- Wall Street’s Q3 earnings season shifts into high gear as investors brace for quarterly results from the megacap tech companies.

- While most of the focus will be on the FAAMG group of stocks, there are several tech gems poised to deliver robust earnings and sales growth.

- As such, investors should consider adding Arista Networks, Fortinet, and AppLovin to their portfolio ahead of their respective results.

- Looking for more actionable trade ideas? Unlock access to InvestingPro for less than $8 a month!

With FAAMG stocks like Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), Alphabet (NASDAQ:GOOGL), Amazon (NASDAQ:AMZN), and Meta Platforms (NASDAQ:META) often dominating the tech landscape, it’s easy to overlook some lesser-known but high-potential companies set to deliver impressive results.

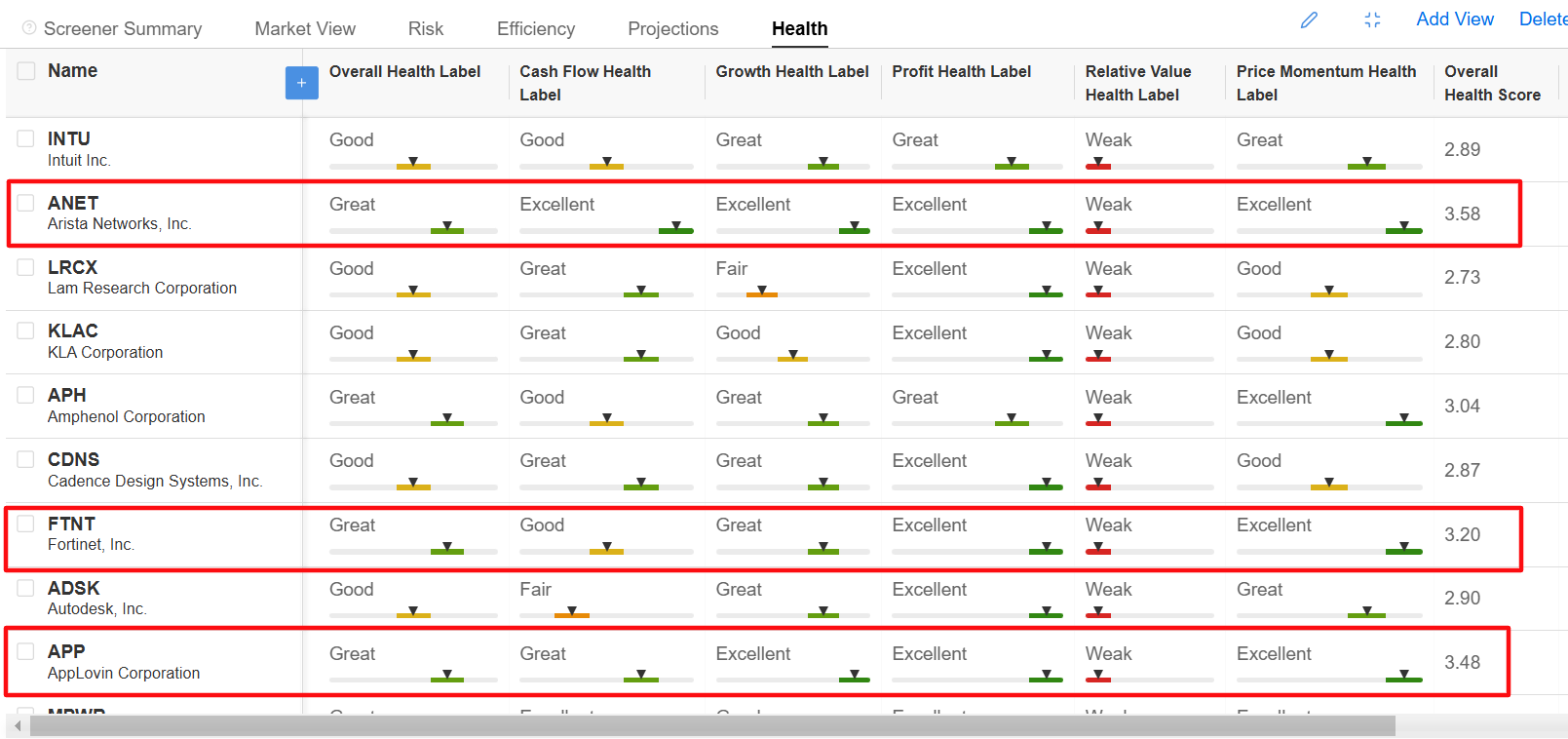

Using the InvestingPro Technology Gems screener, three promising players stand out: Arista Networks (NYSE:ANET), Fortinet (NASDAQ:FTNT), and AppLovin (NASDAQ:APP).

Source: InvestingPro

All three tech companies are expected to report strong double-digit growth in both earnings and revenue, powered by rising demand and innovative product offerings. Furthermore, analysts have notably revised EPS and revenue estimates upward for each, with market optimism high ahead of their earnings releases.

Let's delve deeper into what makes these three tech stocks compelling opportunities for investors.

1. Arista Networks

Arista Networks, known for its advanced cloud networking solutions, has been a favorite among analysts this quarter. The company has carved a niche with its innovative solutions in the networking technology sector and has been successful in grabbing market share from chief rivals Cisco Systems (NASDAQ:CSCO) and Juniper Networks (NYSE:JNPR).

