By Chaim Siegel of Elazar Advisors, LLC

After speaking to the company, we have a tough time holding our estimates down on Apple (NASDAQ:AAPL). Indeed, we're now expecting earnings that will be better than Street numbers this year. Last quarter's earnings showed a better upside surprise than previous quarters. There are three main drivers we see:

- Much easier comparisons

- Sold out of iPhone 7

- High margin services becoming important

In our view, the combination of these three key factors can keep pushing Apple's stock up. On a valuation basis, the company's shares are close to fairly valued but we think earnings momentum can drive the stock higher anyway.

Getting The Bad Out Of The Way First: The U.S. Dollar

The worst issue we heard from the company's perspective concerned the strength of the dollar. The dollar is up big over the last couple of years. That said, we wanted to see what type of drag it could be going forward.

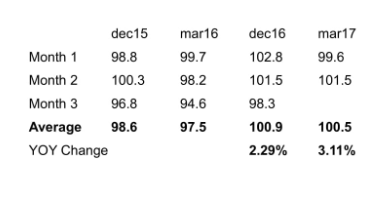

We took the dollar’s closing price of each month of this quarter and last quarter and compared that to the year before.

We noted the dollar comparison between this year’s March quarter versus last year. The dollar fell last year, making the increase in the March quarter this year greater in percentage terms than last quarter. There are more dollar headwinds this quarter than last quarter. That said, if the dollar level holds here, the problem peaks during the March quarter.

Here are the dollar numbers:

Above, month-end prices of the dollar index. The March quarter is only about one percent worse than the December quarter, if the dollar remains where it is. Of course, more headwind is still a headwind, but if 1% is the biggest challenge faced, then things are pretty good for Apple.

Much Easier Sales Comparisons

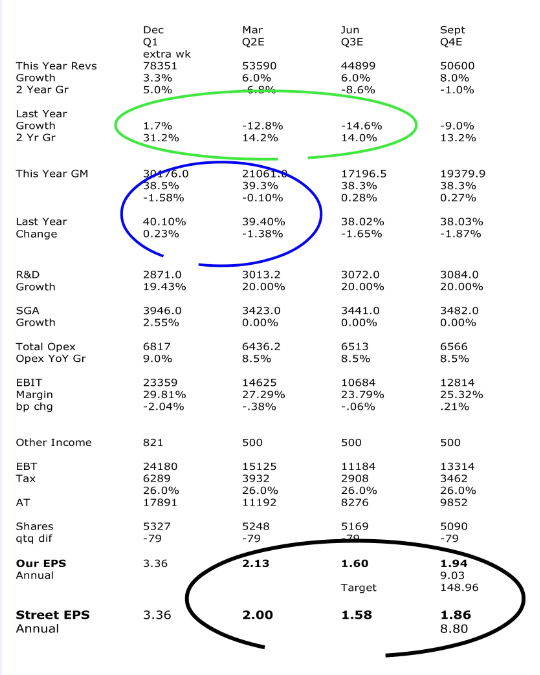

On the model below, we highlighted in green the easier revenue comparisons. From an analysis perspective, it’s one thing to look at this year’s growth rates but we also want to know what we’re up against from last year.

This year’s December quarter actually had tough numbers to 'lap,' meaning compare to the growth rate from the same quarter a year ago. This year’s March quarter has much easier numbers to lap. That can make the “optics” of this year’s results look better.

For example, the one-year growth rate in last year’s December quarter was 1.7%. The March quarter last year dropped off a cliff in comparison, to -12.8%. We now go up against that -12.8%, or almost a 15% easier quarter in March versus December.

The two-year run rate last year also dropped off from December of last year’s 31.2% to March’s 14.2%. This year’s March quarter has a 17% easier comparison when stacking up the last two years.

Given the momentum in iPhone 7 and Services, we think Apple numbers will benefit from those easier comparisons.

