- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

21.08.23 Macro Morning

Risk markets remain rattled on Friday night as the debt contagion from the Chinese property market continues to spread while interest rate concerns rise again in the USD. The USD continues to be strong but has moderated somewhat with the Australian dollar hovering around the 64 cent handle while Euro fails to get back above the 1.09 cent level.

US bond markets again saw a small drop across the yield curve with the 10 year Treasury back down to the 4.25% level while oil prices bounced back after their recent mild selloff with Brent crude slightly below the $85USD per barrel level. Gold remains well below the $1900USD per ounce level however with a pause in its big selloff.

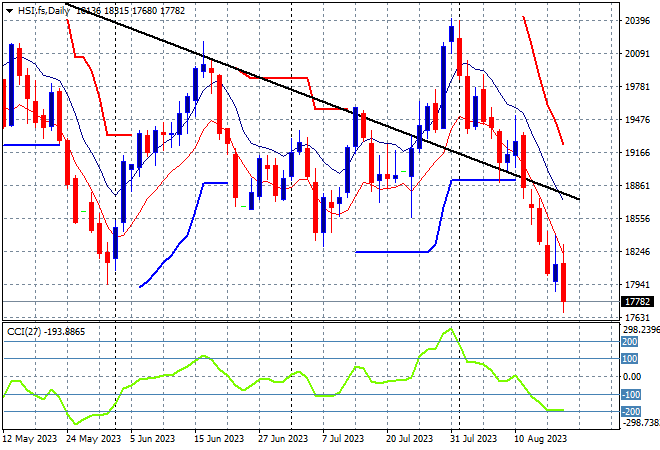

Looking at share markets in Asia from Friday’s session with mainland Chinese share markets sluggish at first before selling off with the Shanghai Composite losing 1% to close the week at 3131 points while in Hong Kong the Hang Seng Index slumped more than 2% to finish at 17950 points.

The daily chart is now showing a near complete selloff that has gone below the May/June lows with the 19000 point support level a distant memory as price action stays well below the dominant downtrend (sloping higher black line) following the prevous month long consolidation. Daily momentum readings remain fully oversold as confidence disappears so watch for this rollover to possibly hit the 17000 point level next:

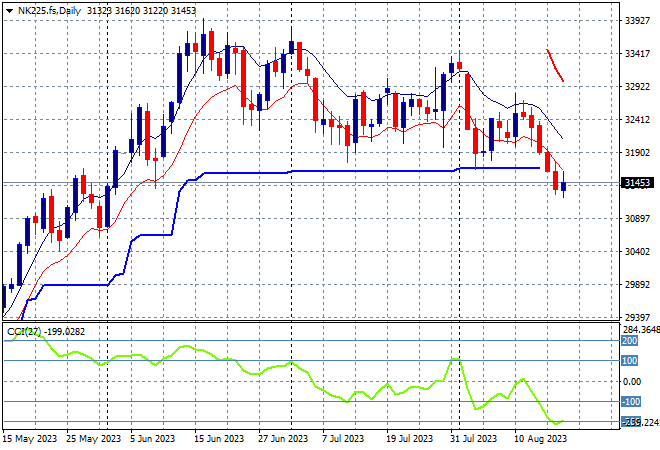

Japanese stock markets continued to stumble due to the higher than expected inflation print with the Nikkei 225 off by more than 0.5% to 31450 points.