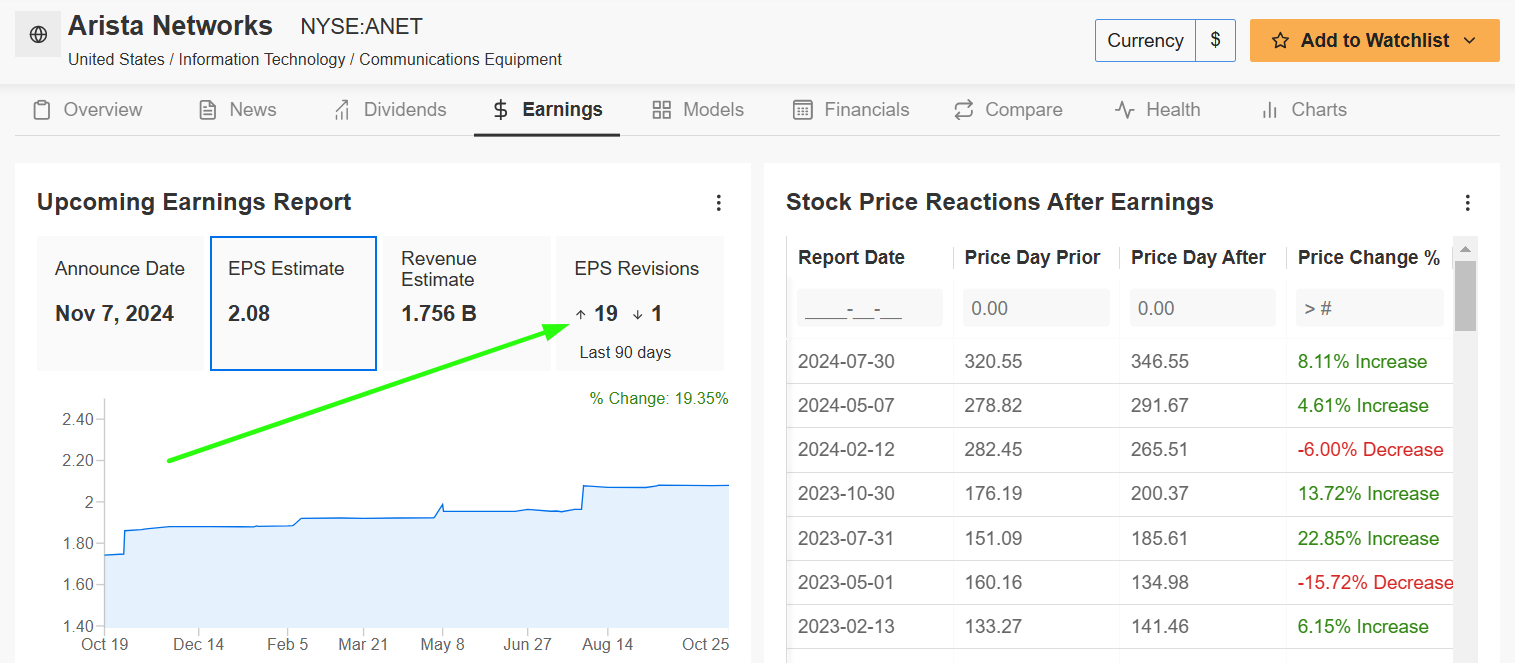

Source: InvestingPro

Not surprisingly, profit estimates have seen 19 upward revisions in the past 90 days, as per data from InvestingPro, compared to just one downward revision.

Consensus forecasts point to another quarter of solid double-digit sales and EPS growth, and analysts are also expecting optimistic guidance from management, supported by long-term contracts and a strong order backlog.

Tailwinds for Arista include a rapid increase in data center spending, especially as companies ramp up cloud and AI investments. Its biggest customers are Microsoft and Facebook-parent Meta Platforms. Newer customers include Google-parent Alphabet as well as Oracle (NYSE:ORCL).

With this demand expected to stay robust, Arista is on track to easily surpass revenue expectations.

Source: Investing.com

ANET stock closed at $401.57 on Tuesday, not far from a recent all-time high of $422.73 reached on October 14. At current levels, the Santa Clara, California-based company has a market cap of $126 billion.

In terms of performance, Arista Networks has outpaced the broader market by a wide margin in 2024, with its stock rallying +70.5% year-to-date.

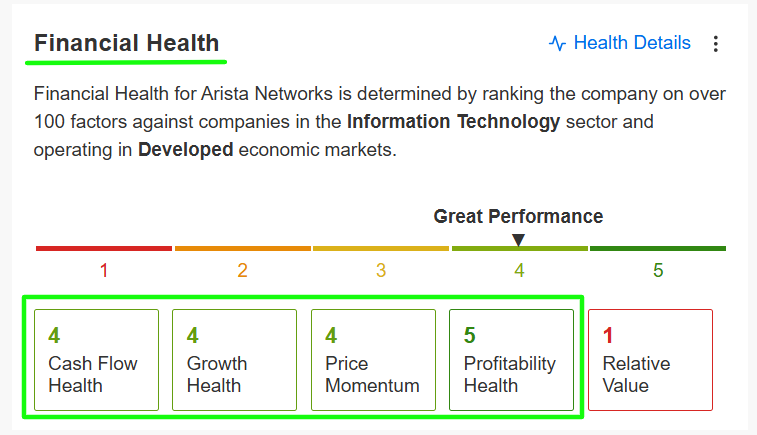

Source: InvestingPro

Demonstrating the strength and resilience of its business, the networking-infrastructure company sports a near-perfect InvestingPro Financial Health Score of 4.0 out of 5.0 thanks to its strong earnings and sales growth trajectory.

2. Fortinet

Fortinet, a leading provider of cybersecurity solutions, has been in high demand as companies prioritize cybersecurity spending in the face of a growing number of cyber threats.

The company’s integrated security fabric—comprising firewalls, SD-WAN, endpoint protection, and other advanced security measures—has established Fortinet as a go-to solution for comprehensive network protection.

