Expect volatility to ramp up; I don’t care what the headlines say. The implied volatility curve of the S&P 500 looks scary, with lots of sharp twists and turns. The term structure of the S&P 500 is all over the place, and quite frankly, I think it is too low, given the amount of risk in the market surrounding Powell, the jobs report, CPI, and the FOMC over the next three weeks. I’d be shocked if short-dated implied volatility doesn’t rise significantly over the next two weeks.

1. Powell This Week

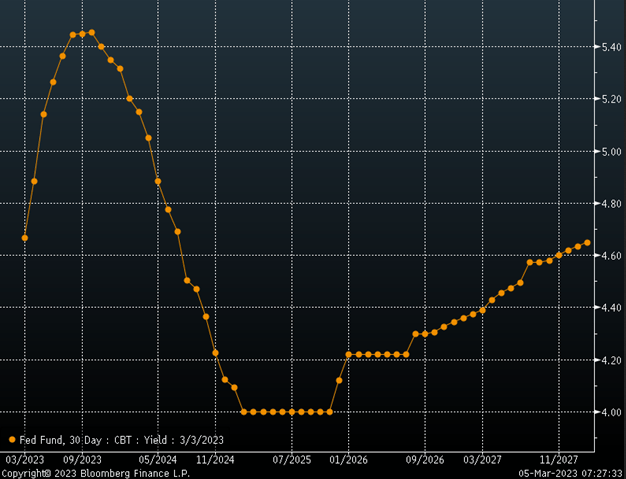

Jay Powell will be in front of Congress on Tuesday and Wednesday this week. This could allow the chairman to preview what’s to come for the March FOMC meeting, but for the most part, it seems unlikely that there will be more than a 25-bps rate hike. However, he could indicate that rates may need to go somewhat higher than what was thought at the December FOMC meeting. What would be more meaningful is if he suggests that rates may need to go above the central tendency of 5.1 to 5.4%.

The market currently sees rates rising to 5.45%, so tough talk from Powell on rate hikes would confirm what the market already sees. Powell isn’t likely to have the ammunition to push rates even higher at this point, as he is likely to stay in data dependency mode. But who knows, this will be the first time we see Powell without Brainard breathing down his neck. With the leader of the Doves no longer on the FOMC, it may encourage Powell to be a bit tougher, especially given the economic resurgence and expectations for inflation to rise.

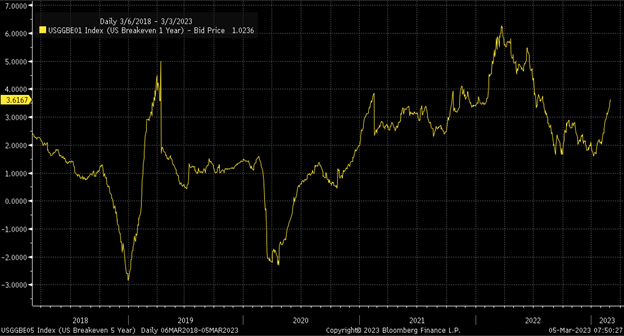

2. Inflation Expectations

One-year breakeven inflation expectations surged this week and reached their highest level since the summer, climbing to 3.66%. This is not a positive sign for where inflation is heading overall and suggests a potential acceleration in CPI in the coming months.

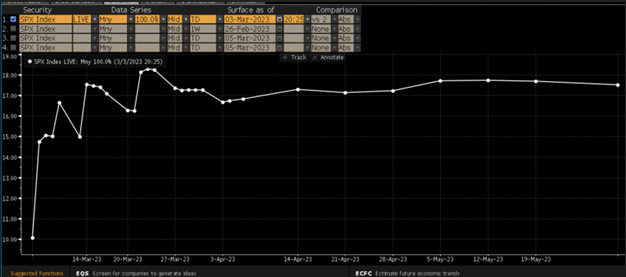

3. S&P 500

Still, stocks rallied this past week, following the word from Atlanta Fed President Bostic, who indicated the Fed could “pause” by mid to late summer. It sounds great, but it would also suggest that we will likely get a 25 bps hike in March, May, June, and possibly July, and then pause. But again, algos aren’t supposed to be wise; they just read for keywords, which sparked a mid-day rally.

The rally carried into Friday. It seems complicated to imagine that a rally sparked by something seemingly insignificant has legs. But given the gap between 4050 and 4080, there should be some pretty good resistance in that region that keeps a lid on things. Could the S&P 500 rally up to around 4,080? Yes, it seems possible. It would also mark the 50% retracement level from the February 2 peak. However, the data should begin to take over by Tuesday or Wednesday. However, the economic data coming in this week will largely determine which way markets go from here.

The jobs report will come on Friday, and expectations are for 215,000 new jobs to have been created, while the unemployment rate is expected to stay at 3.4%, and average hourly earnings increase by 4.7% year-over-year. Rates have been rising in advance of this data point, so it will likely take something hot to keep the upward momentum on the longer end of the curve.

4. 10-Year

For now, the 10-year has hit resistance around 4.1%. A push above 4.1% does set up a retest of the highs and a path for a new high.

5. JPMorgan

JPMorgan (NYSE:JPM) has been trading sideways to higher over the past couple of months. It appears to be in a distribution pattern and a corrective phase of the declines from last year. The stock has almost completed a 61.8% retracement off the lows, which could explain why it has stalled, as momentum trends lower. The bank stocks have been telling us that the economy is not heading toward a recession for some time. However, with a deeply inverted yield curve and rising rates, we have to wonder what the impacts on loan growth and net interest income will be. While banks can undoubtedly earn more money at higher rates, an inverted yield curve may hurt. This is a good proxy for the economy’s health and the overall market. So, a further deterioration in the stock’s performance would be telling. Likewise, a push above $146 could be a positive development for the economy.

6. Procter & Gamble

Procter & Gamble (NYSE:PG) seems like the ultimate gross margin company, and the stock has been hovering around resistance at $141. In an environment of rising prices, a company that can pass on rising costs can expand margins and vice versa. If P&G breaks higher, it could indicate that margins are starting to improve. Right now, it is telling us that margins have not been healthy. Momentum is bearish, and the 200-day moving average will likely offer strong resistance. A rally beyond $142 is positive for S&P 500 margins, while a decline to $123 is negative.

Good luck this week!