Trailing ATR daily support had been paused for sometime now as the market went sideways after a big lift recently, with a welcome consolidation above that level but that has now turned into a proper dip. Daily momentum is well into oversold mode as price action has broken below the support zone, with a weaker Yen still not helping:

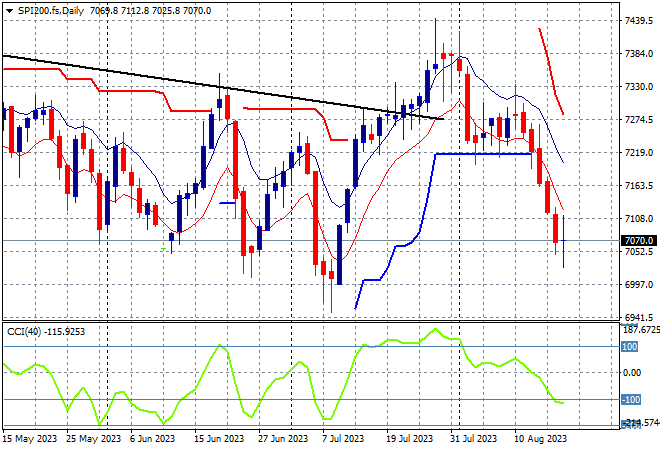

Australian stocks were the only ones still in the green in Asia but only just, with the ASX200 barely closing 0.1% higher at 7148 points.

SPI futures are down more than 0.3% this morning given the volatility on Wall Street on Friday, so the 7300 point level has turned into short term resistance. Medium term price action was slowly getting out of its downtrend with the daily chart suggesting a breakout here as the June highs are bested but that has been fully reversed as daily momentum readings get into oversold mode. China sneezes, Australia catches a cold?

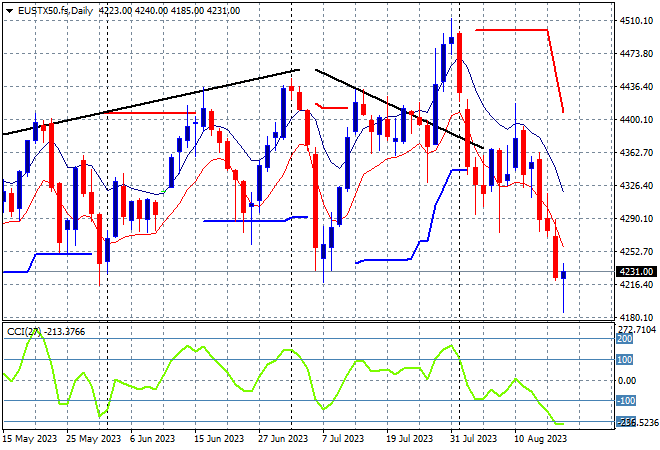

European markets failed to settle down with a very bad trading week with more selling across the continent as the Eurostoxx 50 Index lost 0.3% to finish at 4212 points.

While the daily chart shows weekly support at 4200 points barely defended, weekly resistance at the 4400 point resistance level has now pushed the point of control well below the 4300 point level. There were signs of stability returning here but daily momentum is now going oversold so watch out below:

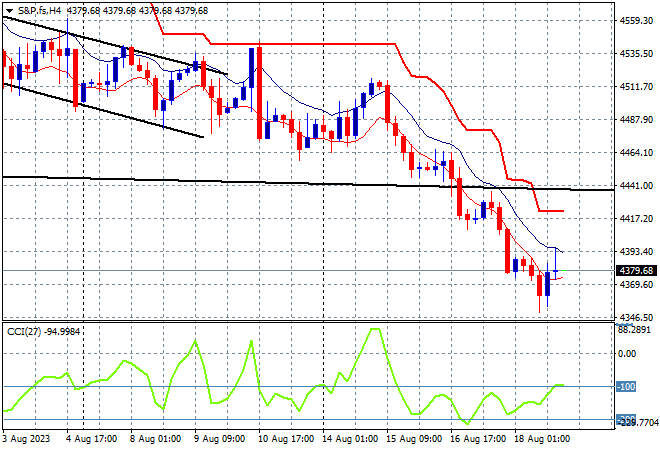

Wall Street sold off initially, failing to gain any positive momentum at all but managed to almost recover towards the end of the session, with the NASDAQ only losing 0.2% while the S&P500 finished dead flat at 4369 points.