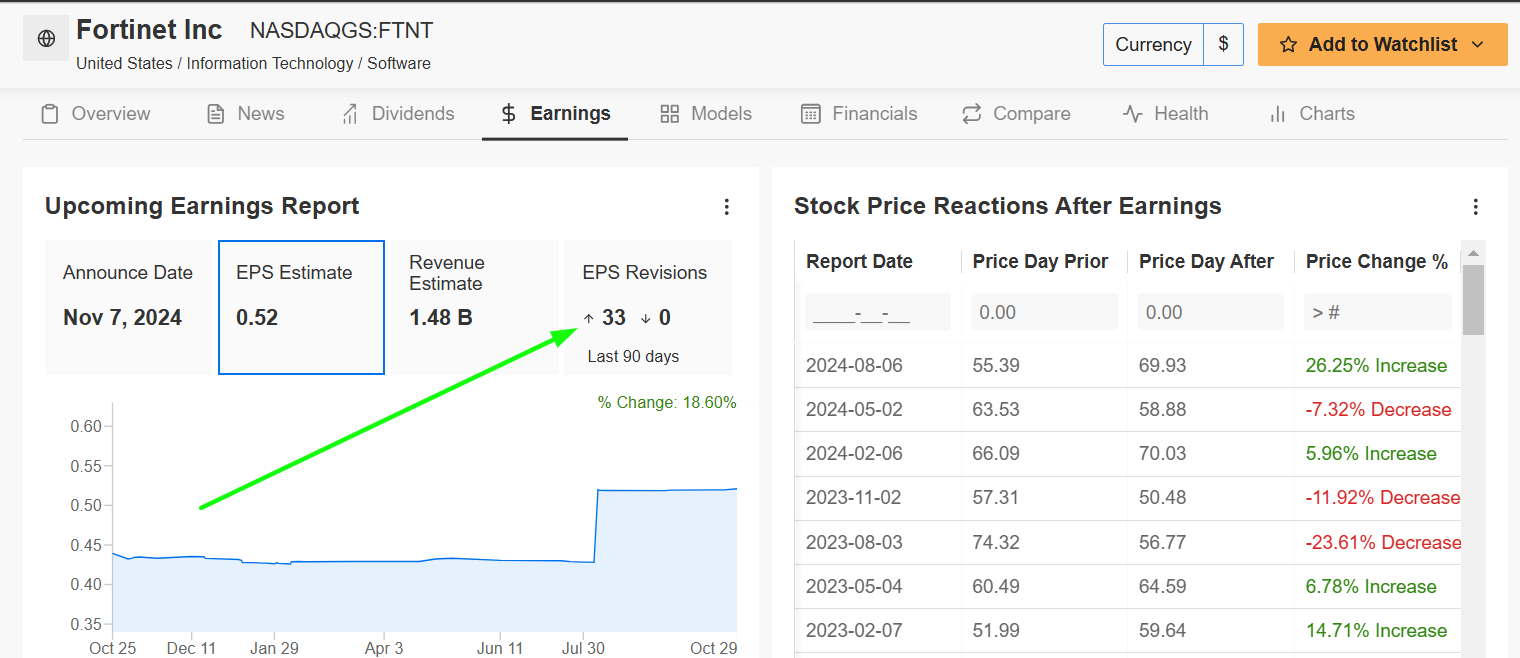

Source: InvestingPro

Recent analyst revisions reflect mounting expectations for Fortinet to post strong growth in both revenue and profit, with EPS estimates notably rising over recent weeks.

As per data from InvestingPro, profit estimates have been revised upward 33 times in the last 90 days, compared to zero downward revisions, reflecting growing confidence among analysts.

The company’s focus on next-generation cybersecurity solutions, especially in cloud security and AI-driven threat detection, has positioned it to benefit from a surge in cybersecurity spending due to the current geopolitical backdrop.

Looking ahead, Fortinet’s guidance is expected to be robust as enterprises and governments alike continue to fortify their cybersecurity budgets, driving sustainable growth for Fortinet’s portfolio.

Source: Investing.com

FTNT stock –which rose to a record of $83.77 on October 14– ended at $79.37 yesterday, earning the Sunnyvale, California-based cybersecurity solutions provider a valuation of $60.8 billion.

Shares are up +35.6% in 2024.

