 0.7400 since mid-July. As a result, although the pair could trade higher in the short run, I would hold a flat stance for now as far as the broader trend is concerned.

• Support: 0.7160 (S1), 0.7115 (S2), 0.7065 (S3)

• Resistance: 0.7210 (R1), 0.7260 (R2), 0.7290 (R3)

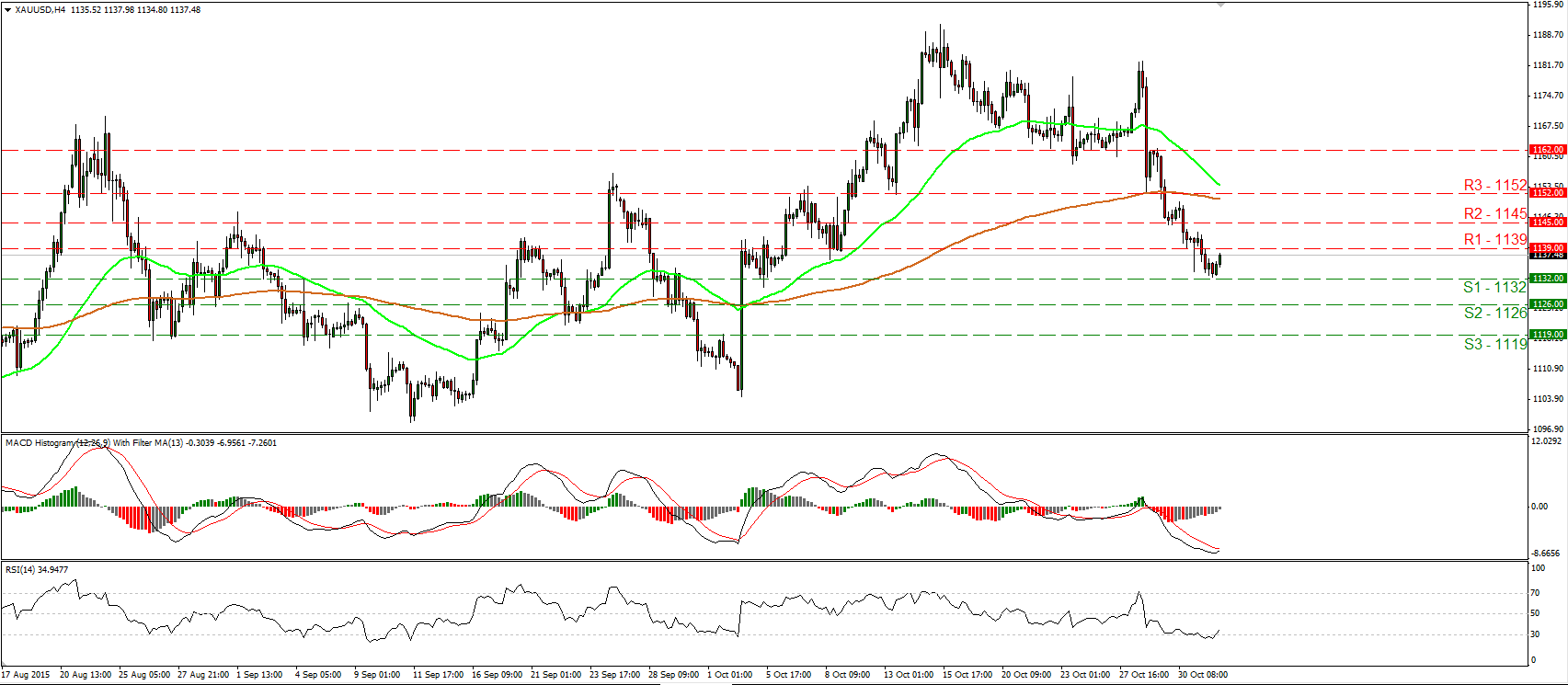

Gold hits support at 1132

• Gold continued a bit lower on Monday, but hit support fractionally above the 1132 (S1) line and then it rebounded somewhat. The short-term trend remains negative in my view and hence, I would expect a dip below 1132 (S1) to initially aim for the next support at 1126 (S2). Taking into account our short-term oscillators though, I see signs that further corrective bounce could be in the works before the bears seize control again. The RSI rebounded from slightly below its 30 line and is now pointing up, while the MACD, although negative, has bottomed and looks able to move above its trigger line soon. On the daily chart, the medium-term outlook still looks cautiously positive. As a result, I would treat the slide started on the 15th of October as a corrective phase, at least for now.

