AUD was bashed:

Commodities too:

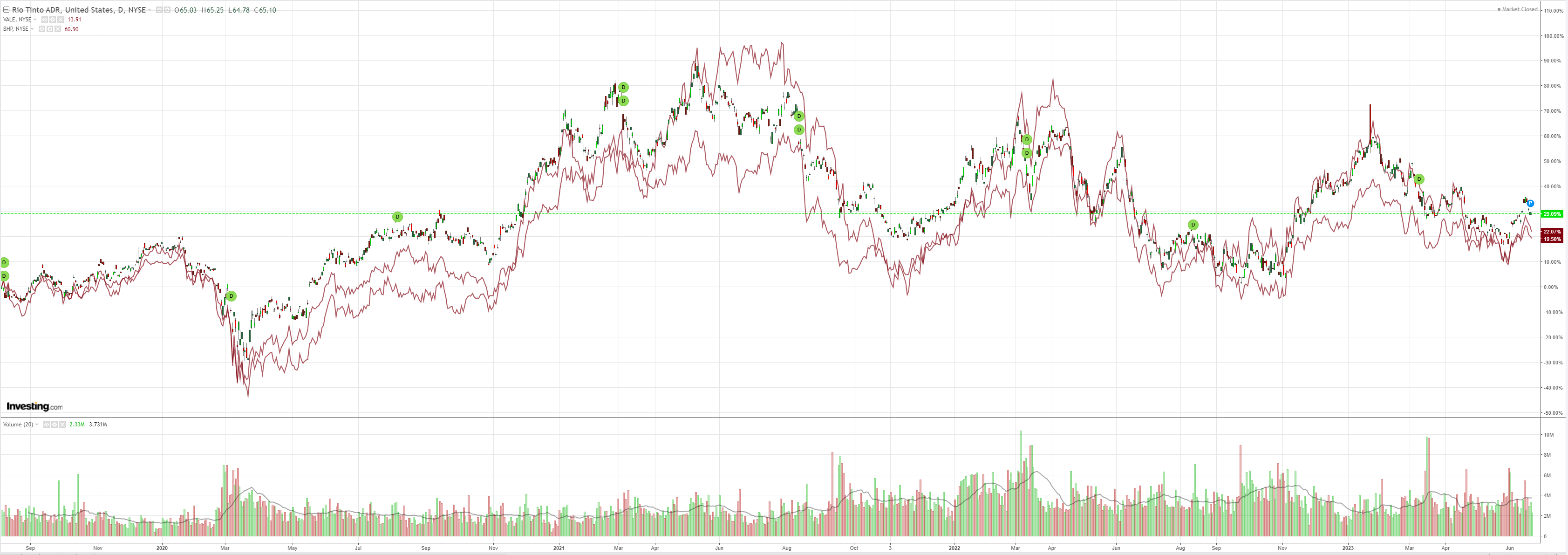

And miners (NYSE:RIO):

