Will 2024 mark the return of the momentum factor to the performance spotlight?

This risk premium’s star faded in 2023, but there are hints that a rebound may be brewing for this slice of the equity risk premium, based on a set of proxy ETFs through Wednesday’s close (Jan. 24).

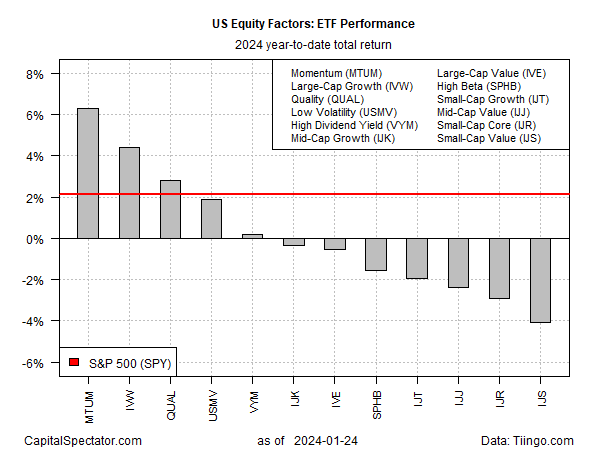

The 6.1% year-to-date rise for iShares MSCI USA Momentum Factor ETF (NYSE:MTUM) certainly looks encouraging.

For the moment, it’s the best-performing factor fund. It’s also outperforming the broad market by a wide margin: the 2.1% increase so far in 2024 for the S&P 500 (NYSE:SPY) pales next to MTUM’s rally.

If January’s results are an indication, MTUM appears on track to recover this year and lead the field.

If so, the rebound would mark a sharp contrast with 2023, when the fund posted one of the weakest factor performances via a 9.2% total return. The broad US market, for instance, surged more than 26% last year, based on SPY.

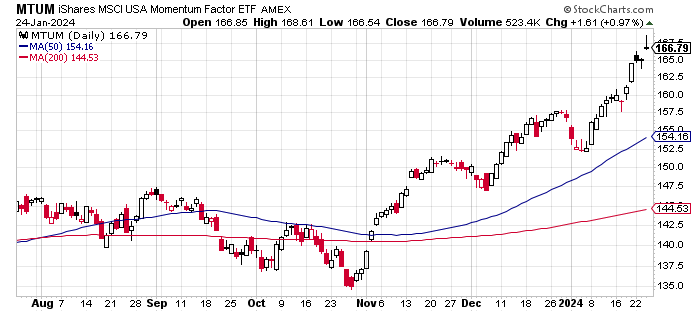

Reviewing recent trend behavior for MTUM highlights the upside shift unfolding since November. After a modest run of weakness, the fund has rallied sharply in recent months.

Meanwhile, small-cap and value are taking a hit so far in 2024. The worst-performing factor return year to date: is iShares S&P Small-Cap 600 Value ETF (NYSE:IJS), which is down more than 4% this year.

The recent weakness in small-cap value inspires contrarian thinking on the outlook for this slice of the equities market.

“Small-cap stocks are trading at discounted prices,” notes Morningstar analyst Bryan Armour. “Morningstar named it one of the top opportunities for equity investors in our 2024 Investment Outlook.”

The recurring question, of course, is whether small-caps are finally poised for a sustainable rally in relative terms?

There have been numerous forecasts in recent years anticipating just that, but so far the rosy outlook has yet to materialize.

Small-cap stocks generally have trailed the broad market (SPY) over the last three years, for instance.

Optimists are hoping, again, that attractive valuation is the catalyst that renews small-cap fortunes in 2024 and beyond.