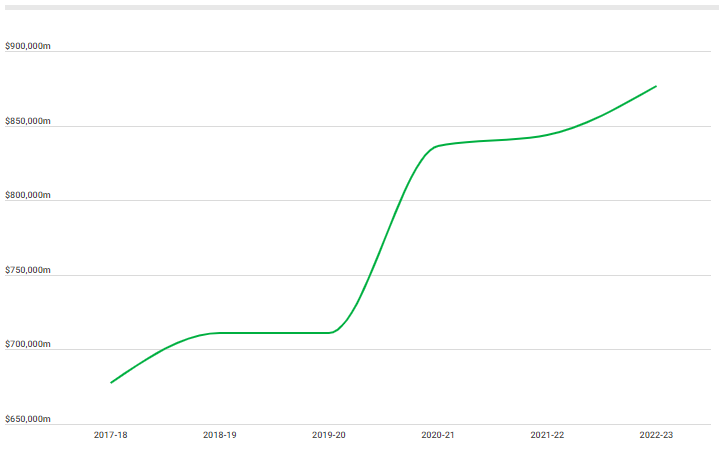

SMSFs now command nearly $876.5 billion of gross assets, according to figures from the Australian Taxation Office (ATO), an average of approximately $1.4 million per fund.

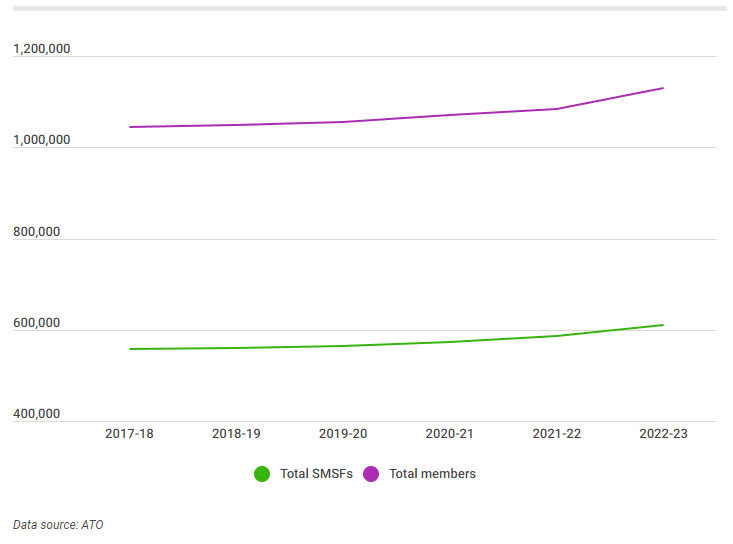

As of 30 June 2023, the nation is home to more than 610,000 SMSFs – a 4.2% year-on-year jump.

And younger Aussies have been among those leading the charge.

“The recent surge in SMSF registrations underscores a significant shift in retirement planning preferences among younger Australians, particularly those aged between 35 and 44 years,” MySMSF director and specialist Rob Joseph told Savings.com.au.

“Notably, women in this age group have emerged as leading participants in the trend towards self-managed superannuation, perhaps driven by a desire for more control over their retirement savings and the opportunity to close the superannuation gender gap.”

Though, the superannuation gender gap still exists in the SMSF sector, just as it does the rest of the industry.

The average woman holding a SMSF has a balance of $736,000 compared to the average man’s $867,000 balance.

Younger Australians are also being drawn to SMSFs due to the choice and flexibility they offer.

Not only can DIYing your superannuation potentially save on fees amid a growing “disenchantment” with institutional funds, it can also allow investments in assets of their choosing, Mr Joseph noted.

“The ability to directly invest in a wide range of assets, including property and alternative investments like gold and cryptocurrencies, has been appealing, especially as traditional investment avenues become less attractive due to interest rates and market volatility,” he said.

Though, it's worth noting that a SMSF can be expensive to run, with costs often coming in at thousands of dollars a year.

While every fund is different, it's estimated one needs a balance of around $200,000 before they become cost-competitive with industry super funds.

The sector now represents a quarter of the total superannuation industry, worth a collective $3.5 trillion.

The typical lifespan of a SMSF, from establishment to wind up, has increased from 11 years in financial year 2017-18 to 13 years in financial year 2021-22 – the latest data available.

SMSF contributions also rose 33% to a total of $22 billion in the year to mid-2022.

The majority of those contributions ($16.3 billion) came from members, while employers also tipped in the rest ($5.7 billion).

“It's clear that the unique circumstances of the COVID-19 pandemic, which led to higher household savings and more free time, resulted in a notable increase in contributions,” Mr Joseph said.

“While it's uncertain if this trend will continue at the same pace, the growing interest in SMSFs and a more engaged approach to personal finance suggest that higher contribution levels could persist as Australians seek to maximise their retirement savings in a post-pandemic world.”

SMSF loans on the decline

After a surge in SMSFs turning to loans – by default, known as limited recourse borrowing arrangements (LRBA) – in the years to 2020, the tide appears to have turned.

Fewer SMSFs (just 11%) are gearing to purchase assets in the 12 months ended 30 June 2022, down from 12% in the year prior.

When it came to the value of LRBAs (limited recourse borrowing arrangements - SMSF loans), SMSFs held $1 billion less debt than they did the year before, coming in at a collective $56.3 billion.

That’s perhaps unsurprising, given the Reserve Bank of Australia’s (RBA) first cash rate hike hit the nation in May 2022, and demand for credit slowing because of it.

“LRBAs have been a popular way for SMSFs to leverage their investments in property and shares, but as borrowing costs rise, the appeal of using leverage diminishes,” Mr Joseph said.

Of the $56.3 billion funded through SMSF loans, as of mid-2022, the majority ($30.9 billion) was used to purchase residential real estate.

Another $23.5 billion was used to buy non-residential real estate, while around $500,000 was used to buy Australian shares.

"As SMSF assets climb to $876b, more young Aussies are jumping on board" was originally published on Savings.com.au and was republished with permission.