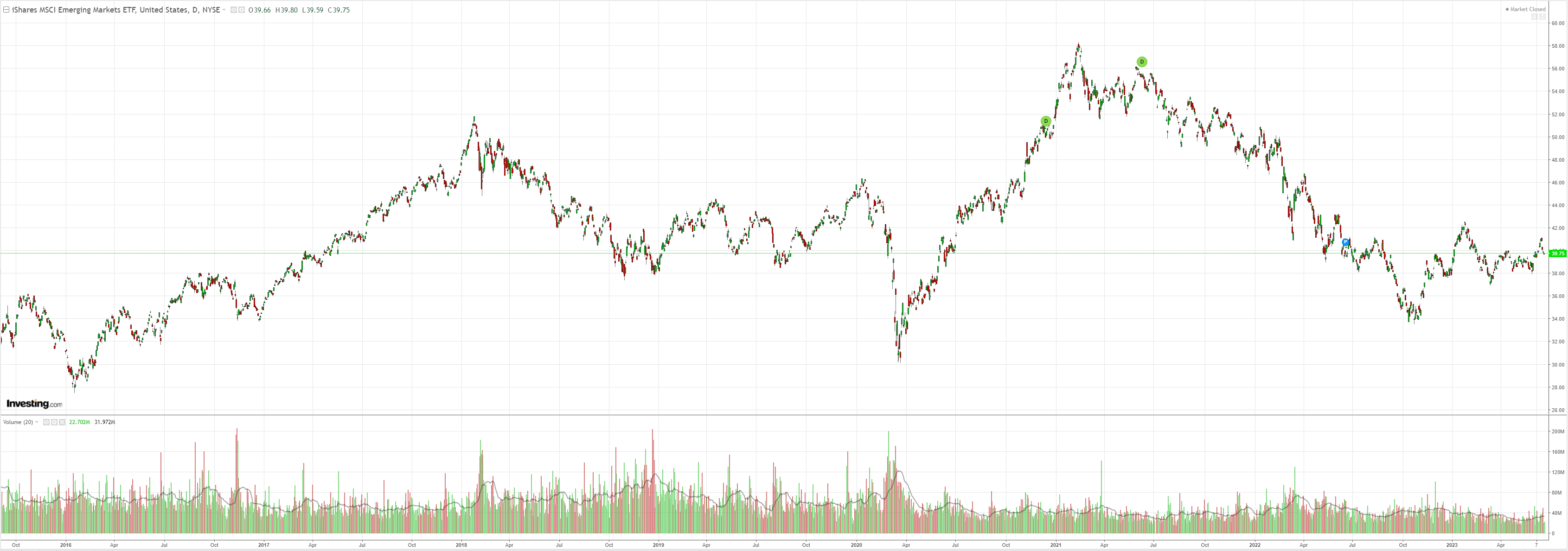

Plus EM (NYSE:EEM):

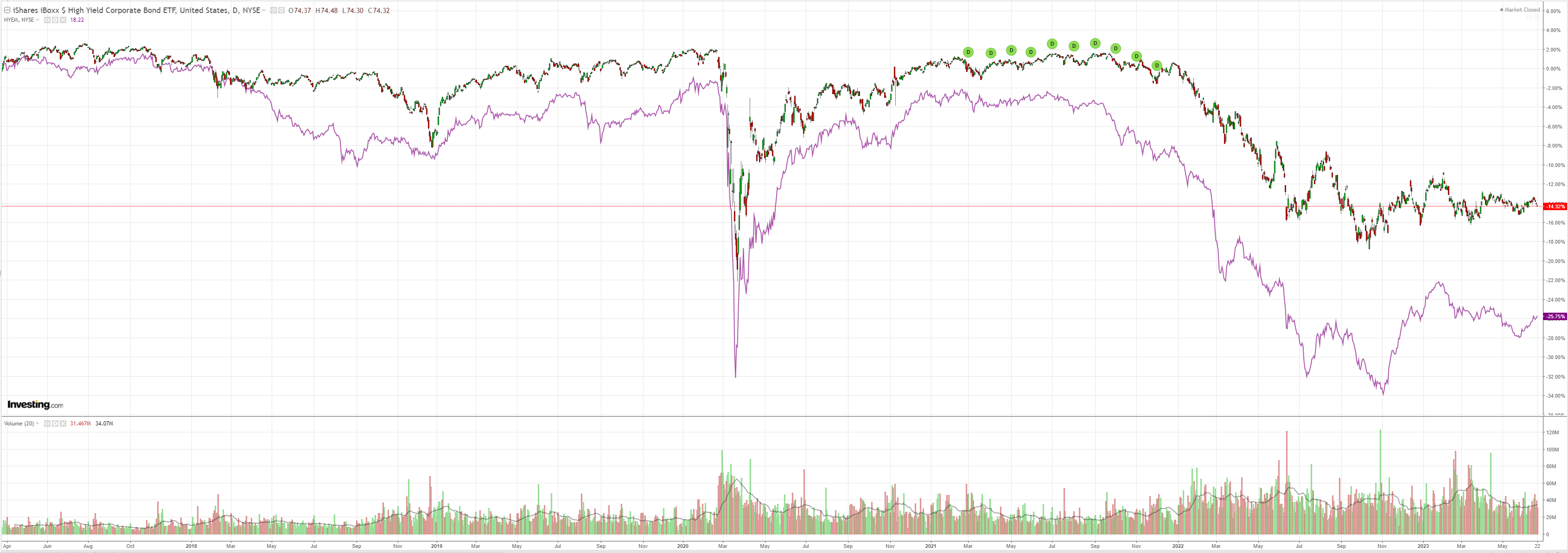

Junk (NYSE:HYG) was mixed:

