- The stock market continues its rally to new highs amid the hype surrounding the business potential of AI.

- The Nasdaq is set to join the S&P 500 and Dow Jones Industrial Average in record territory for the first time in more than two years.

- As such, investors could consider adding the three stocks analyzed in this article.

- Looking for more actionable trade ideas? Join InvestingPro for under $9 a month for a limited time only and never miss another bull market by not knowing which stocks to buy!

The rally in tech stocks is showing no signs of slowing down as investors continue to pile into the sector due to the nonstop buzz related to artificial intelligence (AI).

Coming into Friday’s session, the tech-heavy Nasdaq Composite, which has gained 40% in the last 12 months, now stands within striking distance of its all-time closing high of 16,057 set back in November 2021. Source: Investing.com

Source: Investing.com

But despite the index's mighty gain, savvy investors are well aware that indiscriminate investment in fast-growth stocks does not always ensure success, particularly taking into consideration the tech industry's high volatility.

This is where our flagship AI-powered stock-picking tool, ProPicks, can prove a game-changer.

For just under $9 dollars a month, ProPicks gives you 70+ winners on a monthly basis. Subscribe now and never miss another bull market again!

Now, let's take a look at three compelling options worth considering as the Nasdaq looks set to extend its rally to a new record amid the ongoing AI frenzy on Wall Street.

1. Salesforce

Salesforce (NYSE:CRM), a leader in cloud-based customer relationship management (CRM) solutions, has been at the forefront of digital transformation in recent years.

With its innovative suite of products and services, Salesforce empowers organizations to better connect with customers, streamline operations, and drive growth.

As businesses increasingly prioritize digital engagement and data-driven decision-making, Salesforce's AI-driven CRM platform, Einstein, positions the company for continued success in a rapidly evolving market.

Taking that into account, Salesforce is poised to grow its profit and revenue in the year ahead thanks to robust demand for its CRM tools as well as the positive impact of ongoing cost-cutting measures.

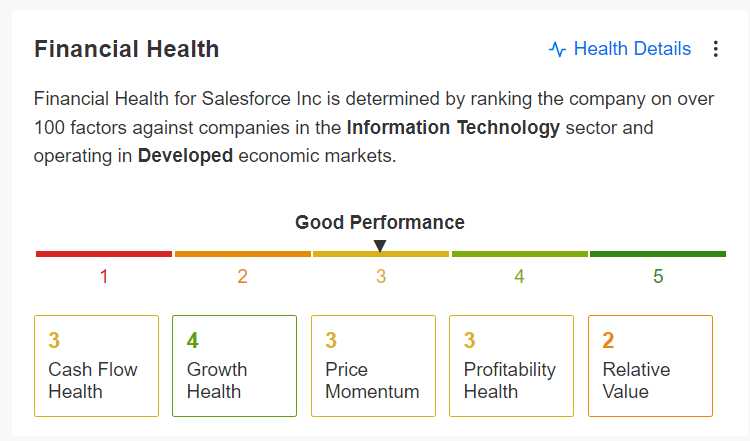

Source: InvestingPro

As seen above, InvestingPro paints a mostly positive picture of Salesforce’s financial health, highlighting its robust outlook for profit, sales, net income, and cash flow growth.

CRM stock ended Thursday’s session at $293.54, its highest closing price since November 29, 2021.

At current levels, Salesforce has a market cap of $284.2 billion, earning it the status as the most valuable cloud-based software company in the world.

Shares have gained roughly 79% during the last 12 months, rising alongside much of the tech sector.

Despite its strong performance, Salesforce stock is still undervalued according to the quantitative models in InvestingPro and could see an increase of 11.7% from current levels.

Source: InvestingPro

That would bring CRM closer to its ‘Fair Value’ price target of about $328.

2. Adobe

Adobe (NASDAQ:ADBE), renowned for its creative software offerings and digital experience solutions, has established itself as a cornerstone of the digital economy.

From Photoshop and Illustrator to Adobe Experience Cloud, the company's suite of products enables creatives and marketers to deliver compelling digital content.

