The Federal Reserve has left interest rates unchanged and rhetoric rather bland in a fairly inconspicuous statement early this morning.

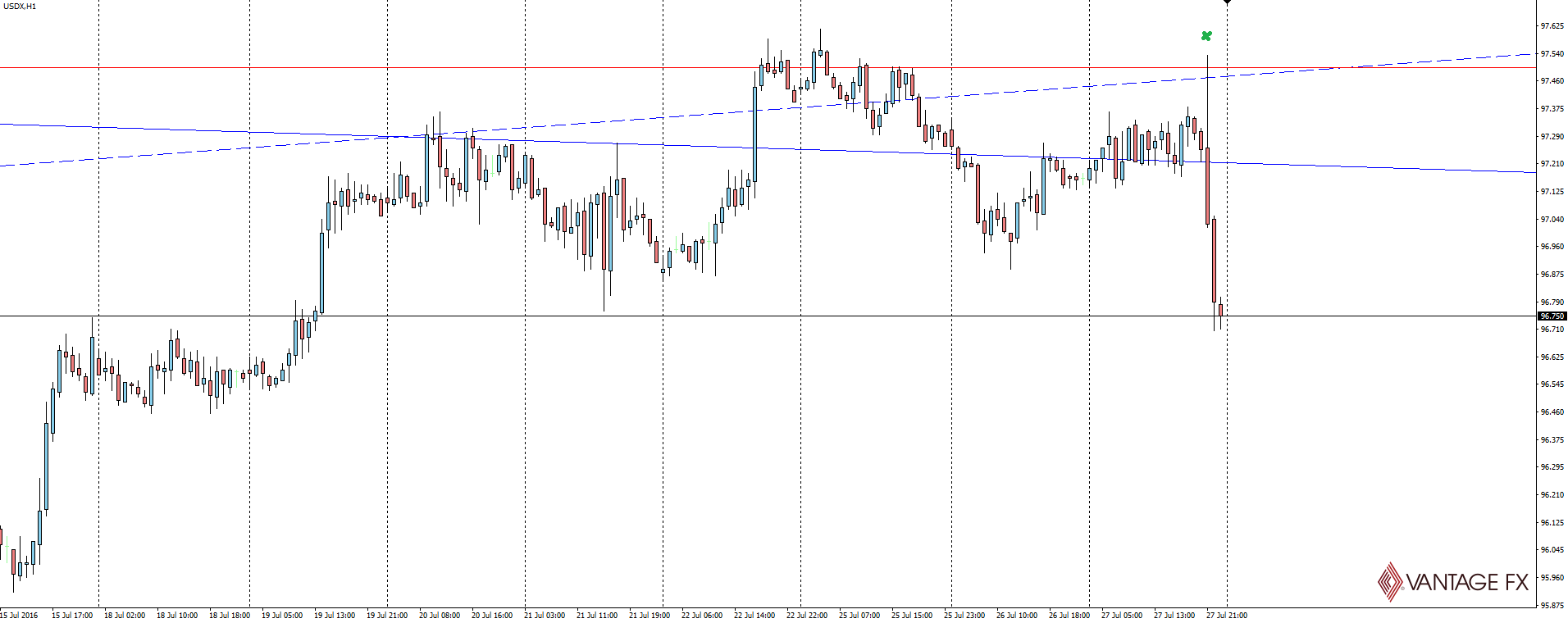

“USD Federal Funds Rate:

You can read the full release here, but some highlighted takeaways are:

“Near-term risks to the economic outlook have diminished.”

“Continues to closely monitor inflation and global developments.”

The second was repeated from the June statement and still lacked any reference to the timing of the next potential rate hike. It’s coming, we just aren’t getting any closer to knowing when.