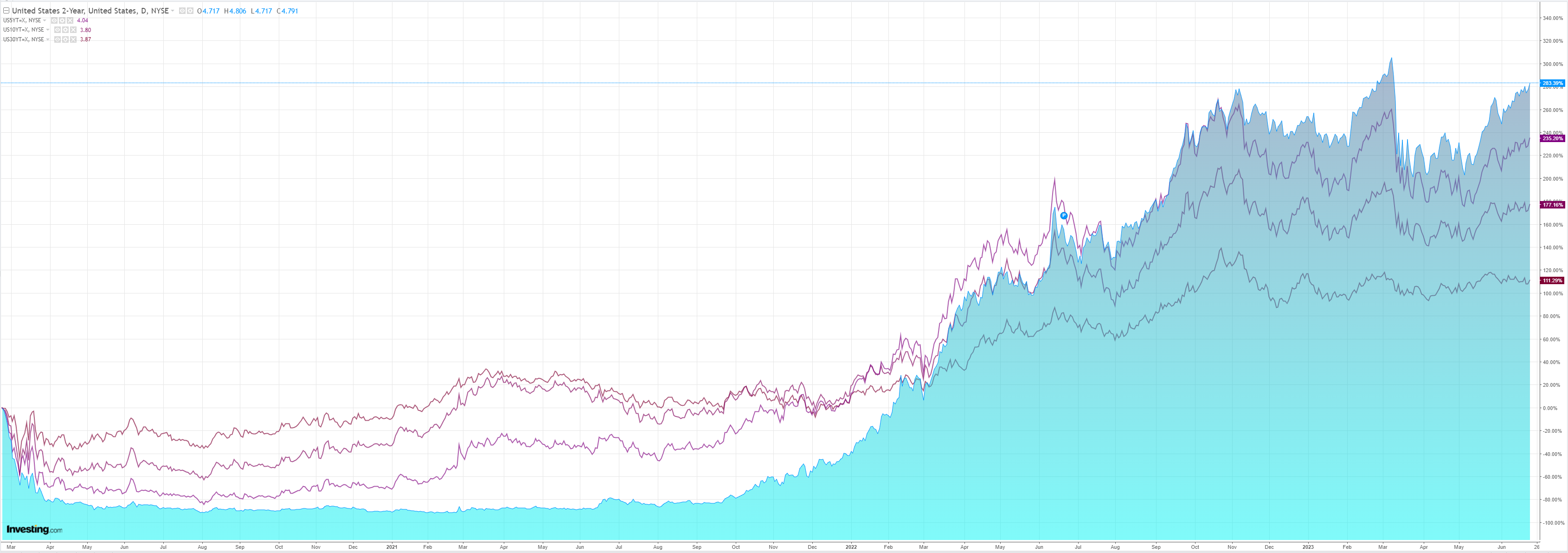

As Treasury yields marched higher:

And AI BTFD!

Very interesting and somewhat sane price action for once. Jay Powell continues his Congress hawkishness which is driving yields higher.

…“it will be appropriate to raise rates again this year, and perhaps twice.”

But the AI bubble is not defeated yet and the colliding dynamics do not work for broader markets.

If an AI boom is imminent then the associated investment and employment flows will be inflationary in the short and medium-term before turning deflationary in the long run.

This will drive the Fed higher as economic activity is sustained via AI investment and AI stock wealth effects on consumption. Most notably in services where disinflationary progress is least evident.

This sets up a creatively destructive AI-real economy tension as the former expands but the latter is choked off by higher rates.

This is where last night’s price action was rational as US banks were smashed:

Another way to put this is that the broadening equity rally of the past few weeks – from Growth like AI into Cyclical Value like banks – does not work. Rates are already real economy restrictive and if the AI bubble drives them even higher then the real economy is going to die.

The Australian dollar is a real economy currency so the AI boom kills it too.