- Warren Buffett's unique qualities, including his long-term investment perspective, market detachment, and resilience to drawdowns, underpin his success.

- While many investors get caught up in short-term market fluctuations, Buffett focuses on long-term profitability and doesn't obsess over daily stock price swings.

- Stock holding periods keep getting shorter every year and today's investors can learn a thing or two from the legendary investor

Warren Buffett, often regarded as the greatest investor of all time, has not only endured the test of time but also consistently outperformed the markets throughout his remarkable career.

He's a name that resonates in the world of investments, and for good reason.

Many have attempted to replicate his success, but what sets Buffett apart are his unique qualities. Let's delve into what makes him truly exceptional.

1. Market Detachment: Buffett Doesn't Obsess Over Short-Term Fluctuations in Data or Markets

At one of Berkshire Hathaway's (NYSE:BRKb) numerous annual meetings, when asked how he evaluates specific market moments, Warren's response was crystal clear.

He and his business partner, Charlie Munger, don't base their investment decisions on macroeconomic factors, short-term predictions, or the day-to-day fluctuations of rates, inflation, or GDP.

Their philosophy revolves around investing in profitable businesses with strong long-term potential, not obsessing over stock prices that can swing wildly in the short term.

Now, ask yourself this: How often have you made investment decisions this year based on enticing forecasts about when the Fed will stop raising rates or how much earnings are projected to increase?

It's safe to say that many investors have fallen into this trap.

2. An Unusually Long-Term Perspective

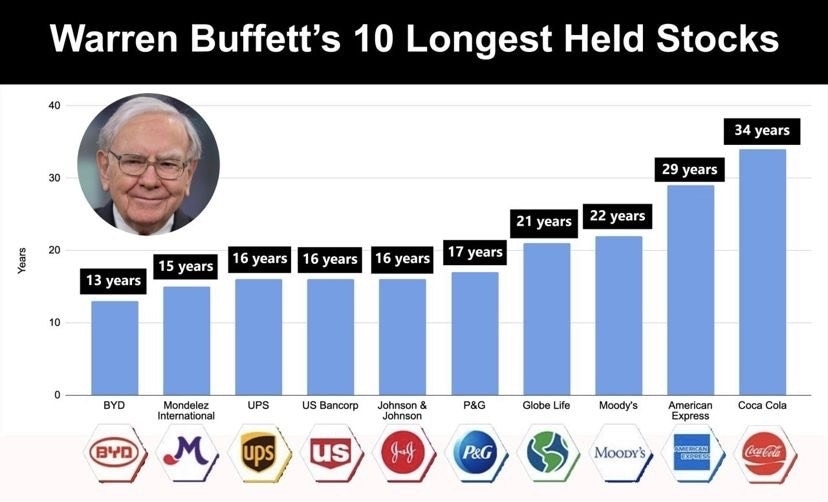

Could you imagine holding a stock in your portfolio for 34 years, enduring the inevitable ups and downs along the way? Warren Buffett certainly can and has. His commitment to long-term investing is remarkable, making it a crucial aspect of his success.

Let's take a closer look at these facets of Buffett's investing philosophy.

When you closely examine Warren Buffett's holdings, such as Apple (NASDAQ:AAPL), which he has held in his portfolio since early 2016, you'll notice that his investment horizon is notably longer than that of the average investor.