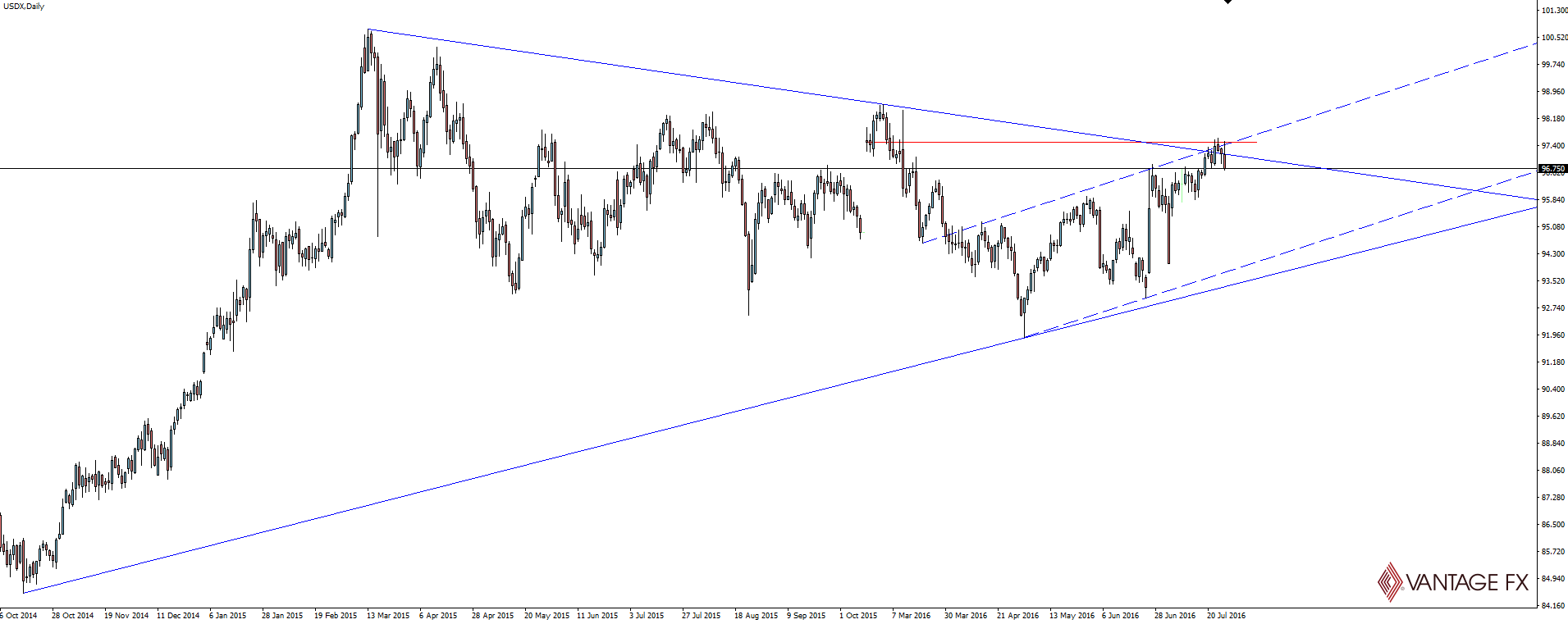

USDX Daily:

Obviously this attitude didn’t halt the USDX from sliding off that confluence of resistance. The key US dollar level for anyone trading the majors right now.