• Support: 1132 (S1), 1126 (S2), 1119 (S3)

• Resistance: 1139 (R1), 1145 (R2), 1152 (R3)

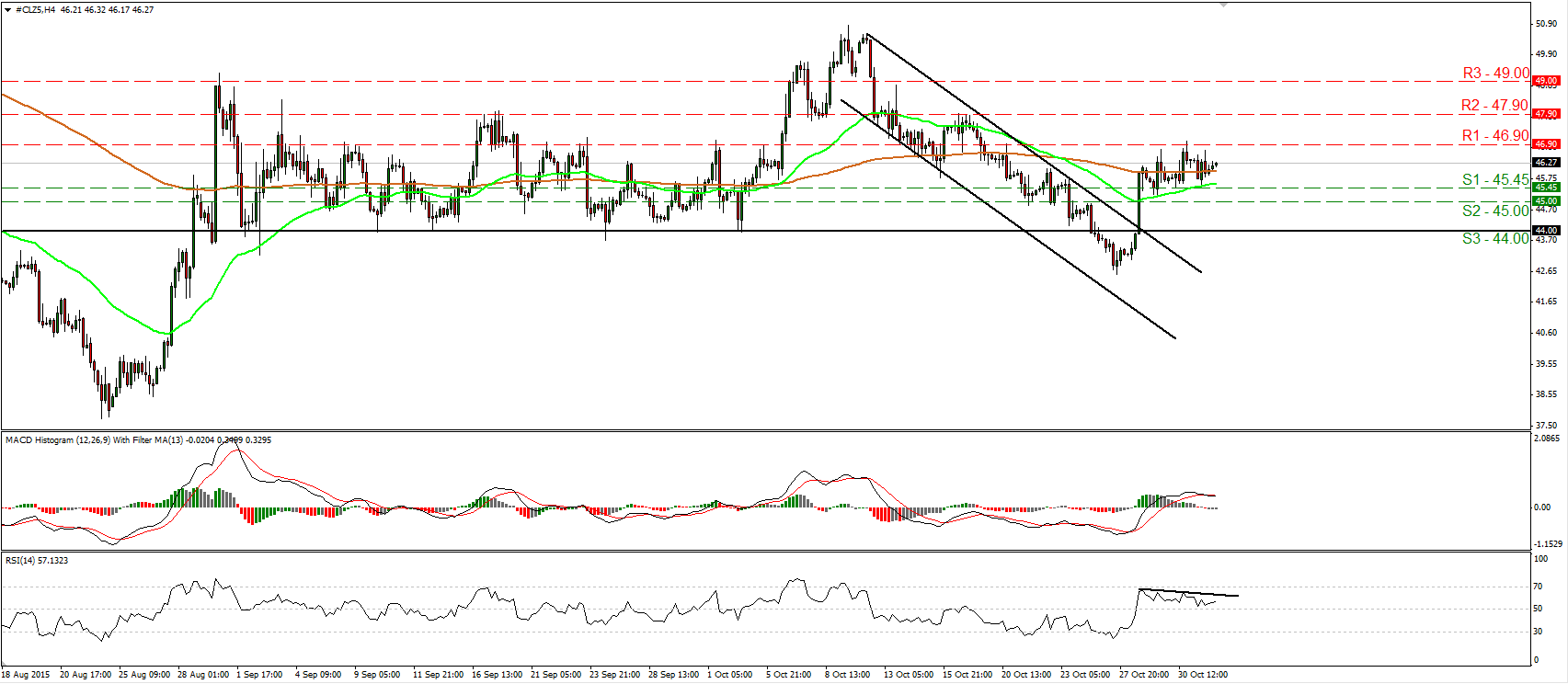

WTI trades in a sideways mode

• WTI traded in a quiet mode yesterday, staying between the support of 45.45 (S1) and the resistance of 46.90 (R1). Given that on the 28th of October, the price surged above the upper bound of a downside channel, I would consider the short-term picture to be cautiously positive. As a result, I would expect a clear move above 46.90 (R1) to aim for our next barrier of 47.60 (R2), marked by the peaks of the 16th and 19th of October. Looking at our momentum studies though, I see signs that further consolidation or a setback could be looming before the next positive leg. The RSI slid after hitting resistance slightly below its 70 line, while the MACD, although positive, has topped and fallen below its trigger line. On the daily chart, WTI printed a lower low on the 27th of October, but given that the price rebounded back above the 44.00 (S3) line, I would switch my stance to neutral as far as the longer-term outlook is concerned.

• Support: 45.45 (S1), 45.00 (S2), 44.00 (S3)

• Resistance: 46.90 (R1), 47.90 (R2), 49.00 (R3)