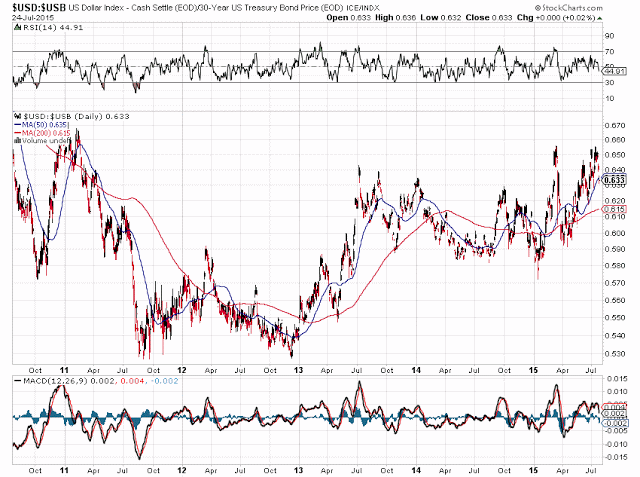

The following 1-Year Daily chart of 30-Year U.S. Bonds (USB) shows that a bearish moving average Death Cross has recently formed — warning that lower prices may be in store. However, the rising RSI indicates building strength from May through July.

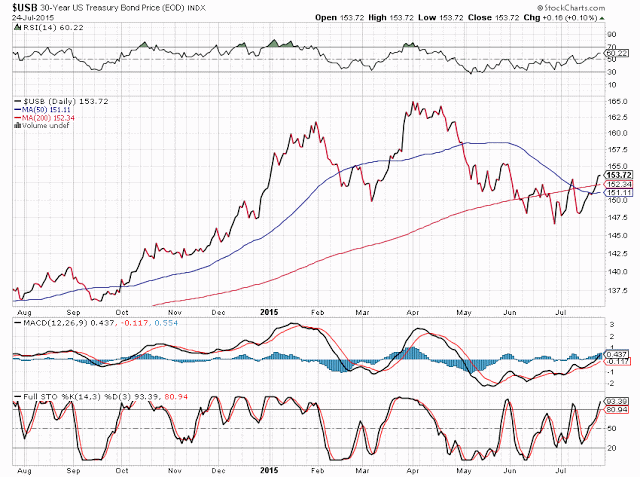

Near-term major resistance lies at 155.00, while longer-term major support sits at 150.00, as shown on the following 5-Year Daily chart. We may see a price break through both sides of this 150.00-155.00 consolidation zone before market participants make a final decision "for" or "against" this bond...watch to see which side of 50.00 the RSI either aligns with, or diverges from. That final choice will confirm sustainability future direction.

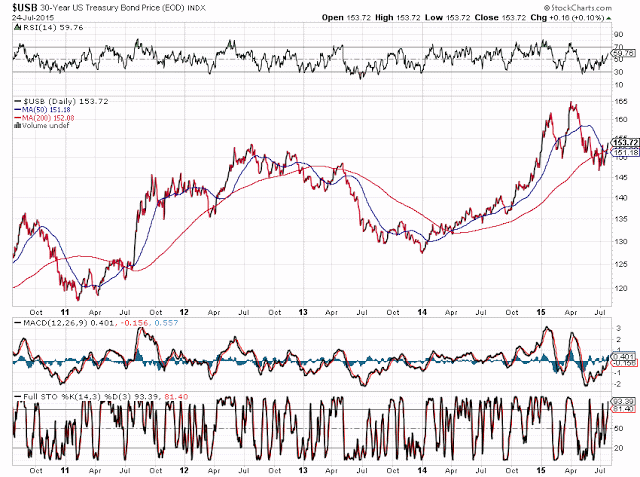

The key to direction may lie in how well the U.S. dollar performs in the near-term. The following 5-Year Daily chart of the USD compares price action to USB.

Price has, basically, moved in tandem on both of these instruments since mid-2013. The RSI is still in an uptrend from May and above the 50.00 level on the USD, and major price resistance lies at 98.00.

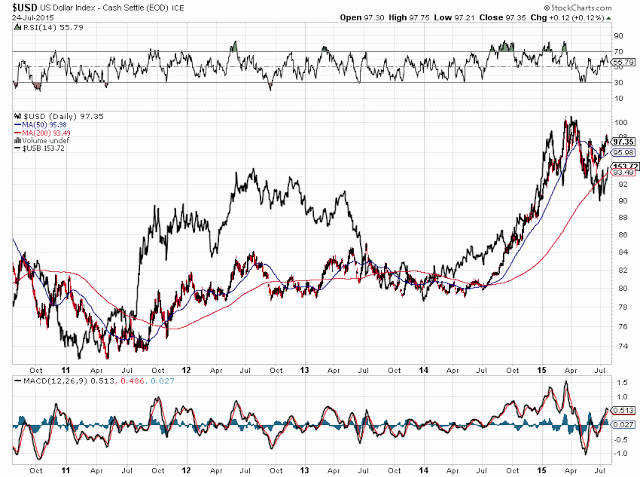

However, the following 5-Year Daily ratio chart of USD:USB shows that, recent attempts by the USD to break and hold above the 98.00 price level have been futile, while buying has strengthened each time in USB. I'd watch the 0.630 major support level on this chart to see if the U.S. dollar can regain a bullish bias...a breakout and hold above 0.660, together with a move on the RSI back above the 50.00 level would reinforce that scenario.