Apple (NASDAQ:AAPL) is the largest holding in Warren Buffett's portfolio. It started a true revolution in technology, and today, it is the world's largest company by market capitalization, with a value of over $2600 billion.

Apple designs, manufactures, and markets mobile media and communications devices, personal computers, and portable digital music players. It also offers a range of software, services, accessories, connected networking solutions, and third-party digital content and applications.

The company's segments are the Americas, Europe, Greater China, Japan, and the rest of Asia-Pacific.

The Americas segment includes both North America and South America. The Europe segment includes European countries, India, the Middle East, and Africa. The Greater China segment includes China, Hong Kong, and Taiwan.

The rest of Asia-Pacific segment includes Australia and Asian countries not included in the company's other operating segments.

Its products and services include iPhone, iPad, Mac, iPod, Apple Watch, Apple TV, a portfolio of professional and consumer software applications, the iPhone OS (iOS), OS X, and watchOS operating systems, iCloud, Apple Pay, and a range of accessories, services, and support.

Data at a Glance

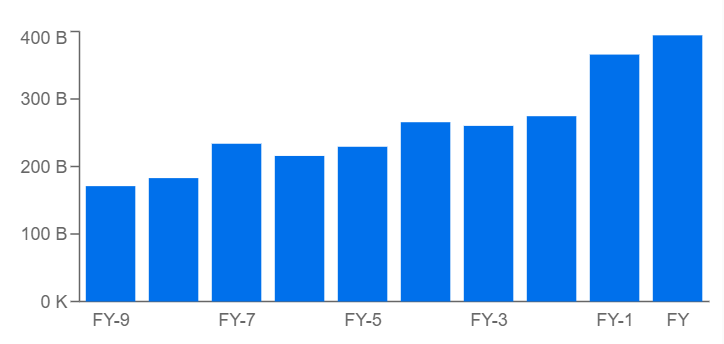

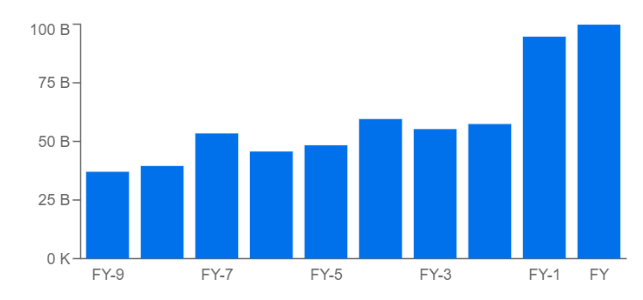

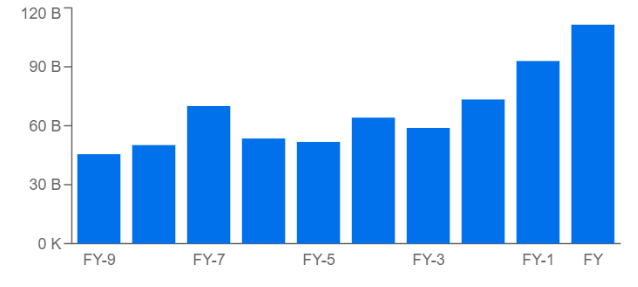

Let's take a look at the historical financial statements using InvestingPro. There are several useful insights we can extract.

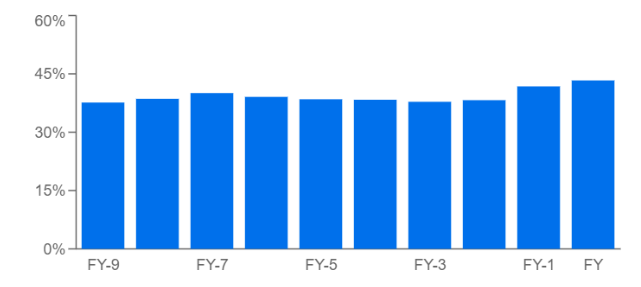

Revenues and profits over time seem to have a very steady upward trend, especially profits. Margins average around 40 percent, also constant over the years, a sign that the company is managing to increase its sales without affecting its margins.

Much of this is due to Apple's competitive advantage over its rivals.

Source: InvestingPro

Source: InvestingPro

Source: InvestingPro

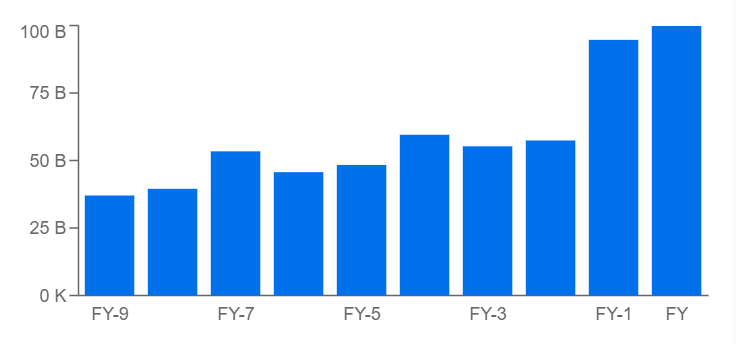

The compound annual growth rate of EPSd (earnings per diluted share) has been 18% over the past 10 years and rising steadily.

Source: InvestingPro

Balance Sheet and Cash Flow

Apple has over $48 billion between cash and short-term investments, for total current assets of around $135 billion, according to InvestingPro. However, compared to current liabilities ($154 billion), this is suboptimal as a short-term balance.

Apple has over $120 billion in long-term investments. The debt-to-equity ratio could also be better, with total liabilities exceeding equity by as much as 6 times.

On the cash flow side, operating cash flow follows a good upward trend on par with earnings, as does free cash flow, as seen below.

Source: InvestingPro

With a free cash flow of $111 billion (the latest available), the FCF yield is about 4.2%. This is positive but not optimal.

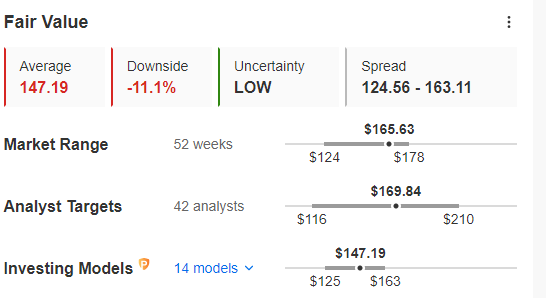

Valuations

The stock is currently more expensive than its fair value at $147 (based on the average of 14 different models available on InvestingPro). Analysts are more optimistic today, with an average target price of $169. This is close to the current value.

Source: InvestingPro

In general, however, the prospects for further growth are still there, despite the current momentum and the entire technology sector being in a period of relative weakness.

So far, it is a good stock, but without any particular discounts. However, the fact that it has been Buffett's main investment for years makes it an attractive long-term investment.

This analysis was conducted using InvestingPro tools.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, consultation, or recommendation to invest and, as such, is not intended to induce the purchase of any assets. I would like to remind you that any investment is evaluated from multiple perspectives and is highly risky; therefore, any investment decision and the associated risk remain with the investor.