Data from Australian credit bureau Experian has revealed enquiries into short-term lending products such as Buy Now, Pay Later (BNPL), credit cards, and personal loans have lifted over the last 12 months.

- Aussies have turned to short-term lending products, with BNPL usage increasing 28% since February last year.

- Credit card enquires have also lifted, increasing 31% since February 2022.

- Despite regulation changes to the BNPL sector, experts predict demand among consumers for these services will remain steady.

Enquiry volumes for BNPL services have increased by 28% in the year since February 2022, as cost of living and interest rate pressures continue to hit consumers’ hip pockets.

After a drop in BNPL enquiry volumes in January 2023, February data shows a lift of 55% month on month.

This is the highest observed figure since the seasonally high retail spending pre-Christmas period of November 2021.

“The lending landscape has changed significantly over the last two years driven by the evolving needs of everyday Australians amidst inflation and other forces,” said Tristan Taylor, Experian General Manager of Credit Services.

“Many Australians with mortgages and loans are likely to be feeling the economic pinch so lenders need to adapt.”

Recent research from open banking provider Frollo also highlighted the growing appetite for BNPL and pay advance services.

Across Frollo’s 31,372 users, 32% accessed BNPL services in the first quarter of 2023, an increase of 7% from the same period last year.

The data found users are also spending 9% more totalling $420 per month.

This comes after Australia’s BNPL industry is set to be regulated under credit laws in a move to ensure consumers remain better protected.

Speaking with Savings.com.au, FIS Banking and Payments Specialist Rob Tesoriero said demand for BNPL is here to stay, despite regulation changes.

“From a consumer perspective, while the number of players in Australia has decreased, customer demand has remained steady,” Mr Tesoriero said.

“While our forecast for BNPL growth is slowing, in no markets do we see demand for this form of credit decreasing.”

Geri Cremin from Credit Smart told the Savings Tip Jar podcast that BNPL is just like any other credit product.

However she said different BNPL platforms interact with reporting differently, which is where credit regulation will level the playing field.

"The current situation is really complex, which is why this conversation is happening around how buy now pay later might be regulated moving forward," Ms Cremin said.

"When it comes to an individual using buy now pay later and how it affects their credit health, lenders will also look at how you're managing your repayments. Buy now pay later repayments are another type of credit repayment, and it goes into the full picture of your credit health when applying for a loan."

Credit cards also getting a workout

Turning to credit cards, enquiry volumes increased 31% since February last year and 54% since February 2021 according to Experian data.

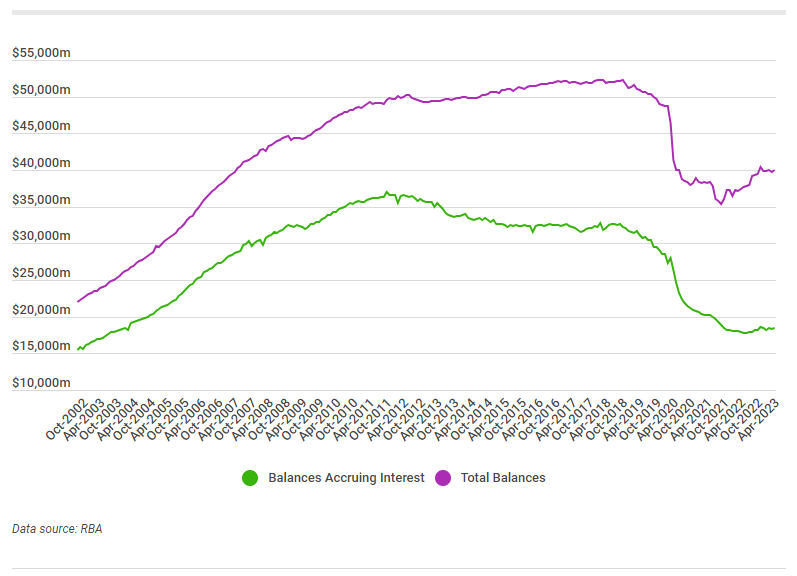

Recent RBA credit card data also showed Australian debt grew to $18.4 billion in April.

Personal loans with Australia’s big-four banks also saw an elevated number of enquiries - 26% in the last 12 months since February 2023.

February this year experienced the second highest number of enquiries for personal loans over the last two years as Australians dealt with eight consecutive months of rate rises.

"Appetite grows for BNPL as cost of living pressures bite" was originally published on Savings.com.au and was republished with permission.