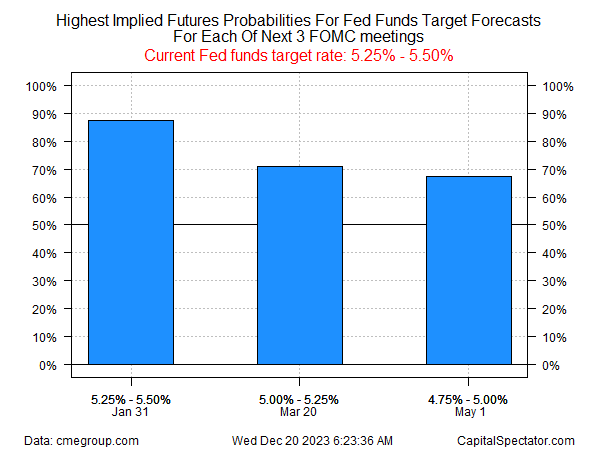

Markets are becoming increasingly confident that the Federal Reserve will start cutting interest rates in 2024. The first cut is expected at the March 20 monetary policy meeting.

Fed funds futures are pricing in a 70%-plus probability that the central bank will announce a 25-basis-point cut in March.

By contrast, the implied estimate for the upcoming January 31 FOMC meeting is a near-90% probability of leaving the current target rate unchanged at the current 5.25%-to-5.50% range.

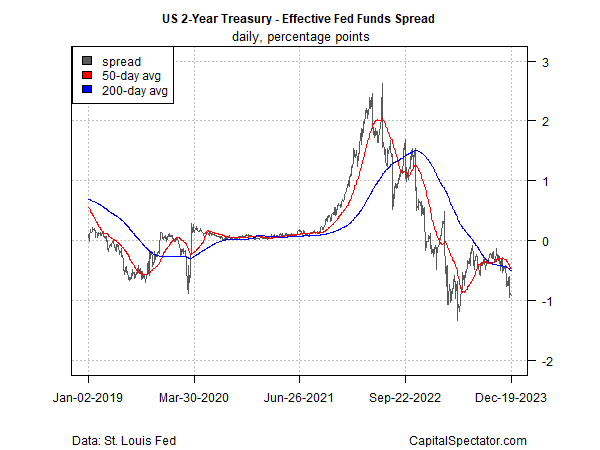

The US Treasury market is also forecasting rate cuts in the near term, based on the spread for the Fed funds rate less the 2-year yield.

The relatively wide gap is considered a proxy for market expectations on the near-term path for monetary policy.

On that basis, the crowd sees elevated odds for looser policy via a 2-year rate that’s nearly a full percentage point below the current Fed funds rate.

Using a simple model of unemployment and inflation indicates that monetary policy is moderately tight, which implies that the Fed has room for cuts and still leaves the bias skewed toward a hawkish stance.

If the Fed does cut rates, a key question for markets: Will the policy shift be driven by expectations of rising recession risk or higher confidence that inflation has peaked and will continue to ease?

Michael Gapen, head of US economics at Bank of America (NYSE:BAC) Securities, tells CNN that it’s reasonable to downplay recession risk as the catalyst for expected rate cuts.

“This cutting could be different than any other time,” he says, reasoning that looser policy will be driven primarily by inflation moving closer to the Fed’s 2% target.

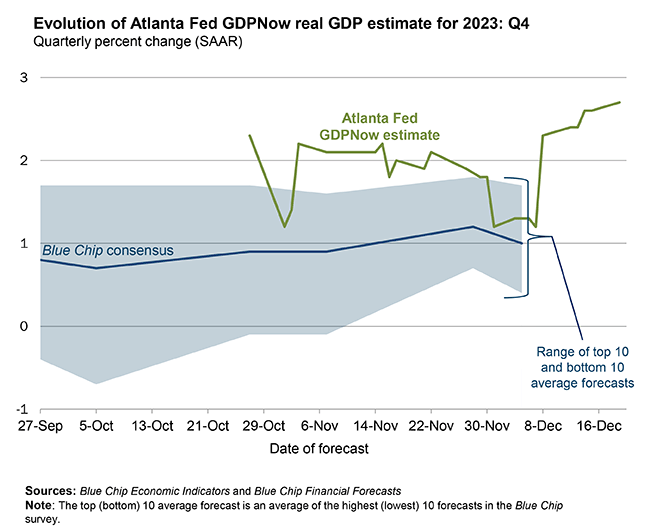

Recession risk certainly looks low, based on yesterday’s fourth-quarter GDP nowcast via the Atlanta Fed’s GDPNow model, which estimates growth at a moderately strong 2.7% real, seasonally adjusted annual rate.

Although that’s well below Q3’s red-hot 5.2% increase, the fact that the Q4 nowcast has strengthened recently, this late in the current quarter, implies a relatively high-confidence estimate for next month’s official GDP report.

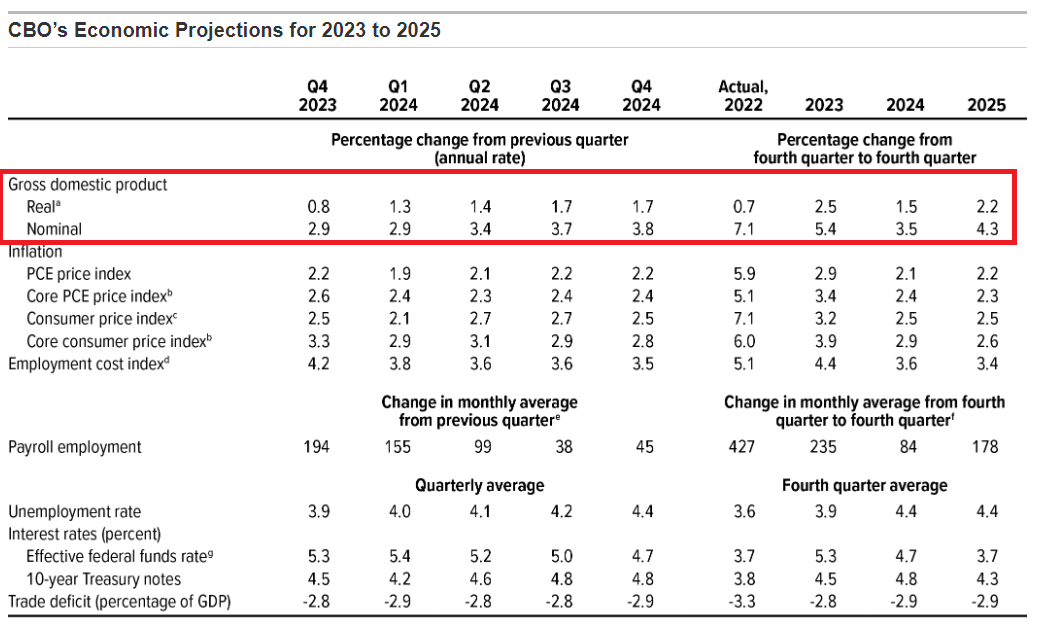

Looking ahead to 2024, the Congressional Budget Office projects that the US economy will slow but still avoid a recession.

The new CBO forecast sees the economy expanding by 1.5% next year, down from 2.5% in 2023. In line with softer growth, interest rates and inflation are also expected to ease in the new year.