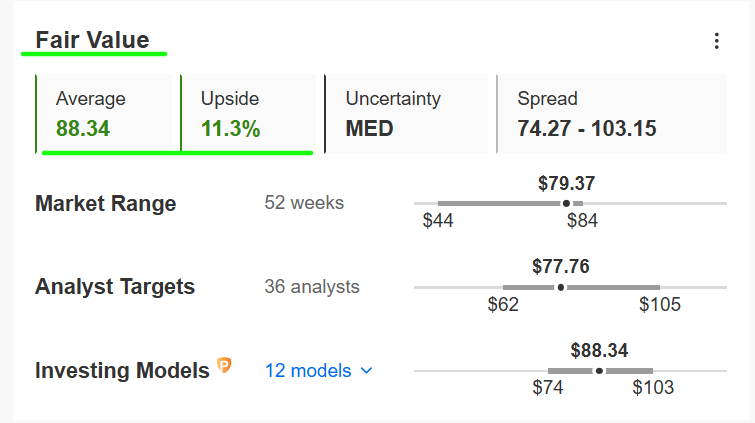

Source: InvestingPro

It is worth mentioning that Fortinet’s stock appears to be undervalued heading into its earnings print according to the AI-backed models in InvestingPro: the average Fair Value price for FTNT stands at $88.34 a potential upside of +11.3% from current levels.

3. AppLovin

AppLovin, a leader in mobile app technology and marketing solutions, has been making waves in the digital advertising and mobile gaming industries.

Through its extensive portfolio of solutions, AppLovin helps app developers attract, engage, and monetize users, making it a key player in the mobile ad ecosystem.