You can see on the model, below, that the June quarter also gets easier.

iPhone Units Should Be Strong

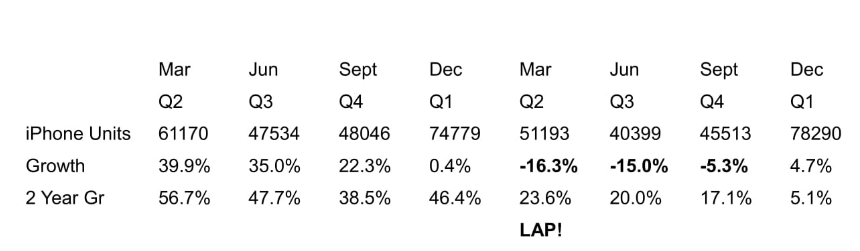

First, looking at iPhone’s comparisons from last year, growth rates are going to be easier to come by based on “easier comps.” (Comps: What we lap.)

This is important because iPhone is currently Apple’s most important product. Easier year-ago comparisons and strong business this year can set us up for strong results in the coming quarters.

Let’s see:

The December quarter just lapped iPhone unit growth of .4%. We now lap -16.3% in the March quarter. This year’s March quarter faces a much easier hurdle to show growth this year. The same holds true for June.

On a two-year basis, December lapped a 46.4% unit growth and now we only lap a 23.6%. This March quarter, on a two-year basis, also gets much easier.

These easy comparisons walk us down a quarterly path that will actually deliver momentum going into Apple's upcoming new iPhone launch, likely in September, probably the iPhone 8.

If the industry and consumer trends show the same current underlying demand, the easier comparisons have the ability to make this year’s reported numbers look better. iPhone growth can accelerate which would fire up a lot of bulls and force a bunch of bears to cover. Sorry about that bears.

Plus, the company is excited about the momentum in 7 and 7+ units, so that could have the ability to continue for another quarter or two, especially against last year’s easier comparisons. Again, that will take us into the iPhone 8 with momentum. Sounds pretty good, right?

Usually you have a pause in growth ahead of a new launch. This time the easier comps soften that pause by “optically” making this year’s numbers look better. Again, sorry bears.

Also if you listen to what management was saying during last quarter’s earnings call, they were hyped up about iPhone demand. They simply couldn’t meet demand. The iPhone is their baby and they can’t keep in-stock positions. For any company you follow, not being able to have enough of something is always a bullish sign. When that something is an iPhone, that's very exciting.

Apple couldn’t meet demand for the iPhone 7 in their largest quarter. Now the coming quarters get smaller so those missed revenues last quarter can occur this quarter. That is also a good setup. Revenues moving from a large December quarter into the company's smaller March quarter can also make numbers look better. Those make-up sales should help reported numbers look better this quarter.

You can't ask for more than a company that is sold out of their main product.

Services Becoming An Important Driver

We heard from bears that Apps growing faster than the overall Services segment means other parts of Services were slower. Who cares? Really.

When Apps are your largest piece of services, and it’s growing fastest, and it has the highest margins, that's a great setup for the Services segment. This is another building, bullish story for Apple.

And how bullish is Apple about Services? Very bullish. They’re very bullish.

How do we know? They were excited enough to provide longer term targets. That’s based on their excitement today. That excitement should translate into strong near-term trends which should justify their confidence, and make it strong enough to offer longer-term targets as well.

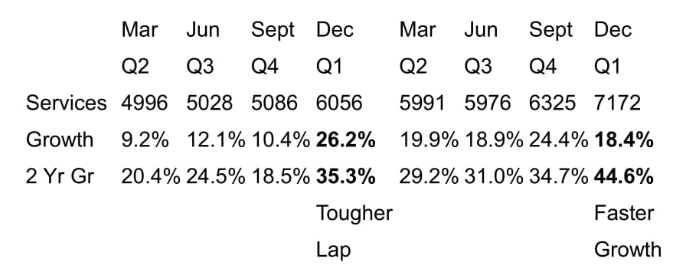

Services proved itself last quarter too. Let’s do the same comparison exercise:

Above you have the Services segment. The December quarter reported 18.4% growth against 26.2% growth and didn’t really slow much. In fact, on a two-year basis, the growth rate accelerated.