With the integration of AI and machine learning technologies through Adobe Sensei, Adobe is poised to capitalize on the growing demand for personalized and data-driven marketing solutions in an increasingly digital world.

As such, Adobe's innovative software solutions and strong foothold in creative and digital marketing tools will likely continue to drive shares higher in the year ahead amid increasing demand for digital content creation and marketing solutions.

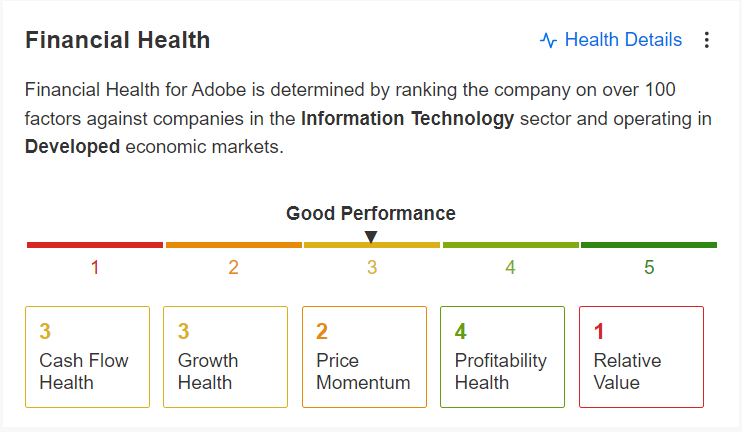

Demonstrating the strength of its business, InvestingPro points out that Adobe is in good financial health condition thanks to strong earnings and revenue growth prospects, combined with its impressive gross margins.

Source: InvestingPro

Adobe looks poised for further gains as the current operating environment fuels demand for its wide array of subscription-based digital media and marketing software tools.

It should be mentioned that Adobe is a strong buy recommendation according to the quantitative models in InvestingPro, which point to a gain of 11.4% in ADBE stock in the next 12 months.

Source: InvestingPro

As can be seen above, such a move would take shares to $599.10 from last night’s closing price of $537.57.

3. Dell Technologies

Dell Technologies (NYSE:DELL)' diversified portfolio spanning hardware, software, and services positions it well for future growth. Its ability to adapt to changing technology trends and deliver comprehensive solutions allows it to cater to a wide range of enterprise needs.

With the cybersecurity landscape evolving rapidly, Dell has been making strides in leveraging AI and machine learning across its product portfolio to optimize performance and deliver transformative technology solutions for businesses of all sizes.

As the shift towards hybrid cloud environments accelerates, Dell is set to benefit from strong demand for its end-to-end hardware infrastructure services and cybersecurity solutions.

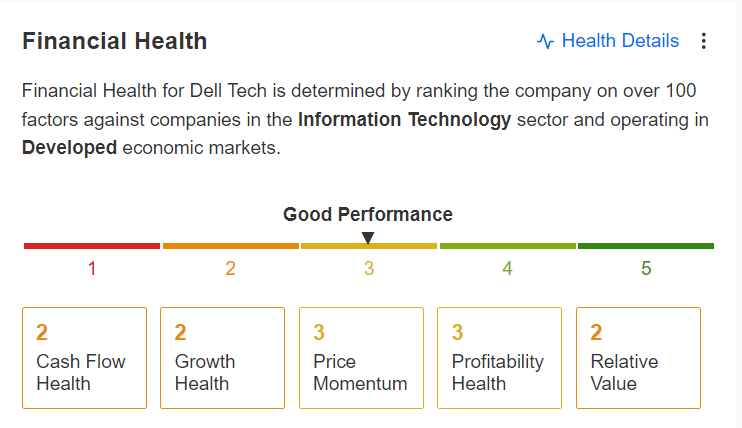

Source: InvestingPro

InvestingPro points out Dell’s strong financial position and diversified product portfolio as two factors that are likely to continue driving its stock to new heights.

In addition, Dell offers investors an annualized dividend payout of $1.48 per share at a yield of 1.69%, one of the highest in the information technology sector.