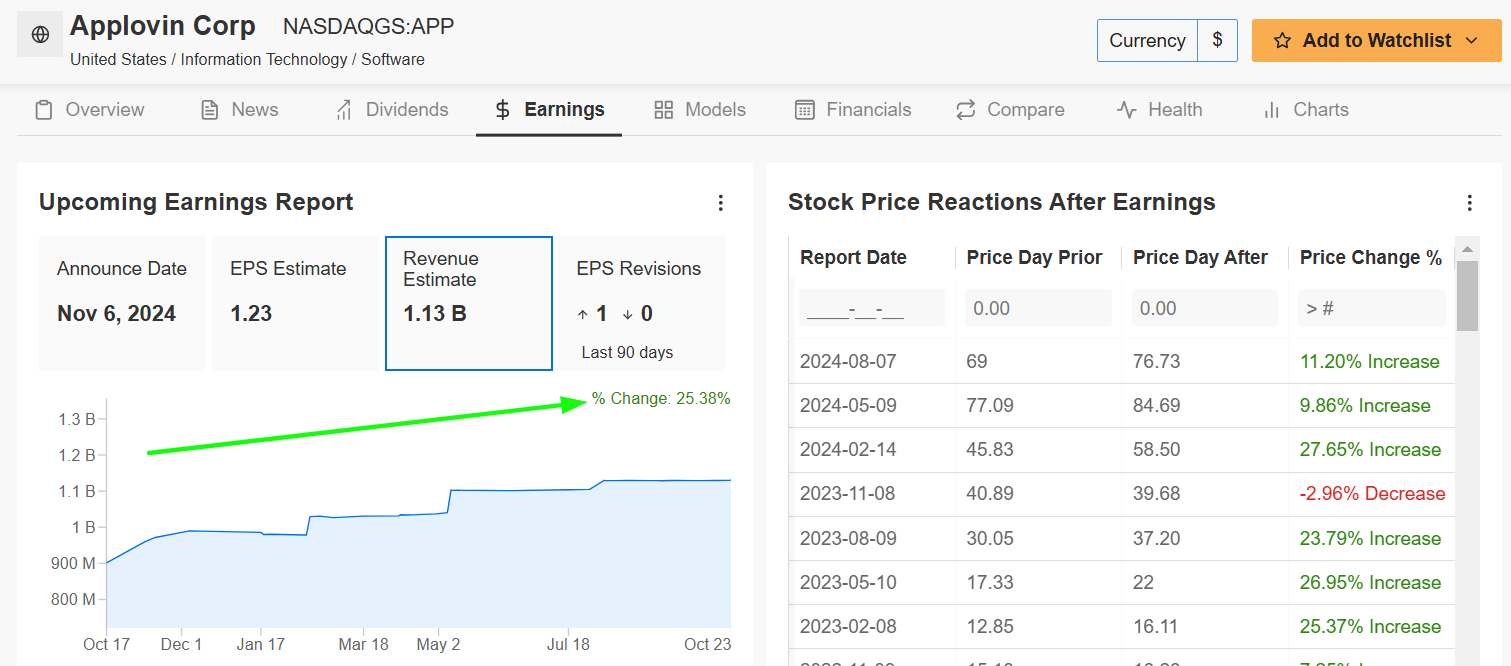

Source: InvestingPro

Analysts are bullish on AppLovin due to a combination of sector recovery and the company’s commitment to innovation in ad tech and gaming.

By harnessing AI-driven insights, AppLovin helps developers maximize the performance of their apps and unlock new revenue streams in an increasingly competitive market.

The mobile app marketing platform’s ability to drive user engagement and ad monetization has led to significant market share gains, particularly as mobile ad spending recovers.

EPS and revenue expectations have been revised upwards as demand for AppLovin’s programmatic ad platform and gaming titles continues to rise.

With mobile advertising seeing a resurgence, AppLovin’s revenue is expected to top consensus forecasts. Guidance should also be optimistic, bolstered by a diversified revenue stream and improving ad market conditions.

Source: Investing.com

APP stock ended Tuesday’s session at a new all-time high of $172.24, eclipsing the record peak made in the preceding session. At its current valuation, the Palo Alto, California-based company has a market cap of $57.5 billion.

