The production increase agreement which came out of last Friday's Vienna meeting of OPEC-non OPEC oil producing countries was largely expected, though the modesty of the increase, beginning next month, surprised markets enough to catapult oil prices significantly higher on the news.

The meeting also solidified the current OPEC power dynamic, as well as which countries and/or individuals are the major beneficiaries of the agreement and which, going forward, have the most to lose.

Return to 100% Compliance but Details Vague

In a statement following the meeting, OPEC said that it would raise output by going back to 100% compliance with previously agreed production curbs, but gave no concrete figures. The cartel also declined to say exactly how much more each member participating the pact would pump.

"As a group we can meet the 100% compliance. As individual countries, it is challenging," said United Arab Emirates Energy Minister and OPEC President Suhail bin Mohammed al-Mazroui said. Saudi Arabia suggested the move would translate into a nominal output rise of around 1 million barrels per day (bpd).

Others saw a more modest increase, with Nigeria's oil minister Emmanuel Ibe Kachikwu saying the end result of the new deal would amount to about 700,000 additional bpd, while Iraq’s energy minister Jabbar Alluaibi estimated that the real increase will be 770,000 bpd.

Under the original deal, set in November 2016 and implemented in January 2017, OPEC, along with other major producing countries led by Russia, agreed to cut their collective production by 1.2 million bpd in order to reduce high global oil stocks and prop up prices. But with OPEC’s compliance reaching an unprecedented 160% in May, the cartel was actually cutting back on about 624,000 barrels of daily oil production more than needed, mainly as a result of unexpected outages in Venezuela, Libya and Angola.

Those outages have effectively brought the supply cuts to more than 2 million bpd in recent months, prompting calls from major consumers, such as the United States, to help reduce the price of crude and avoid a supply shortage.

OPEC and non-OPEC producers will next meet in September to review the current deal. The next formal OPEC meeting is scheduled for December 3 in Vienna.

Given what's currently known about the new oil supply guidelines, the key winners from last week's meeting scored big gains while the losers wind up seriously behind.

Winner #1: Saudi Arabia

It was another masterful performance from Saudi Arabia's influential oil minister, Khalid Al-Falih, who, after a tense few days, managed to reach an eagerly anticipated compromise between the 22 OPEC and non-OPEC producing countries participating in the accord. In a big win for the Saudis, Falih was able to convince his Iranian peer Bijan Zanganeh—who had previously threatened to veto any agreement that would raise output—to support the increase just hours before Friday's OPEC meeting.

But the bigger accomplishment was signing an agreement that did not offer much detail on specific allocations for individual members. That effectively gives a tacit green light to Saudi Arabia, OPEC's de-facto leader, to produce more than currently allowed as part of the deal, as some countries that had suffered production declines would struggle to reach full quotas.

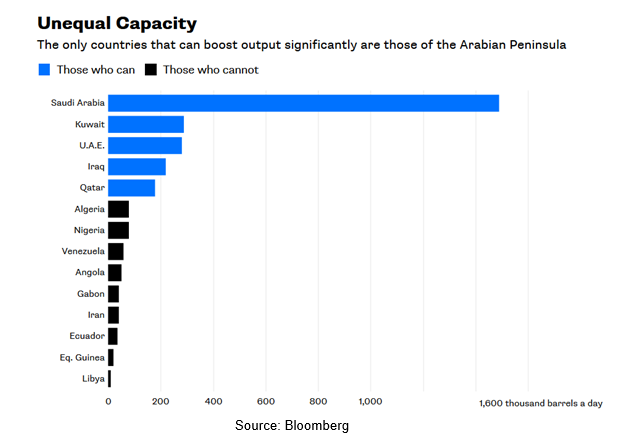

“It is an OPEC group quota, not individual country quotas. That means that the Saudis will be able to make up for the inability of some members, particularly Venezuela, to produce at their previous quota,” said James Williams, energy economist at WTRG Economics. “The lion’s share will come from Saudi Arabia with most of the rest from Kuwait and United Arab Emirates.”

That will allow Riyadh to capture market share at the expense of Iran and Venezuela by pumping more crude. "We already mobilized the Aramco machinery, before coming to Vienna, pre-empting this meeting," Al-Falih said, referring to the Saudi state oil company.

Winner #2: Donald Trump

Ahead of the cartel's meeting last week, U.S. President Donald Trump used his Twitter account to prod OPEC into ramping up production. Trump, perhaps wary of the average U.S. gasoline price hovering near $3 a gallon, has sought to hold OPEC accountable for a recent upswing in oil prices.

appears to have altered its approach to oil production in the wake of the repeated Twitter attacks from Trump.Ahead of the Vienna meeting, the Saudis lobbied hard for other members to fall in line and ramp up crude production—just as Trump wished. Indeed, moments after news broke on Friday that OPEC reached agreement on oil supply quotas, Trump tweeted that he hoped the group would increase production "substantially" to lower prices.

{{%twitter%https://twitter.com/realDonaldTrump/status/1010163024173457409">

Trump, who has shown on a number of occasions that he keeps a close eye on developments in the crude market, has not-so-quietly become the second most important person in global oil markets, second only to Saudi's Al-Falih.

Losers: Iran & Venezuela

Iran, OPEC's third-largest producer and Saudi Arabia's chief regional rival, had unsuccessfully demanded OPEC reject calls from Trump for an increase in oil supply, arguing that he had contributed to a recent rise in prices by imposing sanctions on the Islamic republic and fellow member Venezuela.

Trump slapped fresh sanctions on Tehran in May and market watchers expect Iran's output to drop by a third by the end of 2018. That means the country had little to gain from a deal to raise OPEC output.

Venezuela, another producer which would have preferred to hold back supply, was also left holding the short end of the stick in the wake of the OPEC meeting.

The struggling South American nation has been pumping more than 500,000 bpd below its OPEC target, as output cratered amid a prolonged economic crisis.

A team of HSBC analysts led by Gordon Gray, head of global oil and gas equity research at the bank, said countries like Venezuela, with no spare capacity, are "understandably" against a measure that could pressurize price with no gain for themselves.

Indeed, Iran has objected to having members with additional capacity such as Saudi Arabia fill Venezuelan output gaps.

"They cannot go and say Venezuela has 500,000 bpd on the table and there is no cat to eat this meat, I'm the cat and I will jump on it," Iran's OPEC governor, Hossein Kazempour Ardebili, said Saturday.

According to Kazempour, Venezuela had said its output would partially recover in the next three to four months, another reason why other producers should not step in to compensate.