We think that’s the reason Apple was confident enough to give longer-term targets. The Services segment started to “comp the comps.” They lapped a bigger number and still managed to keep the growth rate up. They passed the test, so to speak.

The company said they had a 14th week in the quarter versus having 13 weeks normally. So if you want to say the extra week helped during the quarter, that's fair. That would have added about 7% more. Still, the two year run-rate would not have slowed and next quarter has an easier comparison by about that 7% so the trends can continue.

The Services segment is also a much more “linear” business, meaning it doesn’t have as much seasonality as the iPhone. That implies that the March quarter, because it’s a smaller quarter, should see a greater benefit from Services’ high margins and faster growth. That gives us a greater percentage of the March quarter’s revenues exposed to higher margin services. That can help near-term results.

Risks: China

China isn’t really getting out of its own way. The currency is a drag, hurting the company’s units as they need to raise prices to hold margins.

That said, comps here also get much easier. Though when a company is doing poorly, easier comps do not necessarily help. This piece of the business may not benefit from the easier comps, although easier comps can help soften the blow to some degree.

The Rest Of The Earnings Model

Gross Margin Drivers

The dollar is driving some headwinds on pricing. As the dollar goes up, Apple wants to hold margins so they are forced to raise their prices. That is hurting their unit growth.

That said, we did the math on the dollar and it’s not so much worse than when they reported last quarter. Gross margins also start to have much easier comparisons.

On the model, denoted in blue, December lapped a gross margin change of .23%; March has a much easier comparison to last year of -1.38%. That makes this year’s reported numbers easier.

Even though the company is being conservative because of the dollar, that doesn’t really make sense to us. You have easier comparisons and Services growing much faster than the rest of the pie at much higher gross margins. Margins should show some upside to the company’s and the Street’s expectations.

Additional Quarters

Last quarter beat the Street nicely. We have upside for the remaining quarters of this year which can give bulls visibility until the release of the iPhone 8, denoted in black.

What we're seeing is a relay race of good quarters until Apple's next big iPhone release. That’s bullish.

The Model

Valuation And Target

We are more momentum-oriented investors so the upside in earnings and large product lines gets us excited. Having said that, whether we can tack on a 15 or 16x multiple on earnings, we don’t get much upside from the current share price of about $139. The stock is trading at about our earnings for this year with a 15x PE. We need to tack on a 16x PE to next year’s numbers to get 14% upside or $157.

We typically like to see 20% upside before we enter a stock. This stock currently gives us about 10% upside if we average out our targets for this year and next year.

Still, if you're a bull, Apple is worth owning. If you're a bear, be prepared...you may need to cover on good earnings.

If the stock were to drop into the $120s we get closer to our 20% upside and it would also be a better longer-term investment. In the near-term though we think the upward momentum can continue.

Conclusion

The biggest risk we hear from the company is the dollar's strength, which based on our math isn’t that bad. On the plus side you have easier comps in almost all businesses and earnings model line items. You also have their key product, iPhones, selling out. You can’t ask for more.

Additionally, services will now appear more important in smaller quarters, helping the overall margin mix drive earnings. While we can’t get to 20% upside yet, we think there should be enough momentum to keep the bulls happy and the bears covering.

Disclosure: Portions of this article may have been issued in advance to subscribers or clients. All investments have many risks and can lose principal in the short and long term. This article is for information purposes only. By reading this you agree, understand and accept that you take upon yourself all responsibility for all of your investment decisions and to do your own work and hold Elazar Advisors, LLC and their related parties harmless. Any trading strategy can lose money and any investor should understand the risks.