- The Santa Claus rally is back on the cards potentially, bringing opportunities for investors.

- Three standout stocks are ready to deliver seasonal gains.

- Here’s what to watch for as year-end approaches.

- Unlock Cyber Monday savings! Get 60% off InvestingPro and access top features like ProPicks AI, Fair Value, and the Top Stock Screener for just $6/month. Claim your deal now!

As Christmas approaches, so does the much-anticipated "Santa Claus Rally"—a seasonal stock market phenomenon that tends to deliver gains during the final days of the year.

From the last five business days of December through the first two days of January, the markets often show an upward trend. In fact, from 1950 to 2023, the S&P 500 has risen 79.45% of the time during this period, with an average gain of 1.32%.

Today, we’ll dive into three stocks that offer investors not one, but two holiday gifts. The first is the attractive dividend yield these stocks provide.

The second is the strong upside potential, with analysts predicting substantial growth in the medium term. Let’s unwrap these opportunities.

1. AbbVie (ABBV)

Founded in 2013 as a spin-off from Abbott Laboratories (NYSE:ABT), AbbVie (NYSE:ABBV) specializes in the research, development and commercialization of advanced therapies.

Its areas include immunology, oncology, neurosciences, and aesthetics. ABBV's market capitalization stands at an impressive $323.2 billion.

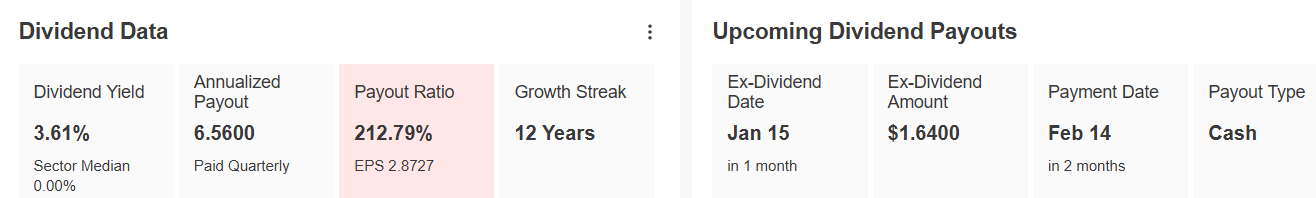

The company is a dividend king with more than 50 years of consecutive increases. It will pay a dividend of $1.64 per share on February 14, and to be eligible to receive it, shares must be held before January 15.

The dividend yield is 3.61%, more than double its industry average of 1.5%.

Source: InvestingPro

AbbVie has been a consistent performer in terms of revenue and earnings growth over the years.

Its strong market position in a recession-resistant sector has enabled the company to accumulate revenues and earnings at compound annual growth rates of 11.06% and 9.54%, respectively, over the past 5 years.

In the most recent quarter, it again beat forecasts, marking its 14th earnings improvement in the last 16 quarters. It also closed the quarter with a cash balance of $7.3 billion, lower than its short-term debt levels of $12.6 billion.

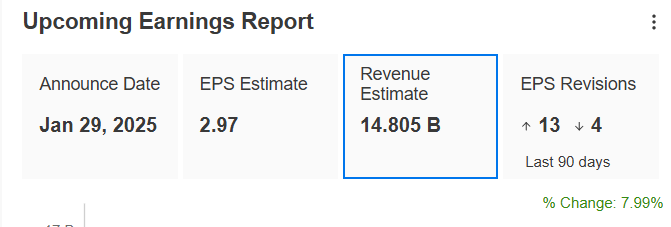

It will report its next quarterly report on January 29, with earnings expected to rise 7.99%.

Source: InvestingPro

AbbVie's flagship product Humira, once the world's best-selling drug, has faced revenue pressures since the expiration of its exclusivity rights in February 2024.

Despite these challenges, the company projects that Humira will generate $7.4 billion in sales by year-end, representing approximately 13.2% of total revenues.

To address the decline in Humira sales, AbbVie has focused on its immunology portfolio, particularly Skyrizi and Rinvoq, which treat chronic autoimmune diseases.

In addition, the acquisition of Allergan (NYSE:AGN) for $63 billion in 2020 has further strengthened its position as a leader in aesthetic medicine.

Its financial health is optimal, earning a score of 3 out of 5 which would be the highest.

Source: InvestingPro

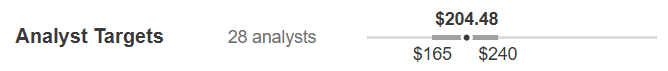

It presents 27 ratings, of which 20 are buy, 7 are hold and none are sell.

The market consensus gives it an average price target of $204.48.

Source: InvestingPro

2. Hasbro (HAS)

Hasbro (NASDAQ:HAS) is a toy company located in Pawtucket, Rhode Island, in the United States. It was founded by three brothers on December 6, 1923, as "Hassenfeld Brothers", a company initially dedicated to the textile sector.

In 1968, the company abbreviated its name by taking the first three letters of each word to create a more easily recognizable brand name.

It is famous for having acquired toys from other companies, such as the Twister-themed board game, Monopoly, Play-Doh modeling dough, and Playskool educational toys.

