- AI stocks have rallied this year, posting significant YTD gains

- But despite the rally, there are still some undervalued gems waiting to be snapped up

- In this piece, we'll take a look at 3 such stocks identified by Morningstar

- Missed out on Black Friday? Secure your up to 60% discount on InvestingPro subscriptions with our extended Cyber Monday sale.

The surge in AI stocks gained momentum with the introduction of ChatGPT, intensifying the competition among companies to integrate AI into their products and platforms.

Despite the overall surge in AI, there are specific stocks that Morningstar identifies as undervalued, holding substantial potential in the medium- to long-term.

In this piece, we will delve into the details of the three undervalued artificial intelligence stocks, as highlighted by Morningstar.

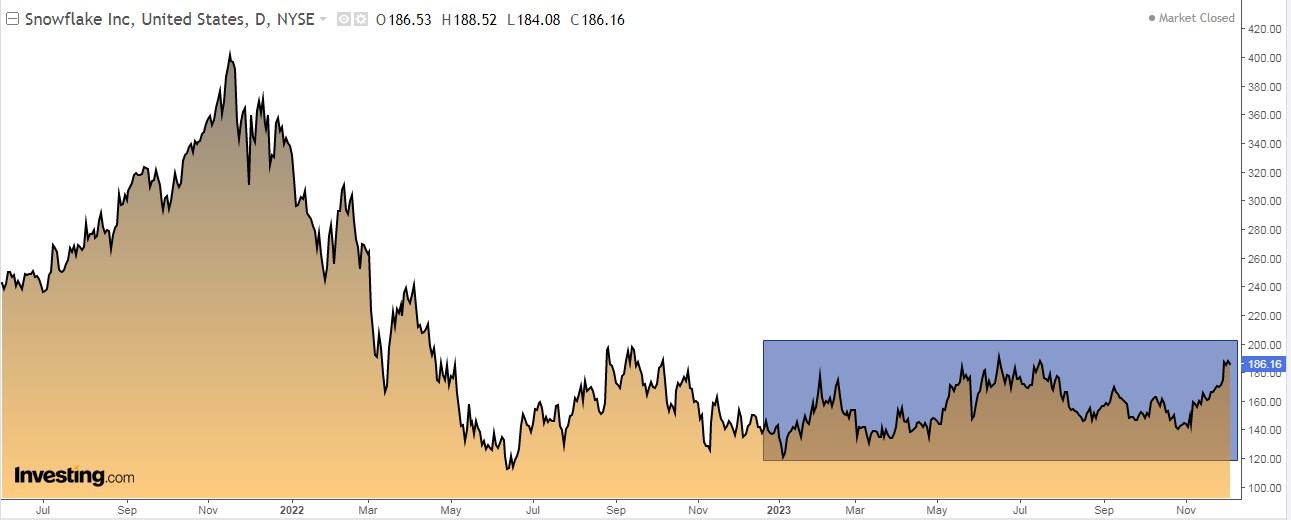

1. Snowflake

Snowflake (NYSE:SNOW) has great medium to long-term upside potential, as future growth can turn it into a data leader in the coming years.

In addition, the company expects the effects of artificial intelligence to unfold gradually, with incremental workload utilization and consumption growth.

Snowflake has demonstrated significant revenue growth of +40.87% over the last twelve months with a gross profit margin of +67.09%. This growth is a testament to the company's ability to scale effectively and maintain profitability.

The company has more cash than debt on its balance sheet and expects sales growth. This financial stability, coupled with expected sales growth, can provide a solid foundation for future expansion and innovation.

It presents its quarterly results on February 29 (in 2024 the month of February is 29, not 28 days). The previous earnings presented in November were very good, adding 35 $1 million+ customers in the quarter.

It also introduced new technologies such as Snowflake Cortex for artificial intelligence and forecasts that product revenues may originate in the fourth quarter between $716 million and $721 million.

By 2024, EPS is expected to grow by +216% and actual revenue by +35%.

The company is focusing on enabling artificial intelligence and machine learning technologies, with a shift in sales focus towards greater specialization and specialist teams.

In addition, it has acknowledged that the partnership with Microsoft (NASDAQ:MSFT) has had a positive impact on its business.

It has 46 ratings, of which 31 are buy, 14 are hold and 1 is sell.

Its shares are up +36.17% in the last year and +18.22% in the last 3 months. The market gives it a 12-month potential at $214.12 and Morningstar at $231.