The mobile app technology firm has delivered stellar returns for investors this year, with its stock soaring +332.2% in the year to date.

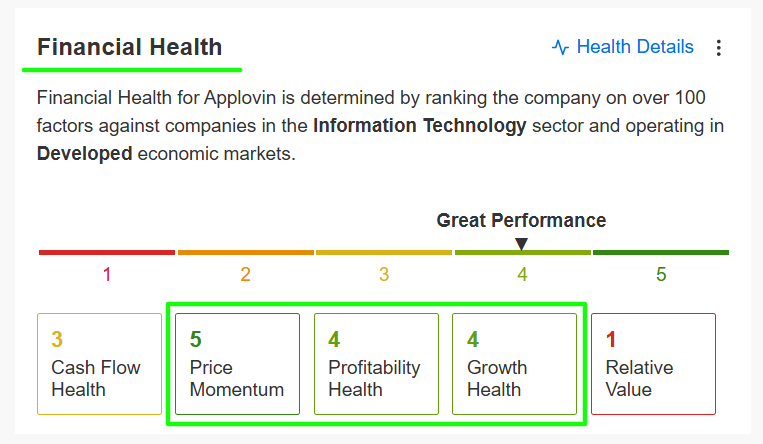

Source: InvestingPro

AppLovin's excellent InvestingPro Financial Health Score highlights its great financial position and strong growth potential, reflecting the company's ability to capitalize on the booming mobile app ecosystem.

Conclusion

Arista Networks, Fortinet, and AppLovin represent some of the most exciting opportunities outside of the FAAMG sphere.

With a combination of double-digit growth, solid tailwinds, and analyst enthusiasm, these three tech gems are worth watching as they report earnings.

Each company’s potential for above-consensus guidance only adds to the case for their inclusion in any tech-focused portfolio, making them standout picks in a sector full of possibilities.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading.

Subscribe now to get an additional 10% off the final price and instantly unlock access to several market-beating features, including:

- AI ProPicks: AI-selected stock winners with proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF, and the Invesco QQQ Trust (NASDAQ:QQQ) ETF. I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.