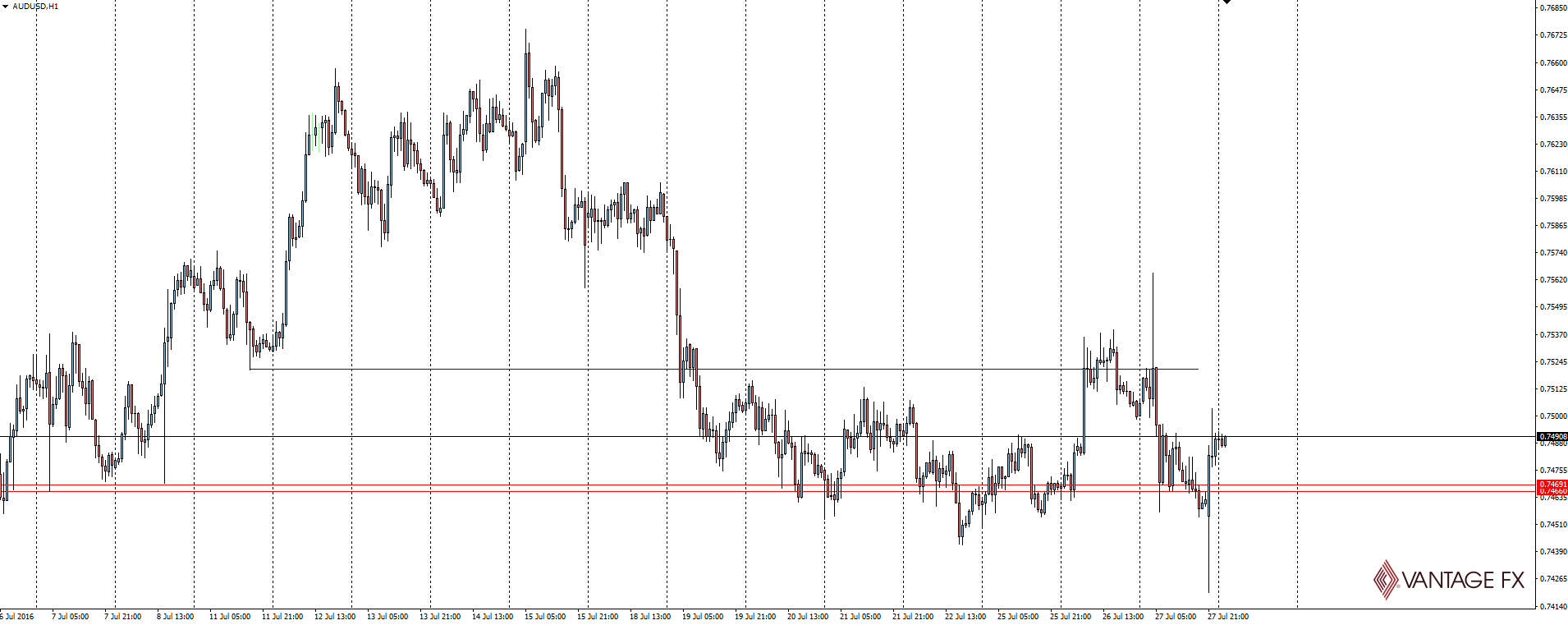

Moving across our set of in play charts on our MT4 platform watch list to AUD/USD and how yesterday’s inflation figure affects the currency pair for traders heading forward.

While the headline q/q figure came in as expected, inflation has continued to remain subdued. At just 1% in annual terms, this is as the RBA has forecasted and well below the target band of 2%-3%.

AUD/USD Hourly:

From a trading point of view, I’ve gone cold on the Aussie. Based on how the dovish the RBA has viewed CPI weakness in the past, I still personally am leaning toward a cut, but a lean isn’t any reason to be trading.

As there is an argument to be made from trading both sides plus interest rate futures now pricing in just a 50%/50% chance of a cut, no matter which way the RBA goes on Tuesday, AUD/USD is going to experience some sort of re-pricing. This obviously doesn’t make a trade ideal from a risk point of view and there is no point forcing an entry if it’s not there.

Lastly this morning, I wanted to leave you with something ridiculous: The Bank of Japan!

Credit where its due to the US Federal Reserve in the way they have handled communicating to the market the adversity they are facing when it comes to the normalisation of interest rates.

Ahead of tomorrow’s meeting, the BoJ on the other hand are doing their best to provide a case study in how NOT to communicate policy to the market.

USD/JPY 5 Minute:

“This many trillion, no wait its actually this many trillion, nope that wasn’t right and it was actually the other one all along.”

The number honestly doesn’t even matter anymore. Trust is gone and with it the clean trade. Well done to those Vantage FX traders that took advantage of the initial re-pricing on that first shock out of daily resistance!

See you tomorrow for:

“Friday: JPY Monetary Policy Statement”

On the Calendar Thursday

EUR: German Prelim CPI m/m

EUR: Spanish Unemployment Rate

EUR: German Unemployment Change

USD: Unemployment Claims

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.