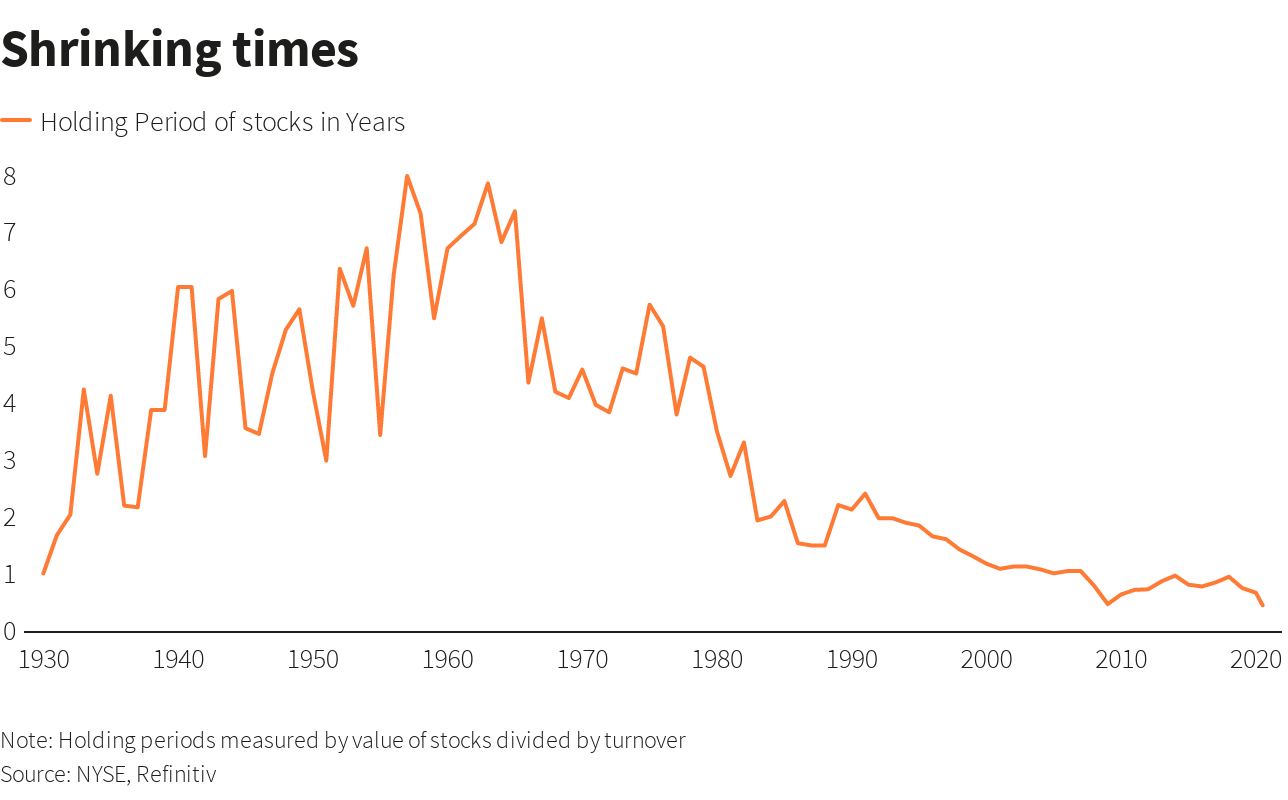

In today's fast-paced financial world, the average holding period for many investors has dwindled to less than a year, in stark contrast to Warren's enduring approach.

Source: Refinitiv

The difference in why he makes money and others do not can largely be explained by comparing the graphs above.