2. Cognizant Technology Solutions

Cognizant Technology Solutions (NASDAQ:CTSH) stock yields a dividend of +1.65%.

It will report its quarterly results on February 1 and is expecting revenues for the quarter to be between $4.69 billion and $4.82 billion.

For 2023 annual revenue is in the range of $19.3 billion to $19.4 billion and adjusted annual earnings per share are in the range of $4.39 to $4.42 per share.

Rising borrowing costs and fears of a slowdown are leading most companies in the sector to control their spending.

While the entire sector is benefiting from the artificial intelligence theme, Cognizant is significantly undervalued due to a discount for mistakes the company made in the past when it was slower to develop cloud solutions.

It presents 28 ratings, of which 6 are buy, 20 are hold and 2 are sell.

In the last year, its shares are up +19.65% and in the last 3 months, they are down -1.23%. InvestingPro models give it a potential at $90.54 and Morningstar at $94.

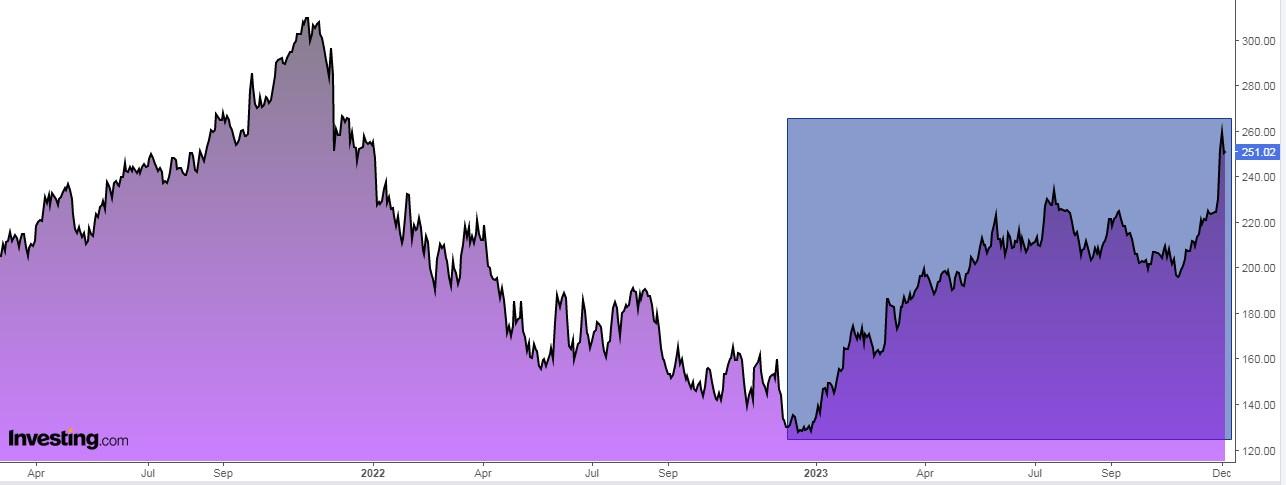

3. Salesforce

Salesforce's (NYSE:CRM) strategic focus on artificial intelligence and cloud data services has fueled its growth.

The company's data cloud, which includes Mulesoft and Tableau, has shown impressive growth, indicating strong demand for its integrated services.

In addition, the company's emphasis on artificial intelligence integration positions it well against its competitors.

Not only that but also solid demand for its Mulesoft and Data Cloud services, strategic focus on growth, higher operating margin guidance, and free cash flow exceeding net income.

On paper, it is one of the best long-term opportunities in software. Although revenue growth has slowed, a new focus on margin expansion should continue to compound strong earnings growth in the coming years.

Morningstar estimates that the five-year annual growth rate for total revenue will be +12% through fiscal 2028 and will be driven by platform strength along with innovation in artificial intelligence.

On February 28 it presents its accounts for the quarter and earnings per share are expected to increase by +47.43%. By 2024 it would be up +56.3% and actual revenue +11%.

Its shares are up +88.35% in the last year and +13.26% in the last 3 months. InvestingPro models see potential at $310.

***

You can easily determine whether a company is suitable for your risk profile by conducting a detailed fundamental analysis on InvestingPro according to your criteria. This way, you will get highly professional help in shaping your portfolio.

In addition, you can sign up for InvestingPro, one of the most comprehensive platforms in the market for portfolio management and fundamental analysis, much cheaper with the biggest discount of the year (up to 60%), by taking advantage of our extended Cyber Monday deal.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.