The four hourly chart is showing price action now stumbling well below the previous downtrend channel since the NFP print with sellers definitely in control. Recent deceleration with a possible breakout brewing was a bull trap as the 4500 point level switches from support to resistance but with the 4400 point level broken there’s daylight below:

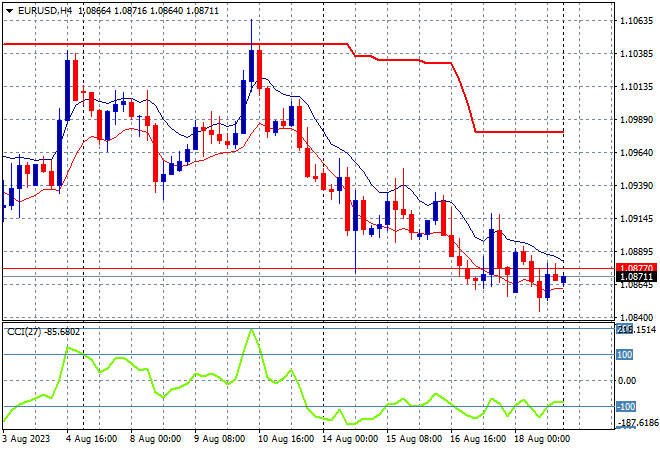

Currency markets moderated the recent USD strength although again Pound Sterling did better then Euro as the union currency hovers just below the 1.09 level.

As I posited last week, Euro needed to have a strong return above trailing ATR resistance just below the 1.10 handle but failed despite a mid week rally to decline back to the previous weekly lows just above the mid 1.09 level. Short term momentum is now solidly oversold with price action now below the August lows:

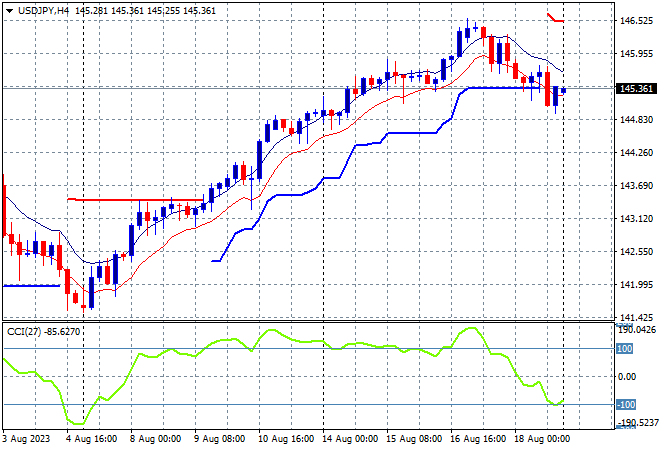

The USDJPY pair remains on a technical uptrend, having surpassed the previous weekly high with a continued series of positive sessions throughout last week, but moderated on Friday night back to the 145 level after the Japanese CPI print.

Four hourly momentum has retraced to almost oversold but not overextended with the heat taken out of the two week trend. The 146 level may become short term resistance here:

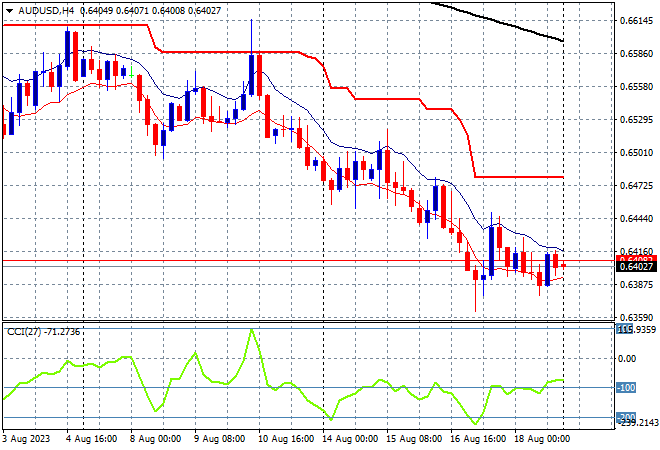

The Australian dollar remains under the pump against King Dollar although it has slid into a possible bottom here at the 64 handle.