3. Resilience to Drawdowns

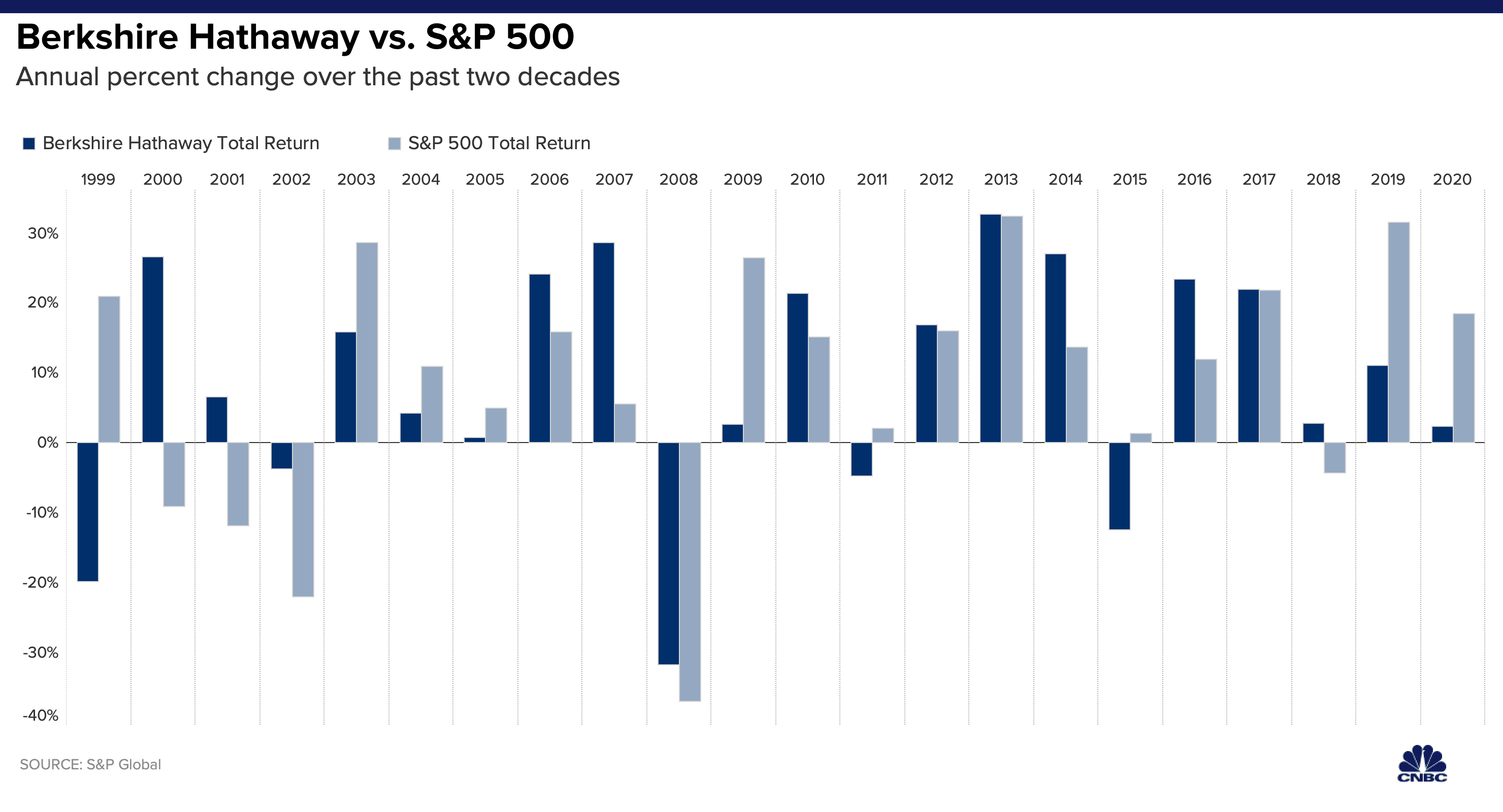

Warren Buffett, at over 90 years old, has weathered a multitude of challenging market periods. The Bear Market '73/74, the Dotcom bubble, the Subprime crisis, the Covid pandemic, just to name a few.

Source: S&P Global

The worst period was probably the one related to the subprime crisis, with a drop of more than 30% in 2008, and a Maximum drawdown probably greater. Most investors exit the markets after a 5 or 10% drop, let alone a 35-40% drop.

The ability to withstand declines is a key characteristic of a good investor, and in his case, since the time horizon is as seen above, it is not surprising that while other investors panic, he is happy to buy at better prices.

4. Buying When There Is Blood in the Streets

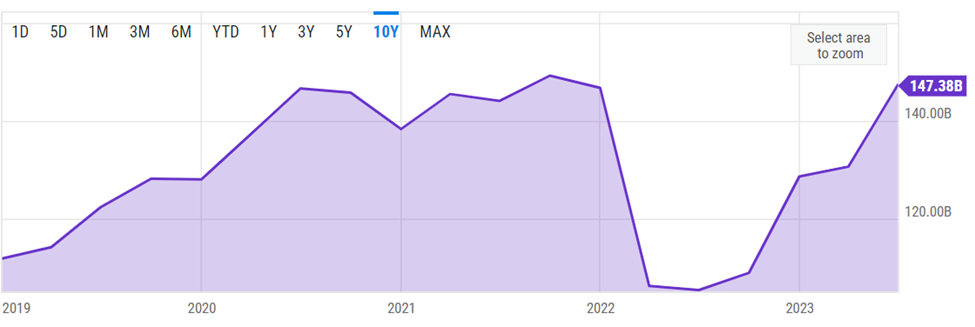

Without wishing to go too far back in time, how many of you (again, you don't have to answer to me, but to yourselves) bought stocks or bonds in 2022 on falling markets?

And how many of you instead sold at a loss, worried that it could get even worse, of deed losing the recovery (not total but almost) of 2023?

Warren Buffett in each of his interviews always shows his preference in steeply falling markets, because that way you buy better (of course, carefully selected good businesses with correct horizons).

In fact, looking at the image above, we can see that his cash holdings fell sharply in 2022 (markets fall he buys) and then rose again during 2023.

So the opposite of what investors normally do, which is to buy on the highs (when risk is higher and expected returns are poor) and sell on the lows (when the opposite occurs).

So again, no one I think will be able to replicate Warren Buffett, what we can do is to take a cue from his behaviors and try to make the most of them, with the humility of knowing that everyone is different, and no one like him.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.