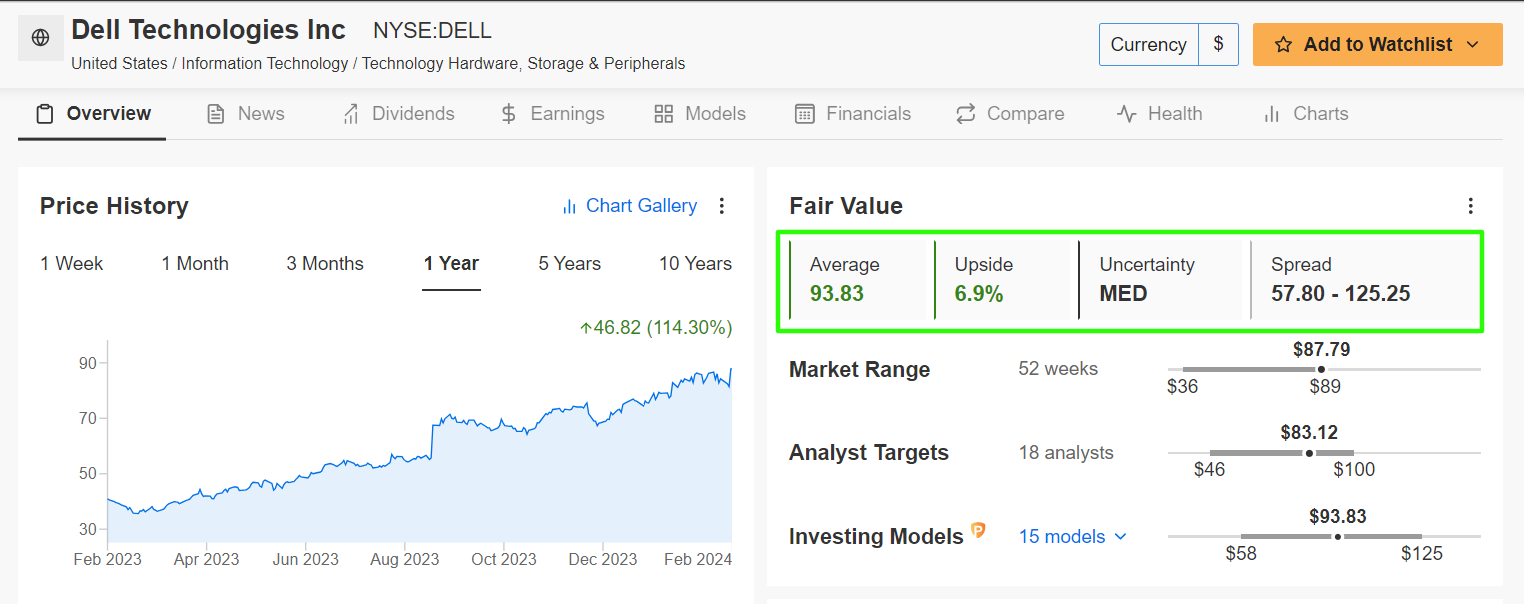

DELL stock closed at a new record peak of $87.79 on Thursday, earning the maker of IT hardware and infrastructure technology a valuation of $62 billion.

Shares have more than doubled in the past year, surging 114% amid the furious rally in the tech sector.

Even with the recent upswing, Dell presents an affordable opportunity for investors seeking exposure to tech amid the growing excitement over AI business prospects.

Source: InvestingPro

Currently trading at a bargain according to several valuation models on InvestingPro, the ‘Fair Value’ price target for DELL stands at nearly $94, a potential upside of 6.9% from the current market value.

***

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. As with any investment, it's crucial to research extensively before making any decisions.

InvestingPro empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

Readers of this article enjoy an extra 10% discount on the yearly and bi-yearly plans with the coupon codes PROTIPS2024 (yearly) and PROTIPS20242 (bi-yearly).

Subscribe here and never miss a bull market again!

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY (NYSE:SPY)), and the Invesco QQQ Trust ETF (NASDAQ:QQQ). I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.