The subsequent price action from the previous Friday night’s bounce looked unimpressive from the start, confirming the weak mantle for the Aussie as ATR resistance and 200 EMA (black line) are still quite far away in both short and medium term trends. The recent unemployment print has entrenched upside resistance but for now has staved off a bigger selloff:

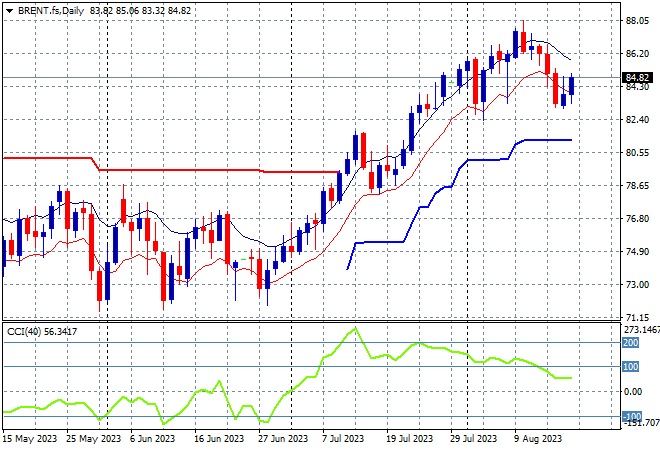

Oil markets had been relatively quiet with some moderation recently with the potential for a top forming although Brent crude was able to stabilise on Friday night at the $85USD per barrel level, maintaining its three month high and current uptrend.

Price had been anchored around the December levels – briefly dipping to the March lows – with the latest move matching the small blip higher in May and now putting aside resistance at the $80 level. Daily momentum has picked up strongly into overbought readings but is now starting to retrace with price action rolling over – watch short term support at $80 to hold:

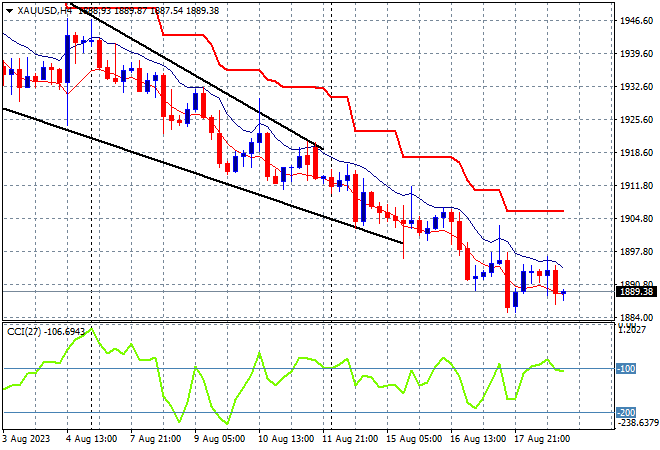

Gold remains in freefall with the latest rollover below the key $1900USD per ounce level seeing no signs of stopping, settling just below the $1890 level as the downtrend remains firmly entrenched.

The four hourly chart shows the attempt at getting back up to the psychologically important $2000USD per ounce level has been over for sometime now as the recent oscillations turn into a proper unwinding here down to $1900. Although this recent move is quite oversold and the chart pattern is now firming as a bullish falling wedge, the potential for a reversal is just not here:

Related Articles

The central bank’s job is never easier, but in the current climate, it’s unusually tricky. In addition to the usual challenges that complicate real-time monetary policy decisions,...

The EU’s most costly budgets, bitcoin’s market swings, and rising US bankruptcies. Each week, the Syz investment team takes you through the last seven days in seven charts. 1. The...

Last week, we discussed that continued bullish exuberance and high levels of complacency can quickly turn into volatility. As we noted then, introducing an unexpected, exogenous...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.