By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

The U.S. dollar ended the day higher against most of the major currencies but what’s notable is that the greenback shrugged off Fed Chair Janet Yellen’s hawkish comments. In contrast to her less enthusiastic peers, Yellen believed that the Fed should be wary of moving too gradually. She felt that persistently easy policy can hurt financial stability and she sees risks of the economy overheating without modest hikes over time. Rate-hike expectations increased following her speech but after an initial rally, Treasury yields and the U.S. dollar descended from their highs. Part of the retracement in the greenback had to do with the more relaxed comments from Fed President and FOMC voters Kashkari, Dudley and Evans but ultimately the next time the Fed is expected to raise rates is in December and between now and then, a number of other central banks could take steps first, making their currencies more attractive than the dollar. At the same time, Tuesday’s U.S. economic reports were disappointing with new home sales falling -3.4% and the consumer confidence index dropping to 119.8 in September from 122.9. Wednesday’s durable goods and pending home sales reports are not expected to have much impact on the greenback. Instead, President Trump’s “big tax plan announcement” along with the speeches from Bullard and Brainard will be more important. The dollar usually rises when Trump talks tax cuts and unlike his prior speeches, a more concrete framework for tax reform is expected and according to the President, taxes will be cut tremendously for the middle class. So while USD/JPY eased off its high today, we would not be surprised to see another run for 112.50.

The EUR/USD dropped as low as 1.1757 before bouncing to end the NY session closer to 1.18. With no major economic reports on the calendar and no new political developments in Germany, the currency traded exclusively on the market’s appetite for risk and U.S. dollars. However its inability to fall beyond 1.1757 and its resilience throughout the North American trading session is a sign that investors have their eyes on the prize – that is, the ECB is still widely expected to announce plans to reduce its balance sheet in less than 2 weeks. This imminent change overshadowed the Fed’s potential move in December and helped EUR/USD rise from its lows. Yet we still believe there could be another leg lower and a potential break of 1.1750 if the market gets excited about Trump’s tax-reform plans. However the EUR/USD won’t fall by much as buyers are likely to swoop in between 1.17 and 1.1750.

Aside from the U.S. dollar, the commodity currencies will be in focus Wednesday with a speech from Bank of Canada Governor Poloz and a Reserve Bank of New Zealand monetary policy announcement on the calendar. The Canadian dollar was the only currency that outperformed the greenback Tuesday. The loonie soared after Finance Minister Morneau said Canada can continue to do well at these dollar levels and higher interest rates are expected given the performance of the economy. Many view these hawkish comments as a precursor to Poloz’s speech on Wednesday. After raising interest rates twice this year, the BoC is widely expected to hike a third time. Since the BoC last met, oil prices have shot sharply higher and the Fed reinforced its plans to raise interest rates one more time this year, giving the BoC the flexibility to tighten. After 10 straight days with no losses, we’ve finally seen USD/CAD pullback and a deeper correction below 1.2300 is likely if Poloz reaffirms the central bank’s hawkish bias. Technically, USD/CAD has found firm resistance at the 200-period SMA on the 4-hour chart. The next stop should be the 50-period SMA near 1.2292.

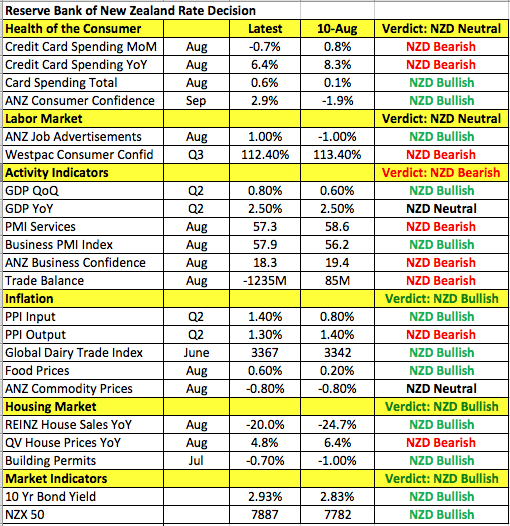

The New Zealand dollar is down sharply ahead of Wednesday’s monetary policy announcement. With the government in flux after the latest election, the Reserve Bank has every reason to wait and see who leads the country before signaling plans to change monetary policy. The last we heard from the central bank, it did not share the enthusiasm of its peers. Instead, the RBNZ expressed concerns about the strong currency and said it was very neutral on rates. Since then, we’ve seen both improvements and deterioration in the economy. Inflation and housing activity ticked up but credit card spending and service-sector activity slowed. The country’s trade surplus also turned into the largest deficit in almost a year as imports surged and exports slowed. The currency is trading marginally weaker. Taking all of this into consideration, there hasn’t been enough improvement or deterioration for the RBNZ to change its guidance and if it maintains a cautious outlook, the New Zealand dollar will continue to sell off against currencies where rate hikes are anticipated.

With no major economic reports released from Australia and the U.K., both currencies traded lower against the U.S. dollar. AUD mirrored the losses of NZD and fell to its lowest level in more than a month while sterling eased lower for the third day in a row. 1.35 is an important support level for GBP/USD because if it breaks, the next stop could be 1.32. For AUD/USD, support is right above 78 cents. The main focus for the U.K. this week will be Bank of England Governor Carney’s speech on Thursday. Australia has no major economic events on the calendar.