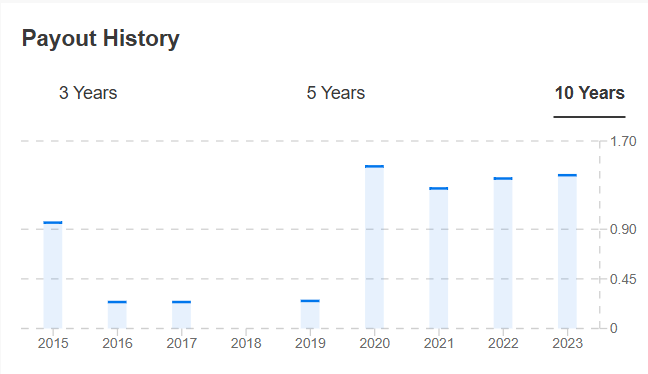

Its dividend yield is 4.33%, which since 2014 has only gone up, and has been distributed for 44 consecutive years. Its payout (percentage of profits it allocates to dividend distribution) has maintained an upward line since 2013.

Source: InvestingPro

The company saw its operating profit margin expand for the third consecutive quarter, driven largely by growth in gaming and licensing. It also aims to save $750 million in costs by 2025, of which it achieved $240 million this year.

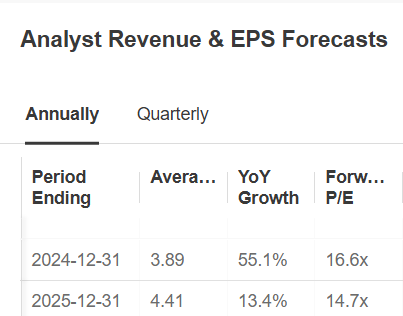

We will learn about its quarterly financials on February 18. Earnings per share (EPS) are expected to rise by 55.1% in 2024 and 13.4% in 2025.

Net income is also expected to grow this year, a positive outlook that aligns with industry resilience where U.S. toy sales have shown significant growth compared to 2019 levels.

Source: InvestingPro

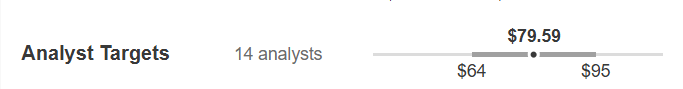

The market consensus gives it an average price target of $79.59.

Source: InvestingPro

3. Upbound Group (UPBD)

Upbound Group (NASDAQ:UPBD) is a U.S. furniture and electronics leasing company based in Plano, Texas. The company was incorporated in 1960 and operates stores in the United States, Puerto Rico and Mexico.

It alone covers 35% of the U.S. rental-purchase market. Formerly known as Rent-A-Center, it changed its name to Upbound Group in February 2023.

Its dividend yield is 4.28% and has maintained a strong consistent payout schedule for 20 consecutive quarters. Its payout since 2019 has risen quite strongly.

Source: InvestingPro

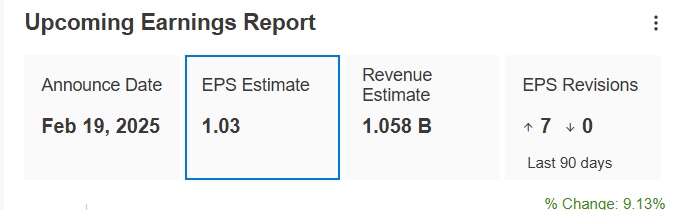

It will release its quarterly report on February 19, with earnings per share (EPS) expected to increase by 9.13%. The company remains optimistic about its growth prospects, including expansion plans in Mexico.

Source: InvestingPro

The market liked its agreement with Google (NASDAQ:GOOGL) Cloud to offer advanced artificial intelligence solutions designed to improve customer experience.

Through this collaboration, Upbound will leverage Google Cloud's Vertex (NASDAQ:VRTX) artificial intelligence to improve product accessibility, personalization and service quality.

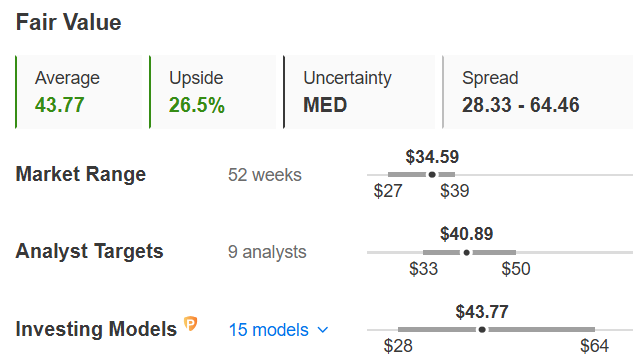

It features 8 ratings, of which 6 are buy, 2 are hold and none are sell.

Its shares are trading 26.5% below its fair value, which stands at $43.77. The target price assigned by the market is at $40.89.

Source: InvestingPro

***

Don't Miss Out on 60% Off This Cyber Monday—Here’s Why You Should Act Fast:

- ProPicks AI Has Been Beating the Market Since November 2023

Since its launch, our AI-powered Tech Titans stock picker has outperformed the S&P 500 by 49%. A $10,000 investment last Cyber Monday would now be worth $19,137. Why wait?

- Fair Value Shows You What Stocks Are Really Worth

Our Fair Value calculator delivers clear signals, helping you spot undervalued stocks ready for growth. Hundreds of picks are trading at discounts right now—don't miss your chance.

- The Market’s Best Stock Screener, Right at Your Fingertips

Find your next winner in seconds with our screener, featuring 167 custom metrics. With pre-defined screens like Dividend Champions and Blue-Chip Bargains, making smarter decisions is easier than ever.

Save 60% now—this deal ends soon!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.